Summary: The years leading up to the 2000 stock market

bubble were extraordinary and unprecedented. They caused unique pain to the

portfolios of valuation-driven investors. The valuation extremes, though,

created the greatest opportunity set for valuation-driven investors since the

Great Depression. While the events of the last decade have not been as striking

as those of the late 1990s, the recent cycle has gone on for significantly

longer and the pain caused to our portfolios has begun to approach 1990’s

levels. As the current cycle has ground on slowly but surely, the valuation

extremes have moved wider, creating an opportunity set for valuation-driven

investors that looks as extraordinary as what we saw 20 years ago.

As the financial markets enter what I expect to be a

rather disruptive completion to the recent speculative half-cycle, it will be

helpful for investors to consider certain propositions that are readily

available from history, rather than insisting on re-learning them the hard way.

Employment data is the last to know

Proposition: Risk-sensitive assets and confidence measures

generally precede economic shifts; production, consumption and income measures

are coincident with broad economic activity; and labor market measures lag the

economy. The unemployment rate is the single most lagging economic indicator

available.

….

Market losses precede recession recognition, not the other way around

Proposition: By the time a U.S. recession begins, stocks have

typically been in a bear market for months. Indeed, by the time a recession is

widely accepted, a great deal of bear market damage has typically already been

done.

…

Low interest rates aren’t your friends

Proposition: Low interest rates don’t “justify” elevated stock

market valuations. Rather, the combination of low interest rates and high

valuations simply implies that both stocks and bonds are priced to produce

similarly low future returns.

..

The present level of overvaluation may be even worse than it looks

Proposition: If interest rates are low because nominal growth

rates are also low, those low interest rates don’t “justify” elevated

valuations at all. The low growth rate itself is sufficient to produce low

returns, without any change in price. In this situation, elevated valuations

simply penalize returns twice.

...

As manufacturing plummets to the weakest levels since

September 2009 and new export orders collapse, the US railroad industry has jus

seen carload volumes tumble to three-year lows… The manufacturing recession is

more widespread than the mid-cycle slowdowns in 2012 and 2015/16. The slowdown

has been concentrated in manufacturing for well over a year, driven by a

downturn in business investments in 2019. The rail slowdown is a direct result

of a manufacturing recession... last week.. indication that the downturn has

spilled over into service sector output and employment.

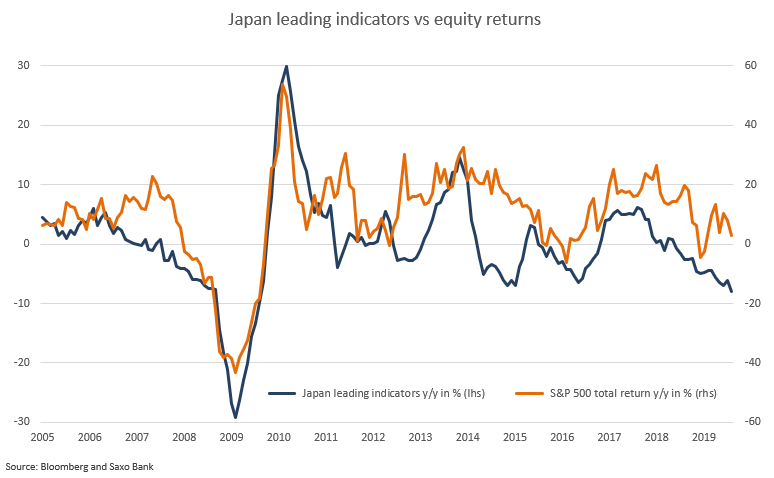

The Disconnect Between Equities And Macro Grows Wider

IMF WEO: The International Monetary Fund made a fifth-straight cut to its 2019 global growth forecast, citing a broad deceleration across the world’s largest economies as trade tensions undermine the expansion.

Contrarian Thoughts

Mark Carney also told the Guardian it was possible

that the global transition needed to tackle the climate crisis could result in

an abrupt financial collapse. He said the longer action to reverse emissions

was delayed, the more the risk of collapse would grow.

Here’s the basic proposition of capitalism: if

something can be done for a profit, then it creates more value than the sum its

of inputs. But here’s the thing: that’s an unproven assertion. In fact, in many

cases, it is not true. Worse, over the not very long run (a couple hundred

years) it is almost certainly false.

The Tyranny of

Economists. How can they be so wrong, so often, and yet still exert so much

influence on government policy?