*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

The debate about the natural rate of interest, or r*, sometimes overlooks the point that there is an entire term structure of r* measures, with short-run estimates capturing current economic conditions and long-run estimates capturing more secular factors. The whole term structure of r* matters for policy: shorter run measures are relevant for gauging how restrictive or expansionary current policy is, while longer run measures are relevant when assessing terminal rates. This two-post series covers the evolution of both in the aftermath of the pandemic ....

...................... Conducting inference on latent variables such as r* is a difficult business, as any estimate is inherently model dependent. In many circumstances the different models agree: for instance, there is widespread evidence that r* declined from the mid-1990s until the aftermath of the Great Recession and remained low until the COVID pandemic. Approaches disagree in terms of assessing what happened afterward, with models relying more on long-run averages indicating that long-run r* remained low, while approaches such as the DSGE where short- and long-run measures are more tightly connected indicate that long-run r* has risen. Tomorrow’s post focuses on short-run r* and its implications for the economy. ...

The Evolution of Short-Run r* after the Pandemic

This post discusses the evolution of the short-run natural rate of interest, or short-run r*, over the past year and a half according to the New York Fed DSGE model, and the implications of this evolution for inflation and output projections. We show that, from the model’s perspective, short-run r* has increased notably over the past year, to some extent outpacing the large increase in the policy rate. One implication of these findings is that the drag on the economy from recent monetary policy tightening may have been limited, rationalizing why economic conditions have remained relatively buoyant so far despite the elevated level of interest rates. .....

Fed, 'landing' scenarios & the yield curve

This note looks at how to map the various ‘landing scenarios’ (soft, hard & no- landing) to pricing for the Fed by using an estimated policy rule. The policy rule model also produces an estimate for the neutral interest rate (R*) which then maps into evaluating the premia in long-end yields. This is particularly relevant given the recent steepening of the curve.

Summary:

This analysis finds that the Fed cutting to 4% (current end of 2024 pricing) looks consistent with a soft-landing scenario while in a hard-landing scenario it is hard to see the Fed cutting much below 1.5% unless core inflation starts printing below 1%.

A rising implicit R* that comes out from this analysis also means that there is less premium in US long-end rates. The bias is still that the US curve needs to build more rate premium over time but positioning and data momentum are tactically stretched and it looks interesting to rotate the implementation from US to Canadian curve steepening in forward space.

A look inside the inflation numbers says the Fed is done

I've long believed that the Fed and most media observers are confused about how inflation works. That's because most people are still captive to the traditional Phillips Curve model of inflation, which says that in order to tame inflation, the economy needs to suffer a significant slowdown in growth. In turn, that means that the Fed needs to be very tight for a significant period; no easing until early next year.

So the market is convinced the Fed will be on hold through at least the end of the year. But a look inside the inflation statistics suggests that is likely to be unnecessary; inflation is very likely to continue to decline in the months to come. At some point, likely well before year end, the Fed is going to have to concede that inflation has been licked—and lower rates accordingly. ....

............ Currently, the market expects the Fed to hold rates steady through the early part of next year, and then to begin easing. If my reading of the monetary and inflation tea leaves is correct, the Fed should begin cutting rates now, not next year. If they wait too long, we will see the CPI entering negative territory (i.e., deflation). .......

FRBSF: Where Is Shelter Inflation Headed?

... The CPI results, as far as I’m concerned, are still tracking towards my sub-2% prediction by the end of this year and I stand by that prediction in light of this data. .....

.... Upon the release of the April 2023 PCE, I provided reassurance that brief upticks in the YoY rate of inflation is common amidst a broader trend of disinflation. The PCE data didn’t scare me then, and the CPI data doesn’t scare me now, particularly when we continue to see core, median, and trimmed-mean CPI decelerating in the latest data. ....

.... By simply swapping Shelter out and using the Zillow Rental Index & the Case-Shiller housing data, the CPI is growing at a pace of +0.5% vs. the BLS’s reported +3.2%. That’s quite a stark difference, suggesting that most, if not all, of the inflationary pressures in the economy are based on the lagging results of OER and therefore Shelter.

As I look forward, I see the following disinflationary aspects:

- Student loan repayment will reduce aggregate demand

- Credit creation is decelerating YoY

- Wage growth is decelerating YoY

- Supply chain bottlenecks are gone

- M2 is contracting YoY

- Deposits are contracting YoY

- Reserves are contracting YoY

- Energy prices are still contracting YoY

- Shelter is decelerating YoY

- Used cars are contracting YoY

- Core, median, & trimmed-mean CPI are in disinflation

- The quits rate is falling

- Average weekly hours worked is falling

- China PPI is in deflation, which leads U.S. CPI

- China CPI is in deflation, which leads U.S. CPI

- ISM Services Prices Paid is declining

- Services diffusion indexes are declining (leading CPI by 3-6 months)

- The real federal funds rate is positive

- 300 basis points of rate hikes haven't been felt yet

- The Fed probably isn't done hiking yet

Given the weight of the evidence and the probable disinflation coming for Shelter, the largest component of the CPI, disinflation is likely to persist. Given the lag effects of monetary policy, which are long and variable, I expect to see the Fed’s rate hikes ripple through the economy through the remainder of the year and into 2024, followed by the Fed holding rates at a restrictive level.

Stocks' Gains Should Not Be Mistaken For Confidence That There's No Recession Imminent

... The empirical evidence suggests the stock market is a poor leading indicator for the economy. This is contrary to the oft-repeated cliche that it is forward-looking; a mistaken assertion that also gets used to cite stock-market gains as confirmation that the economic outlook is positive in a flawed self-reinforcing spiral. .....

That clashes harshly with the soft-landing narrative that has become entrenched in markets, but even this exact economic complacency has dangerous precedent, as Bloomberg’s Chief US Economist Anna Wong highlights.

In October 2007, the FOMC was opining on the economy’s resilience amid an overall soft-landing narrative. It was that same month that the S&P 500 topped out, with the Great Recession starting just two months later. And the trite repetition that this would be the most-forecast recession in US history is the flip side of registering that every prior economic downturn has been underestimated. .....

Almost every major input - the consumer, SLOOS, ISM, the yield curve, policy-tightening that impacts with a lag - is pointing toward a US recession probably beginning in 4Q. ....

Oh, and yes, just in case you were wondering, equity investors should absolutely care if a recession is looming. Excluding the aforementioned 1945 exception, the average S&P 500 decline associated with the other 14 recessions has been 35%.

ECRI: Does the strength of consumer spending make a recession less likely?

It’s well known that consumer spending accounts for over two-thirds of U.S. GDP. A strong consumer is therefore widely assumed to be axiomatically equivalent to a strong economy, and therefore to reduced recession risks.

The cyclical pattern actually contradicts that optimistic take. Consumer spending, i.e., personal consumption expenditures, was indeed the biggest positive contributor to Q1 2023 GDP growth. Notably, consumer spending as a percentage of GDP has been surging in the wake of the 2020 Covid recession, and is hovering near a record high of almost 71%. Here’s the catch: this is precisely what happens around recessions. As the chart shows, consumer spending as a percentage of GDP always soars in the run-up to recessions, and typically stays in an uptrend until after the end of the recession.

In contrast, Gross Private Domestic Investment (GPDI) as a percentage of GDP has been falling. This is also what happens around recessions, as the chart confirms.

What Do Federal Tax Receipts & Total Receipts Suggest About Recession?

Federal tax receipts suggest GDI numbers, not GDP numbers, are accurate. They also hint at recession...

....... When tax receipts and total receipts both plunge, the economy is typically in recession. There were false signals in 1985 and 2003. There have also been recessions unconfirmed by plunging receipts so this is admittedly not the greatest of signals. But the tax data and the income data align ....

Tax Receipts. Another Leading Recession Indicator?

Not So Fast With The CPI Celebrations: Rents Are Surging Again And Back To Record Highs

........ This report will be dedicated to this topic, in order to present why the disinflationary thesis is still intact and perhaps stronger than ever. I will warn you… I am biased, but only because my objective review of the data is still pointing to disinflation. If you want to believe that inflation will reaccelerate, feel free to disregard this report. If you believe that inflation will reaccelerate, but you want to understand the disinflationary thesis better, read on. If you believe in disinflation and want more ammo to defend your perspective, read on. .......

via the BondBeat: DB's US Economic Perspectives - Getting real about rate cuts: Four scenarios for '24 rate reductions

In his press conference following the July FOMC meeting, Chair Powell was quizzed about the conditions under which the Fed would cut rates. While he was, expectedly, non-committal on the quantitative thresholds to trigger these decisions, he continued to view preventing real rates from rising sharply as inflation falls as a key consideration for rate cuts.

We consider what policy rules would imply for the timing and pace of rate cuts in 2024 under different economic scenarios. The four scenarios we consider are: (1) DB's house view for a mild recession starting in Q4 2023; (2) The Fed's median forecast from the June SEP; (3) An immaculate disinflation where inflation drops precipitously without strain in the labor market; and (4) A no landing scenario where inflation remains high and the labor market tight.

Our policy rule analysis finds a pretty consistent message: Absent a no landing-type scenario, the Fed is likely to begin to cut rates in the first half of 2024 and that significant rate reductions could follow over the remainder of the year. Under the no landing scenario, the Fed could well hold rates above 5% into 2025.

The Corporate Debt Maturity Wall: Implications for Capex and Employment

......... We find that for each additional dollar of interest expense, firms lower their capital expenditures by 10 cents and labor costs by 20 cents. The increase in interest expense that we estimate would therefore reduce capex growth by 0.10pp in 2024 and 0.25pp in 2025 and labor cost growth by 0.05pp in 2024 and 0.15pp in 2025. Our estimates suggest about half of the reduction in labor costs comes from reduced hiring and half from lower wage growth ........

Klarman edited the classic to remind investors of basic principles — but he questions “how much of this will be read by institutional investors who may think they know it all.”

.................. “Investors must be resolute in the face of withering criticism from clients, superiors, and their own self-doubt during protracted periods of underperformance,” Klarman writes in the preface.

“There’s cyclicality in investor preferences. When value investing is doing well it becomes more popular, people see the logic of it,” Klarman told Institutional Investor. “When it’s doing poorly, it becomes less popular because people want to make money right away.”

Alternatives Have Been ‘Kryptonite’ to Alpha — At Least for Public Pensions

Richard Ennis finds public pension funds in the U.S. have generated negative alpha of approximately 1.2 percent annually since the global financial crisis in 2008.

US Stocks Will Underperform Global Equities Over Next Decade

... It’s not just that US stocks are extremely expensive when compared to most other global share markets or even their own internal history. It’s that the US slice of global market cap is very stretched relative to the US share of global GDP. .......

Damodaran: The Price of Risk: With Equity Risk Premiums, Caveat Emptor!

China Watch:

IMF: Fiscal Policy and the Government Balance Sheet in China

...... It would be wrong to think that external factors have radically altered China’s prospects. Rather, the country’s gradual decline started more than a decade ago. Those who closely analysed the data, beyond the buzzing business districts and flashy building developments, detected this economic malaise as early as 2008. Back then, I wrote that China was entering a typical overaccumulation crisis. Its booming export sector had raked in a huge amount of foreign reserves since the mid-1990s. In its closed financial system, exporters must surrender their foreign earnings to the central bank, which creates equivalent RMB to mop up the foreign currencies. This led to the rapid expansion of RMB liquidity in the economy, mostly in the form of bank loans. Because the banking system is tightly controlled by the party-state – with state-owned or state-connected enterprises serving as the fiefdoms and cash cows of elite families – the state sector enjoyed privileged access to state bank loans, which were used to fuel an investment spree. The result was rising employment, a temporary and localized economic boom, and a windfall for the elite. But this dynamic also left behind redundant and unprofitable construction projects: empty apartments, underused airports, excessive coal plants and steel mills. That, in turn, resulted in falling profits, slowing growth and worsening indebtedness across the main sectors of the economy. .........

China Facing "Bigger Debt Crisis Than Evergrande" In Under 30 Days

Book Review:

Keen: The Paradox of Debt, by the Tycho Brahe of Credit

Quotes of the Week:

Gross: "all of the bulls on Treasuries... I’d think their arguments are a little misplaced. We are going back to proper valuation on longer-term notes and bonds.”

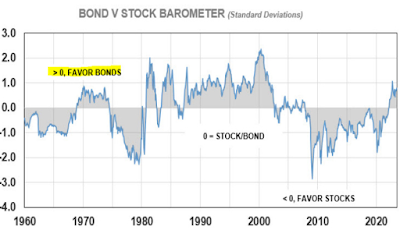

Authers: This matters. A higher bond yield means a higher cost of capital for everyone. And sudden “breakouts” beyond the long-term declining trend in yields have a history of triggering accidents. I’ve published various versions of the following chart many times over the last two decades. Don’t get too excited about exactly where to draw the trend line since the Fed under Paul Volcker slew inflation. Just note how strong that trend was, how financial accidents invariably happened when it was threatened, and that it’s plainly now over:

Charts:

1:

3:

Tweets:

Pro-cyclical deficit spending is changing the Fed's calculus.

— Warren Pies (@WarrenPies) August 7, 2023

In combination, the two main channels of money creation (deficit spending + bank lending) are rising more than 10% yoy.

The Fed can slow bank lending, but it has no control over fiscal policy. pic.twitter.com/VuNuKGhsWW

...

...Looks like major Seasonal Adjustment monkey biz in Retail Sales. The Auto seasonal assumption this July called for a -2.6%m/m decline, vs. expectations of a 0.7%m/m gain on average of the last 3 Julys. But, hey, nothing to see here folks! Meanwhile, by way of reminder, here's… pic.twitter.com/Ahw6FkgDpV

— steph pomboy (@spomboy) August 15, 2023

...Even with the slight uptick in yoy PPI, the Inflation Pipeline suggests that disinflationary pressures for the Crude, Intermediate, and Finished Goods segments could continue to exert downward pressure on the CPI. pic.twitter.com/SlKAcSyJCQ

— Day Hagan Asset Management (@DayHagan_Invest) August 11, 2023

...Our alt inflation headline reads out:

— Jeremy Schwartz (@JeremyDSchwartz) August 10, 2023

Real time headline inflation of 0.5% instead of 3.2%. Yes still a 0 handle on real time headline inflation

Our Alt Core inflation = 1.5% instead of official BLS 4.7%.

At least the SF Fed acknowledging shelter inflation bias! pic.twitter.com/GOcCQGWULx

...It's happening....... pic.twitter.com/1kMAf7p4aY

— Julia Coronado (@jc_econ) August 10, 2023

This time is different...?

— Don Johnson (@DonMiami3) August 5, 2023

Here is a 1-year update to my original pinned recession forecasting post from the end of July 2022.

The recession alert was first triggered October 27th, 2022 - we are now approaching the 'hard landing start window' which begins during the last week… https://t.co/MdY9v1qPKY pic.twitter.com/UkLIYQFBOl

...Backing out #stock based #compensation, the S&P 500 is more expensive than any time in the last 20 years based on free cash flow yields.

— Kailash Concepts (@KailashConcepts) August 14, 2023

Data ex-financials pic.twitter.com/w1morvncW1

-7.5%. Yikes. Worst estimated 12yr equity risk premium in history.

— John P. Hussman, Ph.D. (@hussmanjp) August 3, 2023

Only other instance: 2000 peak. If it's any consolation, the S&P 500 had only lagged Treasuries by -6% a year by 2012.

Best to actually test other methods across history before dismissing this one. They're junk. pic.twitter.com/ZxksbCOYrQ

Podcasts:

Bull Market Investing. Dr. David Kelly, Chief Global Strategist at J.P. Morgan Asset Management

To be good long term investor, you need courage and you need brains. However, you need them in different quantities at different times. In the depths of a bear market, you mostly need courage since it’s almost a “no-brainer” that the economy will recover and will lift financial assets with it. In a bull market, its mostly about brains since, while people are less haunted by economic fears, valuations are higher, increasing the need to be more discriminating in both asset allocation and security selection.

(not just) for the ESG crowd:

Hansen: Uh-Oh. Now What? Are We Acquiring the Data to Understand the Situation?

........ Political leaders at the United Nations COP (Conference of the Parties) meetings give the impression that progress is being made and it is still feasible to limit global warming to as little as 1.5°C. That is pure, unadulterated, hogwash, as exposed by minimal understanding of Fig. 6 here:

......... These numbers say a lot about the extent of the French government’s environmental commitments, and, more broadly, about the gigantic practical joke being played by world leaders in their ‘declaration of war’ on global warming. It is not just Macron. Look at how the rulers of countries hit by the record-breaking July heatwave behaved: as if global warming was some future menace, to be mended with the odd €6 for a jacket here and there (or €10 if it’s lined).

We’re not dealing with denialists here: they are comparatively unthreatening, for their bad faith is transparent, and they grow more pathetic by the hour despite their corporate bankrolling. Far more dangerous are those like Macron – that is, the overwhelming majority of the world’s political class, irrespective of ideological orientation – who feign concern from their air-conditioned offices and private planes, and then do nothing. Worse than nothing, in fact: for they make the public believe that the problem can be solved with half-measures and palliatives, promoting market solutions for a problem created by the market itself. ..............

'Dark brown carbon' in wildfires may have even bigger climate impacts than previously thought

Plants find it harder to absorb carbon dioxide amid global warming

A modelling study suggests that increases in photosynthesis have slowed since 2000, opposing previous research that said this effect would remain strong, helping to absorb CO2 from the atmosphere

‘We’re changing the clouds.’ An unintended test of geoengineering is fueling record ocean warmth

Pollution cuts have diminished “ship track” clouds, adding to global warming

Global heating likely to hit world food supply before 1.5C, says UN expert

Water scarcity threatening agriculture faster than expected, warns Cop15 desertification president

Experts fear US carbon capture plan is ‘fig leaf’ to protect fossil fuel industry

Critics concerned energy department decision on fledgling technology will undermine efforts to phase out fossil fuels

Energy Dept. Announces $1.2 Billion to Advance Controversial Climate Technology

‘Direct air capture’ of carbon pollution is still experimental, but a fossil fuel company is embracing it as a way to keep drilling.

......... Occidental CEO Vicky Hollub has said that because of DAC, “we don’t need to ever stop oil,” and that the technology gives the fossil fuel industry “a license to continue to operate.”

According to Gore, “They’re using it in order to gaslight us, literally.” ......

In a 2019 study that examined the impacts of direct air capture, Mark Jacobson, a professor of civil and environmental engineering at Stanford University, found that it would increase CO2 emissions, air pollution, fossil mining and fossil infrastructure, largely because of the enormous amount of energy required to extract, compress, and separate the CO2.

Even if renewable energy is used to operate DAC, Jacobson told DeSmog that this would simply divert renewables away from directly replacing fossil fuels. .......

Are humans a cancer on the planet? A physician argues that civilization is truly carcinogenic

In "Homo Ecophagus," Dr. Warren Hern gives human activity a deadly diagnosis

Humans have existed on this planet for a relatively short time, yet we've had a major impact on it, dramatically altering its biodiversity and shifting its global climate in only a few centuries. The burning of fossil fuels has cooked the globe so much that ecosystems are threatening to fall completely out of balance, which could accelerate the ongoing mass extinctions caused by our predilection for exploiting nature.

There's a very distinct possibility we could trigger our own extinction or, at the very least, greatly reduce our population while completely altering the way we currently live. Little things like going outside during daylight hours or growing food in the dirt could become relics of the past, along with birds, insects, whales and many other species. War, famine, pestilence and death — that dreaded equine quartet — threaten to topple our dominance on this planet. We are destroying our own home, sawing off the very branch we rest on. .......

Rees: The Human Ecology of Overshoot: Why a Major ‘Population Correction’ Is Inevitable

Sci Fare:

This is your brain on sleep deprivation.

— Dan Go (@FitFounder) August 5, 2023

Scientists in Canada launched the largest study on how lack of sleep affects the brain.

They created games that tested skills like reasoning, language comprehension & decision making.

They had one participant repeat these tests in an… pic.twitter.com/ulC5tMDZx3

Other Fare:

How Asset Managers Took Over Your Life

Why Canada Is Criminalizing Dissent

Things You Won't See In The Oppenheimer Movie

QOTW:

Crooke: “The idea that our Justice Department can indict someone, especially the sitting president’s main political rival, over speech that’s protected by the First Amendment is simply insane … Simply put, this indictment is nothing more than a declaration of war against American voters and their constitutional right to free speech.”

Satirical Fare:

Tweets of the Week:

It’s official. The DNC were running an armed covert election fraud operation in the swing States to take advantage of mail-in voting, to steal the election.

— Clandestine (@WarClandestine) August 8, 2023

This is why the Dems pushed so hard for mail-in voting.

This is why the MSM/CDC/NIH over-exaggerated Covid deaths.

This… pic.twitter.com/xPUEyeVZor

Pics of the Week:

Why All Great Thoughts Are Conceived by Walking

No comments:

Post a Comment