*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

The tagline from Wall Street was that 2023 was the year of the bond. Instead, fund managers are coming to terms with one of the toughest years ever.

Lacy Hunt, Hoisington Investment Management Co.’s 81-year-old chief economist, who’s been analyzing markets, Federal Reserve policy and the economy for around a half-century, says it’s been the hardest of his entire career.

At HSBC Holdings Plc, Steve Major says he was “wrong” to assume the US government’s growing supply of bonds didn’t matter. Earlier this month, Morgan Stanley finally joined Bank of America and moved to a neutral position on Treasuries.

“It’s been a very, very humbling year,” Hunt said. A 13% year-to-date loss for the firm’s Wasatch-Hoisington U.S. Treasury Fund comes on top of 2022’s 34% drop, data compiled by Bloomberg show. .......

“We thought that inflation would come down and it did,” Hunt said. “In fact, there has been no decline that large in inflation that has not been involved with a recession in its immediate aftermath in the past. So the fact that gross domestic product is still rising is unprecedented.”

At the same time, it’s the expectation that a contraction will eventually happen that’s keeping Wall Street’s bruised bulls from retreating too far as they try to manage their so-called constrained funds that can invest solely in the Treasury market.

“A hard landing is coming,” Hunt said. ......

Crisis Events Are A Hallmark Of The Federal Reserve

As the “soft landing” narrative grows, the risk of a “crisis” event in the economy increases. Will the Fed trigger another crisis event? While unknown, the risk seems likely as the Fed’s “higher for longer” narrative is compromised by lagging economic data. ...

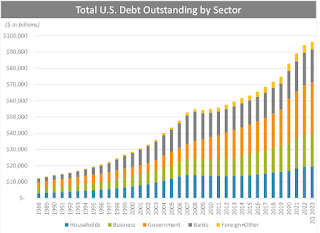

...... We currently live in the most highly leveraged economic era in U.S. history. As of Q2 of 2023, the total measurable leverage in the economy is $97 Trillion. The entire economy is currently at $22.2 Trillion, so it requires $4.36 in debt for each $1 of economic growth. Critically, that level of debt has nearly doubled since 2008, when it stood at $54 Trillion and the economy was roughly $16 Trillion in value. In other words, in just 13 years, the economic leverage rose from $3.38 per $1 of growth to $4.36. That massive surge in leverage was made possible by near-zero interest rates during that period.

.... Given the financial system’s leverage, the collision of debt-financed activity with restrictive financial conditions will lead to weaker growth. Historically, such increases in financial conditions have always preceded recessionary onsets and crisis events. Notably, those events occurred at substantially lower levels of overall leverage.

... Historically, when yield curves invert, the media proclaims a recession is coming. However, when it doesn’t immediately manifest, they assume it’s “different this time.” We just aren’t there yet, as the “lag effect” has yet to take hold. ....

On October 5, 2023, Treasury Secretary Janet Yellen made a very telling statement about the future course of interest rates.

YELLEN SAYS DEBT SERVICE COSTS WILL BE 1% OF GDP FOR THE NEXT DECADE. – Reuters

Her statement implies that the economy will be strong and the government will run budget surpluses, or interest rates will be near zero for the next ten years.

Instead of guessing what she is pondering, we do some math and arrive at the only possible answer. ......

US headline consumer price inflation rose, but the details hint at weakening pricing power and support for a soft economic landing. Most market-determined prices are softening. Durable goods deflation continues. The fairy tale of owners’ equivalent rent, where statisticians pretend people pay themselves an ever-rising monthly rent to live in the houses they own, was the main driver of higher prices.

On a year over year basis, the CPI is up 3.7%. Excluding shelter costs, which we know are artificially inflated by BLS methodology, the CPI is up only 2.0% ....

..... Chart #2 shows how BLS methodology effectively uses changes in housing prices 18 months prior (blue line) to drive the Owner's Equivalent Rent component of the CPI, which makes up about one-third of the CPI. Housing prices and rents stopped rising over a year ago, but the BLS is assuming that shelter costs are still rising at a 7% annual rate, thus artificially boosting the overall CPI. For the next six to nine months, the BLS-calculated increase in shelter costs will be dropping significantly, and that will meaningfully reduce the shelter contribution to the CPI. Meanwhile, the CPI has received a boost from rising gasoline prices in August and September; and a lot of that boost will reverse in coming months, since nationwide gasoline prices have fallen in the past several weeks. In short, expect measured inflation to remain low for the foreseeable future. Low enough to keep the Fed from raising short-term interests rates further than they already have.

October 2023: The New York Fed Staff UIG Measures

- The UIG "full data set'' measure for September is currently estimated at 2.9%, a 0.1 percentage point decrease from the current estimate of the previous month.

- The "prices-only'' measure for September is currently estimated at 2.2%, a 0.2 percentage point decrease from the current estimate of the previous month.

- The twelve-month change in the September CPI was +3.7%, the same level as the previous month.

- -For September 2023, trend CPI inflation is estimated to be in the 2.2% to 2.9% range, a slightly larger range than July, with a 0.2 decrease on its lower bound and a 0.1 decrease on its upper bound.

.........

- The case for lower yields: the signal in financial conditions...

- The case for lower yields: the signal in contracting money supply...

- The case for lower yields: signals in the yield curve and Wicksellian spread...

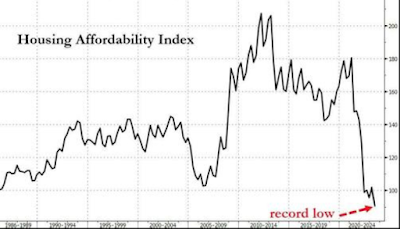

- The case for lower yields: signals in housing affordability ...

- The case for lower yields: still on US recession watch ...

- The case for higher yields: the US economy continues to grow...

- The case for higher yields: energy prices point to continued inflation...

- The case for higher yields: consumer prices and wage inflation look sticky ...

- The case for higher yields: deficits + higher interest = ballooning debt

...

- The case for higher yields: the Fed continues to shrink its balance sheet

- The case for higher yields: foreign accounts are no longer such eager buyers

....... Throughout history, whenever most investors believed the worst about a particular asset class, such has often been the right time to start buying. As we have often discussed, psychological behaviors account for as much as 50% of the reasons investors consistently underperform the markets over the long term. This brings us to the currently most hated asset class: bonds. .......

... One need not take various estimates as “forecasts,” nor specific levels as “price targets” to recognize that market valuations stand at one of the three great bubble extremes in U.S. history. .....

... It’s tempting to assume an arbitrarily high growth rate for future S&P 500 fundamentals in an attempt to justify current index levels. The challenge is that in recent decades, structural U.S. real GDP growth, the combination of demographic labor force growth and productivity growth, has progressively slowed from over 4% annually in the 1970’s to less than 2% annually today. ...

... As Benjamin Graham lamented about the 1929 bubble peak, investors abandoned their concern about valuations at the worst possible time, because years of strong returns, in the face of increasingly rich valuations, led investors to believe “that the records of the past were proving an undependable guide to investment.” The unwinding was disastrous. The same was true of the 2000 bubble. I suspect the current bubble will unwind the same way. ....

... One of the often-overlooked features of reliable valuation measures is that they are highly informative not only about long-term returns, but also about the likely depth of market losses over the completion of a given market cycle. Emphatically, these losses do not necessarily emerge immediately. Rich valuations don’t imply immediate market losses. I can’t repeat that often enough. If they did, we would never observe bubble valuations. The only way that valuations were able to reach the extremes of 1929, 2000 and today was by plowing through every lesser extreme, undaunted.

Unfortunately, the deferral of consequences should not be confused with the absence of consequences. The completion of nearly every market cycle across history has brought projected S&P 500 total returns to the higher of a) their historically run-of-the-mill 10% norm or b) 2% above prevailing Treasury bond yields. At present, that would require a market loss on the order of -63% in the S&P 500. That’s not a forecast, but it certainly is a historically-consistent estimate of the potential downside risk created by more than a decade of Fed-induced yield-seeking speculation. ...

... Financial markets are particularly sensitive to interactions between participants because every share bought by one investor must simultaneously be sold by another investor. Likewise, every single share that’s sold must also be bought. Every dollar a buyer puts “in” is a dollar a seller takes “out.” Prices change depending on which participant – the buyer or the seller – is more eager.

Needless to say, the notion of “cash on the sidelines waiting to get invested” drives me nuts. Every dollar of liquidity created by the Fed must be held by some investor until the Fed retires it by shrinking its balance sheet. That liquidity can be held in only three forms: currency in your wallet, bank reserves that you hold indirectly as a bank deposit, or funds on “reverse repo” with the Fed that you hold indirectly as a money market fund deposit. It can’t turn into anything else. The cash is already “home.” You can’t put it “into” the stock market without a seller taking it right back “out.” Someone has to hold it. That’s how zero-interest rate policy created a bubble. Someone had to hold the stuff, and nobody wanted it. That’s over. Except for physical currency, all that liquidity is now earning 5.4%. ....

... I’ll say this again. The next recession will not be “because” the Fed raised rates – indeed, the Fed funds rate remains slightly below the level that has historically been consistent with prevailing unemployment, inflation, and economic slack. As I noted last month, as an economic expansion progresses, slack in labor markets and productive capacity is gradually taken up, price pressures accelerate, real GDP expands beyond its sustainable potential, and mismatches emerge between demand and supply. Yet even without Fed action, this is already a situation where recession is more likely. Rising long-term interest rates and Fed tightening of short-term interest rates do precede recessions, but those recessions – precisely because of tight capacity and mismatches between the mix of goods and services supplied and demanded – were already more likely than not.

Meanwhile, investors should be careful about the idea that the economy has been “resilient” in the face of rising long-term interest rates. It’s not unusual for the economy to appear resilient as rates are rising. ...

... Finally, among the greatest risk factors for investors here is that while bond valuations have normalized, stock market valuations remain near historic extremes. By our estimates, the gap in expected returns between equities and bonds has joined the worst levels in history, matched only by extremes in mid-1929 and early-2000. We realize that you have lots of “equity risk premium” models to choose from, so thank you for flying with ours, because the most popular ones are runway garbage, and you can prove that to yourself by comparing their implications against actual subsequent market returns. Wall Street doesn’t do this, because it’s much easier to subtract the 10-year Treasury yield from the forward earnings yield of the S&P 500, without all that extra work of research and testing. ...

......................................

....................................

Conclusion

Zooming in on the U.S. economy, I have tried to document how the practitioners of the self-proclaimed ‘science of monetary policy’ have gone out of their way to salvage their paradigm—after the inflationary surge of 2021-2023 made it clear that the New Keynesian emperor was not wearing any clothes. All their elaborate tools and instruments, including the output gap, the unemployment gap, the New Keynesian Phillips curve and forward-looking inflation expectations, were found lacking, incapable of giving timely signals of the re-emergence of high inflation. To be fair, most economists, not just the New Keynesian ones, were caught unprepared—but for Keynesian economists, for instance, it was relatively straightforward to empirically account for the (unexpected) surge in inflation within their existing paradigm, which allows for cost-push inflation, working through backward input-output linkages in global supply chains, and for constant—and rising—profit mark-ups as well as for wealth effects (on consumption) and oil and commodity price speculation (Ferguson and Storm 2023; Breman and Storm 2023; Storm 2023).

New Keynesian economists do not have this luxury of a macro model that is relevant to the real world. ............

Investing:

Rubinstein: Risk of Ruin

Quotes of the Week:

Marks: “Resisting – and thereby achieving success as a contrarian – isn’t easy. Things combine to make it difficult; including natural herd tendencies and the pain imposed by being out of step, particularly when momentum invariably makes pro-cyclical actions look correct for a while. Given the uncertain nature of the future, and thus the difficulty of being confident your position is the right one – especially as price moves against you – it’s challenging to be a lonely contrarian.”

Charts:

1: ...

...

...

...

...

(not just) for the ESG crowd:

............... “Too much change in too short a period of time” aptly describes where we find ourselves in 2023. There is urgent public policy debate about how best to respond to the extreme weather changes that clearly show the Anthropocene having traversed planetary biogeophysical boundaries (although even that is disputed by some). We can ignore the deniers. They suffer understandably from normalcy bias, optimism bias, priming bias, confirmation bias, framing bias, anchoring bias, loss aversion, regressive conservatism (post hoc ergo propter hoc), and sick gut bacteria.

Engaging with them only impedes progress toward actual remedies.

It can be just as difficult to engage with climate believers. There are ongoing, active debates about the best solutions. There are those who believe we should throw our entire climate budget at single strategies like artificial trees or electrification. There are others who believe remediation efforts like carbon dioxide removal and solar radiation management are distracting us from the real need to end fossil carbon extraction, switch to renewable energy, and become much more efficient and less wasteful with our consumerism, ie: a circular economy or donut economics. They argue that solutions like carbon dioxide removal (whether mechanical or natural) allow polluters to keep polluting.

There are those — including reputable scientists — who say that if we just stop pumping more pollution into the atmosphere the natural decay processes of carbon dioxide, methane and the other greenhouse gases will allow earth systems time to recover. That brings me to my first chart, from Jorgen Randers and Ulrich Goluke, published in Nature November 12, 2020.

Randers and Goluke show definitively that whether we get to zero emissions by the end of this century (Scenario 1) or cut to zero instantly (Scenario 2), the decay-chain drawdown effect is only transitory, a temporary decline in this century followed by a continued rise for hundreds of years thereafter. Sea level rise would be entirely unabated.

The reason that happens is best illustrated by three other charts in the same paper:

We have already crossed thresholds, or tipping points, for three climate stability elements: permafrost, albedo, and sea level rise. All of these elements are in quest of a new stasis, but that will not be reached for many centuries, possibly many millennia, or longer — millions of years. In other words, tipping elements like permafrost melt are now self-sustaining and will keep increasing until, in the case of permafrost, it runs out of ice to melt. That drops surface reflectivity and allows more solar heat to be captured each day, resulting in steadily rising surface temperature and sea level. While the albedo (reflectivity) picture may resolve in 500 years (after all glaciers are gone), the other contributing, self-sustaining, factors are just getting started and will still be undergoing acceleration long after 500 years. ......

A deep dive into the problems world leaders have let spiral out of control.

Damodaran: Good Intentions, Perverse Outcomes: The Impact of Impact InvestingIs doing something better than doing nothing?

Sales growth has slowed in the U.S. as car companies are finding a limited pool of consumers willing to pay more for these models

Exploring the impacts of a corporate-led energy transition

Electric vehicles are seen as crucial for the energy transition. In the global North, as well as in China, they have become the symbol of the envisioned low-carbon economy and already account for more than 10 per cent of new global car sales. Despite their much-vaunted green promises of decarbonising road transport, electric vehicles require extracting a wide range of minerals, such as lithium, graphite, cobalt and bauxite.

Geopolitical Fare:

A History of the Americans Creating What They Purport to Abhor.

..... Conflation of the US’s uniparty electoral system with parliamentary systems poses Democrats and Republicans as political opponents when they jointly act as tools of American capital. This distinction without a difference between the American parties leaves a perpetual choice between two dedicated servants of capital. Add back in American imperialism, and differences between the candidates and parties shrink even more. ........

........ However, causes matter. That is why I have argued for more than a decade that unless American capitalism is resolved with something like a return to the New Deal, fascism would be the likely result. However, this formulation ignores how miserable American capitalism has been for Americans in good times. .........

...... ‘Fascists’ didn’t create, pass, and enact the 1994 Crime Bill, Liberal Democrats did. ‘Fascists’ didn’t create the Patriot Act (according to Biden), Liberal Democrats did. Donald Trump found himself on the wrong side of the Democrat’s proxy war against Russia in Ukraine--- he only played a minor part in the slaughter of 450,000 Ukrainian soldiers by agreeing to send American-made weapons there. Trump was derided for his inadequate Covid pandemic response until Biden & Co. assumed his crony capitalist / libertarian logic to create the worst response in the rich world.

Again, these aren’t Liberal failures, they are Liberal successes in the sense that they are the outcomes that American Liberals and their sponsors legislated to make happen. Four to six million excess deaths before the Covid pandemic hit, caused by the neoliberal healthcare system that Liberal Democrats created. Twelve and one-half million citizens likely to be permanently disabled by Long Covid due to the Biden administration’s Covid policies. If Liberals want to claim criminal stupidity, okay. That has been my theory for a long time. .........

War Fare:

...... After wasting $160 billion on character actor Zelensky in their futile attempt to bleed out Russia and Putin, they are about to throw in the towel on that debacle and move on to their next debacle. Of course, they don’t consider it a debacle. Their arms dealers and their financiers on Wall Street have satiated their profit hunger at the pig trough of continuous war.

How convenient that just as the Ukraine war is about to be lost, the most militarized country on earth, with the most glorified surveillance state mechanism in history, was suddenly surprised by a bunch of 3rd world Muslims, using pickup trucks, hang gliders, and improvised missiles. ...

No one will win this Israel vs. Hamas war, because no one is meant win this war. Biden is already doling out the 1st $8 billion to Israel, on top of the billions we already dole out to Israel, which they use to bribe U.S. politicians to give them even more money, contracts and influence over our country. No one will win the Syrian war. No one won the Libya civil war. They won’t allow a true end to the Ukraine war. Iraq and Afghanistan are just on the back burner, until they need to ignite those powder kegs again.

War is a racket, always was a racket, and always will be a racket. ........

..... I’m going to state this very simply.

The way things are going, the only way to stop Israel from committing genocide or a wave of ethnic cleansing that makes the Nakba look mild (and quite possibly both) is if Hezbollah/Syria/Iran and perhaps other Muslim countries declare war and win.

It’s unfortunate, but the Israelis have gone mad with power and demonization of the people who are primarily their victims, the Palestinians.

Kick your victims into a corner, brutalize them for generations, then they lash out with violence that is horrific but not even close to as bad as what you have done to them, use it as justification for more horror.

I again refer you to the actual death/injury card and remind you that Palestinians did not invade someone else’s land and kick them out of their homes, then live in them.

And children, if you think anti-semitism is bad now you haven’t even seen how bad it will be Israel does what it’s planning to do.

It’s interesting how last week Israel had no idea what Hamas was up to, and yet this week they know every mosque, school and hospital that Hamas is hiding in.

When you live under an empire of lies you’ll be asked to believe a lot of very stupid things. The dumbest thing we’re being asked to believe this week is that Israel’s intelligence services are simultaneously so incompetent that Saturday’s Hamas attack took them completely by surprise, but also so competent that all the buildings they’re destroying with their relentless bombing campaign on Gaza are directed solely at Hamas. ...

........ Israel has never been averse to killing Palestinian civilians, and there’s no reason to feel confident Israeli intelligence didn’t let the attack through in order to justify longstanding agendas like the elimination of Gaza as a Palestinian territory. .....

........ In Gaza, despite bombs being dropped overhead, despite us losing tens and tens of our family members right this very second, they know that if it is not now, it will be later. They know this because their whole lives that is all they had to see. They had to see mutilated bodies, they had to see their children dismembered in front of them, and they had to see their futures destroyed.

2004, 2005, 2008, 2009, 2011, 2014, 2017, 2018, 2021, 2022, 2023..

Each war and assault on Gaza it is the same. Each war the amount dead was dismissed and treated lesser than. Our humanity is not valued. For if it was, so would be our pursuit for liberation. ......

......................... But I insist we draw a sharp distinction between what I judge irrational attacks, probably born of fatalistic frustration, and the right of all Palestinians to resist, with arms, Israel’s sustained, inhumane conduct, its confinement of Gazans into what is commonly called an open-air prison. Resistance against the apartheid state’s abuses is a legal right—see Security Council Resolution 37/43—as well as a moral right. I would argue it is also a responsibility Palestinians bear toward themselves and the principles that make us—sometimes, once in a while—human. In this way, resisting oppression is also a responsibility the oppressed have to the rest of us.

Israel has always chosen occupation and supremacy over peace and security.

..........................

.............................

........ I arrived late to the Palestinian cause, but now that I am here, I can say this—the best way to defeat both Hamas and Zionist Israel is to support a free and independent Palestinian state.

I have never stood with Hamas, and I never will.

I once stood with Israel, but I will never do so again.

For four decades now, the Israeli-Hamas collusion has run its tragic course, each side proclaiming its desire to destroy the other, and yet each side knowing the awful truth—that one cannot exist without the other.

The Israeli-Palestine problem has become a never-ending cycle of violence which feeds off the pain and suffering of the Palestinian people. It is time to bring this cycle to an end.

From this moment forward, I will always stand with the people of Palestine, convinced that the only path for peace in the Middle East is one that leads through a viable Palestinian homeland, its capital firmly and forever ensconced in East Jerusalem.

In this way, Hamas will be disenfranchised as a terrorist organization—a legitimate Palestinian state takes away the perpetual state of conflict Hamas contributes to, a status which is justified by the pursuit of a legitimate Palestinian state Zionist Israel will never allow to exist.

A legitimate Palestinian state delegitimizes the notion of a Zionist Israeli entity which, by definition, can only exist by the perpetual exploitation of the Palestinian people. Benjamin Netanyahu was able to sustain the modern-day version of the Zionist Israeli state by generating fear through the endless cycle of Hamas-driven violence.

Remove the threat posed by Hamas, and Zionist Israel no longer will be able to blind the citizens of Israel and the world to the apartheid-like reality of the present-day Israeli existence. Basic humanity will compel Zionist Israel to shed its Zionist ideology, just as apartheid South Africa shed its ugly legacy of White supremacy. Post-Zionist Israel will be compelled by necessity to learn to coexist with its non-Jewish neighbors peacefully and prosperously, not as a colonial apartheid state, but as equal partners in the experiment of life that will have collectively seized the people who call the Holy Land home. ........

Sci Fare:

More additional land animals are killed every year relative to previous numbers than there are humans on earth

.......... Almost every land animal in these cruel factory farms lives a life crueler than that which any dog abuser could dream of. We zealously condemn those who beat dogs while we stuff our faces with the corpses of those who endured a far crueler fate, on account of our dime. .....

Pics of the Week: