C&I loan issuance continues to decelerate YoY …

… and fall outright since August peak

Speaking of which…

Credit cycles and asset returns. voxeu.

Conclusion

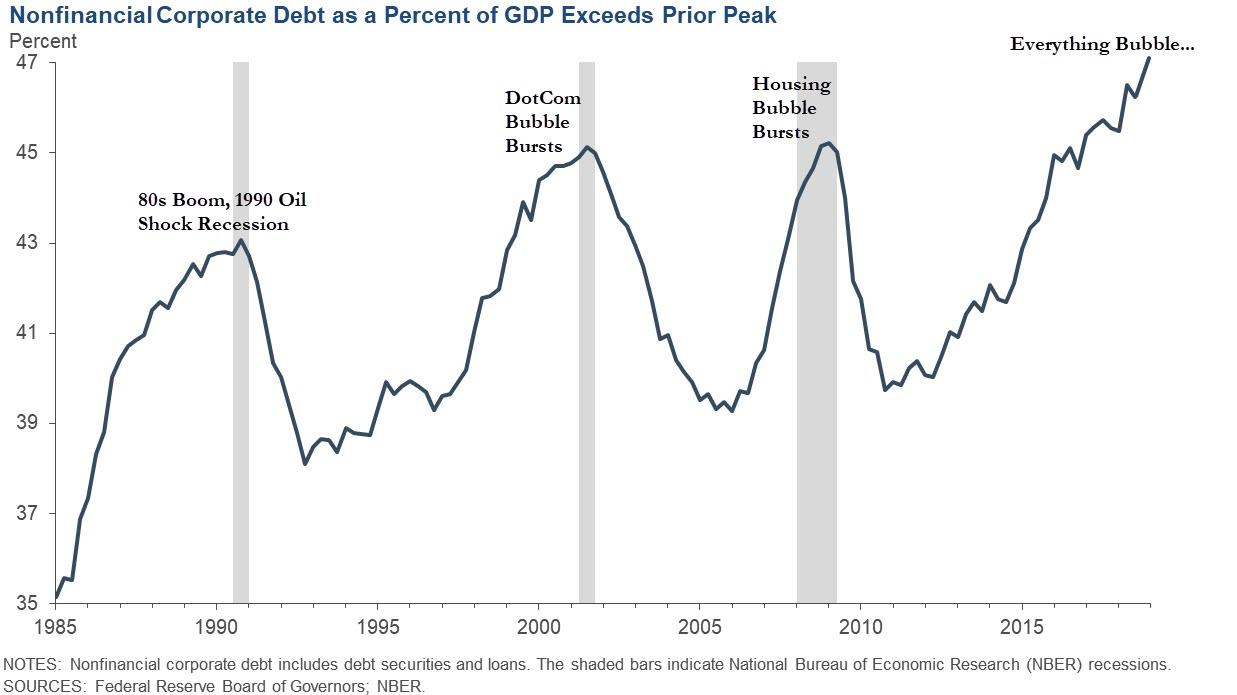

We set out to explore whether leverage cycles leave a signature on asset returns and whether these patterns have predictive value for investors. Already, a wave of research has provided evidence that credit boom and bust episodes deeply influence future macroeconomic outcomes, so it would be surprising if the same were not true of financial markets.

Preliminary evidence supports the hypothesis. Today credit boom periods tend to coincide with strong equity returns in the immediate past but weak equity returns in the near future. This is true to a lesser extent for bonds. We find that credit growth signals can be a useful input for a tactical asset allocation strategy, alongside such tried and tested signals as momentum and value.

Speaking of which…

IMF Slashes Global GDP Forecast For 6th Consecutive Time, Warns "Climate Change" Will Hit Economy.

IMF boss says global economy risks return of Great Depression.

The head of the International Monetary Fund has warned that the global economy risks a return of the Great Depression, driven by inequality and financial sector instability.

Speaking at the Peterson Institute of International Economics in Washington, Kristalina Georgieva said new IMF research, which compares the current economy to the “roaring 1920s” that culminated in the great market crash of 1929, revealed that a similar trend was already under way.

Fed board economist Michael Kiley: Monetary Policy Space in a Recession: Some Simple Interest Rate Arithmetic.

Hat tip: Central Bankers Are Quietly Freaking Out About How To Fight The Next Recession.

Hussman: One Tier and Rubble Down Below.

US wage growth exceeding unemployment rate preceded sharp curve steepenings in past.

Gary Shilling: Why It’s So Hard to Forecast the Economy.

Normal cyclical patterns have gone missing and may not be coming back anytime soon.

Tuomas Malinen is the CEO of GnS Economics: The end of the ‘Chinese Miracle’

China is reaching the end of its debt-driven economic model, and thus well-along in the end-game of the ‘Chinese Miracle’. This will bring drastic changes to the world economy, which will fuel the global economic collapse of 2020-2023. Let’s examine why. …

China’s Growing Economic Miracle…(Collapse). Or… Everyone Pays the Piper!

The Metrics of a Failing Economy.

Many analysts have for nearly a decade opined that China’s belief in national fixed-asset investment, the biggest engine of China’s economy, has long been the fundamental contributor to Chinese GDP growth, which was directly proportional to an ongoing increase in public and private debt. “China has relied on export and debt-financed fixed asset investment for growth for over two decades,” said Ho-Fung Hung, Professor in political economy at the Johns Hopkins University.

But as the world economy slows while the metrics show a recession looming China’s economy is already cooling rapidly. “And as the central government and banking system keeps producing new loans to absorb the debt, it leads to the continuous debt buildup,” Maximilian Kärnfelt, an analyst with the Berlin-based Mercator Institute for China Studies, told news service DW, adding that infrastructure investment still largely drives China’s economic growth since fixed investment contributed to 45 per cent of China’s GDP in 2016.

In a sign of the disaster to come…

China’s Economic Tricks of Sustainability.

As the world economic body politic runs out of any remaining gas to keep a pilot light under the rapidly cooling metrics that show their long forestalled recession is near and certain, China is also contracting. …

Credit growth way up in December -- confirming how worried Beijing is about the rapid Q3 slowdown -- with an awful lot of that occurring outside the banks. I expect that sometime in April or May Beijing will once again be more worried about rising credit than slowing GDP.

Gundlach Round Table: "Jay Powell Doesn't Understand What's Happening In Credit Markets"

Quotes of the Week:

#1 Mike Krieger re repo:

One of the main reasons big finance is able to pull off scam after scam in plain sight relates to the complexity, opacity and esoteric jargon associated with the industry. Repo is a perfect example. The market had a spasm in September and the Fed immediately rushed in with billions to bring the rate down without offering any transparency or a credible explanation of what was going on. Meanwhile, as the crisis continued over subsequent months and the central bank response grew larger and larger, we actually seem to be learning less with each passing day.

Instead of providing the public with the transparency it deserves, Fed officials run around pretending to be financial surgeons called in to perform an unexpected emergency operation on a patient after a freak accident. In reality, central banks are merely pumping billions into an already dead body while enriching connected and powerful individuals and institutions in the process. They know exactly what they’re doing and we need to stop pretending otherwise.

While I’m grateful to those who’ve spent time trying to thoughtfully explain the mechanics of the repo crisis and why it happened, I think that’s a sideshow at this point since nobody who really knows what’s going on is talking. Instead, we should focus on the absurd and unconscionable lack of transparency with regard to Federal Reserve actions. As far as I know, we have no idea which parties are taking up this expanded central bank funding. Think about how criminally insane that is. We have no idea if it’s driven by a troubled institution like Deutsche Bank, hedge funds with over- leveraged trades, treasury issuance, a combination of these factors, or something else.

We don’t know because they don’t want us to know, and they don’t want us to know because they don’t want the public thinking or talking about it. It’s at times like these when the totalitarian nature of central banking comes into crystal clear focus. What we have is government via unelected, unaccountable bankers.

#2: I normally avoid Peter Schiff, but here he’s bang-on, both on Trump, and on the Fed:

“Well, sure. The unemployment rate was very low when Obama left office. I mean, the unemployment rate, at least the official rate, was declining for almost the entirety of the Obama presidency, and when Donald Trump ran against low unemployment, he said that the numbers were fake. That they were phony. That it was a fraud. That it was a hoax, and if you look at the real unemployment rate, where you look at all the people that were working part-time that wanted to work full-time, all the discouraged workers who had dropped out of the workforce, that the real unemployment rate was much higher. And that’s still the case today. We still have a lot of people with part-time jobs that want full-time jobs. We still have a lot of discouraged workers who are not in the labor force. So, you could certainly make the same argument against Trump that Trump made against Obama.

The reason that Trump won is because... Hillary Clinton was selling a lie that we had a real recovery under Obama. Well, the voters knew that there was no real recovery. Well, we’ll see if they have the same realization in 2020, because Trump made a lot of promises that he hasn’t kept about raising the standard of living of average Americans, about revitalizing manufacturing, about making America great again, about paying off the national debt, about making government smaller. There are a lot of boasts that Trump had but the only thing he can really claim credit for is a record high in the stock market. But again, we had record highs under Obama and Trump said, ‘Well, who cares about the stock market because that’s just a bubble.’ Well, now the only thing he does care about really is the stock market and the same fake unemployment numbers that he once criticized. Because the GDP growth under Trump is not measurably different than it was in Obama’s second term.”

“No, they’re not done until they get to zero, and then we’ll see if they’re done or if they want to try to go negative … What the Fed has assured the markets is that under no circumstances will they raise rates. That no matter what the data is, the only decision that the Fed has to make is do rates stay the same or do they go down. And I think that’s the only reason that the stock market has rallied. It’s based on that ‘Powell Put,’ where the fear of a rate hike is no longer in the market. But I do think at some point next year, the economy will be weakening, or maybe we will get a sell-off in the stock market, and the only way for the Fed to try to prop the market back up would be to start doing more rate cuts. And they will supply them as soon as the market demands them.”

(Not just) for the ESG crowd:

Fossil Fuel Interests Applaud Trump Administration’s Weakening of Major Environmental Law.

WE, THE UNDERSIGNED, make this accusation: that you, the teachers of neoclassical economics and the students that you graduate, have perpetuated a gigantic fraud upon the world.

You claim to work in a pure science of formula and law, but yours is a social science, with all the fragility and uncertainty that this entails. We accuse you of pretending to be what you are not.

You hide in your offices, protected by your mathematical jargon, while in the real world, forests vanish, species perish and human lives are callously destroyed. We accuse you of gross negligence in the management of our planetary household. …

More at the link

Big Thoughts:

Noise: How to Overcome the High, Hidden Cost of Inconsistent Decision Making. Daniel Kahneman et al.

Headline of the Week:

97 percent of CFOs surveyed believe economic slowdown or recession coming before end of 2020. Newsweek.

Photos of the Week:

Australia Wildfires