*** denotes well-worth reading in full at source (even if excerpted extensively here)

Quotes of the Week:

...And indeed, his macro thesis driving the trade idea is not solely relying on dropping inflation.

— Alf (@MacroAlf) October 21, 2022

He argues the market is largely underestimating the upcoming weakness in the labor market.

The housing market will freeze and NFPs will print negative soon.

How?

6/

...Unless central bankers admit to this outlook soon, it is safe to say that a pretty deep recession is unavoidable.

— AndreasStenoLarsen (@AndreasSteno) October 21, 2022

I don’t think they will admit to it (before it is too late), why a soft landing is very unlikely. More in my FREE newsletter here.

6/nhttps://t.co/LemZokxfh2

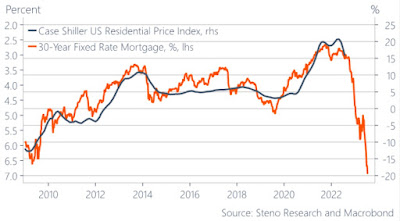

If housing still is the business cycle, bond yield inflection is round the corner. Mind the lag. pic.twitter.com/AhtVuBKWFl

— Steve Donzé (@steve_donze) October 20, 2022

What's really happening with your money? @spomboy breaks down the state of our economy & points the finger at the Fed for leading us toward a recession. The full interview streams exclusively on @foxnation – plus: unlock free sign-up offers only at https://t.co/voL1YtzIDW pic.twitter.com/zgqgDM3a6E

— Tucker Carlson Today (@TuckerToday) October 19, 2022

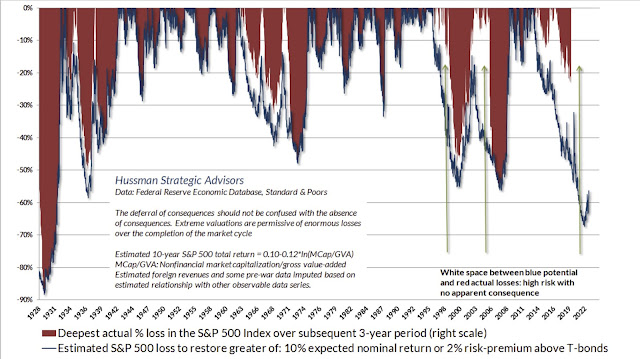

...far more than "optimal" monetary tightening is priced in (not-so-subtle hint number 1) pic.twitter.com/HFem4HE5md

— Dario Perkins (@darioperkins) October 21, 2022

The wheels are coming off the global economy.

— Otavio (Tavi) Costa (@TaviCosta) October 20, 2022

Here is where I think the market is heading.

👇👇👇

Bubble Fare:

(not just) for the ESG crowd:

Contrarian Perspectives

Extra [i.e. Controversial] Fare:

*** denotes well-worth reading in full at source (even if excerpted extensively here)

Krishnamurti: “It is no measure of health to be well adjusted to a profoundly sick society.”

Endemic Fare:

Read [almost?] everything by eugyppius; el gato malo; Mathew Crawford; Steve Kirsch; Jessica Rose!

Chudov, Lyons-Weiler, Toby Rogers are also go-to mainstays; a list to which I have added Andreas Oehler, Joey Smalley (aka Metatron) and, Julius Ruechel; Denninger worth staying on top of too for his insights, and especially his colorful language; and Norman Fenton; Marc Girardot; plus Walter Chesnut (on twitter); later additions: Sheldon Yakiwchuk & Charles Rixey & Aaron Kheriarty; and newest additions Meryl Nass and the awesome Radagast; and Spartacus is on substack now!!; I will of course continue to post links to key Peter McCullough material, and Geert Vanden Bossche, and Robert Malone, and Martin Kulldorff, and Jay Bhattacharya, and Sucharit Bhakdi, and Pierre Kory, and Harvey Risch, and Michael Yeadon, and John Ioannidis, and Paul Marik, and Tess Lawrie, and Dolores Cahill, and [local prof] Byram Bridle, and Ryan Cole, and... of course Heather Heying and Charles Eisenstein often bring their insight and wisdom to the topic as well... and if Heying's substack isn't enough, she joins her husband Bret Weinstein at their DarkHorse podcast ....

New study shows that pretty much everyone is getting heart damage from the COVID vaccines

They just aren't letting you know that. In Canada, the medical community is very smart about this: they don't let doctors measure troponin levels before you are vaccinated so nobody is the wiser.

... In the graph shown at 6:21, we see that the 777 people who got the booster in this study have uniformly higher troponin levels than their matched unvaccinated peers. That is not supposed to happen. If the vaccines are safe, the troponin levels should be nearly identical between vaccinated and unvaccinated groups.

Here are Professor Prasad’s exact words:

It's not just the tip of the distribution that has elevated high sensitivity troponin, it's that the entire distribution is right shifted. Everybody's having a little bit of elevation in high sensitivity troponin. That's what this graph would have you infer.You get a troponin elevation when there is damage to your heart:

Troponin is a type of protein found in the muscles of your heart. Troponin isn't normally found in the blood. When heart muscles become damaged, troponin is sent into the bloodstream. As heart damage increases, greater amounts of troponin are released in the bloodWhat the study shows is that nearly everyone is getting a little heart damage when they get the COVID vaccine, some get a lot more damage than others.....

Chudov: Cancer Rates are Increasing -- and May Get Much Worse

Wiped Out Immune Systems Take Time to Manifest

We have a problem: cancer deaths began to increase, off the charts, in late 2021, with cancer death incidence exceeding expected levels by a statistically “impossible” 9-sigma difference — and we are seeing only the first small ripple of a storm coming in the future.

Nobody exemplifies this wave of cancers better than the Belgian Covid vaccine advocate and misinformation fighter Michel Goldman, who developed a “rare” form of lymphoma (immune system cancer) following his Covid vaccination. His lymphoma rapidly worsened after his booster dose ...........The vax were wrongly promoted as stopping transmission. That lie was a basis for authoritarianism. It distracted us from myriad ways of responding to the pandemic. That those arent known widely shows how corporate power has destroyed the public sphere https://t.co/Nzam69an3a

— Prof Jem Bendell 🌍☸️ (@jembendell) October 15, 2022

CO-VIDs of the Week:

Please watch this incredible movie, "Out To See" featuring Prof. John Ioannidis. Only about an hour out of your day, but worth every second. https://t.co/6aqcg0Sw0L

— Jay Bhattacharya (@DrJBhattacharya) October 20, 2022

Pushback Fare:

....... Alas, the thinking classes across Western Civ have now gone insane. Today, they are the ones perpetrating real crimes against humanity. They have given themselves permission — as elites will — to behave cruelly, unjustly, and idiotically against the public interest and against the inherent rights of individuals to fair treatment. They’ve subjected millions to injury and death. They’ve maintained the fraudulent “Emergency Use Authorization” (EUA) for hugely profitable, ineffective, and dangerous drugs by prohibiting treatments with proven effective drugs — the use of which would nullify the EUA and the legal protections it affords the drug-makers. They’ve concealed the statistics that would show all that. And they appear to be acting with arrant malice driven by political actors offstage.

COVID Corporatocracy Fare:

Back to Non-Pandemic Fare:

...Let's have a war with Russia, China, Iran and a few other countries we deem insufficiently deferential (Peru? Nigeria? Pakistan?) all at the same time just to see how it works out. https://t.co/CCf6N1FJF1

— Glenn Greenwald (@ggreenwald) October 18, 2022

“In the methods of their action, including burning people alive, use of weapons prohibited by international law, torture and other crimes against humanity, the current neo-Nazis are no different from their fascist idols exemplary to the German occupation.” — Glazyev

— 🅰pocalypsis 🅰pocalypseos 🇷🇺 🇨🇳 🅉 (@apocalypseos) October 20, 2022

- build webs of trust and find people who you think are at least trying to tell the truth. acknowledge that all this has limits, but use this new massive plurality of punditry and perception to find those who seem sensible. assess their track records. trust lightly, then build to more as greater trust is earned. engage also with the other side and those with whom you disagree. hear their arguments in their own words so that you can assess them and they yours. in this way, you can assess the world and try to keep the disinformation, curation, and misperception to a minimum.

- stop having an opinion on things. in many ways, this is the more potent solution. the great illusion of the modern age is that you must have a view on everything. you don’t. it’s totally fine to say “i have no idea whether to support or oppose this” and to do and say nothing. neutrality pending future information and assessment is a valid position. many times, you’re just not going to get enough trustworthy information to generate a sound view. if such is the case, then the only reasonable action is not to have an opinion. this need to generate one and join a tribe in the conflict is more likely to get you into trouble than out of it. and making the same mistake over and over again while expecting it to be different this time, well, we all know what that’s the definition of…

So how did we get, in rather less than half a century, from liberal pundits preening themselves over the open society to their present-day equivalents demanding blind faith in the dogmatic utterances of officially approved experts? That’s a complex story, and we can begin it with a famous BBC documentary titled The Century of the Self, which originally aired in 2002. ....

I have to say, my brain is slowly turning to some gloopy mess after trying to navigate a week’s worth of “news” and opinion. Not to mention my spirit. There was a time when the world seemed to make some sort of sense to me.

I think one of the reasons I have focused on gender ideology over the past months is not so much that it is important (which it obviously is) but that it is an example of something that is stark raving bonkers. How did we ever manage to talk ourselves into the position that in order to become, one merely has to identify? And that’s only one of the deranged dogmas that have been voided from the bowels of the all-consuming gender ideology behemoth.

Compassion and kindness is one thing, living in some weird sexualised (and genderised) fantasy world that bears only a superficial resemblance to reality, quite another.

But nutters have always been with us. What’s interesting about the gender ideology stuff is how many ordinary non-nutty people seem to have swallowed it.

Today I want to try to simmer down a bit and get a bit technical. I feel like I need some kind of anchoring in sanity and rationality before attempting to sally forth onto the hellish woke battlefield once again.

This morning I’ve seen a couple of tweets stating things like “half of my 14-year-old granddaughter’s class identify as trans”, or that “half of my daughter’s class are LGBTQ+”

My immediate thought, beyond social contagion, is what’s the probability of that?

Probability is a fundamental part of our lives and a fundamental part of how we view the world. We’re conditioned to think in terms of risk, for example. The risk of nuclear war, the risk of climate change, the risk of covid, the risk of not vaccinating or wearing a mask, the risk of suicide if gender-affirming care is not available, and so on.

Everywhere, we’re invited to frame things in terms of risk. Warning; there be dragons ahead.

What we’re all pretty hopeless at, unless we put in some effort, is putting this risk landscape into perspective. It’s hard not to be swayed by a headline that says “eating bacon doubles your risk of a heart attack”. Eating bacon becomes a risky business - at least in our minds. Our subconscious will have got the message; bacon = bad.Evolution has tried to give us a balance somewhere in between being paralyzed by fear and being wholly unconcerned with risk at all. Neither of these extremes would have been a great survival strategy. But, alas, it has also left us vulnerable to manipulation and this has been exploited by politicians and tyrants throughout history. Just two examples; Hitler stoked up fear of the Jews, Trudeau stoked up fear of the unvaccinated. There’s no essential difference in technique here. Both leaders, presumably, thought their highlighting of the ‘risk’ was appropriate and justified in some way.

So, how do we combat the current pandemic of (alleged) risk that seems to be plaguing us?

The only real way out of this is by education. To be more specific, it’s a particular kind of education. It’s the kind of education (and it could be self-education) that questions, and attempts to place everything within a rational framework. It’s a kind of day-to-day working out of the scientific method applied more generally which I state in typically Riggerian fashion

If something doesn’t fit, your ideas might be shit

.......

No comments:

Post a Comment