***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

- Global central bank assets are contracting and significantly deviating from overall stock trends.

- Yield curve inversions are steepening after being extensively inverted, a classic signal in credit markets that typically coincides with the onset of an economic decline.

- The unemployment rate has surpassed its 2-year moving average, an indicator that has consistently foreshadowed a recession over the last 50 years.

- Every time the ISM manufacturing index remained below the key 50 level for 12 consecutive months, a recession ensued.

- Household saving rates are nearing historic lows.

- The Conference Board Leading indicator has declined for 19 consecutive months, a trend observed only during the Stagflationary recession of 1973-4 and the Global Financial Crisis.

- Market leadership has narrowed with technology mega-cap stocks isolated from the rest of the market, reminiscent of the times preceding the 2001 Tech Bust.

- The recent enormous value destruction in fixed-income assets worldwide

- The perilous divergence between falling Treasury prices and the Nasdaq 100 Index, which continues to defy gravity in a markedly higher cost of capital environment.

- Typical late-cycle valuations among equity markets are historically overblown across several fundamental multiples: price-to-book, price-to-free cash flow, price-to-sales, cyclically adjusted price-to-earnings, overall market cap of US stocks relative to GDP, and others.

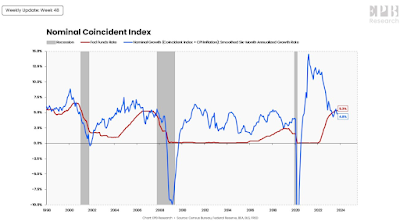

- Monetary policy operates with a lag and the Fed has been in a rate hike cycle for 21 months and 20 months into quantitative tightening.

- Banking credit is starting to contract, reaching levels only experienced during the Global Financial Crisis.

- An aggregate index of cyclical industries such as banks, retail, homebuilders, autos, and small caps is now down 20% relative to the S&P 500.

- Trucking employment is contracting at a faster rate than it did during the 2000 and 2008 cycles.

- Consumer sentiment, in terms of present situation versus future expectations, is currently near record levels, serving as an incredibly reliable contrarian indicator.

- Federal tax receipts have declined for seven consecutive months, a sequence only observed during recessions.

- An overwhelming amount of corporate and sovereign debt obligations are maturing in the next 12 months, with effective interest rates on the verge of a drastic rise from historically low levels.

- Corporate margins are yet to feel pressure from rising wage increases as the cost of living remains high and labor strikes continue to unfold.

- Less than one-third of all small-cap stocks in the US have turned a profit in the last three years.

- Aggregate corporate earnings currently reside at the upper boundary of a 70-year channel, historically marking a critical juncture with profits declining significantly in the subsequent years.

- Warren Buffett has made a strategic move to accumulate the largest cash position in Berkshire Hathaway’s history, comprising 52% of cash relative to total assets.

Academic Fare:

Quotes of the Week:

Waller: "If you think about central banking, we talk about a “Taylor rule” – or various types of Taylor rules – that kind of give us a rule of thumb about how we think we should set policy. And every one of those things would say if inflation is coming down – once you get inflation down low enough – you don’t necessarily have to keep rates up at those levels. So, there’s certainly good economic arguments from any kind of standard Taylor rule that would tell you – if we see disinflation continuing for several more months – I don’t know how long that might be – three months, four months, five months – that we feel confident that inflation is really down and on its way [to target], then you could then start to lower the policy rate just because inflation is lower. It has nothing to do with trying to save the economy or recession. It’s just consistent with every policy rule I know from my academic life as a policymaker. If inflation goes down, we’d lower the policy rate. There’s just no reason to say you would keep it really high if inflation is back at target.”

SOMETHING HAS TO GIVE

— AndreasStenoLarsen (@AndreasSteno) December 1, 2023

The overall market conclusion is now that the central banks will have to cut massively in 2024, with inflation easily dropping to target, while the economic landing will be all fine, and yet cyclicality is not performing in PMIs. Something has to give.…

Charts:

0:

Capex intentions collapsing, worse than the "mid-cycle" slowdown of 2015-2016. The consensus sell side forecasts of "late-2024 recession" could be wrong. An "I" and "G" led shallow recession may already be here. The Fed overreacts for pol reasons. Voila... your 2024 forecast. pic.twitter.com/i6MHFYLT4N

— Marko Papic (@Geo_papic) November 29, 2023

Call me stupid (and many people do - regularly), but I'm not sure how @OxfordEconomics can say that their Beige Book Activity Index going negative is not recessionary when, looking at the chart, every time it has done it before there has been a recession!

— Albert Edwards (@albertedwards99) November 30, 2023

H/T @SoberLook pic.twitter.com/wRaJyygtGl

The share of industries in the ISM saying they are now expanding is all the way down to a grand total of 17%. The chart says we’ll be drawing a fresh shaded region before long. pic.twitter.com/sEbMxSiuR4

— David Rosenberg (@EconguyRosie) December 1, 2023

...Here’s the history of what happens after the Fed's “last tightening.” The top panel shows the change in the Fed policy rate and the 10-year yield (measured through the subsequent easing cycle); the bottom panel shows the change in the real S&P 500 and real earnings.

— Jurrien Timmer (@TimmerFidelity) December 1, 2023

Everyone's… pic.twitter.com/Wb8Tf0ZKJP

...The theme of this year's stock market has been narrow leadership by mega caps. That's what happened in the early 1970s, when investors only trusted blue chips, and in the late '90s, when high-flying tech stocks ran amok, creating the dot-com bubble. The chart shows the… pic.twitter.com/V9nABiYqF4

— Jurrien Timmer (@TimmerFidelity) November 29, 2023

If the market truly bottomed out in October of last year, then basic market math tells us that the tape should eventually broaden again. This weekly chart shows the S&P 500 equal-weighted index against a red/green shading indicating market breadth — the percentage of stocks… pic.twitter.com/NwJ7ysBnAt

— Jurrien Timmer (@TimmerFidelity) November 29, 2023

...If the Fed has reached the end of its tightening cycle, as is widely believed, what's next? As this chart illustrates, history offers a vast range of potential answers, from aggressive dovishness after the 1989 peak to the back-for-more hawkish path following the 1959 peak.… pic.twitter.com/3B5cbJqweo

— Jurrien Timmer (@TimmerFidelity) November 29, 2023

...PCE Inflation, 6-month annualised:

— Steven Anastasiou (@steveanastasiou) December 2, 2023

Headline: 2.5%

Core: 2.5%

Supercore: 1.8%

The current high inflation cycle is over.

It's time to end the “higher for longer” mantra.

To help avoid pushing the US economy into a recession, it's time for the Fed to adopt a loosening bias. pic.twitter.com/Zf5k3dhrWP

70 % of Core CPI the BLS reported was Shelter.

— James E. Thorne (@DrJStrategy) December 2, 2023

The inflation is permanent thesis that so many fell for will be proven to the so wrong …

Rates are going so much lower then consensus thinks.

Get ready for the “we didn’t see it coming” narrative. pic.twitter.com/ao2c8nXExR

(not just) for the ESG crowd:

.... Whatever Miller was advocating for, the issue that provoked her to take to the pages of The Hill is a high-stakes one: an upcoming and highly anticipated rule-making announcement by the US Department of Treasury that will decide who qualifies for some of the most lucrative (and scientifically dubious) tax credits codified into law by the Inflation Reduction Act of 2022 (IRA). The race is on to pilfer scores of billions from the US taxpayer in the name of chasing green energy unicorns, and there is a full-blown administrative brawl underway between the various factions trying to get theirs while the getting is good. It is a story of cronyism, a failure to learn from Europe’s energy madness, and a familiar scheme guaranteed to incinerate heaps of the public’s money.

Sci Fare:

Geopolitical Fare:

........... On October 7 the repressed reality of Palestinians under direct or indirect Israeli rule literally exploded in the country’s face. From this perspective, while I was shocked and horrified by the brutality of the Hamas attack, I was not surprised at all that it occurred. This was an event waiting to happen. If you keep over two million people under siege for 16 years, cramped in a narrow strip of land, without enough work, proper sanitation, food, water, energy, education, with no hope or future prospects, you cannot but expect outbreaks of ever more desperate and brutal violence. ........

- The initial Hamas attack did not have a lot of atrocities committed, despite Israeli claims. No widespread rape, no baby killing and few civilian casualties caused by Hamas. Hamas’s targets were military, plus grabbing hostages and most of the civilian casualties seem to have been caused by indiscriminate Israeli fire, some due to calousness, some due to panic and some due to the Samson doctrine that states Israel will not allow hostages to be taken.

- Hamas treated its captives humanely. Israel routinely tortures and sexually humiliates theirs.

- Israel attacked multiple hospitals and deliberately forced them to shut, while cutting off all water, power and food. The population pyramid of known casualties very closely follows the Gaza population pyramid, and the most common age of those killed was five. Most dead were women and children, which means they weren’t soldiers and couldn’t be.

- Israel is clearly engaging ethnic cleansing and genocide.

Leadership:

Having open-minded conversations with believable people who disagree with you is the quickest way to get an education and to increase your probability of being right. #principleoftheday pic.twitter.com/nyzrU57fp5

— Ray Dalio (@RayDalio) December 2, 2023

Many of you have asked how to better manage teams so I'm sharing a list of principles that have helped me over the years. #principleoftheday pic.twitter.com/bg43ne55dx

— Ray Dalio (@RayDalio) December 1, 2023

No comments:

Post a Comment