***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Where Does $6.8 Trillion in Government Spending Go?

Fed officials trying to figure out just-right interest rate and some think they might be close to that destination

I know that Trump wants to be seen as the bull market president, but MAGA is not a bull market set of policies. Sure, he’ll be great for some industries, but those are the industries that are beaten down and unloved. He’ll create bull markets where there have been epic bear markets. Meanwhile, accelerating nominal growth, along with high interest rates, are terrible for the sorts of businesses that are dominating the markets today. What if 2022 was a dress rehearsal for what the rest of the decade looks like?? Think back to what worked then, and what didn’t work. I think we’re about to have an inflection back to the strategy book of 2022. If so, we’re going to catch a whole lot of investors offsides

.......... And so, after it first revised the 12 months ending March 31 by 818K, the downgrades extended into the second quarter of 2024, when the Philadelphia Fed early benchmark estimates showed that instead of the 1.1% gain shown initially by the BLS, payroll jobs in the 50 states and the District of Columbia were actually down 0.1%!

..... And while we don't yet know the specifics of the revisions - those will be revealed on Feb 7, 2025 when the final numbers are published - at the national level, we do know that all the jobs reportedly "created" in the second quarter, were actually fake, there were no net jobs created at all, and in fact, the US lost jobs in Q2!

Neoliberal economics is a superstitious, secular, totalitarian religion. It's past due time to nail some theses to the doors of Central Banks. It's all based in rules, and rules can change.

The day after the Wall Street Journal ran Why This Frothy Market Has Me Scared, it published More Men Are Addicted to the ‘Crack Cocaine’ of the Stock Market. We encourage you to read both in full if possible ........

Market strategist and historian Russell Napier outlines a future in which governments mandate where investors should deploy their capital. The global monetary system that has existed since 1994 is being radically restructured.

........................................ Historically, every thirty or forty years monetary systems collapse. The current one, the one we have lived with since 1994, is collapsing in front of our eyes.

Bubble Fare:

With US equities at record valuation peaks, investors should re-examine their risk appetite

On Friday December 6th, the U.S. stock market pushed to the most extreme level of valuation in U.S. history, based on the measures that we find best-correlated with actual subsequent 10-12 year S&P 500 total returns, as well as the depth of subsequent losses over the completion of market cycles across a century of data. That’s not a forecast. Rather, it’s a statement about current, measurable, observable market conditions.

While we’ve seen an initial retreat based on concern that the Federal Reserve may lower interest rates less aggressively than hoped, record valuations leave the market vulnerable to a hundred risks, not just one. Presently, our most reliable valuation measures exceed those observed at the 1929 and 2000 peaks, and I continue to view the period since early-2022 as the extended peak of the third great speculative bubble in U.S. history.

The chart below shows our most reliable gauge of market valuations in data since 1928: the ratio of nonfinancial market capitalization to gross value-added (MarketCap/GVA). Gross value-added is the sum of corporate revenues generated incrementally at each stage of production, so MarketCap/GVA might be reasonably be viewed as an economy-wide, apples-to-apples price/revenue multiple for U.S. nonfinancial corporations.

The chart below shows the relationship between MarketCap/GVA and actual subsequent 12-year S&P 500 average annual total returns, in data since 1928.

..........

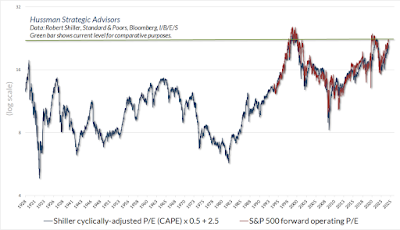

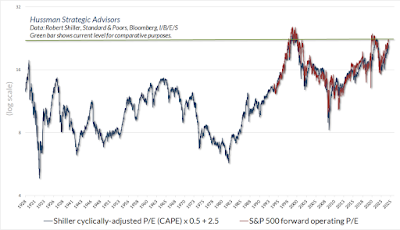

It’s tempting to imagine that our valuation perspective relies on the assumption that current profit margins are unsustainable. Yet even if one takes average profit margins over the past decade at face value (as the Shiller cyclically-adjusted P/E does), and even if one takes Wall Street’s unprecedented expectations for year-ahead profit margins as the basis for market valuation (as the S&P 500 forward operating P/E does), market valuations are presently at levels observed only surrounding the 2000 and 2022 market peaks. Indeed, given the fairly linear relationship between the forward operating P/E and the Shiller CAPE, we can get a good sense of what the forward operating P/E would have looked like on a historical basis, had data on this measure been available. Presently, valuations are easily above the 1929 extreme even on these measures.

While preparing charts for this month’s comment, I checked on an older valuation measure that I constructed decades ago. The chart below shows my original “weighted price-to-fundamental” ratio (WtdP/F), which is a composite of the S&P 500 price/peak-earnings multiple that I created back in 1998 (Alan Abelson of Barron’s wrote a nice article on it back then), along with scaled price/revenue, price/dividend, and price/book multiples for the S&P 500. It should not be a surprise that the WtdP/F is also at record extremes.

A key feature of the bubble period since 1995 is that average valuations have been substantially above their long-term historical norms. That observation makes it tempting to assume that valuations have simply “shifted” higher. As Graham and Dodd described this temptation in 1932, “the conclusion to be drawn was not that the stock was now too high but merely that the standard of value had been raised. Instead of judging the market price by established standards of value, the new era based its standards of value upon the market price.”

On this point, it’s important to recognize that there’s a remarkably stable mapping between the level of reliable valuation measures and the level of subsequent annual returns. For any given set of future expected cash flows, higher valuations imply lower returns, and lower valuations imply higher returns. .....................

..................................................................................... Between the optimistic extremes in investor expectations for future returns, and valuations implying precisely the opposite, there is an enormous bubble in the gap, hiding in plain sight.

I’ve often described a market crash as “risk-aversion meeting a market that is not adequately priced to tolerate risk.” That perspective may be particularly relevant given that prevailing S&P 500 valuations and Treasury yields easily imply the most negative estimated risk-premium in history, based on estimates that are tightly correlated with actual subsequent S&P 500 total returns in excess of Treasury returns across a century of data – and there are lots of estimates that have little or no such reliability.

....................

...................... Even here, it’s notable that nearly nobody has picked up on the deterioration in civilian employment growth, which has already gone negative on a year-over-year basis. Civilian employment is part of the “household survey” that determines the unemployment rate, as opposed to the “establishment survey” that provides the headline month-to-month “non-farm payroll” figure. Given our emphasis on signal extraction and noise reduction, our preference is always to extract the common signal from a very broad range of independent or partially correlated sensors. In my view, we would still need more evidence to expect a recession with confidence, but we certainly shouldn’t rule out that outcome even in response to the possibly sizeable disruptions that may be just ahead.

China Fare:

Ten-year yield falls to 1.71% after economic data releases

Inside China's Export Ban on America's Must-Have Metals

Quotes of the Week:

Powell: “We're in a good place, but I think from here, it's a new phase,”

2: DB: YE 2025 Treasury yield expectations (average 4.2%) are a bit lower than current levels with only 4% believing we’ll end 2025 >5%"Where do you see 10-year US treasury yields by year end 2025? We will bucket the answers, so slide as near as possible to your desired answer:"

4:

(not just) for the ESG crowd:

Narrowing storm bands may be a surprising and dangerous new feedback of climate change

What if I told you the next energy revolution isn't in the sky, but under your feet?

Deep underground, beneath layers of dirt and ancient rock, an endless furnace burns hotter than the surface of the sun.

It's been running since Earth formed 4.6 billion years ago, generating enough heat to easily power all of humanity.

This vast energy source has always been tantalizingly out of reach. But armed with a newly repurposed technology, three American startups are now racing to tap into Earth's natural power plant.

Temperatures reach 10,800°F at Earth’s core. Just a few miles down, the rocks are hot enough to boil water instantly. This is the source of geothermal energy.

The heat locked in Earth's crust holds more energy than all the world's oil, coal, gas, and uranium combined—and it’s not close .............

Geopolitical Fare:

......... These two stories together say so much about the way the label “terrorist” is used under the US-centralized power umbrella.

The guy who shot the health insurance CEO is a terrorist, but the people systematically slaughtering civilians in Gaza are not terrorists. The people fighting against those who are slaughtering the civilians are terrorists, and noncombatants are being categorized as belonging to this terrorist organization in order to justify killing them. The al-Qaeda affiliates in Syria were terrorists, but now they’re a US puppet regime so soon they won’t be terrorists — but they need to be designated terrorists for a little while longer because the claim that Syria is crawling with terrorists is Israel’s justification for its recent land grabs there. The Uyghur militant group ETIM used to be a terrorist group, but now they’re not a terrorist group because they can be used to help carve up Syria and maybe fight China later on. The IRGC is a military wing of a sovereign nation, but it counts as a terrorist group because of vibes or something.

Is that clear enough? .............

............. The U.S. and Israel are high-fiving that they have successfully wrecked yet another adversary of Israel and defender of the Palestinian cause, with Netanyahu claiming “credit for starting the historic process.” Most likely Syria will now succumb to continued war among the many armed protagonists, as has happened in the previous U.S.-Israeli regime-change operations.

In short, American interference, at the behest of Netanyahu’s Israel, has left the Middle East in ruins, with over a million dead and open wars raging in Libya, Sudan, Somalia, Lebanon, Syria, and Palestine, and with Iran on the brink of a nuclear arsenal, being pushed against its own inclinations to this eventuality.

All this is in the service of a profoundly unjust cause: to deny Palestinians their political rights in the service of Zionist extremism .......

The Romanian Constitutional Court’s decision to nullify the election results based on unfounded allegations of Russian interference sets a terrifying precedent

Other Fare:

This isn’t about all the high minding crap she said (lost the confidence of the PM, etc…) it’s an attempt to pressure Trudeau to resign, so the Liberals don’t have him as an albatross hung around their neck during the next election. The Liberals will still lose, I’d think, but they won’t get slaughtered, or that’s their hope.

Freeland has terrible politics. She’s the worst sort of neoliberal. She’s been Trudeau’s strong right hand, and done most of his dirty work. Given this is the case, I don’t think she’ll make a good candidate if she’s the new Liberal leader.

Pollievre, the Conservative leader, will probably be the next Prime Minister. He’s right wing of the modern American variety. Nativist, nasty, and stupid. About the only good thing I can say about him is that he’ll fight if Trump goes ahead with tariffs. ........

...................... To be clear, I don’t believe that this gradual enshittification is part of some grand, Machiavellian long game by the tech companies, but rather the product of multiple consecutive decisions made in response to short-term financial needs. Even if it was, the result would be the same — people wouldn’t notice how bad things have gotten until it’s too late, or they might just assume that tech has always sucked, or they’re just personally incapable of using the tools that are increasingly fundamental to living in a modern world.

You are the victim of a con — one so pernicious that you’ve likely tuned it out despite the fact it’s part of almost every part of your life. It hurts everybody you know in different ways, and it hurts people more based on their socioeconomic status. It pokes and prods and twists millions of little parts of your life, and it’s everywhere, so you have to ignore it, because complaining about it feels futile, like complaining about the weather.

It isn’t. You’re battered by the Rot Economy, and a tech industry that has become so obsessed with growth that you, the paying customer, are a nuisance to be mitigated far more than a participant in an exchange of value. A death cult has taken over the markets, using software as a mechanism to extract value at scale in the pursuit of growth at the cost of user happiness.

These people want everything from you — to control every moment you spend working with them so that you may provide them with more ways to make money, even if doing so doesn’t involve you getting anything else in return. Meta, Amazon, Apple, Microsoft and a majority of tech platforms are at war with the user, and, in the absence of any kind of consistent standards or effective regulations, the entire tech ecosystem has followed suit. A kind of Coalition of the Willing of the worst players in hyper-growth tech capitalism. ........................

UnitedHealth Group is not an insurer, it's a platform. And it's in the crosshairs as Elizabeth Warren and Josh Hawley propose breaking it apart, severing its pharmacy arm from the rest of the business