*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

A purely price-based signal suggests the bottom is in for stocks despite several lingering risks.

This is a hard column to write. Deposit flight, poor liquidity, weakening earnings, a credit crunch, recession – it would be much easier to list reasons why equities should be lower. But that doesn’t necessarily mean it will be so. As anyone who has spent enough time in markets understands, they have a habit of being “anti-utilitarian”: causing the most people the maximum amount of pain. It thus always pays to consider the other side of the case. ....

... The Coppock is at base a momentum oscillator, which triggers when medium and longer-term measures of momentum begin to turn up on a persistent basis. Based on adapted parameters, it triggers only rarely, but the times when it has done – e.g. October 1982, August 1988, April 2003, August 2009 – are a catalogue of generationally good buying opportunities. ...

If technical signals’ strength is their simplicity, it is also their weakness. No trader or investor could ever take a decision based purely on them (unless part of a more sophisticated quant strategy). It would be tricky, to say the least, to explain to a client or your CIO that you went long purely because one arbitrary moving average passed above another.

On the other hand, it pays to incorporate them into one’s view. In today’s case, the message is that despite everything pointing toward weaker stocks, the price action is whispering that that just might be wrong.

The Federal Reserve has a mandate to maintain long-run employment and price stability. However, lags in monetary policy and unexpected shocks can lead to short-term deviations from these targets. This column argues that the Fed’s objective is asymmetric, with inflation overshoots being more costly than undershoots. Using data from the Summary of Economic Projections it shows that the Bernanke Fed was too hawkish, the Yellen Fed was too dovish, and the Fed under Jerome Powell has at times been too hawkish and too dovish. Modern macroeconomic models should integrate such asymmetries when analysing monetary policymaking.

Non-monetary policymakers haven’t risen to the challenge.

The financial sector is still roiling from the failure of Silicon Valley Bank. At the epicenter of factors triggering the collapse is the Federal Reserve’s strategy of hiking interest rates. This would be a good time to ask: How else might we tamp down inflation?

Rapidly ratcheting up interest rates is intended to “cool down” the economy by inducing unemployment, or at least reducing job openings. Policies that lower labor demand make it easier for companies to compete for employees without triggering so-called “wage-price” inflation. And lower employment, in turn, also means there are fewer people with “excess wealth” demanding goods and services and thus driving inflation.

The alternative is an economy that meets or over-supplies goods and services. Such an economy is disinflationary because it drives competition and thereby lowers prices. Economists like to point out that such supply-side solutions are “time-consuming to implement.” They are. So too are the effects of rate hikes. As Congressional Research Service economists wrote recently, it can take “from 18 months to several years for the effects of Fed policy changes to feed through to inflation.” .....

.... My take: There are only two things you need to know about inflation today: 1) without the Owners' Equivalent Rent component (which makes up about one-third of the CPI), the CPI would have declined at a -1.6% annualized rate in March, and 2) OER inflation has peaked and will almost surely decline significantly in coming months. In short, our national inflation nightmare is over. If the economists at the Fed can't understand this, they should be fired. There is absolutely no reason the Fed needs to raise rates further, and every reason they should begin cutting rates—beginning with the May 3rd FOMC meeting if not sooner.

.......... To paraphrase Wayne Gretzky, the Fed should be focused on where CPI is going, not on where it has been. It's on its way to zero, and that means the Fed should cut rates—and the sooner the better.

#50: Now, how long can they hold...

........... More broadly, buying equities on the Fed’s pause has surprisingly mixed results. Recessions tend to hurt stocks eventually, but big gains can happen in the interim. In 2000, the Fed’s pause coincided with the market top. In 2006, the S&P 500 would gain another 25% after the Fed paused before cratering in the Great Recession. Stocks loved the 2018 Powell Pivot, gaining 43% before the COVID crash. But this cycle is different in so many ways - perhaps historical analogs will prove less useful.

..... Even the US Federal Reserve accepts that a recession is unavoidable. At its last meeting, its economists agreed that there would be a ‘mild recession’ in US economic activity this year. And according to economists at the Bank of America, there are plenty of signals that suggest a recession in the US has not been avoided and they provide several charts to back that up. ...

..... Much has been made on the left about the huge rise in corporate profit margins after the end of the pandemic. And this is undoubtedly the main contributor to the inflationary spiral experienced in all the major economies in the last 18 months – not any wage-cost push as the Keynesians argue; or too much money supply as the monetarists argue. A January study from the Federal Reserve Bank of Kansas City found that “markup growth”—the increase in the ratio between the price a firm charges and its cost of production—was a far more important factor in driving inflation in 2021 than it had been throughout economic history. ...........

Timing and predicting recessions is an important task, not only for traders looking to make a profit but also for policymakers looking to correctly time stimulus measures. Not many people are against government stimulus measures during difficult times, but the problem is that recessions are difficult to spot in real-time, and policymakers often provide help too late and then offer support for too long.

In 1980, Victor Zarnowitz and Geoffrey Moore, two pioneers of business cycle research, proposed a signaling system that could help alert policymakers to recessions. The concept was that policymakers could be alerted to recessionary periods in a series of stages, helping to conduct timely stimulus measures because the effectiveness of any stimulus effort is only as good as the timing. Most, if not all, government stimulus today is highly reactionary, which has amplified the boom-bust cycle. .........

Signal #1: Warning of Below Trend Growth

....... Signal #1 was triggered in May 2022. The last time Signal #1 was triggered, in 2006, the Fed paused monetary tightening. This time, the Fed got more aggressive and hiked interest rates even faster after Signal #1 was triggered. After the Leading Index warns you of below-trend growth, the next signal defines actually arriving at that below-trend growth.

Signal #2: Transition to Below Trend Growth (Pre-Recession)

...

Signal #3: The Recession

Signal #3 confirms a recession, but at this point, significant problems have hit the economy. Signal #3 is triggered when the Leading Index is negative, and the Coincident Indexes are negative. This is an undeniable recession. On average, this signal occurs two months after the recession start date, which is why investors and policymakers must key off Signal #2.

Signal #2 has a 100% track record of spotting recessions. Waiting for Signal #3 will leave policy lagging. The official recession dates aren’t known for well over a year, and the Federal Reserve, average economist, and average investor don’t realize the recession until it’s well underway.

The Most Dangerous 8-Month Period

On average, there is an eight-month lag between a Signal #2 reading, which is a reliable recession flag, and Signal #3, the undeniable confirmation of a recession. This eight-month gap is the most dangerous period for the Federal Reserve and for investors. The recession is virtually assured, but most investors and the Fed still can’t see it or refuse to believe it. Only when Signal #3 comes does the Fed panic and investors give up as the waves of job losses create defaults and deflationary pressure.

With the Leading Index deeply negative and the Coincident Indexes below 2%, we have a sustained Signal #2. This signal was triggered five months ago, and the average recession starts six months after getting a Signal #2. Policy should be easing already as a result of this, but the Federal Reserve is still raising interest rates targeting lagging economic indicators. Monetary policy has never been this opposed to the business cycle signals in the last 50 years.

Watch them go POOF

.......... So which option is true? In this post, I let the evidence speak for itself. Looking at cross-country evidence, I find that interest rates are decidedly non-neutral. As interest rates rise, three things happen:

- the interest share of income increases;

- the labor share of income decreases;

- income inequality increases.

In short, the evidence suggests that interest rates play a key role in the game of class warfare. And that makes sense. Interest, after all, is a rate of return. And when it comes to divvying up the income pie, rates of return are always zero sum.

Beijing’s economic policymakers largely accept that China must rebalance its economy so that growth is driven more by domestic consumption and less by investment. But once China begins to take seriously the need to rebalance its economy, China’s annual GDP growth is unlikely to exceed 2–3 percent for many years, unless there is a substantial increase in the growth rate of consumption.

How bailouts are corroding America's economy

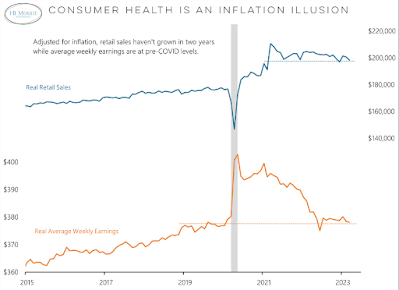

.................. More so, with a likely rise in unemployment as well as tighter lending conditions, it is bound to fall further, likely hitting the historical lows of the last inflationary boom-bust cycle in 1974

However, there is a disturbing difference to 1974: back then, debt levels were negligible, today they stand at 370% public and private debt to GDP

The combination of a stalling economy and high debt levels historically always lead to mass defaults and other credit events. For the US today, with Silicon Valley Bank as prelude, the next source of trouble is taking shape - US office real estate. It only requires some very basic math to see why: ....

The crisis that has engulfed crypto in the last year is a crisis of fractional reserve banking. Silvergate Bank and Signature Bank NY were fractional reserve banks. So too were Celsius Network, Voyager, BlockFi, Babel Finance and FTX. And still standing are the crypto fractional reserve banks Coinbase, Gemini, Binance, Nexo, MakerDAO, Tether, Circle, and, I would argue, every one of the DeFi staking pools. All of these are doing some variety of fractional reserve banking. Custodia Bank and Kraken Finance claim to be full-reserve banks – but 100% reserve backing for deposits is both hard to prove and not a guarantee of safety.

What do I mean by “fractional reserve banking”? My definition might surprise you. For me, fractional reserve banking simply means that the composition of a bank’s assets is less liquid than that of its liabilities.

Fractional reserve banking is not dead

The well-known fractional reserve banking model taught to economics students proposes that:

banks keep 10% of deposits in reserve and lend out the rest (no they don’t)

for every $10 a bank receives in deposits it can create $90 of new loans (no, this is not how bank lending works)

every $1 of bank reserves becomes $10 of bank money (no it doesn’t).

This was never more than a toy model, a wildly over-simplified description of banking that bears little resemblance to what banks actually do. It conflates lending with payments and thus creates a wholly fictional relationship between lending and reserves. And after a decade of QE, the relevance of this model of fractional reserve banking, based as it is on the mistaken notion that banks “multiply up” their reserves by some percentage set by the central bank, is extremely doubtful.

But though the model may be past its sell-by date, this does not mean the concept of “fractional reserve” is dead. Far from it. The current crisis has once again brought to the fore the fundamental risk of fractional reserve banking – namely that banks, and other financial institutions doing bank-like things, can literally run out of money. .......

Factor timing has its champions and skeptics — so academics set out to find an answer to the controversial practice.

Quotes of the Week:

Goolsbee: "Given how uncertainty abounds about where these financial headwinds are going, I think we need to be cautious," Goolsbee said Tuesday in prepared remarks for an Economic Club of Chicago event. “We should gather further data and be careful about raising rates too aggressively until we see how much work the headwinds are doing for us in getting down inflation.”

Charts:

1: ...

...

(not just) for the ESG crowd:

Buying a gas car in 10 years will be about as difficult as buying a sedan today.

AI Fare:

Unlike with other tech tools, working with generative AI is closer to collaborating with humans

Other Fare:

not everyone can do everything

Recently I watched a surprisingly-good movie called Chang Can Dunk with my girlfriend, chosen pretty much at random from Disney+’s lineup. We weren’t expecting much, but it’s a fun and surprisingly delicate consideration of “never give up on your dreams” culture and its inevitable limits. It’s right in my wheelhouse in its willingness to point out a certain reality: everybody can do some things, but there are some things that some of us just can’t do. And all of the rhetoric about believing in yourself and never giving up, all of the social justice platitudes about accessibility and equity, can’t change that. The world isn’t fair. One of the ways it’s unfair is that some people are simply better than other people at certain skills and abilities. Born better. That’s true in athletics, it’s true in academics, and it’s true in creative fields. There’s an awful lot of mystification and obstruction when it comes to this reality, but I doubt there are very many people in the world at all who don’t understand it. Like so many other sad realities in human life, the fact that we aren’t all equally good at things has become impolite to mention

Fun Tweet Vid of the Week