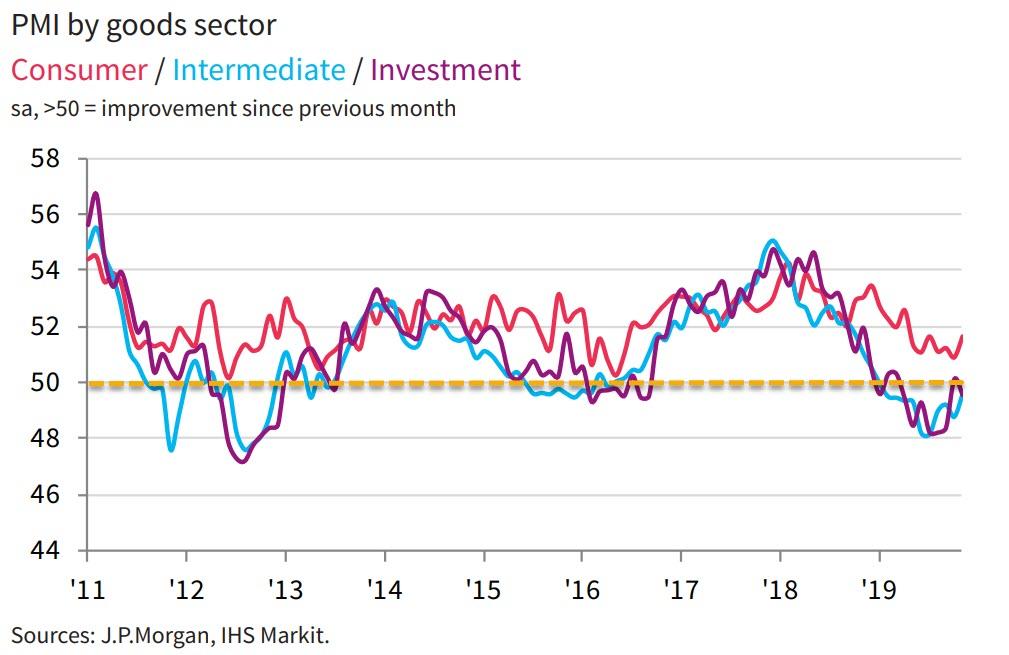

Global Manufacturing Inches Back Into Expansion, Despite Ongoing Slump In Export Orders.

Brookings Institution study shows 44 percent of all American workers toil in “low-wage” jobs, with median earnings of $18,000 a year.

December 2019 Economic Forecast Index Declines And Now In Contraction.

Merchant Wholesalers Inventories-to-Sales Ratio Up, … with Sales down, exemplified by household appliances and electronics:

Japan's 10Y Yield On Verge Of Turning Positive As Abe Prepares Massive Debt-Busting Stimulus.

Japan preparing $120 billion stimulus package to bolster fragile economy.

The Credit Market Powder Keg: The ratio of loan downgrades to upgrades has soared.

Saxo Bank: "The S&P500's Valuation Is The Highest Since 2001"

Hussman: The meaning of valuation.

"Lower For Ever": One Bank Makes A Stunning Discovery - The Fed's Rate Cuts Are Now Deflationary.

Geopolitics:

Ross Says Trump Will Hike Tariffs If No China Deal By Dec 15.

Krieger: Two Paths Forward with China – The Good and The Bad.

(Very Brief) Book review of the week:

The Debt Delusion.

(Not just) For the ESG crowd:

An introduction to the state of energy storage in the U.S.

Decrying ‘Utterly Inadequate’ Efforts to Tackle Climate Crisis, UN Chief Declares ‘Our War Against Nature Must Stop’.

IMF: Carbon Calculus: For deep greenhouse gas emission reductions, a long-term perspective on costs is essential.

Oil and Gas Industry Rebukes Fracking Ban Talk as UN Shows Just How Much Fossil Fuel Plans Are Screwing Climate Limits.

Must read of the week:

Are evidence-based decisions impossible in politics?

Human psychology and institutional incentives are powerful barriers to truth and reason, but both can be addressed.

Other fare:

Frozen II isn’t just a cartoon. It’s a brilliant critique of imperialism.

Climate change: Elephants killing and injuring people due to drought. And: Climate change likely to blame as Russian town overrun by polar bears.

OECD Regional Well-Being Index: A Closer Measure of Life.

Think celebrities and CEOs make way too much money? Check out this chart.

Quote of the Week:

Speaking of stupidity…

Photo Toon of the Week:

Brookings Institution study shows 44 percent of all American workers toil in “low-wage” jobs, with median earnings of $18,000 a year.

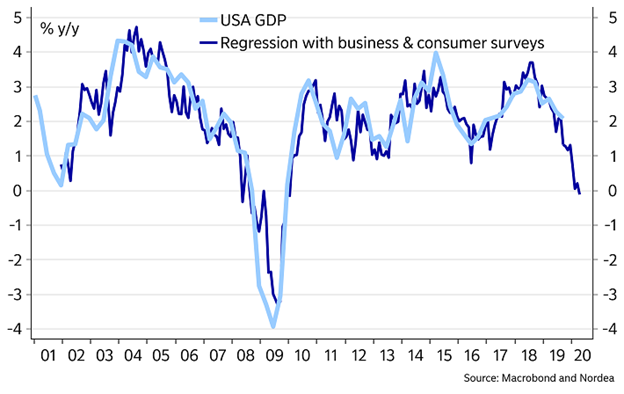

December 2019 Economic Forecast Index Declines And Now In Contraction.

The Econintersect Economic Index (EEI) is designed to spot Main Street and business economic turning points. This forecast is based on the index's three-month moving average. The three-month rolling index value is now a NEGATIVE 0.122 - a decline from last month's positive 0.025. The economic forecast is based on the 3-month moving average as the monthly index is very noisy. A positive value of the index represents Main Street economic expansion. Readings below 0.4 indicate a weak economy, while readings below 0.0 indicate contraction.

Merchant Wholesalers Inventories-to-Sales Ratio Up, … with Sales down, exemplified by household appliances and electronics:

Japan's 10Y Yield On Verge Of Turning Positive As Abe Prepares Massive Debt-Busting Stimulus.

Japan preparing $120 billion stimulus package to bolster fragile economy.

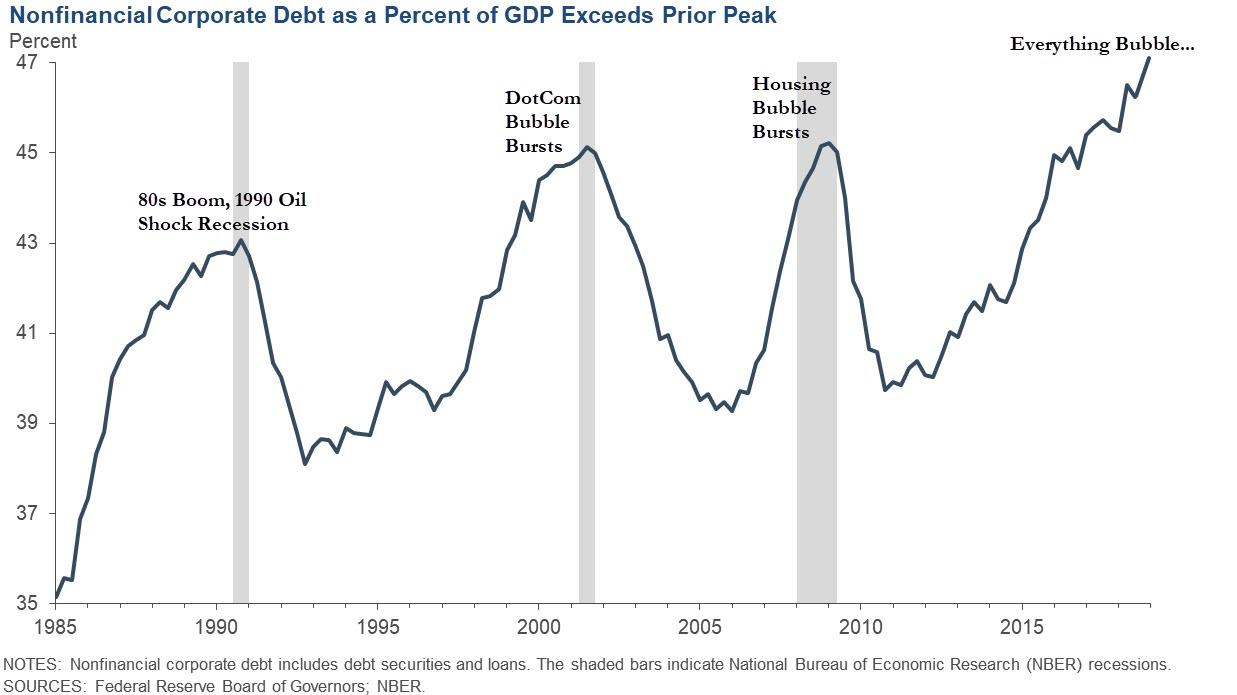

The Credit Market Powder Keg: The ratio of loan downgrades to upgrades has soared.

Saxo Bank: "The S&P500's Valuation Is The Highest Since 2001"

“Based on the current valuation level in the S&P 500 we observe historically a 0.5% real return annualized with a +/- 2%-points uncertainty. This means that investors buying into current valuation levels are pursuing momentum effects rather than long-term return expectations. These moves never end good.”

Hussman: The meaning of valuation.

While there’s no question that waves of speculation and risk-aversion can produce substantial market fluctuations over various segments of the complete market cycle, investors should understand that long-term returns, as well as full-cycle downside risks, are driven by valuations. When I say “valuation,” I’m not simply talking about the ratio of current stock prices to next year’s estimated earnings. Stocks aren’t simply a claim on next year’s earnings, and a single year of earnings is typically not a “sufficient statistic” for long-term cash flows, particularly at the peak or trough of an economic cycle. Valuations measure the tradeoff between current prices and a very long-term stream of expected future cash flows. Every useful valuation ratio is just shorthand for that calculation. Every valuation ratio that fails that criterion is inferior, and you can show it in historical data.

The valuation measures that investors use should survive two criteria. First, a good valuation measure should reasonably mirror a proper discounted cash flow analysis, and as you can see above, this is something we can check. Second, a good valuation measure (technically, it’s log value) should be strongly correlated with actual subsequent market returns in cycles across history. Again, this is something we can check.

Based on the most reliable valuation measures we’ve examined or introduced over more than three decades, the current tradeoff between stock prices and likely future cash flows now rivals the 1929 and 2000 extremes.

"Lower For Ever": One Bank Makes A Stunning Discovery - The Fed's Rate Cuts Are Now Deflationary.

In light of the gloomy structural framework detailed above, it will come as little surprise that Rabobank's outlook for rates is not so much "lower for longer as lower forever."

Charts 13 and 14 below show Rabobank's forecasts for US policy rates and yields through to the end of next year. The bank's Fed watcher, Philip Marey, who has been spot on in his Fed calls in the past two years, expects the Fed to be forced into cutting policy rates once again in April 2020 as a slowdown becomes more pronounced.

With this deceleration of activity seen triggering a recession in the second half of next year, Rabo’s base case is for the Fed to cut rates at each subsequent meeting taking the lower end of the fed Funds target range to zero by the end of the year (a development that will naturally prompt discussion of another wave of, self-defeating, QE in addition to the NOT QE we have right now).

Rabo expects 10y yields to hit a new record low in H2 2020 with 1.0% currently viewed as the resting point at the end of the year, and strikingly, the bank states that it views the risks to this forecast "to be titled to the downside"

Geopolitics:

Ross Says Trump Will Hike Tariffs If No China Deal By Dec 15.

Krieger: Two Paths Forward with China – The Good and The Bad.

“I’ve consistently forecasted a significant worsening in U.S.-China relations and remained adamant that all the happy talk of trade deals and breakthroughs is just a lot of hot air. … it’s highly unlikely the current trajectory will reverse course and result in a return to what had been business as usual. Instead, we’re probably headed toward a serious and historically meaningful escalation of tensions between the U.S. and China, with what we’ve seen thus far simply a prelude to the main drama.”

(Very Brief) Book review of the week:

The Debt Delusion.

I have been reading Prof John Weeks’ book ‘The Debt Delusion‘. I should say, upfront, that I know John, and enjoy his company: he is a fellow member of the Progressive Economy Forum. The book would be worth reading without that association.

In essence, John uses the book to tackle six myths, which he identifies as:

1) We must live within our means;

2) Governments should balance their books;

3) We should tighten our belts to achieve this objective;

4) Debt is always bad:

5) Government debt should be avoided by reducing expenditure and not raising taxes;

6) In combination, these mean that there is no alternative to austerity.

Readers will be familiar with such claims and that I, like John, have no time for them. For this reason I recommend the book. But I also do so because it is intensely readable. This is a book that uses the odd graph and table, but most certainly not formulas. Instead John uses an easy narrative flow to make his argument. …

… to explain that the constraints that we face are not financial. “Our means” very clearly is not defined by the relationship between government expenditure and taxation. If the term has any relevance at all, then it definitely refers to the capacity of an economy to meet the real needs of those who live within it. The finance follows. For those looking for an explanation of this fact I recommend John’s book.

(Not just) For the ESG crowd:

An introduction to the state of energy storage in the U.S.

Decrying ‘Utterly Inadequate’ Efforts to Tackle Climate Crisis, UN Chief Declares ‘Our War Against Nature Must Stop’.

IMF: Carbon Calculus: For deep greenhouse gas emission reductions, a long-term perspective on costs is essential.

Oil and Gas Industry Rebukes Fracking Ban Talk as UN Shows Just How Much Fossil Fuel Plans Are Screwing Climate Limits.

as the UN’s new “Production Gap” report reiterates, unrestrained oil and gas production is inconsistent with the world’s climate targets. Current production plans result in 43 percent more oil and 47 percent more gas in 2040 than would be consistent with a 2°C pathway, according to the analysis.FT: Why business cannot tackle climate change on its own.

Must read of the week:

Are evidence-based decisions impossible in politics?

Human psychology and institutional incentives are powerful barriers to truth and reason, but both can be addressed.

Making good political decisions is difficult because human beings spend so much time in what economist and psychologist Daniel Kahneman calls “System One” mode. This is a way of thinking that is fast, emotional, easy and efficient. It’s heavily reliant on cognitive shortcuts and fast judgments, and prone to bias. Much of our politics exists in this space - the immediate, the gut, the familiar and emotional. And many of our structural incentives - our institutions, rules, laws and habits - keep us locked into this mode.

It’s not that we don’t want to do better. We often do. Plenty of us like evidence, rigorous reasoning and careful thought. But in a busy, distracted, speedy and complex world, we often take the path of cognitive least-resistance and get stuck battling the psychological tendencies that lead us towards poor reasoning. And given that we are often rewarded for doing so, at least in the short term, we’re encouraged to keep it up.

Other fare:

Frozen II isn’t just a cartoon. It’s a brilliant critique of imperialism.

Climate change: Elephants killing and injuring people due to drought. And: Climate change likely to blame as Russian town overrun by polar bears.

OECD Regional Well-Being Index: A Closer Measure of Life.

Think celebrities and CEOs make way too much money? Check out this chart.

Quote of the Week:

In 1976, a professor of economic history at the University of California, Berkeley published an essay outlining the fundamental laws of a force he perceived as humanity’s greatest existential threat: Stupidity. Stupid people, Carlo M. Cipolla explained, share several identifying traits: they are abundant, they are irrational, and they cause problems for others without apparent benefit to themselves, thereby lowering society’s total well-being. There are no defenses against stupidity, argued the Italian-born professor, who died in 2000. The only way a society can avoid being crushed by the burden of its idiots is if the non-stupid work even harder to offset the losses of their stupid brethren.from: The five universal laws of human stupidity.

Speaking of stupidity…