COVID-19 notes

More people are

getting COVID-19 twice, suggesting immunity wanes quickly in some

To Save the

Economy, Save People First

Reply from

Authors of “To Save the Economy, Save People First” Regarding “Lockdowns Work”

Count me skeptical, but, fwiw:

Just the headlines:

After Big

Thanksgiving Dinners, Plan Small Christmas Funerals, Health Experts Warn

WFH Fare:

Blinking hell:

how to keep tired eyes healthy during a pandemic

Regular Related Fare:

Bonds Aren't

Buying The "Light At The End Of The Tunnel" Narrative

‘We Basically

Made Recovery Much, Much Harder Than It Has to Be’

CounterSpin interview with Josh Bivens on pandemic

unemployment

12 Million

Workers Facing Jobless Benefit Cliff on December 26

The endemic mindset is the world of abstractions we see under the

influence of learned helplessness. There are only so many days in which death

or hospitalization counts may still function as information for the human mind.

There are only so many descriptions, images or videos of hospitals in the early

stages of being overwhelmed which will be able to change anyone’s perspective.

There is a point of diminishing informational returns from another story about

a lost small business, or a struggling low income family. In the real world,

the difference between 1,500 deaths in a day and 1,000 is staggering, real and

personal. To the endemic mindset, they are functionally identical. In the real

world, the difference between a 60% drop in revenue and a 30% drop in revenue

is breathtaking. To the endemic mindset, they are functionally identical. In

the real world, the difference between being out of work for 9 months and being

out of work for 4 months may be nearly existential. But if we are not the one

affected, to the endemic mindset, they are functionally identical. In short,

the endemic mindset is one in which our default expectation is that our world

has become permanently worse in a way that we are helpless to do anything

about. I don’t think I miss the mark by saying that ALL of us are suffering

from this just a little bit.

"Surreal

Debt Tsunami": IIF Shocked To Forecast Global Debt Hitting $360 Trillion

In Ten Years

Don't Blame

Covid: The Economy is Imploding from Over-Capacity (and Corrupt Cartels)

Here’s the fantasy: if we stop the shutdowns, the economy will naturally

bounce back to its oh-so wunnerful perfection of Q3 2019. This is a double-dose

of magical thinking and denial. The U.S. economy was unraveling in 2019 from 11

long years of Fed-induced over-capacity in almost everything (except integrity,

competition, transparency and social cohesion) and the bone-crushing burden of

corrupt, greedy cartels that have the nation by the throat. The reality nobody

dares mention is that thanks to 20 years of the Federal Reserve’s easy money,

there’s rampant over-capacity everywhere you look: there’s too many cafes,

bistros, restaurants, fast-food outlets, hotels, resorts, AirBnBs, unprofitable

Tech Unicorns, airline flights, Tech startups, office towers, retail space,

malls, absurdly overpriced apartments for rent, storage facilities, delivery

services, office sublets, colleges, attorneys, unemployed workers with multiple

credentials–the list of too much, too many is endless. Thanks to the Fed, the

most profitable venture was borrowing to increase capacity, then borrow some

more to extract the phantom value created by the greater capacity…

Zombification in

Europe in times of pandemic

The COVID-19 crisis has prompted extraordinary financial support to firms

by governments and central banks. This support has taken the form of public

credit guarantee schemes, debt moratoria, direct support to firms via financial

aid programmes, central bank lending and purchase programmes, and a loosening

of micro- and macro-prudential supervisory rules. While this support is crucial to keep a cash-strapped economy afloat, it

has invigorated a debate on whether such policies are promoting ‘zombie’

lending and ‘zombie’ firms. Zombie lending is generally defined as lending to

non-viable (i.e. zombie) firms. The literature proposes different methods to

measure zombies, which remains challenging, however. The ‘zombification’ of the

economy refers to a situation where public support programmes and bank lending

actions keep unviable firms alive. This term gained widespread prominence

following the Japanese crisis of the 1990s, when a collapse in real estate

prices followed by a prolonged period of low growth resulted in many weak banks

and firms, with weak banks preserving their lending relationships with weak firms,

rolling over credits to unviable firms. Why would banks lend to

alleged zombie firms? The literature has put forward two main

explanations. On the dark side, banks may want to engage in the ‘evergreening’ (i.e. rolling over) of existing loans to avoid loan

loss recognition. Recognising loan losses implies a

deterioration of capital buffers. It therefore follows that especially

low-capitalised banks have an incentive to lend to zombies. On the bright side,

banks may lend to zombies to preserve valuable relationships. To the extent

that relationship lenders have an informational advantage over their customers,

this may allow them provide credit to illiquid but viable firms in crisis

times. Provision of such liquidity to firms in distress has the positive externality

that it can avoid disruptions of supply chains.

A zombification of the economy is of great concern because it can lead to a drop in productivity through credit misallocation. This credit misallocation

channel can operate both directly and indirectly. The direct channel arises

mechanically because keeping zombies alive reduces aggregate productivity, or

through a crowding-out effect when zombie lending tightens the credit

constraints of high-productivity.

…

This time is different

The COVID-19 pandemic has given rise to unprecedented policy support to

firms, which has also intensified the debate on a potential zombification of

the economy. There are at least three reasons to believe that this time may be

different from some of the earlier experiences.

1.

First, the pandemic shock is hitting firms in

sectors that are otherwise generally viable. The shock was not caused by

excessive risk-taking by firms or banks, as in previous financial crises. Many

sectors that have gone into (partial) lockdowns, such as tourism, will rebound

after the pandemic. For these sectors, this shock is therefore a liquidity

squeeze not a solvency shock.

2.

Second, banks entered this episode with

relatively high capital positions and therefore should be able to absorb loan

losses to a larger extent. This should, at the same time, reduce adverse

incentives.

3.

Third, the health and economic ramifications

of the pandemic have brought about exceptionally large-scale government

support, which has mitigated the liquidity squeeze and the risk that

illiquidity turns into insolvency.

…

Is There Really

A China Economic Miracle?

What is behind the Chinese miracle compared to the poor eurozone?

A planned GDP. The GDP of China is dictated by production, not demand. It

is not an observed GDP, but rather planned by the government together with the

provinces. For this reason, many analysts scrutinize the data and deduct

various factors, including the increase and valuation of inventories. It is not

by chance that inventories of iron ore, automobiles and finished goods have

risen to the highest level in seven months as the economy recovers.

If the economic situation were in the announced expansion, inventories would

be falling rapidly when sold.

Much is produced that is then not sold and remains in warehouses. Thus,

it is not surprising that industrial prices fell 2.1% in September, export

prices 0.9%, and the country’s debt soared 13.5% amid an apparently miraculous

recovery.

As for the economic effects, the US has experienced the partial rebound I

predicted in March. But I believe now, as then, that this will be followed by a

long struggle, for three fundamental reasons, beyond the pandemic itself.

First, there is the collapse in global investment, which affects the economy’s

advanced sectors. Second, the impulse to save in the face of economic anxiety

will devastate services providers, and the jobs and incomes they provide,

affecting millions of workers. And, third, unpayable debts are piling up,

affecting the entire system. Trump may have lost the election, but truly effective responses still lie outside the scope of the current

political debate. One may safely predict, therefore, that they

will not be pursued – at least not until facts force ideas to change.

… The progressive goal now should be to define a wide-ranging agenda.

Beyond measures to address COVID-19, this should include an energy

transformation, improved infrastructure, a job guarantee, universal health

care, a $15 minimum wage, union rights, and mechanisms for debt restructuring

that prevent families from losing their homes. Progressives should ignore the tired chatter about “excessive”

deficits and public debt,..

… The weakness shared by all three of those books was that they pulled

their punches on policy. The US economy is not an equilibrium engine (or

system) that needs only a bit of tinkering and some fuel (stimulus) to keep it

going. We are in serious trouble, and nothing is guaranteed. The only way to address the sources of discontent is with far-reaching

changes that recognize the severity of the health crisis, the poor state of

economic and environmental conditions, and the country’s declining relative

power. This is why today’s rhetoric – which depicts “recovery” as inevitable –

is so misleading.

«Central Banks

Keep Shooting Themselves in the Foot»

Interview with William White, former chief economist

of the Bank for International Settlements

Q: After the Financial Crisis, there was a lot of talk about deleveraging

the system. Nothing happened. Why?

A: In 2008, the ratio of global household, corporate and government debt

to GDP was 280%. Early 2020, this ratio had grown to 330%. And it’s not just

the quantity of that debt, it’s the quality. Most of the new corporate debt is

BBB-rated, covenant light, low quality stuff. The reason for that is the ultra

easy monetary policy we have seen post-2008. Governments made the mistake of

embracing fiscal austerity too early. By that, they left the job to the central

banks to frantically try to create economic growth. This is a mistake we must

avoid after this crisis. Fiscal policy will have to play a much larger part

going forward. …

Q: Looking forward, can there be such a thing as normalization in

monetary policy?

A: There is no return back to any form of normalcy

without dealing with the debt overhang. This is the elephant in the room. If we agree that the

policy of the past thirty years has created an ever-growing mountain of debt

and ever rising instabilities in the system, then we need to deal with that.

Q: How?

A: In theory, there are four ways to get rid of an overhang of bad debt.

One: Households, corporations and governments try to save more to repay their

debt. But we know that this gets you into the Keynesian Paradox of Thrift, where the economy collapses. So this way

leads to disaster. Two: You can try to grow your way out of a debt overhang,

through stronger real economic growth. But we know that a debt overhang impedes

real economic growth. Of course, we should try to increase potential growth

through structural reforms, but this is unlikely to be the silver bullet that

saves us. This leaves the two remaining ways: Higher nominal growth – i.e.

higher inflation – or try to get rid of the bad debt by restructuring and

writing it off.

Q: Which way will it be?

A: Probably a combination, but they are all very hard to achieve.

…

Q: What about the fourth way: write-offs?

A: That’s the one I would strongly advise. Approach the problem, try to

identify the bad debts, and restructure them in as orderly a fashion that you

can

…

Q: It almost seems the easiest way is to just keep doing what we are

doing?

A: You are right. My colleagues at the BIS and I have been warning of this debt trap issue for twenty years. I am reminded of the

economist Herb Stein who once said that, if something cannot go on

forever, it will stop. To which Rudi Dornbusch quipped: Yes, but it will go on

for a lot longer than you anticipate.

…

Q: Knowing that complex adaptive systems are prone to tipping points:

What could derail this system?

A: I don’t know. One of the conclusions of

the complexity literature is that the trigger itself is irrelevant. If the

system is unstable, anything could be a tipping point, even if the instability

goes on without incident for years.

Regular Fare:

Architecture

billings, Housing starts, Real estate loans

The Oldest

President Ever Will Confront a Generational Wealth Gap

Bubble Fare:

Hussman: Pushing Extremes

2021: Fastest

Earnings Recovery Ever

#1: Analysts expect 2021 to be a record year for S&P 500 profitability,

the fastest return to new-high earnings since at least the 1980s. Based on the

latest FactSet data, the Street is looking for $168.38/share on the S&P

next year. This would be 3.9 percent higher than 2019’s all-time high of

$163.02/share. The more typical recovery time to new-high profits is 3 ½ to 4

years,

The important thing to note here is just how much 2021’s expected

earnings growth outpaces revenue growth everywhere except Real Estate …

The only time you can pencil in 14 points of leverage (as the Street is

doing now for 2021) is very early in an economic cycle.

… We’ll close on this thought, though: if you don’t believe US corporate

earnings can show dramatic operating leverage in 2021 then now is the time to

consider lightening up on risk exposure.

You’ve got to

ask yourself one question. Do you feel lucky?

On a price to sales basis, stocks are at the highest level in history (at 2.71x).

Quote of the Week:

Jeremy Grantham, on CNBC: “The one reality

that you can never change is that a higher-priced asset will produce a lower

return than a lower-priced asset. You can’t have your cake and eat it. You can

enjoy it now, or you can enjoy it steadily in the distant future, but not both

– and the price we pay for having this market go higher and higher is a lower

10-year return from the peak.”

(not just) for the ESG crowd:

New study aims

to quantify climate change risks for Canada’s banks, insurers

Don’t Depend on

Wall Street for Renewable Energy Investment (transcript of interview available, as well as video of interview)

1% of people

cause half of global aviation emissions – study

Expert

IPCC Reviewer Speaks Out

Other Fare:

Top 10 Emerging

Technologies of 2020

The way we train

AI is fundamentally flawed

Fun (satirical) Fare:

'We Must Cancel

Thanksgiving,' Says CDC Scientist Who Looks Suspiciously Like A Turkey In A Lab

Coat

Tweeted Pics of the Week:

Between now and Dec 21 Saturn & Jupiter approach each other on the sky until a mere tenth of a degree separates them. Last time this happened Galileo was alive. The solar system: A Cosmic Ballet, choreographed by the forces of gravity.

Astonishing heat for November in Asia right now

Tweet Vid of the Week:

CBSNews: Thousands of cars lined up

to collect food in Dallas, Texas, over the weekend, stretching as far as the

eye can see.

EXTRA FARE:

Socio-political Fare:

Only a few years ago, the nation seemed sturdy enough

that its very existence would not be called to question. Now, not so much. In

2016, the elite, blue, coastal oligarchy was too smugly self-satisfied with its

correctness-in-all-things — especially its right to power — to bother rigging

the election beyond the usual urban ward-level hijinks in the usual places. But

then, Hillary lost to Mr. Trump via the inside straight of his bagging the

swing states electoral votes without winning the national popular vote.

They sure weren’t going to let that happen again, and

thus the weird spectacle this time of wee hour vote-tallying suspensions

followed by improbable ballot pump-and-dumps in favor of Ol’ White Joe Biden,

the most inert, empty, uncharismatic presidential candidate ever conjured by

any conclave of scheming cabalists in US history. (Next to Joe Biden, Warren G.

Harding was an American Augustus.) And so, the 2020 vote was rigged to the

rafters, just to make sure that the outcome this time would bend towards the

Democrats’ beloved arc of justice.

The legal battle over that brazen theft has incited

some exciting fightin’ phrases, mostly coming from freelance attorney Sidney

Powell, an informal adjunct to the president’s official lawyers, Jenna Ellis

and Rudy Giuliani. Miz Powell has promised to “release the kraken” and “blow up

Georgia” in a “Biblical” firestorm of fatal writs, “fixing to overturn the results

of this election” — leaving us early this week in the spooky eye of

post-election sturm-and-drang, with the real action yet to come.

The president and the RNC lost a bunch of state court

cases the past week and, naturally, that discouraged the pro-Trump troops

across “red” America — which is mostly everything between Hackensack and

Fresno. But these weak pleadings might have been designed to simply speed the

process through the states so as to get the main arguments before the US

Supreme Court, namely, that the foreign-owned Dominion vote tabulation company

was pre-programmed to overcome any Trump lead; that the Dominion software was

originally created to queer elections and indeed used many times to do just

that in foreign lands; and that US election officials with their poll-worker

grunts in select states connived to cover the fraud with as many unverifiable

write-in votes as the job required. And then, evidence-as-proof!

….

It’s not known exactly what further evidence Miz

Powell and the president’s lawyers will bring to the SCOTUS — beyond what has

already surfaced on the Internet, which is pretty eyebrow-raising. The news

media has made a big show of calling for it, and caviling loudly when the

lawyers say they’re holding back until the court is ready to entertain the

case. It’s hard to imagine that Miz Powell and Mr. Giuliani would sacrifice

their reputations on some kind of bluff. Anyway, what’s to bluff in this game?

I don’t believe this trio would bring a wiffle bat to a gunfight.

One result of these final innings in the contest will

be the delegitimizing of Ol’ White Joe Biden as president, should his forces

finally prevail. Half of America will not only refuse to buy it, but it will

incite a counter-resistance on the right as determined as Hillary’s pussyhat

brigades and bureaucrat activists of the post-2016 era, and possibly more

bloodthirsty, especially if the left makes a move to confiscate guns. The

prospect of Joe Biden functioning as president is a joke, anyway. Have you

forgotten his non-campaign campaign? The empty parking lots with the white

circles? The pitiful gaffes? And lurking in this fog of war is all that odious

monkey business selling influence abroad involving crack-head son Hunter and

the rest of the Biden family. Think that’s going away?

What you’d actually get with a Biden “victory” is a

Deep State junta of malicious, coercive, and vengeance-crazed characters such

as John Brennan, Andrew Weissmann, Nancy Pelosi, Susan Rice, and Adam Schiff,

with Barack Obama hovering somewhere backstage, commanding this-and-that …

Biden Will Likely Be Worse Than Obama. The Left Must

Lead The Backlash, Or The Right Will.

And from all appearances it looks like Biden is going

to be worse.

Unlike Obama, Biden did not campaign on hope and

change, he campaigned on opposing the socialist

inclinations of Sanders progressives and

an aggressive foreign

policy of planetary domination. He assured rich donors that nothing will fundamentally

change under his presidency and his transition team is

full of corporate sociopaths, war pigs and propagandists. Biden has been a corporatist warmongering

authoritarian throughout his entire career, and as his mental capacity continues to deteriorate he will function as nothing more than an

empty vessel for his establishment handlers to advance their most pernicious

agendas through. The empire has not gotten less desperate since Obama was

in office, it has gotten more

desperate.

If I prove right about this, the Biden

administration will generate backlash just like that which arose in response to the

Obama administration, and that backlash will be

more severe than its previous iteration. This is absolutely guaranteed. You can

only oppress, neglect and enrage a population so much before the discontent

begins to grow.

Biden

Rounds Up the Usual Suspects

Surprise! President-elect Joe Biden isn’t listening to

progressive voices in his party. Instead, he’s been rounding up the usual

suspects for his cabinet and staff. Turns out, progressives, that if you give

your support and vote to a Democratic establishment tool like Biden without

making firm demands, you won’t get anything in return. Who knew?

Here are a few good articles on Biden’s staff and

cabinet:…

Oligarchic Gaslight In America's Twilight

If the billionaires who own the place want their

failing state to turn an even bigger profit for them, their first task is to

ensure that the superfluous population keeps fighting among themselves instead

of punching up at them, their real oligarchic enemy.

Rudy Giuliani gave examples of voter fraud during his

presser at RNC HQ

Call me crazy for taking the man with hair dye

dripping down his cheeks seriously, but I think it would be unfair to dismiss

Rudy Giuliani. Amusingly shambolic he may be. That doesn’t mean he is wrong.

The media has been claiming since the election ended that President Trump’s

claims of voter fraud are ‘baseless’ and ‘without evidence’. That just is not

true. The President’s lawyer gave examples of it during today’s press

conference at the Republican National Committee headquarters in Washington DC.

But everyone is too busy mocking him to pay attention.

Making

Sense Of The News About Sidney Powell

Currently, I believe this election was marked by epic

fraud. You cannot convince me that Biden, who got 5 or 6 people to his rallies,

as opposed to the 52,000 or so at Trump’s rallies in Pennsylvania, ended with

more votes than Obama.

Nobody ever said proving this fraud would be easy (or,

sadly, even possible). I’m treating unfolding like an epic novel with a

surprise ending. I just wish I knew whether it was going to be a happy or a

tragic ending.

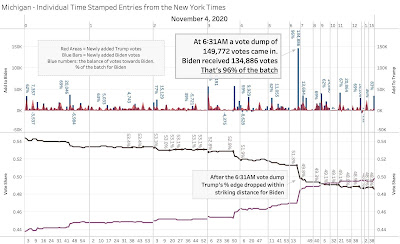

Statistically suspicious votes put Biden in the lead

The Pentagon and the CIA Are in Charge of Foreign Policy

New York Times Job Listing Shows How Western

Propaganda Operates

People who are only just beginning to research what’s

wrong with the world often hold an assumption that mainstream news reporters

are just knowingly propagandizing people all the time. That they sit around

scheming up ways to deceive their audiences into supporting war, oligarchy and

oppression for the benefit of their plutocratic masters.

Once you’ve learned a bit more you realize it’s not

quite happening that way. Most mainstream news reporters are not really witting

propagandists–those are to be found more in plutocrat-funded think tanks and

other narrative management firms, and in the opaque government agencies which

feed news media outlets information designed to advance their interests. The

predominant reason mainstream news reporters say things that aren’t true is

because in order to be hired by mainstream news outlets, you need to jack your

mind into a power-serving worldview that is not based in truth.

…. In order to get a job at the New York Times, you

need to demonstrate that you subscribe to the mainstream oligarchic imperialist

worldview which forms the entirety of western mass media output. You need to

demonstrate that you have been properly indoctrinated, and that you can be

guided into toeing the imperial line with simple attaboys and tisk-tisks from

your superiors rather than being explicitly told to knowingly lie. Because if they

did tell you to knowingly lie to the public to advance the interests of the

powerful, that would be propaganda. And propaganda is what what happens in evil

backwards countries like Russia. Mainstream establishment orthodoxy is

essentially a religion, as fake and power-serving as any other, and if you want

to work in mainstream politics or media you need to demonstrate that you are a

member of that religion.

Do Trump Supporters Live in an Alternate Universe?

How 'Western' Media Select Their Foreign

Correspondents

Did you ever wonder why 'western' mainstream media get

stories about Russia and other foreign countries so wrong?

It is simple. They hire the most brainwashed, biased

and cynical writers they can get for the job. Those who are corrupt enough to

tell any lie required to support the world view of their editors and media

owners.

They are quite upfront about it.

Here is evidence in form of a New York Times job

description for a foreign correspondent position in Moscow:

Quotes of the Week:

“The only reason to use voting machines is

to allow cheating.”

Tweets of the Week:

D.T. Cochrane: "What matters is not

the size of the debt ... but whether we can look back with pride, knowing that

[it] exists because of the many (mostly) positive interventions that were taken

on behalf of our democracy." Kelton

Debt since 1947: $15T

Military outlays since 1947: $18T

No comments:

Post a Comment