**** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

In his November 7, 2023 New York Times newsletter, the economist Paul Krugman asks a good, albeit belated, question: Why did so many economists get the inflation outlook wrong? After all, the near-consensus among mainstream economists in recent years was that inflation would persist – and even accelerate – and that this justified substantial interest-rate hikes by the US Federal Reserve. Yet the quasi-inflation of 2021-22 proved transitory.

Krugman poses his question with impeccable diplomacy, professing “respect” for three authors of a September 2022 paper published by the Brookings Institution (which was then promoted by Harvard University’s Jason Furman) projecting that it would take at least two years of unemployment at 6.5% to bring inflation back to the Fed’s self-imposed 2% target. But inflation had already peaked before the Brookings paper appeared, and long before the Fed’s rate hikes might have been felt. Over the next year, inflation petered out, even as unemployment remained below 4%. “Team Transitory” – which once briefly included US Secretary of the Treasury Janet L. Yellen – endured two years of derision, but it was correct all along.

Krugman rightly focuses on the illogic of certain inflation “pessimists,” who “came up with new, completely unrelated justifications” for their contention that inflation would “remain stubbornly high” long after the 2021 fiscal stimulus packages had been absorbed. Since these pessimists encountered very little mainstream dissent, their doomsaying continued to dominate the discourse well into 2023..........

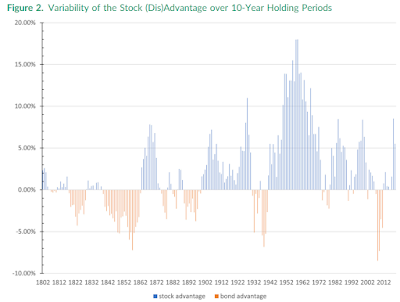

When Jeremy Siegel published his“Stocks for the Long Run” thesis, little was known about 19th-century stock and bond returns. Digital archives have made it possible to compute real total return on US stock and bond indexes from 1792. The new historical record shows that over multi-decade periods, sometimes stocks outperformed bonds, sometimes bonds outperformed stocks and sometimes they performed about the same. New international data confirm this pattern. Asset returns in the US in the 20th century do not generalize. Regimes of asset outperformance come and go; sometimes there is an equity premium, sometimes not.

Stocks are driven by stories. Stories such as AI, weight-loss medication, or CRE being a headwind for regional banks.

The bond market, on the other hand, is different. Bonds and credit are contracts. Contracts are formal and legally binding agreements about delivering future cash flows to investors.

The most remarkable difference between stocks and bonds is how unquantifiable stories are, how stories come and go, and how stories involve selecting certain facts and ignoring other facts.

At the moment, stocks are focusing on the rapid decline in inflation. But stocks could also have chosen to focus on rising delinquency rates on credit cards and auto loans, the rise in HY default rates, or the rapid decline in bank lending, see charts below. But these facts are complicated. So, for now, the stock market is holding on to the simple story that inflation is falling. Without the nuance that a rapid decline in inflation would often be driven by a rapid decline in the economy.

With Fed hikes every day biting harder and harder on consumers, firms, and banks, and rates staying high at least until the middle of 2024, the risks are rising that we over the next six months will get a soft landing in inflation and a hard landing in the labor market.

Stocks seem to be increasingly growing in conviction that inflation will slow sufficiently without the US economy rolling over. That is the dream-like scenario of a soft landing, but it’s also a dream. So, enjoy it while it lasts. ....

.......................... The IMF sums it up: “the medium-term outlook for global growth is at its lowest in decades. The IMF’s five-year ahead global growth projections have steadily declined from a peak of 4.9 percent in 2013 to just 3.1 percent in 2023, lowering the pace of convergence in living standards between emerging market and developing economies and advanced economies, while also posing challenges for debt sustainability and investment in the climate transition.” ...........

I've been predicting the demise of inflation for at least a year now, and today's CPI report makes it official—there's no denying that inflation has fallen to within spitting distance of the Fed's target. Not coincidentally, the market has finally acknowledged what I've been expecting for many months: the chances of another Fed tightening at this point are zero. The only issue now is when the Fed starts to cut rates; the market thinks the first cut comes at the May 1st FOMC meeting, while I think it happens much earlier.

... Absent shelter costs, which we know have been artificially inflated due to the BLS's flawed methodology (see Charts #2 and #3), the CPI is up only 1.5% in the year ending October '23. In fact, by this measure, inflation has been at or under the Fed's target for the past six months. ......

Is there any reason at all for the Fed to hold off on lowering rates until May? Not that I can see.

Monetary policy is manifestly tight, as reflected in a variety of indicators: 1) a significant deceleration in the rate of nearly all price increases, 2) a 57% plunge in new mortgage originations since early 2022 (i.e., high interest rates have severely impacted the housing market), 3) a 20% decline in non-energy commodity prices since early 2022, 4) at 2.3%, real yields on 5-yr TIPS (an excellent barometer of how tight monetary policy is) are substantially higher than their 28-yr average (1%), and 5) the yield curve is still inverted.

If the Fed remains true to form, they will wait too long to lower rates, just as they waited too long to raise rates two years ago. And that, in turn, means that when they eventually do lower rates, they will have to lower them faster and by more than if they were to start now. .....

If inflation was transitory, after all, what's next? We are expecting a resumption of the low inflation environment that occurred for many years prior to the Great Virus Crisis. However, there is already a strong whiff of deflation in the air. If that's what happens next, then the source will be China's economy, which is weighed down by its deflating property bubble and by its rapidly aging population.

The resurgence of economic orthodoxy is a great example of how declining schools of thought can maintain dominance in the narrative for extended periods of time if the vested interests are powerful enough. In the case of the economics profession, mainstream New Keynesian theory persists because it serves the interests of capital. Recently, the IMF urged the Australian government to engage in ‘fiscal consolidation’ in order to support further interest rate hikes by the RBA aimed at reducing inflation quickly. In general, the IMF is urging nations to engage in fiscal austerity in order to bring their public debt ratios down. The problem is that even their own research shows that these fiscal adjustments on average do not succeed. And, usually, they leave a damaged society where the lower income and disadvantaged cohorts are forced to endure the bulk of the negative effects. ....

China Fare:

The Collapse of China’s Real Estate Bubble: Causes and Consequences

Successive defaults of China’s major property developers and the Evergrande Group filing for bankruptcy are triggering concern that the Chinese economy is becoming more like Japan’s. Could China be set to repeat the Japanese course, with a “lost 30 years” following an asset bubble’s collapse?

Quotes of the Week:

....... “Philip Carret, who wrote The Art of Speculation (1930), believed “motive” was the test for determining the difference between investment and speculation. Carret connected the investor to the economics of the business and the speculator to price. ‘Speculation,’ wrote Carret, ‘may be defined as the purchase or sale of securities or commodities in expectation of profiting by fluctuations in their prices.’”

Chasing markets is the purest form of speculation. It is simply a bet on prices going higher rather than determining if the price being paid for those assets is selling at a discount to fair value.

Benjamin Graham and David Dodd attempted a precise definition of investing and speculation in their seminal work Security Analysis (1934).

“An investment operation is one which, upon thorough analysis, promises safety of principal and a satisfactory return. Operations not meeting these requirements are speculative.”

......... Jeremy Grantham, GMO

“You don’t get rewarded for taking risk; you get rewarded for buying cheap assets. And if the assets you bought got pushed up in price simply because they were risky, then you are not going to be rewarded for taking a risk; you are going to be punished for it.”

.... George Soros, Soros Capital Management“It’s not whether you’re right or wrong that’s important, but how much money you make when you’re right and how much you lose when you’re wrong.”

QTR: First, I’ll take to my mea culpa: I have been predicting that equity markets are going to move lower for the last two years, since rates have started to rise, and for the most part I’ve been wrong. This doesn’t mean I'll be wrong in the future, but it's important to know that thus far my timing has been poor, while I continue to believe that the fundamentals of my thesis – namely, that 5% rates on the largest outstanding bubble of debt in history - are still going to wreak havoc. ........................

This is the same type of stark, inevitable realization that we’re going to have about our economy: all this bullshit simply can’t fit into the confines of mathematics and reality.

We simply can’t keep rates where they are without something breaking, and the two-year lag that generally follows moves in monetary policy changes is all but behind us now: we are officially walking into the unknown and, ironically, it’s coming at the point when everybody is the closest to declaring victory.

Tweets of the Week:

...

...

12:13:

...

...

Vid Fare:

(not just) for the ESG crowd:

In a new “state of the climate” report, researchers admit that this year of climate records and continued inaction has scared them. Their vulnerability is neither strategic nor exaggerated—they’re just being honest.

If all proposed export terminals are built, the climate-warming emissions would be equivalent to 532 coal plants.

Kenyan president William Ruto has reinvented himself as Africa’s climate champion. But, his policy contradictions reveal that this is just his latest hustle.

Kenyan President William Ruto’s climate agenda is riddled with contradictions. From forestry to agriculture to energy to transportation and beyond, amassing greater power, prestige and wealth is the single thread that ties his policies together. His biggest hypocrisy—climate positivism, carbon markets, and win-win green growth—is no different.A student of the late dictator Daniel arap Moi, Ruto is a consummate opportunist and master storyteller. He is a chameleon deftly saying one thing while doing another to strengthen his political power and enrich himself at the expense of his fellow Kenyans. His public life has been plagued by charges of corruption and violence. Once he became President, he appointed allies, charged with everything from corruption to assault and rape, to top positions. It is an open secret in Kenya that political office is a personal business. No one embodies this more than Ruto.Ruto is a salesman first and a politician second. He gained the presidency by selling his chicken-seller, rags-to-riches story. In this story, he is the hustler-in-chief among a nation of struggling hustlers. He is the everyman. This is an old story dressed in new clothes. He is more con man than hustler today. His newest con is win-win green growth. An old lie in new, green clothes.

Sci Fare:

..................... Through mass vaccination we’re forcing the CD8+ T cells to do the job these NK cells would normally be doing. And whereas the NK cells maintain their effectiveness despite growing genetic diversity of Spike, there’s now clear evidence of widespread T cell exhaustion in the population.

The impact of this problem will reveal itself as the circulating genetic diversity of the virus increases. You will need more and more CD8+ T cells, to do the same job as a given number of NK cells do.

The most important thing to take away from this is that there are persistent differences in the immune response between vaccinated and unvaccinated people. The IgG4 response has been discussed at length by me and others, but the CD8+ T cell dominant response in the vaccinated has to be kept in mind too.

The eventual outcome of this is the unravelling of the human immune system. That’s a big claim to make, but all the signs are there: The IgG4 response, the elevated level of T cell exhaustion that can now be observed in most of the population, the long COVID cases that increase with every new wave. ...

I have to point this out. There’s a new study that looks at what happens to dogs when they are infected by SARS2. I don’t endorse these experiments for obvious reasons, but I can’t ignore the news. They find that after infection, everything turns to shit. T cells infiltrate the brain, the blood brain barrier degrades, the vessels in the brain get fucked up and eventually neurons start dying too. This continues after the virus itself is gone from the brain.

That’s the thing with the “0.2% fatality rate” narrative. There’s a vast demographic of people who survive but have some form of lingering damage to their body. And then they get infected again. And you have to be really intellectually creative to just deny this growing pile of evidence that people’s brains are degrading as a consequence of their exposure to this virus.

Geopolitical Fare:

For a group of journalists and scholars, the ‘Nazigate’ scandal in Parliament seemed entirely predictable

................................. Israel’s allies keep trying to portray it as a rational actor and a positive force in the world, but if you listen to Israelis themselves you get a very different understanding of what this murderous apartheid state is actually about.

As Maya Angelou said, when someone shows you who they are, believe them the first time.

White South Africans realised their apartheid project was unsustainable; Israelis will, too.

As Palestine is openly genocided — as its children, hospitals, food, and water are destroyed — people are expected to condemn Hamas. Hamas, the force defending Palestine. The force fighting the colonizers in open battle, while Empire hides behind jets and computer screens. Why on Earth would I condemn Hamas? Do you think I write about anti-colonialism and anti-imperialism for clout?

I support Hamas. I hope they win. More power to them.

The western media just says the word ‘Hamas’, says nothing at all about them, and expects its racially conditioned audience to just bark along. They just say the world ‘Hamas’ and we’re expected to be scared because it’s Muslim sounding. I have been told to fear Muslims my entire adult life, while imperial troops kill, rape, torture, and steal ‘because’. I refuse to believe that bullshit anymore. Muslim people living in the land of the prophet are not the problem. The godless colonizers trying to steal their resources underneath are. ............

I also refuse to condemn Hamas because of their October 7th attack on Israel. That’s like condemning the Warsaw Ghetto Rebellion. You shouldn’t and I won’t. I’m with the people in the concentration camp, not the guards. The Al Aqsa Flood was a military hit against an occupying army and the Palestinians — and only the Palestinians — have a right to self-defense. The Al Aqsa Flood was a disciplined attack, killing many military personnel and zero babies. No physical proof of rape has been offered at all, because it didn’t happen. Hamas did take hostages to exchange for the thousands held by Israel, which is certainly scary, but that’s war. Israel, in its wild response, has actually killed those hostages just as it killed its own civilians on October 7th, bombing its own positions and strafing everyone out of pure cowardice and incompetence. I don’t condemn the Al Aqsa Flood. It was a righteous hit on the most evil colony of the most evil Empire ever. I’m with the rebels, not the Death Star.

I especially reject the demand to condemn Hamas, based on the source. The Western media, which has backed every imperial war forever, has no place lecturing anyone on ethics.........

...

Other Fare:

Dispersed power is hidden power, hidden power is unaccountable power, unaccountable power is illegitimate power, and illegitimate power does not deserve your compliance

Who, if anyone, or what, if anything, is in charge?

In many ways this is the question of the age, inspiring passionate debates across the ideological spectrum, with divergent answers springing not just from left and right but from every boutique micro-ideology howling within humanity’s splintered mind. ..........................

......... Politicians in our representative democracy don’t really decide anything. They serve as a distraction. They’re leader-shaped appendages of the managerial state, dangled in front of the public in order to draw attention away from the shapeless cloud within which actual power resides. They provide brief little bursts of hope – this guy will really change things! – and when the shine inevitably comes off, they act as lightning rods for popular discontent. The relationship of elected politicians to the permanent bureaucracy is essentially that of an anglerfish’s bioluminescent lure to its giant, toothy mouth.

The entire system seems to be designed around maximization of the system’s ability to wield power, whilst diffusing responsibility such that identifying the actual source of power is nigh impossible, thereby shielding those wielding power on behalf of the system from any negative consequences of their decisions. ..............................

Cloaking power behind layers of anonymity and secrecy provides fertile soil for rampant and thoroughly justifiable paranoia, but the seeming futility of trying to reason with or in any way influence power also engenders learned helplessness. You can complain, you can meme, you can shitpost, you can write long analytic essays grappling with the nature of the managerial state, you can do deep investigations into this or that conspiracy, you can demonstrate at length the misguided nature, lack of empirical footing, and obvious deleterious consequences of this or that policy, but none of it seems to have any effect. It’s like fighting with mist. No matter how much you struggle, it just swirls around you. After a while, you stop struggling. Thus, the peculiar mood of our age: on the one hand, trust in institutions is at an all-time low, while suspicion as to the motivations behind institutional actions is at an all-time high ... but on the other hand, there is a pervasive apathy, a sense that there is nothing that can really be done about any of it. ........

A response to Ayaan Hirsi Ali's declaration "Why I am Now a Christian"

................. Thus, there are perfectly rational reasons to ground morals and values in universal humanistic principles, and these do not depend on adherents being theists or atheists. That they are universal principles mean that they apply to all people—Jews, Christians, Muslims, Buddhists, Hindus, pantheists, deists, agnostics, and atheists. Whether or not there is a God—much less the Christian God—is irrelevant. That’s what universal means. ............

Atheism isn’t the alternative to the Judeo-Christian worldview, Enlightenment Humanism is. We can ground human morals and social values not just in philosophical principles such as Aristotle’s virtue ethics, Kant’s categorical imperative, Mill’s utilitarianism, or Rawls’ fairness ethics, but in science as well. From the Scientific Revolution through the Enlightenment, reason and science slowly but systematically replaced superstition, dogmatism, and religious authority. As the German philosopher Immanuel Kant proclaimed: Sapere Aude!—dare to know! “Have the courage to use your own understanding.” As he explained: “Enlightenment is man’s emergence from his self-imposed immaturity.” The Age of Reason, then, was the age when humanity was born again, not from original sin, but from original ignorance and dependence on authority and superstition. Never again need we be the intellectual slaves of those who would bind our minds with the chains of dogma and authority. In its stead we use reason and science as the arbiters of truth and knowledge.......

With a few more books and a few old ideas.

.... We can begin from a simple but really rather profound and worrying point: in most western societies today, there is a massive and increasing gap between what governments and medias say about the world, society and the economy, and the way that we experience these things in real life. I say “we,” because even the higher reaches of the Professional and Managerial Caste. (PMC), or the Inner Party, as I have come to call them, are aware of the reality of the world to some small extent: they just don’t care, and in any case the phantom society conjured up by speeches, documents and media reports from the PMC and its minions suits them just fine.

I think this is a situation unprecedented in western history. The average citizen is repeatedly told things and invited to believe things that they know cannot possibly be true, and are duly disproved by the unfolding of events; but which are then continually repeated, as though in fact they were true. Now, some who lived through the period of Communism in the Cold War have said much the same, but I think there’s an important difference. Those societies did in fact make efforts to improve the living standards of ordinary people, and to provide decent education and healthcare, all while running what amounted to a permanent wartime economy in peacetime. And the people of those countries were sufficiently mature to understand that they were being systematically lied to, in a way that we are not. After all, until the 1980s, western governments were on the whole efficient and effective, and, especially in the thirty years after 1945, they oversaw an unprecedented increase in the health, security and education of ordinary people. Rather like a frog boiled slowly in the famous saucepan, our societies today have difficulty in understanding that the institutions of the past have been sold off or neutered, the political systems have been totally corrupted, and the economy is just a way for the Inner Party to rob the people. Slow and quiet revolutions are always the most effective and long-lasting. ....

Other Tweets: