***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Bloomberg's Cameron Crise discusses credit-market dynamics and offers perspective on the unreliability of economic data at turning points.

.... What makes things particularly difficult is that the rush to publish economic data in a timely manner means that it can be inaccurate, or sometimes downright misleading. Particularly as the economy appears to be approaching something of a turning point, it’s worth retaining your sense of skepticism and taking much of the data that you see with a grain of salt.

..... It is an unfortunate, but nevertheless true, feature of modern life that an incorrect opinion confidently stated seems more credible than an accurate view laced with caveats.

... I was reminded of this last week when the Conference Board leading indicator posted a monthly gain for the first time in two years. That broke one of the longest streaks of negative readings in history, and apparently makes the Fed’s ongoing guidance toward rate cuts seem all the more perverse. Here’s the thing, though. That indicator is subject to very substantial revision, to the degree that it’s hard to look at what it says with a straight face. Take a gander at the readings around the GFC, for example. The revised monthly prints (shown by the white line) tell a much different message from the initial release of that index, which actually rose during the second quarter of 2008 as well as the eventful September of that year.

... By way of disclosure, a number of years ago I wrote a piece trumpeting the virtues of the leading indicator as a recession indicator, only to be apprised of its Orwellian revision history by a few readers. A relevant recent example of a similar phenomenon can be found in the ADP survey, which was suspended a few years ago while it was re-jigged to make it ostensibly more accurate in real time. Even official data can be highly misleading. Regular readers may recall that I have cited the change in continuing jobless claims from their one-year low as a useful recession predictor. Well, it now seems less useful than it used to; a couple of weeks ago some changes to the seasonal adjustments dramatically altered the trajectory of that data, and the rise in claims from its lows now looks much less severe than it did prior to the revisions.

... It wasn’t my recession call that was bad, it was the data that I used to make it. Yeah, right. Either way, wrong is wrong, and misleading inputs are one of the occupational hazards of making forecasts or taking investment positions. The Fed is obviously aware that data can be misleading at turning points, and has perhaps adopted a more traditional risk-management strategy into their policy deliberations now. That’s a fact of life, whether you’re worried about Orwellian data revisions or not.

.......................... Ok... but what does all of that mean in English?

Well, to make some more sense of the data, we went through the Early Benchmark state-level data excel spreadsheet provided by the Philly Fed (link), and simply added across the various states to obtain aggregate, country-level data so that we could compare the far more accurate QCEW data with what the BLS had been peddling for the past year.

The result was - again - shocking, and as shown in the chart below, a little over a year after we, or rather the Philly Fed, found that the BLS had overstated payrolls in 2022 by 1.1 million, here we go again, only this time the BLS had overstated payrolls by 800,000 through Dec 2023 (and more if one were to extend the data series into 2024). It's truly statistically remarkable how every time the data error is in favor of a stronger, if fake, economy. ......

As such, we urge all readers to read Philly Fed analysis (link here) and to analyze the excel data (link here) at their own leisure

Activity and jobs growth have slowed to a more trend-like pace in recent months. A couple of hot inflation prints have reignited market doubts over the disinflation path. We see little reason to think this will persist; on the contrary, pipeline price pressures remain benign. We continue to expect the Fed to begin lowering rates from June.

… Indeed, financial markets appear more worried about inflation than about downside risks to the growth outlook. Near-term market-based measures of inflation expectations have risen sharply since the start of the year, and markets now expect three rate cuts from the Fed this year, compared to almost six cuts back in January (we continue to expect five rate cuts). Inflation in January-February did come in on the firm side, although this followed some especially weak readings at the tail-end of 2023. The core CPI, for instance, rose 0.4% m/m in both January and February, which is around double the normal rate of price growth (though still far below the 0.7-8% readings at the height of the inflation surge). We did not see anything in the reports to suggest these firm inflation readings would persist. The strength was driven by three main factors: 1) pass-through from the recent jump in oil prices to some core components, such as airfares; 2) lumpy pass-through of earlier rises in housing rents; 3) possible residual seasonality in the m/m data (as Fed Chair Powell also suggested).

The bottom line is that pipeline price pressures still point to significant disinflation to come, especially from housing rents, with rents for new leases growing at rates below the pre-pandemic trend already for the past half year…

“Why do people feel that to be a good leader, they must absolutely believe in one direction over another, one path over another, one person over another?” asked the investor, an allocator.

“Why do most people feel they have to live in a world of absolutes?” We were discussing the illusion of certainty.

“We live in a world filled with questions. And the best traders I’ve known have never been sure of anything.”

The blessing and curse of this business is that it forces us to come to terms with how little we know.

It is at once terribly humbling and awe inspiring, in that to maintain your balance you must continually seek to define a wide range of possible outcomes, possibilities. ........

Bubble Fare:

........... As noted, valuations are terrible market timing indicators and should not be used for such. While valuations provide the basis for calculating future returns, technical measures are more critical for managing near-term portfolio risk.

.................. “Mean reverting events,” bear markets, and financial crises result from a combined set of ingredients to which a catalyst ignites. Looking back through history, we find similar elements every time.

Like dynamite, the individual ingredients are relatively harmless but dangerous when combined.

Leverage + Valuations + Psychology + Ownership + Momentum = “Mean Reverting Event”

Importantly, this particular formula remains supportive of higher asset prices in the short term. Of course, the more prices rise, the more optimistic investors become.

While the combination of ingredients is dangerous, they remain “inert” until exposed to the right catalyst.

What You Need to Know

- Artificial intelligence is an example of companies opening a new industry deemed likely to be pathbreaking.

- The emerging technology draws parallels to electric vehicles and PalmPilots.

- With sticky inflation and higher interest rates, inflation is unlikely to be sorted out in the next year or two.

- Investors shouldn’t bet against the artificial intelligence bubble that’s driving the U.S. stock market but don’t need to participate in it either, financial analyst Rob Arnott suggests.

“One of the points that I like to make with regard to bubbles is never short-sell a bubble. It can go further than you can possibly imagine,” Arnott, Research Affiliates founder and chairman, told ThinkAdvisor in a phone interview this week. “Be very, very careful about the notion of shorting bubbles but you don’t have to own them.”

Nor should advisors and clients assume that an S&P 500 index fund would leave them diversified enough to avoid damage from a bursting AI bubble, he said.

“The dot-com bubble was special and rare but shockingly similar to today,” he said, adding that investors who were broadly diversified across the S&P saw a roughly 45% loss by the time the market reached its lows. ........

Every week, usually once or twice, I sit down to put onto paper my thoughts about the market. And every week, my disgust not only for the rigged system that encompasses our equity markets, but also for the sound of my own whining, grows exponentially.

When I sit down to perfunctorily prattle on about how nothing makes sense and how I constantly see things the polar opposite of 99% of everybody else in the world of finance every week, I usually wonder two things.

First, I wonder whether or not today will finally be the day that I capitulate, get bullish on the stock market ......

.................. Moreover, the pros and cons of private equity have become increasingly pertinent, and hotly debated. Almost every major institutional investor in the world is investing more and more in private equity — it has become the go-to strategy for any pension plan struggling to hit its targets — but some experts argue the higher returns are a mirage, and even some insiders admit they are probably going to decline. ..........................

Investors seem more optimistic — but only up to a point

Are investors the mark, or in on it?

Podcast & Vid of the Week:

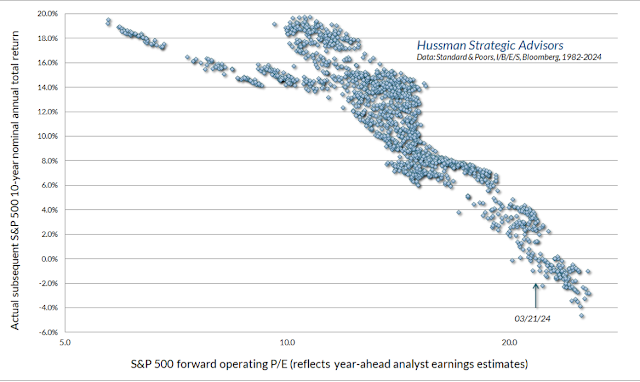

"Today is in the top percent on the Shiller P/E of all time, and when you start from this level, you have a very hard time going up materially. You’ve done it once or twice, but you’ve only done it for a while: in the last gasp of 1929; in the last gasp of 1999; and notably and most impressively in Japan, where maybe for two and a half years you kept going. And in each case, they ended incredibly badly. So, the price you paid for bucking that kind of law was a very high price.

In general, if you want to make a lot of money, and you want to have a long bull market, you need high unemployment, depressed profit margins, and depressed P/Es. It’s beautiful double-counting. Multiplying depressed earnings by a low P/E is really double counting. Multiplying peak earnings by a high P/E, which is what we’re doing today, is also double jeopardy the other way. And the gap between peak P/E times peak profits all the way to trough P/E times trough profits, that’s a big run. That’s the kind of thing we saw ending up in 1974 and 1982, and to some extent in 2009. Yes, it was somewhat higher in 2009 than 1982, but the discount rate, interest rate, everything else had shifted, and it was down an awful lot from its peak.

But it feels good at the top of the spike, always feels terrific. And people always torture the logic to think, like in 1929, that it’s a “new high plateau.” 1929 – in the most predictive model that I have come across, which is run by Hussman, the only one that is about the same is 2021, and a little bit higher, both of them, than today. These are not good times to start a 10-year bull market, and yet, one or two bulls are saying whoopee, this is the beginning of a great bull market.

We have totally full employment, totally wonderful profit margins. All the things you would not want to start a bull market from. This is where you start bear markets from. Great bull markets start with exactly the opposite. But it always feels wonderful. Peak profit margins, getting there takes years, and it feels nice. And so you’ve got a great track record. You can’t get to peak margins without leaving a terrific track record. You’ve got the peak P/E, so you feel wonderful, the stock market has gone up and up and up and up. So everyone feels great, and that’s how you get to a market peak. You feel great about everything. Of course, almost by definition.

When do you start going down? You still feel great. You just don’t feel quite as great as you felt the day before. That’s why it’s so damn hard, at both ends."

Animal spirits have certainly been running wild in the stock market of late.

The S&P is up over 1,000 points (roughly 25%) in the past 4.5 months.

Is this a new era of easy gains as giddy bulls are proclaiming? One investors should jump in and make the most of?

Or is this the latest incarnation of irrational exuberance? And is caution warranted instead?

For insight, we're fortunate to speak today with Jonathan Treussard, former partner and head of product at Research Affiliates, and now founder of Treussard Capital Management.

Jonathan, who authored academic research on financial bubbles at UCLA, indeed concludes we are in the midst of another such bubble now.

To hear why and what that means for investors, click here or on the image below:

Quotes of the Week:

“A recent study by economists at the Federal Reserve found that less than half of the published papers they examined could be replicated, even when given help from the original authors.”

7:

RIP:

Joe Lieberman was a fairly unremarkable Washington politician who managed to get famous by becoming a particularly enthusiastic, inveterate warmonger and corporate marionette within the Democratic Party.

(not just) for the ESG crowd:

Accumulating evidence supports the interpretation in our Pipeline paper: decreasing human-made aerosols increased Earth’s energy imbalance and accelerated global warming in the past decade. Climate sensitivity and aerosol forcing, physically independent quantities, were tied together by United Nations IPCC climate assessments that rely excessively on global climate models (GCMs) and fail to measure climate forcing by aerosols. IPCC’s best estimates for climate sensitivity and aerosol forcing both understate reality. ..............

Our paper, Global Warming in the Pipeline was greeted by a few scientists, among the most

active in communication with the public, with denial. Our friend Michael Mann, e.g., with a large public following, refused to concede that global warming is accelerating. We mention Mike because we know that he won’t take this notation personally. Accelerated global warming is the first significant change of global warming rate since 1970. It is important because it confirms the futility of “net zero” hopium that serves as present energy policy and because we are running short of time to avoid passing the point of no return. ............

The fact that the climate physics is understandable is no reason to relax. On the contrary, we have shown that the world is approaching a point of no return in which the overturning ocean circulation may shut down as early as midcentury and sea level rise of many meters will occur on a time scale of 50-150 years. Time is running short to make the public and policymakers aware of the threat posed by the delayed response of our climate system and of the actions that should replace present wishful thinking (hopium). ................

Drastic polar ice melt is slowing Earth’s rotation, counteracting a speedup from the planet’s liquid outer core. The upshot is that we might need to subtract a leap second for the first time ever within the decade

Biden is calling on Congress for an additional $8 billion in funding for the program.

Geopolitical Fare:

Former President Barack Obama compared anti-genocide protesters to rude Trump supporters Thursday night as they repeatedly interrupted him and Joe Biden and Bill Clinton at their $26 million schmoze-fest as Radio City Music Hall. .....

.... According to Obama, no matter how outrageous the behavior of their leadesrs may be, now matter how much death and destruction these powerful leaders spread throughout the world, the only permissible response of the citizenry is abject silence. Protest is not civil, and civility trumps everything else. If you want to be a loyal Democrat more than you want to be a free-thinking humanist, then you will pretend that Clinton, Obama and Biden are angels and that it is only the "other side" (Trump) who is the demon .......

Russia has already shown that Western ostracism is not necessarily fatal.

25 years ago, NATO began bombing Yugoslavia in violation of international law. This was the fall from grace that officially turned NATO into an offensive alliance and ushered in the beginning of the “rules-based world order.”

.......... The war was based on lies, as the German state television station ARD showed in a report a few years after the war . But this report was not shown often and quickly disappeared into the channel's closet.

Instead, the Western media and politicians to this day glorify the war as a “humanitarian intervention” that was justified due to Yugoslavia's alleged war crimes. That was the beginning of the “rules-based world order” because the US-led West ignored international law and created its own rules, according to which the West has since then attacked other countries under any pretext. ..........

Again. In a manner of speaking.

Right, then.

We are now in the degenerate phase of the Ukrainian crisis, and more especially in the sorry and pathetic story of the West’s collective attempts to manage it. Western political leaders are in zombie mode, staggering forward in various states of disrepair, blundering on because they have no real idea what to do, completely overmatched by events that they did not see coming, and cannot now understand. Declarations by national leaders and politicians become more and more bizarre and surreal, and most of them are not worth parsing, because they have almost no actual content. They are really cries of rage and despair from the depths of misery. Only President Macron and some other French government figures, have been saying anything remotely consistent, although hardly anyone in the media seems to have the command of the background and language to understand properly what they’ve said.

The subject of this essay is one I’ve lived with, and in some cases worked on, since the end of the Cold War. So I thought it might be useful to offer a (hopefully) reasonably informed view on three points. I’ll explain where we are politically and militarily, and how western leaders are actually fumbling towards an exit strategy. In addition, with a short diversion into history, I’ll explain where I think the French are coming from, and then I’ll set out very briefly some thoughts about where this may all lead.

The idea that this crisis has its origins in culpable ignorance and stupidity by western leaderships is pretty widely accepted now. But what hasn’t had enough publicity, I think, is that this ignorance was actually willed and deliberate. That is to say, certain things were simply assumed to be true, and no attempt was actually made to verify their accuracy, because it was not thought necessary. The belief in a weak Russia that could be pushed around, the idea that even if the Russians didn’t like what was happening in Ukraine there wasn’t much they could do about it, and the conviction that any attempted Russian intervention would collapse into chaos after a few days leading to a change of government in Moscow, were not judgements arrived at after proper analysis, they were articles of ideological faith, for which no evidential support was necessary or looked for.

And this isn’t the first time either. The grisly list of western political disasters of the last twenty years, from Iraq to the 2008 financial crisis to Libya, to Syria, to Brexit, to Covid to the rise of so-called “populism,” is distinguished less than by malevolence or stupidity (though both were present) than by an arrogant belief in the rightness of the opinions of the Professional and Managerial Caste (PMC) and by their ignorant but strongly-held views about the world, which the world itself had a responsibility to adhere to. Why bother with the labour of finding out the facts when are sure you know them already?

It’s one thing for governments to accept that they were wrong about some issue of fact, even if it’s not easy: it’s quite another to accept that they were deluded and that their brains were out to lunch. When your public estimate of Russia, and your comments at the beginning of the war, are not based on any actual knowledge or any professional estimates, but just on ideological assumptions, then you lose the ability to respond and adapt as circumstances demonstrate the falsity of your assumptions. It is this incapacity that is causing an incipient nervous breakdown among western leaders, who resemble increasingly patients at a nursing home for the mentally afflicted, with their antisocial and sociopathic behaviour. ......................

So we can take it for granted that the western political class and their pundit parasites will never admit that they fundamentally misunderstood what was going on because they couldn’t be bothered to find out. It’s as if something as basic and menial as discovering what’s happening is too difficult, and anyway beneath them. There’s an entire, vicious, pointless controversy being fought out in a virtual space by people completely separated from reality. In the past, this hasn’t really mattered because the consequences of our ignorance have never come back to haunt us. This time they will. ....................

Historical Fare:

Sci Fare:

In a recent paper, biologists outlined a three-part hypothesis for how all life as we know it began.

Other Fare:

....... The FAO and corporate executives have attributed recent food price increases to disruptive supply chains for oil, gas, fertilisers and staple goods. This is a half truth, and thus deceptive. They don’t mention how the current structure of the food system encourages and amplifies such disruptions.

For decades, the World Bank and the International Monetary Fund (IMF) have promoted structural adjustment policies, and green revolution technologies (hybrid seeds + chemical pesticides and fertilisers) across the world. We now have a global food system designed around the production of a small number of agricultural commodities (wheat, rice, maize, soybeans, palm oil) in a few areas of the world totally devoted to the massive industrial production of monocultures dependent on the supply of inputs, and concentrated in the hands of a few companies. Any disruptions within this global system, be it war or drought, can have major impacts on people’s access to food. This is particularly acute in countries of the global South that are now highly dependent on food imports because of policies imposed on them through multilateral banks and free trade agreements. Moreover, we are entering a period of intense climate crisis, water crisis, geopolitical tensions, and declining crop yield gains that are set to generate more frequent and more severe disruptions. .........

Valter Longo, who wants to live to a healthy 120 or 130, sees the key to longevity in diet — legumes and fish — and faux fasting.

How do you tell that a defender of factory farming is lying? Their lips are moving.

Tara Vander Dussen has a piece, as short as it is dishonest, about factory farms not existing. It was written in the service of defending the existing farming industry and is rather typical of factory-farming apologia—insanely misleading, with nearly every sentence being either flatly false or in some way misleading, and filled with confident yet baseless assertions, and all done in an attempt to get people not to think too hard about the tortured animals that adorn their plates. .......

In the beginning there were many different sons of God – Western Christianity triumphed not by destiny but accident.

Pics of the Week: