Durable Goods Orders Rebound Bigly In October, CapEx Proxy Surges.

Surging China PMIs, Crashing Korea Exports Spark Even More Confusion About Global Economy.

Charles Hall: Does Trump have a bunch of 'losers' to thank for a growing economy?

Brick & Mortar Melts Down as Ecommerce Jumps by Most Ever.

US: Growth in small business employment has been slowing.

Why The US Job Market Is About To Crack In 8 Charts. Lots of charts from DB.

This Is The Chart Albert Edwards Is Watching To Decide When The US Becomes "Japanified".

Federal Reserve Proposes New Rule To Let Inflation Run Hot Ahead Of Next Recession.

Danielle DiMartino Booth: "...And You Thought Recession Risk Was A Thing Of The Past..."

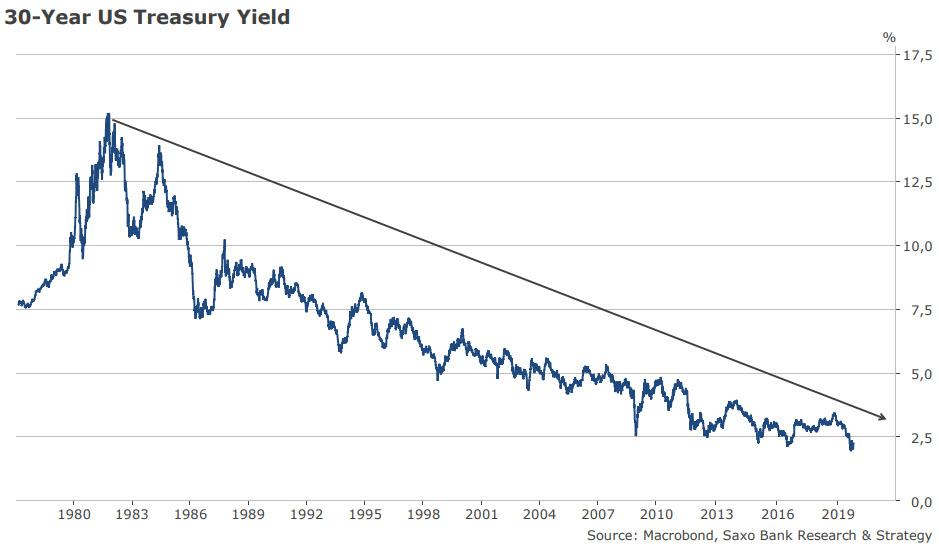

Charlie McElligott: "The Bull Market In Bonds Is Back On".

Crescat Capital: The Impending End of a Mania.

"A Once In A Decade Divergence" Warns This Global Macro Fund (between global equities and their underlying fundamentals)

See link for more charts on Pervalle’s leading (long leading and short leading) indicators

(Not just) for the ESG crowd:

FT: Climate change: how China moved from leader to laggard. If you can’t access FT.

A Solar 'Breakthrough' Won't Solve Cement's Carbon Problem.

The Collapse of Civilization May Have Already Begun.

Nate Hagens. Economics For The Future – Beyond The Superorganism. Science Direct.

Quotes of the Week:

Scott Adams, on staying in your lane: “At the time of this writing, the two most influential politicians in the United States are a real estate developer who became president and a bartender who got elected to Congress.”

Also: Graham, Gundlach, Dalio, Klarman, Grantham, Marks, Montier…

Headline of the Week:

Left in Car on Its Own, Florida Dog Shifts Into Reverse and Drives in Circles for an Hour.

The video of the cops just standing there watching is pathetic / funny, take your pick.

Photos of the Week:

Humpback whales feeding off Alaska.

“A herd of elephants marched 12 hours to the house of Lawrence Anthony after he died – the man who saved them.

They stayed there silent for two days. Exactly one year after his death, to the day, the herd marched to his house again.”

Surging China PMIs, Crashing Korea Exports Spark Even More Confusion About Global Economy.

Charles Hall: Does Trump have a bunch of 'losers' to thank for a growing economy?

“There are many complex factors that determine the state of the economy, but only one absolute prerequisite — available and affordable energy to manufacture and move things to market, and to transport, feed, comfort and amuse people. …. This situation means that relatively cheap oil and gas are keeping the U.S. economy strong. But this cheap oil and gas is being partially subsidized by investors who are either losing money or receiving a poor return on investment. In this respect, President Trump has these financial “losers” to thank for a large part of the current health of the U.S. economy.”Related: Phase 2 of the Great American Shale Oil & Gas Bust.

Brick & Mortar Melts Down as Ecommerce Jumps by Most Ever.

US: Growth in small business employment has been slowing.

Why The US Job Market Is About To Crack In 8 Charts. Lots of charts from DB.

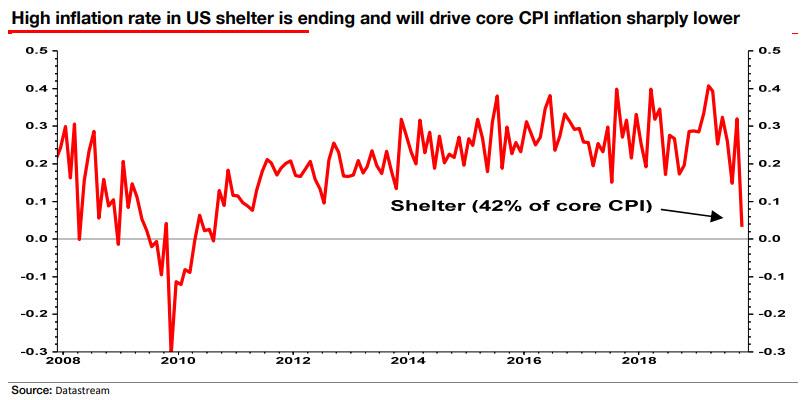

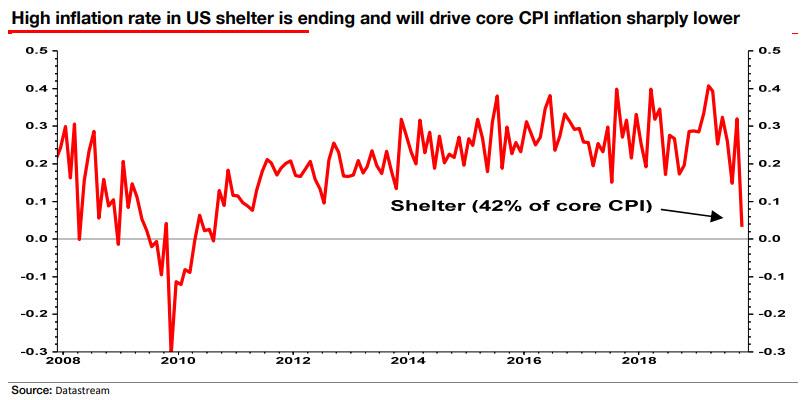

This Is The Chart Albert Edwards Is Watching To Decide When The US Becomes "Japanified".

Federal Reserve Proposes New Rule To Let Inflation Run Hot Ahead Of Next Recession.

Danielle DiMartino Booth: "...And You Thought Recession Risk Was A Thing Of The Past..."

Charlie McElligott: "The Bull Market In Bonds Is Back On".

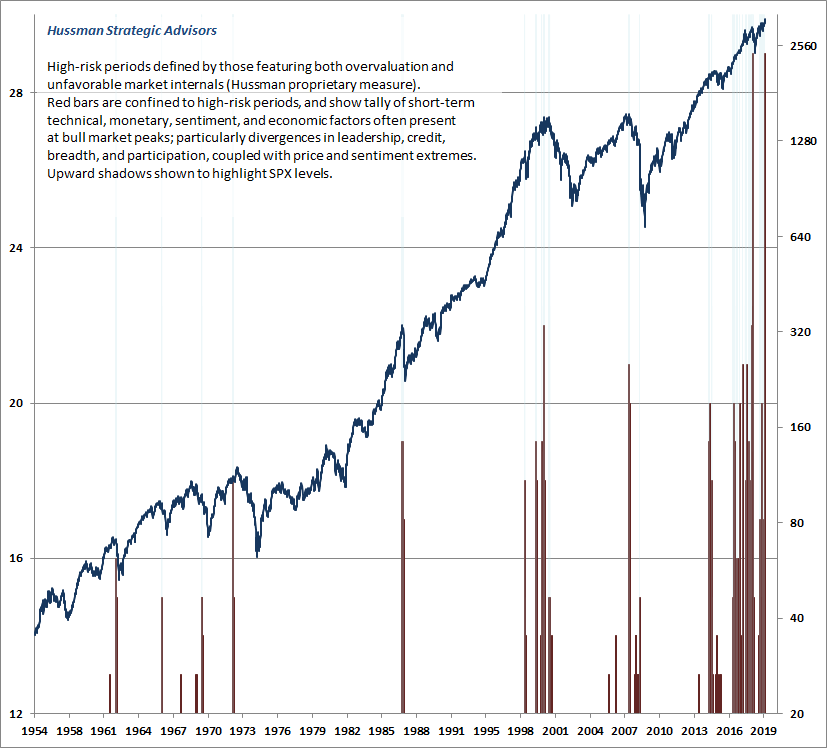

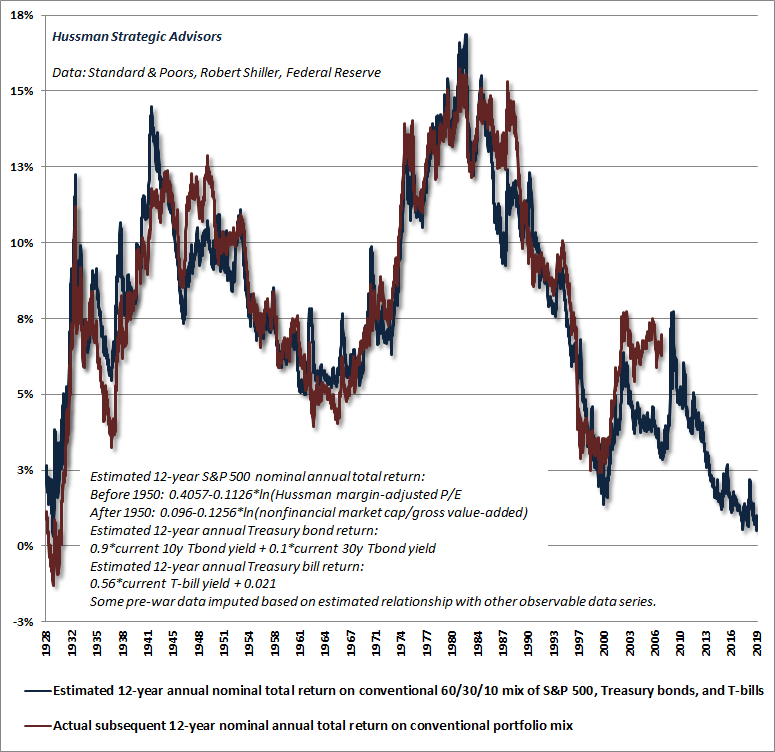

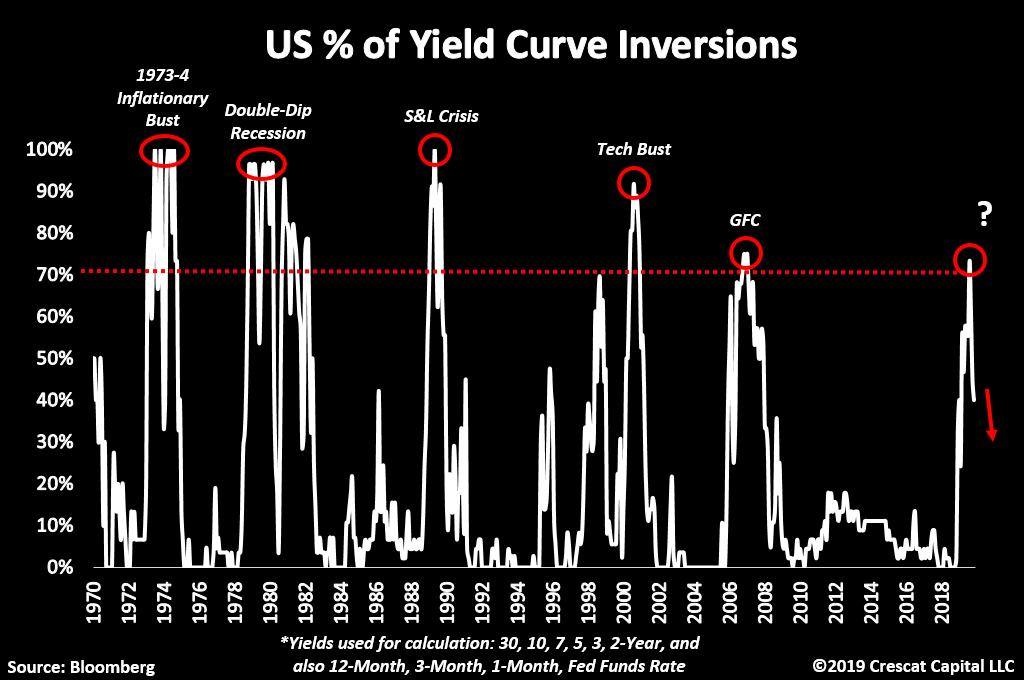

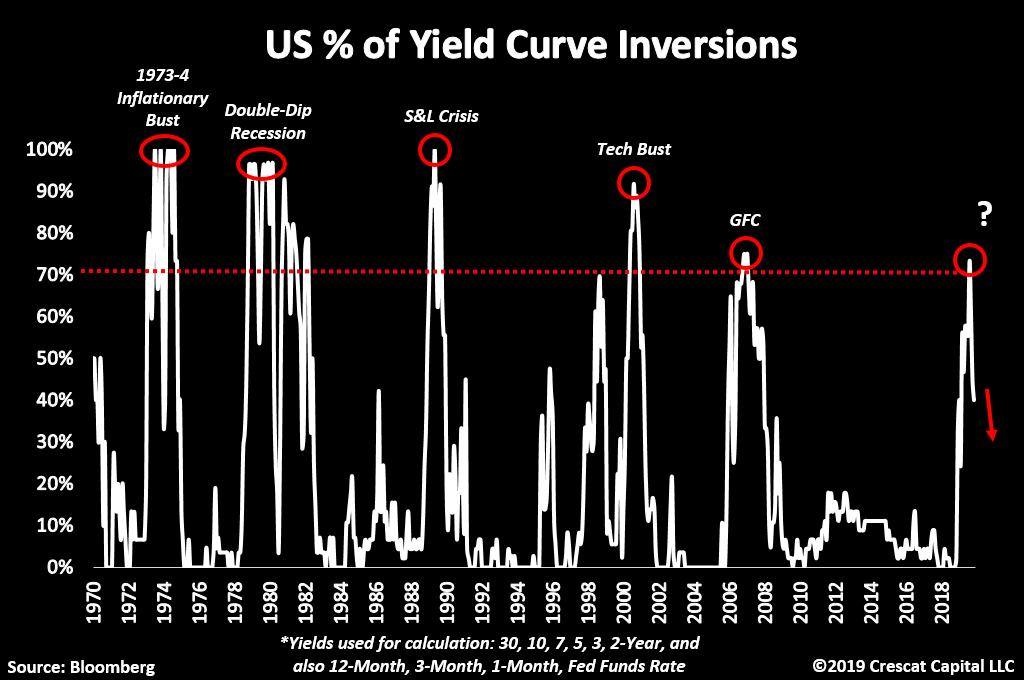

Crescat Capital: The Impending End of a Mania.

Macro Imbalances

There is a laundry list of dangerous assets bubbles in the global financial markets today that have built up over a record long US economic expansion:

Catalysts

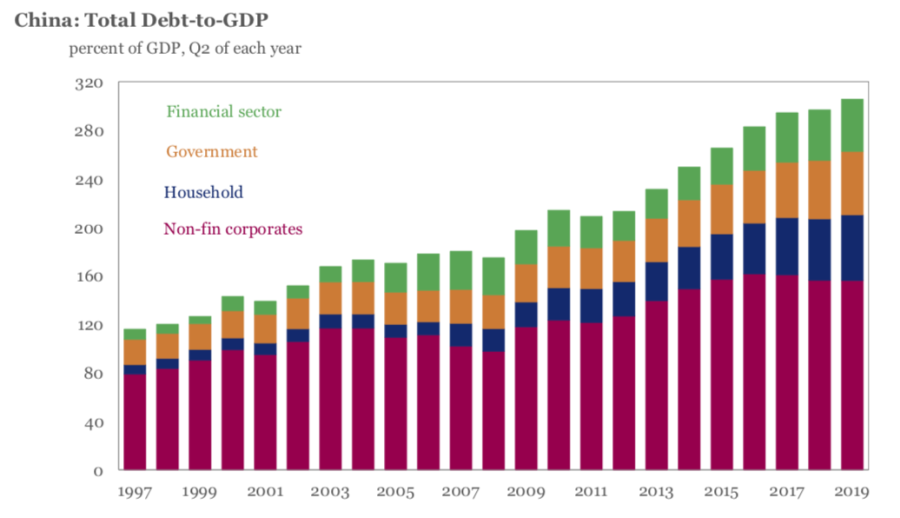

- Highest ever global debt to GDP levels;

- …

- Record indebtedness of US public and private corporations combined relative to GDP…

The unwinding of these imbalances is likely to be highly destructive to the investment portfolios of unprepared global savers today. Below, we list the confluence of macroeconomic timing signals, including social and geopolitical forces, now bearing down for an assault on overvalued financial assets. Most of these have been uncanny warning signs directly ahead of past bear markets and business cycle peaks.

In the US:

- The Treasury yield curve recently exceeded the critical 70% inversion threshold that has preceded each of the last six recessions with no false signals;

- The Conference Board’s consumer expectations survey has diverged strongly to the downside compared to its unsustainably high present situation index;

- Job openings are declining while the lagging and contrarian unemployment rate is at cyclical lows;

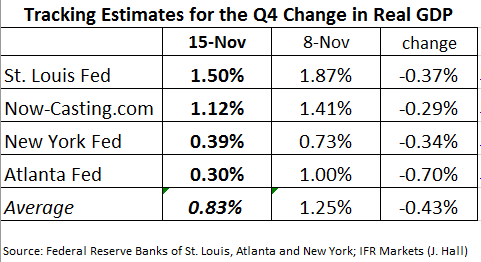

- Both the Atlanta and New York Fed’s real-time GDP trackers have been trending steadily down for almost two years and appear to be approaching recessionary levels;

- Corporate earnings of the Russell 3000 already contracted on a year-over-year basis in the last reported quarter;

- US share buybacks are now 30% lower than 2018;

- Increased insider selling of stocks;

- Declining CEO/CFO confidence surveys;

- M&A transactions drying up;

- ISM manufacturing PMI at recessionary levels;

- Construction spending declining;

- Bearish deteriorating stock market breadth while indices reach highs;

- Implied volatility for stocks retesting low levels that preceded previous selloffs;

- Smart money flow index diverging from the recent run-up in the S&P 500;

- Leveraged loans stumbling;

- Busted/delayed/cancelled IPOs;

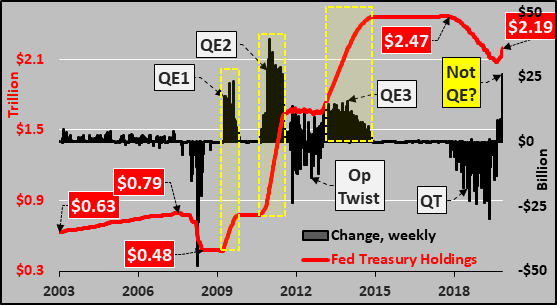

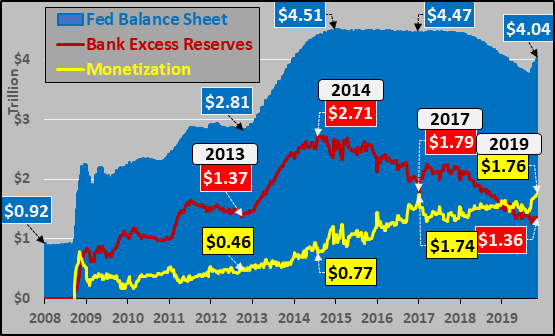

- Recent liquidity crisis that spiked interest rates in the overnight US Treasury rehypothecation market;

- Inflation rate above the entire Treasury yield curve;

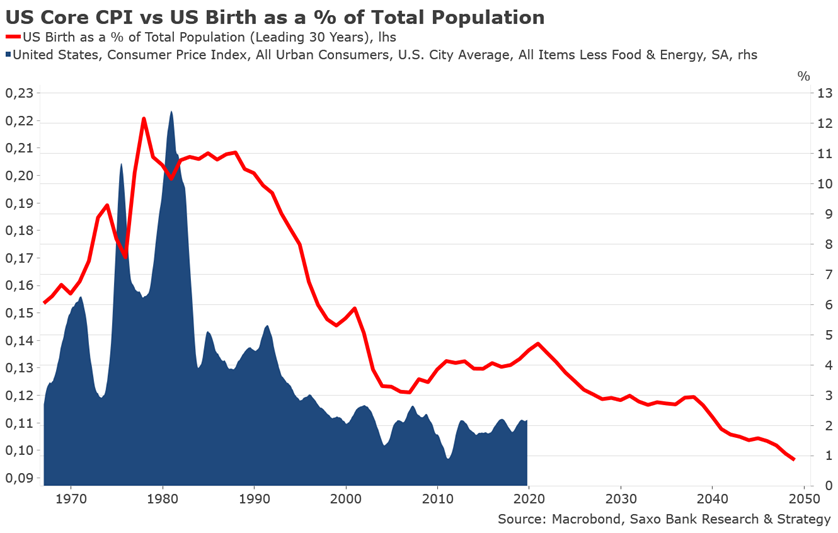

- Core and median CPI at 10-year highs diverging from long-term inflation expectations at 40-year lows;

- Capacity utilization now falling;

- Commercial & industrial loans declining the most since the housing bust;

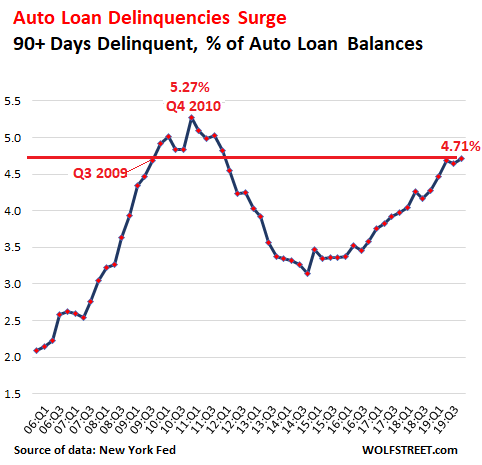

- Auto loan spreads rising as delinquency rates rise;

- Net exports of services now falling the most since the GFC and tech bust;

- Increased election uncertainty and rising political polarization creates an unknown binary outcome for future tax policy which is now friendly for financial markets but could swing 180 degrees; …

"A Once In A Decade Divergence" Warns This Global Macro Fund (between global equities and their underlying fundamentals)

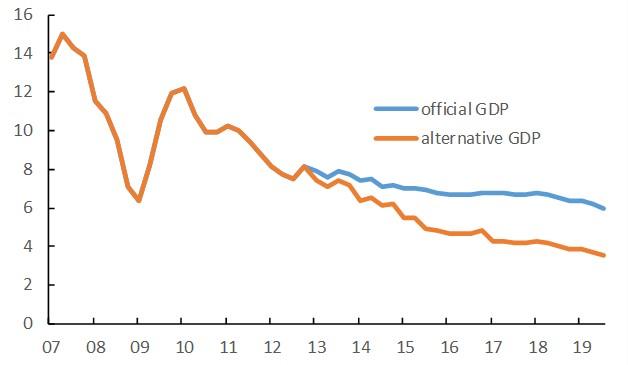

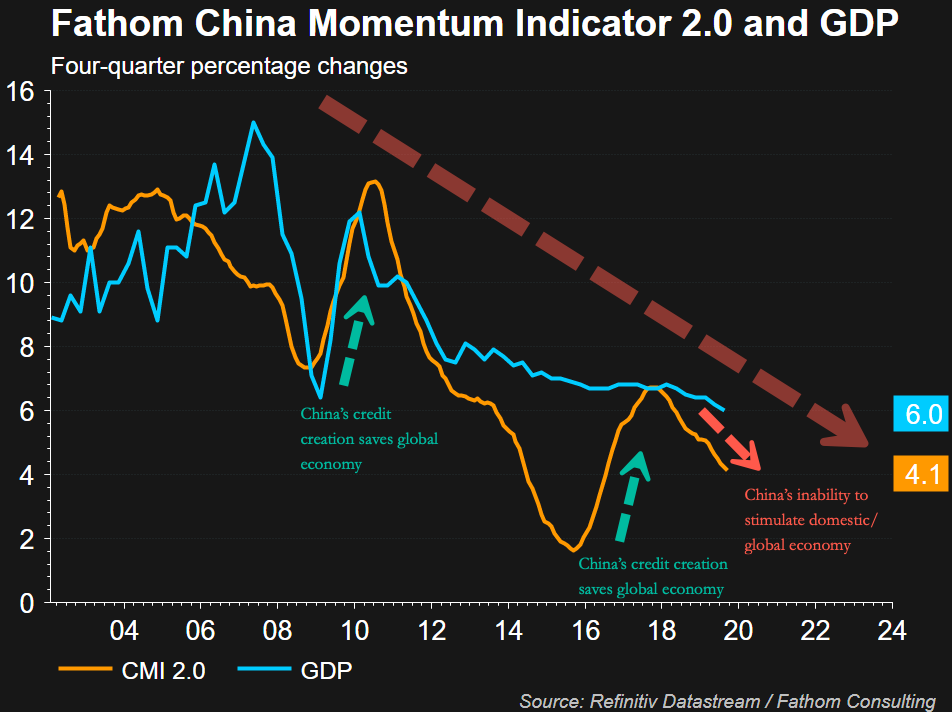

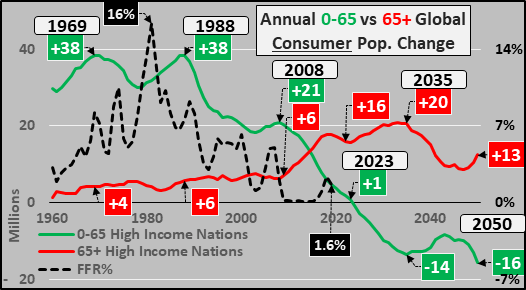

“As we look out over the next six months, we see material risk for global equities as market participants come to the realization that economic growth will not rebound in a similar fashion to the 2016 global growth cycle. However, given our current visibility, we do see stabilization in the global economic data in Q12020, but the rebound following this stabilization will likely be the weakest since 1998 – implying an L like recovery versus a V or U.

This is largely a function of global credit growth, which has only risen 0.84% from its lows versus the historical cyclical upturn threshold minimum of 2.70%. While we see stabilization globally, our US leads point to further deterioration in consumption and employment through 1H20, which complicates the potential global bottom. Nevertheless, global equities are currently pricing in a 2016 like rebound in global growth, which will likely need to be priced out before we become more constructive on international equities and weak dollar plays,"

See link for more charts on Pervalle’s leading (long leading and short leading) indicators

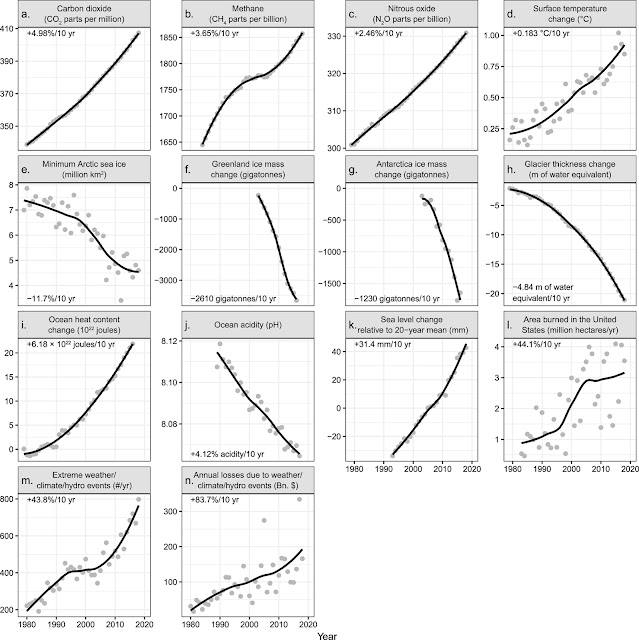

(Not just) for the ESG crowd:

FT: Climate change: how China moved from leader to laggard. If you can’t access FT.

A Solar 'Breakthrough' Won't Solve Cement's Carbon Problem.

The Collapse of Civilization May Have Already Begun.

Scientists disagree on the timeline of collapse and whether it's imminent. But can we afford to be wrong? And what comes after?

“It is now too late to stop a future collapse of our societies because of climate change.” These are not the words of a tinfoil hat-donning survivalist. This is from a paper delivered by a senior sustainability academic at a leading business school to the European Commission in Brussels, earlier this year. Before that, he delivered a similar message to a UN conference: “Climate change is now a planetary emergency posing an existential threat to humanity.”

Nate Hagens. Economics For The Future – Beyond The Superorganism. Science Direct.

“The real problem of humanity is the following: we have paleolithic emotions; medieval institutions; and god-like technology.”– E.O. Wilson

Despite decades of warnings, agreements, and activism, human energy consumption, emissions, and atmospheric CO2 concentrations all hit new records in 2018. If the global economy continues to grow at about 3.0% per year, we will consume as much energy and materials in the next ±30 years as we did cumulatively in the past 10,000. Is such a scenario inevitable? Is such a scenario possible? Simultaneously, we get daily reminders the global economy isn’t working as it used to such as rising wealth and income inequality, heavy reliance on debt and government guarantees, populist political movements, increasing apathy, tension and violence, and ecological decay. To avoid facing the consequences of our biophysical reality, we’re now obtaining growth in increasingly unsustainable ways.

The developed world is using finance to enable the extraction of things we couldn’t otherwise afford to extract to produce things we otherwise couldn’t afford to consume. With this backdrop, what sort of future economic systems are now feasible? What choreography would allow them to come about? In the fullness of the Anthropocene, what does a hard look at the relationships between ecosystems and economic systems in the broadest sense suggest about our collective future? Ecological economics was ahead of its time in recognizing the fundamental importance of nature’s services and the biophysical underpinnings of human economies. Can it now assemble a blueprint for a ‘reconstruction’ to guide a way forward?

Before articulating prescriptions, we first need a comprehensive diagnosis of the patient. In 2019, we are beyond a piecemeal listing of what’s wrong. A coherent description of the global economy requires a systems view: describing the parts, the processes, how the parts and processes interact, and what these interactions imply about future possibilities. This paper provides a brief overview of the relationships between human behavior, the economy and Earth’s environment. It articulates how a social species self-organizing around surplus has metabolically morphed into a single, mindless, energy-hungry “Superorganism.” Lastly, it provides an assessment of our constraints and opportunities, and suggests how a more sapient economic system might develop.

Quotes of the Week:

Scott Adams, on staying in your lane: “At the time of this writing, the two most influential politicians in the United States are a real estate developer who became president and a bartender who got elected to Congress.”

Also: Graham, Gundlach, Dalio, Klarman, Grantham, Marks, Montier…

Headline of the Week:

Left in Car on Its Own, Florida Dog Shifts Into Reverse and Drives in Circles for an Hour.

The video of the cops just standing there watching is pathetic / funny, take your pick.

Photos of the Week:

Humpback whales feeding off Alaska.

“A herd of elephants marched 12 hours to the house of Lawrence Anthony after he died – the man who saved them.

They stayed there silent for two days. Exactly one year after his death, to the day, the herd marched to his house again.”