***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Part One of this article described the burgeoning bull steepening yield curve environment and what it implies about economic growth and Fed policy. It also discussed the three other predominant types of yield curve shifts and what they suggest for the economy and Fed policy.

Persistent yield curve shifts tend to correlate with different stock performances. With the odds growing that a long bull steepening may be upon us, it’s incumbent upon us to quantify how various stock indices, sectors, and factors have done during similar yield curve movements.

Limiting Losses With Yield Curve Analysis

Stocks spend a lot more time trending upward than downward. However, in those relatively brief periods where longer-term bearish trends endure, investors are advised to take steps to reduce their risks and limit their losses. An active approach puts you on higher ground than you otherwise might have been. Moreover, when the market resumes its upward trend, you have ample funds to purchase stocks at lower prices and better risk-return profiles. ...........

Recession forecasts have been wrong for years. Here's why a 'perfect indicator' doesn't exist.

It hasn't been a great time for folks in the business of predicting recessions.

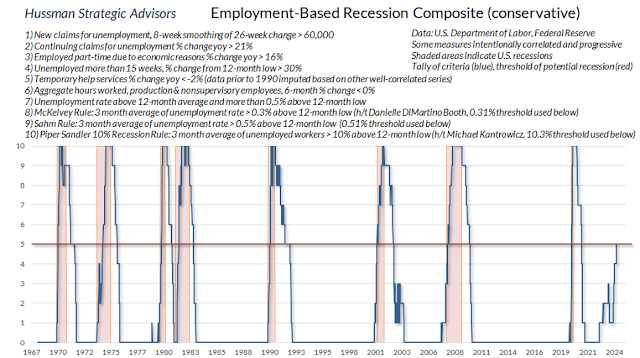

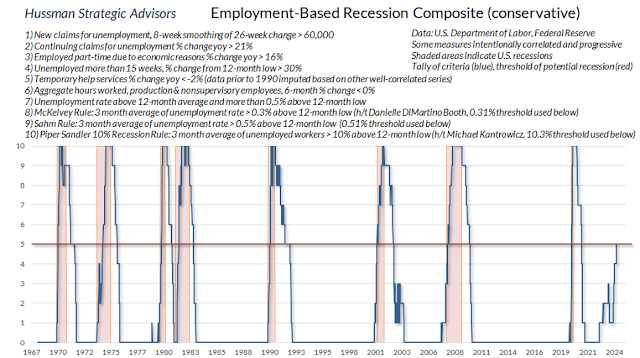

The Conference Board's Leading Economic Index signaled a recession in 2022. The highly regarded inverted yield curve recession indicator has been activated since November 2022. Even the commonly accepted layperson's definition of recession — two negative quarters of GDP — occurred in 2022. Most recently, the Sahm Rule, which measures short-term rises in unemployment, triggered its recession red flag in early August.

But as many economists will tell you, the US isn't and hasn't been in recession. ........

… But what are $HY bond markets telling us about the likelihood of a near-term recession? We analyze three indicators below that have proven to be a good leading signal of future credit stress, future S&P 500 weakness, and ultimately weaker economic growth.

1) $CCC Spreads: $CCC bonds are the most vulnerable to default, given very high leverage and weak free-cash-flow generation. But $CCC spreads have tightened 40bps since August 1, and are near 3yr lows, supported by hopes of a meaningful Fed cutting cycle. This performance remains consistent with our view that US spec-grade default rates will slowly decline through Q2'25 and with our preferred portfolio expression to overweight a barbell of $BBs & $CCCs over $Bs.

2) $HY Funding Costs: $HY funding costs generally rise before a recession begins, using 1990, 2001 & 2008 as prime examples. Today, $HY funding costs are falling, with market yields having declined nearly 100bps from mid-April to 7.3% today. This easing of financial conditions for leveraged companies is highly inconsistent with a near-term downturn.

3) $HY Total Returns: Similar to 2) above, negative $HY total returns on a trailing 12m basis generally signal major weakness in the S&P 500 and ultimately the US economy ahead. But trailing $HY returns are becoming more positive in recent months.

Simply put, there is little recession signal coming from $HY credit. And post Jackson Hole, the presence of an effective Fed put is likely to keep credit concerns at bay.

Bubble Fare:

"On Tuesday, July 16, our most reliable gauge of U.S. stock market valuations hit the steepest extreme in U.S. financial history. We cannot, and do not, assert that this places a ‘limit’ on speculation – even the previous January 2022 peak slightly exceeded the high of 1929. In our investment discipline, valuations are not enough. The uniformity or divergence of market internals is critically important (particularly following our 2021 adaptations), and we also attend to syndromes of extremely overextended market conditions. Our discipline does not rely on forecasts, scenarios, or projections of market action. Instead, we try to align our investment stance with observable, measurable market conditions as they change over the market cycle. Still, there’s a very rare set of market conditions extreme enough to deserve a ‘warning.’ As Madge said in the old Palmolive dish soap commercials, ‘you’re soaking in it.’

– John P. Hussman, Ph.D., You’re Soaking in It, July 21, 2024

From the standpoint of full-cycle investment prospects and risks, little has changed since July. Valuations remain near record extremes. Certain elements of market internals have improved somewhat despite a slight decline in the S&P 500 from its peak, but our key gauge remains in an unfavorable condition. While recent economic data have been comfortable, many reliable leading gauges remain just at the border that distinguishes expansion from recession (though we would need more evidence to expect a recession with confidence). Meanwhile, we see numerous stocks being taken behind the shed and clobbered by 10%-30% on earnings reports that are quite good but notch down guidance even slightly. When you see that behavior at extreme valuations, it tends to be a sign of underlying skittishness and risk aversion. When valuations are setting record extremes because the news can’t get any better, even a slightly less optimistic outlook becomes a risk. ..........................................

............................

I’ve always believed that investors underestimate the extent to which precious metals can support a diversified approach to the fixed income markets. The reason is that except when inflation is very high and rising (e.g. core consumer price inflation on the order of 6% or more), we find that the main driver of returns in precious metals stocks isn’t inflation but rather the behavior of interest rates. The chart below illustrates this in data since 2003, but the same relationship holds true across history. Generally speaking, we find that the strongest return/risk profile in precious metals shares is associated with periods of falling interest rates, while the weakest outcomes are associated with periods of rising interest rates – again, unless inflation is quite high and rising. .......................

...... given that we can expect a pivot toward lower rates in the near future, how much do valuations tend to increase, on average, in the 3, 6, 12, and 24 months following a Fed pivot?

The answer is simple. They don’t. See, Fed tightening tends to occur when the economy is running hot and the financial markets are doing quite well. The pivot tends to happen in response to increasing risk of economic weakness. As it turns out, both the median and average response of stock valuations is a decline over subsequent quarters, particularly if valuations have been elevated, as they were in 2001 and 2007. In fact, with the exception of the August 2019 pivot, where much of the subsequent advance was driven by trillions of dollars of pandemic subsidies over the following year, the only instances when valuations rose following a Fed pivot (1957, 1980, 1981, 1984) were periods when valuations started at or below historically run-of-the-mill norms. .............

.................. When a speculative bubble collapses – and I suspect this one will end like others before it – it isn’t because people take money “out” of the market. Every dollar a seller takes out is the same dollar a buyer just brought in. Prices collapse because the sellers are more eager to get out than the buyers are to get in, and a price decline is needed in order for stocks and cash to exchange hands (that’s why it’s called a stock exchange). The hypervalued market capitalization people call “wealth” simply vanishes because market capitalization is just price times shares, and the only way to get sellers and buyers to trade with each other is for the trade to happen at a lower price. With market valuations just shy of their recent record extreme, it may be helpful to seriously consider your exposure to risk, and the full-cycle losses that have resolved speculative episodes across history.

Tweet of the Week:

Quotes of the Week:

Keynes: It is of the nature of organised investment markets, under the influence of purchasers largely ignorant of what they are buying and of speculators who are more concerned with forecasting the next shift of market sentiment than with a reasonable estimate of the future yield of capital-assets, that, when disillusion falls upon an over-optimistic and over-bought market, it should fall with sudden and even catastrophic force.

......

Speculators may do no harm as bubbles on a steady stream of enterprise. But the position is serious when enterprise becomes the bubble on a whirlpool of speculation. When the capital development of a country becomes a by-product of the activities of a casino, the job is likely to be ill-done.

......

We should not conclude from this that everything depends on waves of irrational psychology. On the contrary, the state of long-term expectation is often steady, and, even when it is not, the other factors exert their compensating effects. We are merely reminding ourselves that human decisions affecting the future, whether personal or political or economic, cannot depend on strict mathematical expectation, since the basis for making such calculations does not exist; and that it is our innate urge to activity which makes the wheels go round, our rational selves choosing between the alternatives as best we are able, calculating where we can, but often falling back for our motive on whim or sentiment or chance.

Charts:

1:

...

...

...

(not just) for the ESG crowd:

........... All they know, and which they keep reminding us of, is that “things are worse than predicted” i.e. climate science is largely failing to make forecasts.

........... The main reason why climate science is virtually dead at this point is simply that the models, theorems, assumptions and parameters on which it operates are based on a planet which no longer exists.

......... For any scientific discipline to thrive it is essential that the system it studies does not change. Whether it is biology, cosmology, physics or climate science, in order to study these systems, they have to remain relatively constant ..................

We have entered a Great Uncertainty whereby, even if we try to speed up and understand this new planet, by the time we do this it will have changed again, as new climate tipping points are crossed. From global ocean currents to glaciers, to the permafrost and rainforests, all moving parts of the climate sphere are changing rapidly and radically, to comprise a brand-new planet that has never been studied before, by anyone. ...........

So climate science as we knew it is almost dead, or at least, it has become orders of magnitude more difficult. Why is nobody talking about this? Because of a number of typical human behavioural biases and hindrances. ........

Most of all, science is forbidden from crossing the knowledge-society barrier, to actually articulate the implications of its data and its findings on wider society. Climate scientists collect the evidence, but the most crucial role, that of interpreting it, is left to politicians and PR spin doctors. The greatest failure of climate science has been the failure to panic in the most public and affirmative way. ..........

....... Every climate scientist at this point should be an activist. Acting otherwise would be a fatal disservice to society.

The Democratic Party’s attempt to associate militaristic policies with a campaign centered on hope and joy represents a dangerous conflation of progress and military power.

............. True hope for the future lies in reimagining our approach to national security, global cooperation, and economic progress. One where movements social movements around the world can unite to support one another in resisting and replacing economic and political oligarchs locally and globally. By challenging the normalization of militarism within progressive discourse and presenting alternative visions for a more peaceful and just world, we can reclaim the concept of hope from those who would use it to justify endless war and surveillance.

.......... And these are just highlights. One could make a list of thousands.

We are swimming in an ocean of shit.

No one can make good decisions: who to vote for, who to support, what to believe, or what to do, if they believe large numbers of lies.

And it truly is an Ocean of Shit: there’s so much that no one can keep up, certainly no one who doesn’t make it one of the main things they do. .........

You’ll often hear Democrats calling people “privileged” if they talk about voting third party, or if they say it doesn’t matter whether Donald Trump or Kamala Harris wins the election in November. The idea is that if you’re not doing everything you can to make sure the Democrat wins, it must be because you are white and wealthy and coddled enough to be unconcerned about Donald Trump getting in and implementing racist and discriminatory policies.

This narrative is false. Nonvoters in the United States are statistically much more likely to be poor and nonwhite, because those groups tend to see both mainstream political factions as more or less equally worthless at helping to improve the condition of their lives. .......

.... The truth of the matter is that you simply don’t get to vote on any of the most consequential things your government does.

You don’t get to vote on whether wars, militarism and imperialism should continue.

You don’t get to vote on whether your government should engage in nuclear brinkmanship with Russia and China.

You don’t get to vote on whether your government should keep systems in place which ensure the destruction of our biosphere.

You don’t get to vote on whether your government should be continuously working to subvert and destroy any nation anywhere on earth who dares to disobey its commands. ..........

You don’t get to vote on whether billionaires should remain billionaires while so many ordinary people struggle to survive.

You don’t get to vote on whether you and your compatriots should be subjected every single day to mass media propaganda which serves the information interests of your government and the status quo politics it relies on. ..........

Noam Chomsky was correct when he said “The smart way to keep people passive and obedient is to strictly limit the spectrum of acceptable opinion, but allow very lively debate within that spectrum.” Until you really understand that quote and how far it goes, you can’t understand anything about mainstream western politics and political discourse.

.............. A lot of Americans seem to suffer from the delusion that they live in a normal country with a normal government, so they should be allowed to go about their business in private without unwelcome scrutiny from foreigners. But the US is not a normal country with a normal government; it’s the hub of the most powerful empire that has ever existed, which uses its military and economic power to bully and dominate the rest of the world. You don’t get to tell anyone who lives on this planet that US politics are none of their business.

It’s wild when you realize that nobody can actually articulate a reason why Israel should be supported that is both logically coherent and morally defensible. ......

The decay of western civilization is unfolding in real time right in front of our eyes.

Israel has ramped up its assault on the West Bank with an incursion the likes of which has not been seen since 2002, at the same time we learn that the Biden administration has been scrambling to increase its weapons shipments to Israel. Haaretz reports that August has been the second-busiest month for weapons shipments from the US to Israel’s Nevatim Airbase, second only to October 2023.

This is the same Biden administration that Americans have been assured is working “tirelessly” and “around the clock” for a ceasefire in Gaza. They’re committing genocide and lying about it while laughing and grinning and celebrating the “joy” of the Kamala Harris campaign.

Meanwhile in the UK the government is going insane arresting critics of Israel’s western-backed atrocities for speech crimes. .........

............. So what’s the good news?

There is none.

There is no good news to be found in the unfolding of dystopia and armageddon. Expecting otherwise would not be reasonable.

This doesn’t mean there’s nothing to be happy about, or that there’s no joy or beauty to be found in our world. Joy and beauty can be found everywhere you look. You’re just not going to be made happy by reading the real news stories about the times we are living in.

We live in an unfathomably beautiful world, and happiness is the default position of human consciousness underneath all the madness and egocentricity we’ve heaped on top of it. All it takes is a little inner work and inner clarity and you can experience as much happiness and beauty as you can stand in any moment of your waking life.

There is stunning beauty to be found on the crest of the wave of the apocalypse. .........

.............. I have written thousands of essays and millions of words trying to wake people up to the tyranny of the US-centralized empire we live under, but I have never written anything more effective at radicalizing people against imperial status quo politics than the supposedly “left-wing” political party of the world’s most powerful government telling people it’s unreasonable to demand that it stop committing genocide. ............

We need a word that’s stronger than “dystopian” for this. Democrats finally learn that they need energy and enthusiasm in order to win elections, so they start squealing about “joy” and “fun” and making memes and flower power posters… but they do it during an active genocide that’s being perpetrated by the same administration they’re feigning all this “joy” about. ..........

Lunatics. Bunch of deranged fucking lunatics.

❖

Trump isn’t evil because he’s another Hitler, he’s evil because he’s another Obama. So much emphasis gets placed on how different Trump is from other US presidents, when all the evidence of his actual presidency showed the most evil thing about him is how similar he is to them. ........

The United States is the single most tyrannical and murderous government on earth, by an extremely massive margin. Trump is evil because he spent his administration going along with all that tyranny and murderousness just like those who came before him and after him, not because of who he is as an individual. If you think Trump is some freakish aberration in an otherwise acceptable status quo, it’s because you don’t appreciate how horrific the status quo is.

..............

❖

Trump and Harris are 99% identical in terms of the real policies they’ll promote. Trump supporters and Harris supporters hate each other because of that 1% difference; I hate them both because of that other 99%.

“If we lose, we’ll be tried as war criminals.” US General Curtis LeMay speaking of the US firebombing of Tokyo (and here) in WWII.

In addition to the war against Russia that the US launched with its coup in Ukraine of 2014, the next president of the US will have the US role in the genocide in Palestine to contend with. With respect to US relations abroad, it would be one thing if these conflicts had been forced on the US. But they weren’t. They were chosen by the Biden-Harris administration as part of its too-little, too-late, recognition that US-based capital, Wall Street acting in league with subsidized industries like Big Tech, has destroyed the US economy for most workers, meaning citizens.

Other Fare:

Canada’s health system reels as by one estimate 1,000 die weekly. Each infection carries risks. Where’s the prevention?

Or How Silicon Valley Started Breaking Bad

.............

(1) Instead of pursuing truth, new technologies aim to replace it with mimicry and fantasy.

...

(2) This has empowered shamming, scamming & spamming at unprecedented levels.

....

(3) Users are not the real customers—so billions of people must suffer to advance the interests of a tiny group of stakeholders.

...

(4) Real people become inputs in a profit-maximization scheme which requires that they are constantly controlled and manipulated.

...

(5) In this environment, everything gets viewed as a resource or input and the natural world (including us) is ruthlessly exploited.

...

(6) The groundwork for this was laid by theorists who replaced truth with power.

...

(7) In the past, governments controlled huge technologies (nuclear power, spaceships, etc.) so they were somewhat accountable to citizens, but now the most powerful new tech is in private hands, and the public good is no longer even considered.

...

(8) So much wealth is concentrated in the hands of the winners in these processes, that they literally become more powerful than nation states.

...

(9) With this shift in power, even the most independent politicians turn into controlled agents working for the technocracy — making a mockery of democracy.

...

(10) If you oppose this command-and-control tech you can be theoretically (and often literally) erased, suspended, deplatformed, shadow-banned, surveilled, de-banked, digitally faked, etc. —so who will dare?

...

Study pinpoints two measures that predict effective managers

Good managers are hard to find. Most companies pick managers based on personality traits, age, or experience — and according to a recent National Bureau of Economic Research paper, they may be doing it wrong.

Co-authored by David Deming, Isabelle and Scott Black Professor of Political Economy at Harvard Kennedy School, the study concludes that companies are better off when they select managers based on two measures highly predictive of leadership skills.

The Gazette talked to Deming about the study’s findings. This interview has been edited for length and clarity.

What are the qualities that make a good manager, and why is it so hard to find them?

Being a good manager requires many different qualities that often don’t exist in the same person. First is the ability to relate well to others, to create what Amy Edmondson and others have called psychological safety, meaning the ability to make people feel stable and secure in their role so they are comfortable with critical feedback. That’s a key component of being a good manager. Communication skills are also essential. As a manager, you should know that there’s not one good way to deliver feedback to your workers because the words you use and the way you frame your statements also matter.

At the same time, you must also be analytically minded and open to different ways of doing things and be able to take a step back and reassess whether your team or organization is working as well as it could be. Overall, being a good manager requires both interpersonal skills and analytical skills. You also need to have a strategic vision — which is something that our study does not capture. Managers must have a sense of what their organization is trying to accomplish. Any one of those skills is hard to find. Having all three, and knowing when to use them, is even more difficult. .........

Fun Fare:

............... As of publishing time, the Weinberger family was also trying to get Immanuel Kant to return their lawn mower after the transcendentalist refused to acknowledge its material existence in his tool shed.

Pics of the Week:

No comments:

Post a Comment