***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

............ Here are some more highlights from the decision:

TARIFFS:

- The major shift in direction of US trade policy and the unpredictability of tariffs have increased uncertainty, diminished prospects for economic growth, and raised inflation expectations. Pervasive uncertainty makes it unusually challenging to project GDP growth and inflation in Canada and globally.

- Expects tariffs and supply chain disruptions to push up some prices.

- Major shifts in US trade policy have increased uncertainty and cut prospects for growth and raised inflation expectations.

INFLATION:

- Higher inflation in last couple of months reflects some rebound in goods price inflation and end to temporary suspension of sales tax.

- Starting in April, inflation will be pulled down for one year by removal of consumer carbon tax; lower oil prices will also dampen inflation.

- Will continue to assess timing and strength of both downward pressure on inflation from weaker economy and upward pressures from higher costs.

- Short-term inflation expectations have moved up. as businesses and consumers anticipate higher costs from trade conflict and supply disruptions. Longer term inflation expectations are little changed.

................ “What happens to the Canadian economy and inflation depends critically on US trade policy, which remains highly unpredictable,” Governor Tiff Macklem said in prepared remarks. “Given this uncertainty, point forecasts for economic growth and inflation are of little use as a guide to anything.”

................. When explicitly asked why the Bank chose not to cut, given the depressing economic outlook, Macklem emphasized that the Bank would be cautious in its decisions going forward. The decision to hold was brought up several more times, and it appeared at its core that the Bank, much like seemingly everyone else, is paralyzed by uncertainty.

The decision was also accompanied by a Monetary Policy Statement. However, this statement was not quite like those of the past. For the past few months, the Bank of Canada has highlighted rising uncertainty surrounding how US tariffs would impact the Canadian economy. The following are key issues that complicates the Bank’s outlook.

- What tariffs will ultimately be imposed

- The extent of countermeasures from Canada and other countries

- How long that tariffs will last

- The outcome of future trade negotiations

Additionally, the Bank noted that there is a second layer of uncertainty, which pertains to “how households, businesses, and governments will react and adapt to tariffs.” In order to address this uncertainty as best it can, the Bank has chosen to explore the following two scenarios:

- Scenario 1: Most tariffs imposed since the trade conflict began are negotiated away, but the process is unpredictable. Uncertainty about trade policy continues until the end of 2026.

- Scenario 2: The uncertainty and limited tariffs in Scenario 1 persist, and other US tariffs are added. A long-lasting trade war unfolds

Powell said: "tariffs are highly likely to generate at least a temporary rise in inflation."

"The inflationary effects could also be more persistent. Avoiding that outcome will depend on the size of the effects, on how long it takes for them to pass through fully to prices, and, ultimately, on keeping longer-term inflation expectations well anchored.

Powell again stressed the central bank's focus on preventing potential tariff-driven price hikes from triggering a more persistent rise in inflation.

“Our obligation is to keep longer-term inflation expectations well anchored and to make certain that a one-time increase in the price level does not become an ongoing inflation problem,” Powell said.

Powell added that policymakers would balance their dual responsibilities of fostering maximum employment and stable prices, “keeping in mind that, without price stability, we cannot achieve the long periods of strong labor market conditions that benefit all Americans.”

Powell raised the spectre of stagflation:

"We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension. If that were to occur, we would consider how far the economy is from each goal, and the potentially different time horizons over which those respective gaps would be anticipated to close."

This differs from Waller earlier this week:

Should the Fed face both a rapidly slowing economy and still elevated inflation, “the risk of recession would outweigh the risk of escalating inflation.” ..............

HSBC: The Major bond letter - After the tantrum (via The Bond Beat)

All was well in the USD29trn Treasury bond market, or at least seemed to be. Yields were moving along a downward path through the first three months of the year, in sympathy with the US Treasury Secretary Scott Bessent’s early objective (Bloomberg, 6 February 2025). And then along came the reciprocal tariffs in the second week of April and the bond market had a bit of a tantrum.

In “normal” times, bond yields move with rate expectations, and this is because most of a bond’s yield is explained by the policy rate and the market’s view of where this rate is going. But something strange is afoot. The gap between rate expectations and bond yields has increased quite sharply (see chart), indicating that investors are requiring additional compensation for holding bonds compared with money market rates.

...........

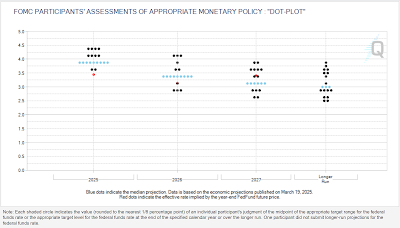

Market expectations of where policy rates will be in a year’s time are approximated by the one-year forward (1Y1M). As the chart shows, this red line can move a long way from the policy rate. Ahead of the first rate cut for this cycle (18 September 2024) markets anticipated a total of 250bp easing over the following year. There have since been 100bp of Fed funds cuts and, at 3.64%, today’s 1Y1M implies the equivalent of three more 25bp cuts below the current Fed funds upper bound.

The gap between the two series in the chart captures the additional yield required in compensation for taking duration risk. It is a type of term premium. We once described the theory behind term premium as a “dark art” because it always seemed to be shrouded in mystery and conspiracy (see Dark Art, 21 April 2017) – something that you know lies out there in the shadows, but often can’t quite be seen. Yet, inevitably, when everyone’s talking about term premium (with some even trying to forecast it), you know it is probably on the way to being priced in – and at the point where it starts to fade from view…

Quant assessments of trade war scenarios

Summary

- The Trump administration wants to remake the US by reshaping the world. This requires a deep correction in global savings and investment imbalances, focusing on China.

- We explore five different trade war scenarios, ranging from negotiations to full escalation to bifurcation: in short, the harder the US pushes, the bigger the impact on China’s surpluses.

- While that suggests trade wars ‘work’, they come at a rising cost as they get ‘hotter’.

- Nonetheless, from an economic statecraft perspective, this still implies the risks of outcomes

- that markets do not yet fully price for.

Converging Forces

Five pivotal U.S. economic considerations, including tariffs, monetary policy, fiscal policy, debt overhang, and demographics, are aligning to depress economic growth for the balance of this year and into 2026.

• First, the recessionary effects of tariffs, supported by compelling historical evidence and economic theory, will dominate the inflationary ones, potentially leading to a significant reduction in world trade and capital flows.

• Second, the Fed's continued maintenance of a highly restrictive monetary situation is significant and could have severe implications. A significant reversal in Federal Reserve policies this year is necessary for economic acceleration in 2026.

• Third, current federal spending plus the lagged negative multiplier effects from 2021 to 2024 will reduce economic activity this year. Benefits from the presumed tax reductions will impact 2026, but their delay will cause fiscal policy restraint for 2025. .............

........... Basic economic theory was at work. Except for energy products, the demand for nearly all internationally traded goods is price elastic. This price elasticity means, in percentage terms, the fall in demand will be far greater than the associated tariff-caused price increase, resulting in a drop in total revenue. ....................

Since the Fed's first year of operation in 1914, the current four-year percent change for detrended real M2 is in its ninth fall into negative territory (marked as #9 in Chart 1). The second occurrence, marked as #2 Chart 1, is a highly relevant experience for the current situation. Money growth began decelerating sharply in the late 1920s and then turned negative from 1931-35. Then, aggregate demand faltered in response to repeated contractionary BTN measures and the depressive effects of extreme over-indebtedness. However, the Fed did not reverse the monetary contraction, for which it was subsequently excoriated by Nobel Laureate Milton Friedman and former Fed Chair Ben Bernanke.

The lagged monetary restraint from 2022 is confirmed by the movement in the Fed's H.8 line item, Other Deposit Liabilities (ODL). As measured on a real detrended basis for the last four years, ODL, which decelerated before all recessions since 1961, has been negative since 2024 (Chart 2). ..........

In recent times, Fed leaders have reiterated that they are data dependent. The experience of a century ago is that tariffs are recessionary but even more so when real money growth contracts. In such circumstances, the Fed should be preemptive, act before data confirmation .........

The U.S. population increased by 3.3 million or about 1% in 2024, the fastest pace since 2001. Immigration, dominated by illegal entry, accounted for 84% of this increase. Global Economics at Goldman Sachs estimates "net immigration by the end this year will total 500,000" compared with slightly over 2.5 million in 2024. Immigration's recent history of indirectly boosting employment and raising both government and private spending is coming to an abrupt end. .........

The Fed has yet to cushion the economic restraint from current federal spending and adverse multipliers, the lagged effects of prior central bank actions, and the immediate demographic drag. Thus, the five convergent factors mentioned initially suggest that the risk of recession is high, and the transition to meaningful recovery will be fitful, uncertain, and labored. Such an uncertain environment of tepid or negative economic growth will be conducive to a downward trajectory of long-term Treasury rates. ..........

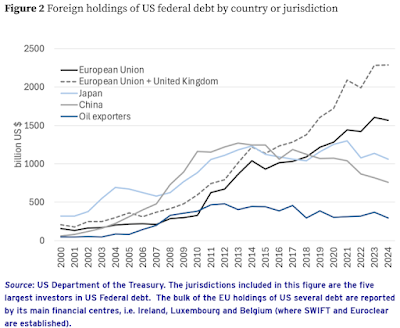

The trade war launched by the Trump administration follows a longer-term pattern of geo-economic fragmentation, but it dwarfs all prior expectations. This column looks beyond the trade war, asking if, in a more fragmented global economy, official investors should continue to hold US federal debt to the same extent as before. The answer is likely no, due to the increasing exchange rate risk on this debt as global trade stalls. Yet this does not imply the demise of the dollar as the global reserve currency, unless economic rationale fails to win precedence over brinkmanship.

References

- Ahmed, R and A Rebucci (2025), “A ‘reverse conundrum’ and foreign official demand for US Treasuries”, VoxEU.org, January 15.

- Aiyar, M S and M A Ilyina (2023), “Geo-economic fragmentation: Implications for the international monetary system”, VoxEU.org, March 28.

- Amedolagine, V, A Prebistero and R Rabelliotti (2024), “Chinese infrastructure lending and Africa's global value chain participation”, VoxEU.org, December 19.

- Anil, A (2025), “Chaos theory: Assessing the legal validity of Trump’s tariffs”, VoxEU.org, February 12.

- Arjona, R and D Revoltella (2024), “Enhancing the resilience and security of EU supply chains”, VoxEU.org, November 12.

- Attinasi, M G and M Mancini (2025), “Trade wars and fragmentation: Insights from a new ESCB report”, VoxEU.org, March 28.

- Bergin, P and G Corsetti (2024), “Monetary policy in response to tariff shocks”, VoxEU.org, November 27.

- Bertoldi, M and M Buti (2025), “America under Trump: Domestic and European implications”, VoxEU.org, January 13.

- Blanchard, O J, F Giavazzi, and F and Sa (2005), “International Investors, the U.S. Current Account, and the Dollar”, Brookings Papers on Economic Activity 1: 1-49.

- Boeckelmann, L, I Moder and T Spital (2024), “A new index to measure geopolitical fragmentation in global greenfield foreign direct investment”, VoxEU.org, November 15.

- Bombardini, M, A Gonzales-Lira, B Li and C Motta (2024), “The increasing cost of buying American”, VoxEU.org, December 12.

- Bordo, M and R N McCauley (2025), “Miran, we're not in Triffin land anymore”, VoxEU.org, April 7.

- Cheng, W and D Zhang (2012), “A monetary model of China-US trade relations”, Economic Modelling 29: 233-238.

- Choi, J, D Dang, R Kirpalani and D Perez (2024), “Exorbitant privilege and the sustainability of US public debt”, VoxEU.org, October 26.

- Comin, D and R Johnson (2025), “Tariffs are coming: How trade dynamics will shape aggregate demand and inflation”, VoxEU.org, January 25.

- Eichengreen, B (2023), “Is de-dollarisation happening?”, VoxEU.org, May 12.

- Eijffinger, S (2025), “Trump’s non-cooperative game”, VoxEU.org, April 4.

- Evenett, S and J Fritz (2025), “US reciprocal tariffs: Upending the global trade policy landscape”, VoxEU.org, April 3.

- Faber, M, G Kozliakov and D Marin (2025), “Global value chains in a world of uncertainty and automation”, VoxEU.org, February 12.

- Felbermayr, G, H Mahlkow and A Sandkamp (2023), “Cutting through the value chain: the long-run effects of decoupling the East from the West”, Empirica 50: 75-108

- Grzana, M and E Ilzetski (2025), “The impact of Trump’s economic policy on the EU economy”, VoxEU.org, March 16.

- Laser, F, A Mhailov and J Weidner (2024), “Currency denomination of foreign exchange reserves: From taboo in the past towards disclosure and exciting research nowadays”, VoxEU.org, October 25.

- Monteiro, J A and R Piermartini (2024), “Trade and inclusiveness”, VoxEU.org, November 11.

- Moro, A and V Nispi Landi (2025), “FraNK: Fragmentation in the New Keynesian model”, VoxEU.org, January 3.

- Subacchi, P and P van den Noord (2023), “Exorbitant privilege and fiscal autonomy”, Oxford Review of Economic Policy 39(2): 283–299.

- Subacchi, P and P van den Noord (2025), “Should Europe continue to fund U.S. federal debt?”, SciencePo Chair in Sovereign Debt and Finance Working Paper.

- Yared, P (2024), “US military strength secures financial dominance”, VoxEU.org, December 20.

Dive into how rising government debt and fiscal policies limit central banks' ability to fight inflation

In a world of rising government debt and expansive fiscal policies, fiscal dominance is becoming a key force in shaping monetary policy.

When government debt levels soar, central banks face increasing pressure to keep interest rates low, limiting their ability to fight inflation effectively. ........

What Is Fiscal Dominance?

Fiscal dominance occurs when a government’s fiscal policy-spending and borrowing-overwhelms a central bank’s monetary policy.

In this environment, central banks may be forced to accommodate high levels of debt by keeping interest rates low, even if inflation is rising.

For example, when a country’s debt-to-GDP ratio exceeds 100%, servicing that debt becomes increasingly difficult if interest rates rise sharply.

As a result, central banks may have to tolerate higher inflation to avoid triggering a fiscal crisis.

This dynamic can lead to prolonged periods of loose monetary policy, even when inflationary pressures demand tightening.

While volatility can produce a bounce, it is no sign of strength. History suggests that patient investors will be presented with better opportunities in the days/weeks/months ahead.

Before rolling over this past week, the 200-day average for the S&P 500 had risen continuously since June 2023. At 460 days in a row, it was the 6th longest uninterrupted stretch of strength in the past 35 years. While there is no meaningful difference in the performance of the S&P 500 based on whether the index is above or below the 200-day average, the direction of the 200-day average matters. A lot. All the net gains in the S&P 500 since 1990 have come when the 200-day average has been rising.

Put another way, the 200-day average has been falling roughly one-quarter of the time in the past 35 years and when that has been the case, the index has not made any upside progress. But it has brought plenty of volatility and stress for investors. Daily market swings (in both directions) tend to be larger when the equity markets are in downtrends. Stepping to the sidelines in this environment is not about the risk of missing the best days in the market, its about the benefit of missing both the best days and the worst days and not taking on unnecessary risk and volatility.

With the 200-day average for the S&P 500 rolling over, none of the items on our bull market behavior checklist remain positive. As we discuss below in our monthly review of the weight of the evidence, this is an environment in which patience will likely be rewarded. Fools rush in. ...........

What Stock Market Crashes Have Taught Me About Investing: Although Their Duration and Severity Have Varied, the Market Has Always Recovered and Reached New Highs.

Bubble Fare:

I’ve regularly described the period since early 2022 as the extended peak of the third great speculative bubble in U.S. history. As I noted in the April comment, Humpty Dumpty was Pushed, I believe that process is now complete. As discussed in that comment, our Recession Warning Composite also now indicates the likelihood of an oncoming recession in the U.S. economy.

In our day-to-day investment discipline, we’ve had several opportunities to vary the intensity of our defensive investment stance, some informed by the hedging implementation I described last September (for more, see Asking a Better Question, Subsets and Sensibility, and the section titled “The Martian” in The Turtle and the Pendulum), and some in response very short-lived “compression syndromes” that I’ve regularly discussed over the years.

While we remain open to changes in market conditions, as well as periodic “fast, furious, prone-to-failure” advances that can relieve the oversold “compression” produced by market losses, we are presently on high alert for a possibly abrupt and cascading market and economic dislocation in the weeks ahead.

The trap door swings open

At its core, a market crash is nothing but risk-aversion meeting a market that’s not priced to tolerate risk. We always become concerned about “trap door” outcomes when rich valuations are joined by deterioration in the uniformity of market internals – which is our most reliable gauge of speculation versus risk-aversion among investors.

Our concerns about trap door conditions become even more pointed when investor confidence has been destabilized. Recall that the 1929 and 1987 crashes started after the S&P 500 was already down about 14% from its highs. As a general rule-of-thumb, when investors are jolted by a decline in the S&P 500 of 10% or more from its 10-week high, and Baa corporate yields or credit spreads are widening, “trap door” conditions tend to be resolved by abrupt and often substantial market losses.

The chart below shows what this looks like, in data since 1928. The blue line is the S&P 500 Index (left scale, log). The red bars show instances that are assigned our most negative return/risk classification – based on measurable, observable market conditions such as valuations and market internals – coupled with a loss in the S&P 500 of more than 10% from its 10-week high and deteriorating Baa credit conditions (versus 6 months prior). The green line (right scale, log) is the cumulative return of the S&P 500 in the 65 weeks since 1928 when this particular set of conditions has been in effect. It’s a rare syndrome, but it has regularly occurred at the breakpoint of memorable market collapses, including 1929, 1987, 2000, 2008, and 2020. ..............

One way to understand abrupt market losses is to consider what I’ve often called the “Iron Law of Equilibrium.” Every share of stock that’s been issued must be held by some investor at every point in time. Investors cannot “get out” of stocks, in aggregate, nor can they “get into” stocks, in aggregate. Every dollar a buyer brings “into” the market is taken “out of” the market by a seller. Every dollar a seller wishes to take “out of” the market has to come “into” the market from a buyer.

Consider, for simplicity, two sets of market participants – “trend-following” investors whose demand reflects backward looking market returns, and “value-conscious” investors whose demand reflects the level of market valuations and, by extension, expected future returns.

As I’ve shown in simulations of this kind of equilibrium, when prices are unusually elevated relative to the norm, it’s almost always because trend-followers (and other price-insensitive buyers) are “all in.” Those positions are – and in fact have to be – offset by equal and opposite underweights by value-conscious investors. A sudden decrease in the desired holdings of trend-followers and price-insensitive traders has to be satisfied by inducing a price decline large enough to give value-conscious investors an incentive to buy.

As always, nothing in our investment discipline relies on forecasts, particularly involving extreme outcomes like those above. Instead, our discipline is to align our investment outlook with prevailing, measurable, observable market conditions, and to change our outlook as those conditions change. Even amid the initial break of what we view as the third great speculative bubble in U.S. history, we’ve had multiple opportunities to vary the intensity of our defensive outlook in response to market behavior, and we continue to watch for “compression syndromes” that can produce “fast, furious, prone-to-failure” market advances to clear oversold conditions.

For now, I would describe present market conditions as a “crash warning” – featuring an environment that includes extreme valuations, broken market internals, and destabilized investor confidence. Nothing in these conditions ensures a market collapse – abrupt crashes are the rarest of events, and investors should approach current risks with that understanding. Still, we should be aware that virtually all market crashes share a common feature – risk-aversion meeting a market that’s not priced to tolerate risk. .............

Quotes of the Week:

Millard: They say there are decades where nothing happens and weeks where decades happen. This sentiment sure rings true these past few weeks.

Vid Fare:

When today's guest was on this program last back in December, he predicted the following:

That a contraction in global liquidity could set the stage for increased market volatility -- check.

That stocks would peak early in 2025, and then experience a 15-20% correction -- check.

That new U.S. trade tariffs could lead to retaliatory measures from trading partners, triggering a global trade conflict -- check, especially in regards to China.

So far, he's 3 for 3.

He also recommended that investors start 2025 defensively, reducing equity exposure, avoiding long-duration bonds, and instead load up on T-bills and gold. Again, this was a winning combination.

So who is this prescient forecaster? None other than Felix Zulauf, Founder and CEO, Zulauf Consulting. ...........

...

...

...

(not just) for the ESG crowd:

The Most Neglected Social Issue of Our Time

Future generations will look back on factory farming as a moral abomination.

Humans are notoriously bad at predicting the future of moral progress. The moral movements of yesteryear that are today viewed as table stakes in a just society — women’s suffrage, the abolition of slavery, gay marriage — were at one point seen as ludicrous. All this to say, one should have humility when considering possible new frontiers of ethical progress. No society to this point has been without ethical blindspots. Why should we assume that ours is the first?

One doesn’t need a philosophy degree to recognize that the way we think about animals is, at best, deeply inconsistent. ...............

................ Humans like to assume that they would have been on the right side of history in the moments that count. Importantly, being on the right side of history has almost never entailed going along with conventional wisdom. Rather, it has required charging against conventional wisdom towards a new moral horizon. Said differently, nobody gets credit for supporting women’s suffrage in 2025, but they certainly did for supporting it in 1825.

We have an opportunity to stand boldly on the right side of history and, in doing so, prevent the suffering of millions, billions, even trillions of individuals. The question is, will we answer that call?

TDS:

In an era of polarized narratives, Donald Trump’s true character is often reduced to soundbites and crafted caricatures. That’s the Donald Trump comedian and political commentator Bill Maher thought he knew. ............

Trump 2.0:

There is a growing chorus about a “new world order,” but much of the language surrounding it is vague and recycled, attempting to impose clarity on a moment defined by fragmentation.

The truth is harder: we are not entering a new order so much as watching the old one unravel. The post-1945 framework—and especially the assumptions forged after 1991—are breaking down. Alliances are shakier, norms increasingly hollow, and power is moving in directions the old system can’t contain. This isn’t a transition; it’s a structural upheaval with no agreed-upon successor.

Trump’s trade policy exemplifies this rupture. It marks a blunt rejection of the U.S. role as global underwriter—militarily, economically, financially. Allies are being pushed to choose sides or risk losing access to American energy, security guarantees, and the dollar. To some, this feels like a sudden break. To others, it’s just the next chapter in a story that started with the 2008 crash, ran through COVID-19, and deepened with the war in Ukraine. What critics call reckless may, in historical context, look more like a reversion to pre-WWII realpolitik: harder borders, transactional alliances, and every state for itself. ..............

........... Successive shocks—financial, epidemiological, military—have exposed the system’s vulnerabilities. Many see a drift toward a multipolar world where rules matter less, and power, geography, and resource control matter more.

But the truth is more nuanced. What we call the “old order” was not a single unified system, but at least four distinct phases (Figure 1). The first spanned from the end of WWII to the early 1970s, defined by Cold War containment, Bretton Woods monetary stability, U.S. oil dominance, and postwar reconstruction. The second, from 1972 to 1991, featured the collapse of Bretton Woods, the rise of petrodollar diplomacy, oil shocks, and the beginning of global capital mobility. The third phase, from 1992 to 2008, was defined by U.S. unipolarity, NATO expansion, hyper-globalization, and the illusion of liberal inevitability. The fourth phase—from 2009 to the present—has been defined by fragmentation, rising multipolarity, and the return of strategic rivalry.

The 2008 financial crisis was the inflection point. It shattered confidence in Western institutions and marked the beginning of U.S. retrenchment. It was followed by the shale revolution, a spike in commodity prices, and a rising China. As the old frameworks eroded, countries like Russia, China, and Iran began building parallel systems—alternative currencies, supply chains, and security blocs. ............

Physicist David Bohm spoke of this kind of pattern in nature—a tension between what he called order and measure. What we observe often looks fragmented or chaotic only because it’s just a surface-level projection of a deeper, unfolding movement—what he called the implicate order. That lens helps when thinking about geopolitics too. What looks like disorder may actually be the visible tip of a larger transformation we haven’t yet decoded. ................

Thomas Kuhn’s Structure of Scientific Revolutions makes it clear: paradigms don’t shift through orderly progress—they erupt, usually in defiance of the very institutions meant to nurture them. Scientific communities defend the dominant paradigm, ignoring inconvenient data and sidelining dissent. When the old model stops working, crisis sets in. A new paradigm takes over—not because it’s embraced, but because the old one collapses. The shift is messy. Yesterday’s experts become today’s relics, and the cycle begins again under a new orthodoxy. ..............

The Trump administration is losing face and losing leverage. But for those hoping for a trade-war backpedal — don’t hold your breath.

The April 2nd Liberation Day announcement was an intentionally choreographed shock-and-awe affair that worked much better than many admit, at least at first. Swinging aggressively and recklessly, Trump caught everyone — trading partners and market watchers — on the backfoot, commanding global attention. This bad-cop routine also gave room for a good-cop retreat. .............

................. The mojo has run dry. While Trump’s most steadfast followers weave narratives about strategy, most observers recognize dysfunction. If the plan was to encircle China, why alienate everyone else first? The shoot-first paradigm has created a situation where it’s not even clear that US negotiators have a specific objective, let alone a means to achieve it.

But the loss of the leverage does not mean the end of the trade-war. ...............

Stop trying to predict and appraise President Trump's tariffs policies based on economic theories or market realities. Tariffs are pure psychology for the president, fused into his brain like no other topic.

Why it matters: Trump's tariff brain is unpredictable to the outside (and to market analysts) but wholly knowable to those who know how his mind works.

- "There'll be trial and error. There'll be pushing the envelope. There'll be all of that Trumpian stuff," said a top adviser involved in trade discussions.

The big picture: Trump approaches tariffs, the remaking of the U.S. economy and the reshaping of global trade as a continuation of his presidential campaign.

- He ignored experts and assembled a team dedicated to executing his will and shrugging off the consequences of his unpredictability. He's not changing now — rocky rollout and chaotic financial markets be damned.

- "Donald Trump works at his own tempo, and he doesn't change the subject until he's sure he's clubbed people into seeing it as he does," the adviser said.

Between the lines: In Trump's first term, free traders such as then-National Economic Council Director Gary Cohn controlled Trump's impulses to impose tariffs the way he has now. Trump's current NEC chief, Kevin Hassett, is pro-tariff.

- So is the rest of the economic team: Vice President Vance, Commerce Secretary Howard Lutnick, Treasury Secretary Scott Bessent, White House trade adviser Peter Navarro, Council of Economic Advisers chair Steven Miran, and U.S. Trade Representative Jamieson Greer.

The intrigue: Trump keeps such a huge team of advisers because he invariably solicits conflicting opinions. He often suffers from analysis paralysis and can be particularly influenced by whomever he talks with last.

- Trump also can be unclear on specifics, resulting in contradictory messages from his advisers, each of whom serves as a TV avatar of his tariff brain. Bessent and Lutnick have been criticized for giving mixed messages.

- "We saw it in business with Trump," one adviser said. "He would have these meetings and everyone would agree, and then we would just pray that when he left the office and got on the elevator that the doorman wouldn't share his opinion, because there would be a 50/50 chance [Trump] would suddenly side with the doorman."

- "There are too many people in his ear," the adviser said. "You didn't see this with other presidents. Nixon didn't act as the maître d' of his own supper club, where every millionaire and billionaire who could get to him at dinner could chime in and affect policy."

On political issues: Trump is often more directionally consistent than his critics give him credit for. He's liable to switch up on policy specifics. But the direction is clear: tariffs. The specifics: wide-ranging.

- "It's about several things," his adviser said. "It's about isolating China. It's about making money for the United States Treasury. It's about settling what Donald Trump believes is a score where, as he says, stupid people allowed countries to take advantage of us and ripping us off."

The backstory: Trump's tariff-based chip-on-the-shoulder "America First" mindset has been part of his political DNA since his first presidential-style campaign visit to New Hampshire in 1987. ................

................................. Animating Trump and his team is the belief, his adviser said, that "in its very most basic form, the patient, which is the United States economy, has been very sick. It's been sick for 40 years, and nobody would say so."

"It took Trump to come in and say, 'Okay, the patient is really sick. It's going to die. So I'm going to put it on life support, and let's all hope and pray and work together to make sure this life support works.' That's really the way we look at it." ......................

My friend CP is angry about the tariffs, which concerns me as a long-term protectionist. Ever since reading Pat Buchanan’s The Great Betrayal in college, I’ve been convinced of the case for tariffs and protecting domestic industries. Buchanan convinced me, against my Jeffersonian biases, that the Yankees were correct and Republican Party policies to build domestic industry during the 1800s were both right and necessary if the United States were to develop into a proper nation with real sovereignty1.

My friend’s primary argument is that Trump’s tariffs seem contradictory in their purposes. If they are opening positions subject to negotiation, then no one will invest in domestic manufacturing, knowing they are likely to be rolled back. If they are meant to be permanent, their broad nature doesn’t seem to make sense. Do we want to have sweatshops making stuffed animals in our advanced economy, or is it better for this to be done in Vietnam?

Thoughts:

- I don’t see Trump’s position as necessarily contradictory but rather irrational for a purpose. ........ If the result is a renegotiation of trade agreements to be less punitive to US exporters, this may have something like 25% of the effect of a long-term tariff program, with more immediate benefits and less dislocation in the economy. I suspect this is likely the case given the limits of a democratic society to stick to a long-term strategy. Unlike the Chinese, our democratically elected leaders are renters, not owners, of political power and cannot successfully execute a multi-decade plan to reindustrialize. Since they know that we know this, Trump is most likely doing his crazy act to seem irrationally tied to the proposal no matter the consequences, as documented in his master class in brinksmanship in The Art of the Deal. Since he may have to stick to the crazy act for a time to demonstrate his commitment, it’s smart to do this as early as possible in his term.

Globalization, once hailed as a panacea, has proven to be fundamentally corrupt and needs to be blown to kingdom come

From NPR this morning:

But, by the end of the day, Trump apparently had reached his threshold of market pain. He reversed course, ditching some of the tariffs, because, he said, people “were getting a little bit yippy, a little bit afraid.”

The market rallied Wednesday, but with Trump increasing tariffs to 145% on China, by Thursday, the Dow was down again. And, remember, China has leverage, too, because it buys a lot of U.S. government debt, and they seem to have every intention of using it.

Translation: a serial trade and human rights violator that with the help of decades of corrupt politicians from both parties polluted, price-dumped, and stole its way to a generation of American jobs and revenue, now owns so much of our debt that we must put up with its shit indefinitely. That’s the point of view of our own federal news agency. We have officially cucked ourselves past the point of no return.

Trump or no Trump, the international trade system needs to be blown to hell:

..................... It seemed obvious that NAFTA, the WTO, and the extension of cushy trade arrangements with China and other unfree labor zones were a gigantic end-run around American labor, safety, and environmental laws. It was an asset-stripping scheme, designed to help CEOs boost their share prices by cutting costs of American parts, labor, and regulatory compliance from their bottom lines. There seemed nothing complicated about this, except the marketing challenge. How could corporate management convince Americans, who fought for so long to scrape their way into the middle class, that it was in their interest to compete against countries that didn’t have to follow any of the same rules we did?

.................. Are we supposed to go on like this forever, or do something? Even the biggest bank-sucking spokestools in media recognize the situation is untenable, but cling to the idea that something could be done gradually or “incrementally,” as Joe Kernan tried to frame it in an interview with Peter Navarro on CNBC’s Whore Box the other day.

Everyone who follows this site knows I’ve always had an uncomfortable relationship with the Trump phenomenon. At the best of times, I find him puzzling and maybe dangerous, even when he’s being funny or taking aim at deserving targets.

Now he’s president and people seem reflexively to want more criticism of him, but on this issue, what choice is there? The global economy created by both parties from the eighties onward was not only designed to be a giant predatory clusterfuck, but nearly impossible to unwind. Forget “incrementally,” it’s got to be exploded. Would more of the same and a slow death be better?

Critics of Trump’s new round of tariffs are making a lot of noise. According to the pundits and legacy media talking heads, these tariffs are going to “hurt the economy,” “drive up prices,” and “alienate allies.” But what they won’t acknowledge or even refuse to address is that the problems they’re suddenly so concerned about have been with us for decades. The economic distortions Trump’s tariffs are trying to correct didn’t begin with tariffs. They began with decades of reckless policy, fantasy economics, and willful denial.

Let’s start with the basics. The American economy today is not grounded in real production or sustainable growth. In truth, it’s been kept afloat on $20 trillion in global stimulus, debt, and fictional accounting. ............................................

.................... None of this is sustainable. And none of it has anything to do with tariffs.

On the international front, our trade deficits have become structural. That wouldn’t be fatal if we were reinvesting foreign capital inflows into high-return domestic projects, like infrastructure, energy, or next-generation manufacturing. But we haven’t done that. Instead, we squandered trillions, outsourced our industrial base, hollowed out the middle class, and borrowed cheap capital to fund consumption and entitlement expansion.

There’s nothing inherently wrong with trade deficits and they can be manageable when they’re cyclical and we have something to show for the money borrowed. But we entered a multi-decade period of permanent, corrosive trade deficits, and we have little to show for these actions other than transient consumer goods from China. .................

So when people claim Trump’s tariffs are the source of our problems, they’re either dishonest or hopelessly uninformed. The tariffs are a symptom of the crisis, not the cause. They are an imperfect but necessary negotiating ploy to begin the long, painful work of rebuilding an economic system that works for everyday Americans again.

We can no longer afford to live in a fantasy economy built on debt, inflation, and illusions of prosperity. We should stop pretending this crisis is new or that it can be blamed on a single policy or politician. The problems were already there, deeply embedded in our economy, ignored by a complacent elite that insisted everything was fine.

Trump’s tariffs didn’t cause this. They are the first honest attempt in generations to deal with a completely broken system.

By the time this is published, everything may have changed, and that is to be expected. Throughout his career, well before and since becoming a politician, Trump has explicitly stated that he does not think it is always a good strategy to be predictable. And while markets love predictability, sometimes markets, and the systems propping them up, need disruption. This is such a moment. ................

And even that devastation was tolerated for decades because its effects were mostly felt in what we now call rust belt states. Our service economy and tech sectors boomed, along with what was left of manufacturing, satiating a majority of the population that loved buying cheaper foreign imports. But this whole scheme could never go on forever. America’s trade deficit in 2024 was up to $918 billion, a new record. .............

Which brings us to the geopolitical reality we must confront: the rise of China. No other nation has done more to finance the rapid industrialization of China than the United States. But now, the United States depends on China for critical minerals, electronic equipment, machinery, iron, steel, medical apparatus, organic chemicals, pharmaceuticals, and much more. Every year, the biggest percentage of our trade deficit is with China, over $300 billion in 2024. ............

The Trump administration recognizes three realities that softer heads and wishful thinkers try to either deny or bury in nuance.

(1) We are in a cold war with China, and if we don’t step up, we will lose.

(2) We have hollowed out our manufacturing prowess, and that must change. Fast.

(3) Federal spending is out of control; the trends are unprecedented and must be reversed.

This is the rest of the story. Tariffs are just the beginning salvos in a fight we can’t avoid any longer. ...........

With the rollout of sweeping US tariffs aimed at nations worldwide, economists and geopolitical analysts alike are astounded by what at face value looks like irrational self-sabotage attributed to incompetence within the White House.

In reality, the tariffs are a central pillar of bipartisan foreign, trade, and economic policy implemented first during the previous Trump administration, continued and even expanded upon during the following Biden administration, before being expanded further still under the current Trump administration.

Rather than a random idea that formed within the mind of President Donald Trump himself or among those within his cabinet, sweeping tariffs are the stated policy of unelected corporate-financier interests, articulated in-depth within the pages of special interest-funded think tank documents including Heritage Foundation’s “Project 2025” paper under Chapter 26: Trade Policy.

The policy, far from a sound plan to re-industrialize America or genuinely balance America’s trade deficit, is instead meant to maintain America as “the world’s dominant superpower.” .........................

The success the US has achieved in undermining and stripping away European industry is almost certainly guiding a much larger and more ambitious policy worldwide, ultimately in regard to China.

Project 2025 lists a number of actions to be taken in regard to China specifically including: .............

Such papers declare China as “a serious existential threat,” not to America as a nation-state or to the American people – both of which would only benefit as the rest of the world has from cooperation with China – but to the deeply entrenched corporate-financier monopolies no longer able to compete with not only Chinese goods and services, but those in nations rising alongside China everywhere from Latin America to Africa and across the whole of Eurasia. ...............

Were the US preparing for the deliberate destruction of the current global economic system, or large-scale war with one or more of its declared “adversaries,” decoupling itself from the global economy first on its own terms ahead of time – especially in terms of America’s dependence on China for supply chains including all throughout its military industrial base, would be a necessary prerequisite. .............

The Obama administration’s “pivot to Asia” began the transformation of America’s military forces from one organized around the decades-long “War on Terror,” to a fighting force tailored for conflict with peer and near-peer competitors. During the first Trump administration, the US withdrew from arms control treaties, allowing for the development and deployment of treaty-violating missiles ranging from anti-ballistic missile defenses to intermediate and long-range missiles now being deployed across the Asia-Pacific.

During the Biden administration, the entire US Marine Corps was transformed from a combined-arms expeditionary fighting force to one custom-tailored specifically for anti-shipping missions in the Asia-Pacific region ...............

While a global tariff policy to wall off the US economy from its own premeditated destruction of the global economy is a drastic policy, the complete reorganization of US military forces specifically for war with China along with the seizure of key maritime choke points worldwide are equally drastic and make sense only as part of a strategy to precipitate that destruction.

Empire in terminal decline throughout human history has suffered from dangerous desperation. In the 21st century, the US represents a modern-day empire in terminal decline – one armed with nuclear weapons, a global-spanning military, and in control of global economic tools capable of destroying the entire global system rather than concede its role placed above it. The goal would be to survive the controlled demolition of the global order it has presided over for decades and emerge the strongest player, best positioned for establishing itself once again as “the world’s dominant superpower.” ................

Billionaire investor Ray Dalio warned that President Trump’s shifting tariff policy is part of a broader set of economic and geopolitical pressures that could trigger a crisis "worse than a recession." .............

"I've studied history," Dalio adds, noting that "this repeats over and over again."

Dalio explained that the US economy is confronting several overlapping challenges: rising debt, internal political divisions, growing geopolitical tensions, and shifts in global power.

“Such times are very much like the 1930s,” he warned. “If you take tariffs, if you take debt, if you take the rising power challenging the existing power – those changes in the orders, the systems, are very, very disruptive.” ..............

Dalio said history is shaped by five major forces:

- monetary cycles like credit and debt;

- internal political conflict;

- shifting global power dynamics;

- technological change;

- and natural disasters such as pandemics.

In his view, all five are currently in play.

Yesterday, president Trump laid out the stakes in the ever-escalating trading war between the US and China, in typical laconic fashion: "We may want countries to choose between us and China" ............

The idea, as we laid out in not so many words, is to extract commitments from U.S. trading partners to isolate China’s economy in exchange for reductions in trade and tariff barriers imposed by the White House. US officials plan to use negotiations with more than 70 nations to ask them to disallow China to ship goods through their countries (the so-called "transshipment" loophole), prevent Chinese firms from locating in their territories to avoid U.S. tariffs, and not absorb China’s cheap industrial goods into their economies. ................

Forget tariffs and trade wars – the full-blown decoupling of global finance will touch every aspect of capitalism as we know it

The financial decoupling between the United States and China is no longer a distant threat. It is here, formalized, accelerating, and profoundly disruptive. For investors, understanding this new era is not optional; it’s imperative.

The sweeping tariffs on Chinese imports, now codified into law, mark more than a trade skirmish. They signal a historic reordering of global capital flows, supply chains, and technological ecosystems.

This is not merely about economics. It is about economic power—and control. Investors must now adapt to a world in which the foundational rules of global commerce are being redrawn at speed and under pressure. ............

...................... While the financial divorce is not yet final, the momentum behind it suggests it is becoming irreversible. And as with any messy separation, fortunes will be made not by those who react emotionally but by those who anticipate where assets, influence and opportunities will migrate once the old household is split.

For the discerning investor, the coming decades will not be defined by a return to the familiar but by a mastery of the new.

Trump insider claims demolition plan will necessarily ‘decimate millions of investors’ while reset will bring ‘greatest wealth creation’ ever seen

The press daily reports ever louder shrieks of concern that Trump’s actions – tariffs, deportations, chainsaw destruction of federal agencies by people barely out of their teens – risk causing a worldwide economic crash.

The naïve shriekers Bill Ackman, Larry Fink, Larry Summers and countless others don’t yet realize that there’s no risk: it’s the guaranteed end state of a plan that Trump developed before the election – but has never publicly revealed.

We now know this from a 64-minute “infomercial” released on April 1 by stock promoter Porter Stansberry in the form of a staged interview with well-known Trump insider and investment advisor Brad Thomas.

His most compelling takeaway: “It’s actually the left-wing media who’ve got the most accurate read on his plans . . . They’re actually right: Trump does want to destroy the economy” (minute 14:30 of the video stream).

Thomas identifies himself as a “dyed in the wool Trump loyalist” and a trusted advisor for many years who has been closely involved with Trump’s real estate interests. He discussed the demolition plan with Trump at Mar-a-Lago.

Basic to the plan he reveals is Trump’s having recognized that correcting America’s impossibly unsustainable finances must produce colossal losses one way or another no matter who is in charge. Trump and his close personal advisors drew two conclusions.

First, it is better to execute “a controlled demolition of the financial markets” comparable to a controlled forest burn to “get rid of dead wood” than to permit a haphazard collapse as in previous depressions. Second, it is better to front-run the inevitable crash so as to place the blame squarely on his predecessor. .................

In a series of high-level discussions in Rome and Berlin, Thomas Ferguson—a leading authority on money and politics—offered a sweeping analysis of the deeper forces driving President Donald Trump’s tariff agenda. Far from a spur-of-the-moment decision, Trump’s economic moves reflect a broader political realignment and years of behind-the-scenes preparation.

Ferguson, who serves as Director of Research at the Institute for New Economic Thinking, reveals that what is unfolding now is more than just a trade war—it’s the unraveling of a decades-old global order. ...............

Objections about how the administration arrived at the various tariff levels it proposed miss the key point: the tariffs are really the first stage of a broader realignment of the whole international monetary system. ..............

........... For much of the dispirited left, Trump’s trajectory means a beeline to hell. And yet there is a sizeable gap between what Trump wants to do and what he’ll be able to carry out. State cultures and capacities can be attacked but not so easily recast. Global economic structures are stubborn. International reactions are uncertain. Class contradictions abound. ................

............ But it is the economy that will be decisive for his populist base, and on this measure, Trump is very unlikely to succeed. As for the business elite, they have always assumed Trump was not so mad as to start a tariff war that risked undermining the American empire itself. As that danger materializes, business will rebel. The question will then shift from what Trump intends to do to what he will he do as his plans go astray.

Steve Bannon, Trump’s first term whisperer, once described himself as a Leninist because “Lenin … wanted to destroy the state and that’s my goal too. I want to bring everything crashing down, and destroy all of today’s establishment.” Trump was apparently listening and learning. There is method in at least some of the early madness of Trump’s chaotic second term.

The shock and awe unleashed by Trump wasn’t just to concentrate state power in his hands or a vengeful rampage by someone who was rebuffed in 2020. Of greater consequence is the intent to disturb the normal functioning of the “deep state” to neutralize any of its oppositional inclinations and force it on its back foot. This is not about destroying the state; state interventions serving authoritarian ends will no doubt increase. Rather it is the permanent crippling of those aspects of the state that might limit capital and address collective needs. ............

In addressing the Trump phenomenon, it’s common to treat Trumpism as unique. This is an exaggeration. The rise of a far-right preceded Trump and its rise extends far beyond the U.S. Something with a longer historical pedigree than Trump and common structural underpinnings seems at play. In this regard, four interrelated developments have been especially pivotal: the trajectory of neoliberalism, the crisis of legitimacy, the polarization of options, and the rise of nationalism. ........................................

............................. Far more significantly, there are still plenty of things that nations, cultures, and communities can do to shield themselves against some of the impacts of the ongoing decline. Until quite recently, I was fairly sure that none of those would be done on any scale large enough to matter. At the moment, though, it appears as though one of the most important of those steps is being carried out with considerable verve by the government of the United States. Readers who have been with me since the peak oil days will remember when economic relocalization was a major theme of discussion, and dependence on global resources was recognized as a lethal weakness in the face of decline. Now, to my great surprise, here we are: the global economy is being dismantled and economic relocalization pushed by, of all people, Donald Trump.

Yves here. While Tom Neuburger is correct in pointing out that our now worse-than-1788-France-levels of inequality call for a revolution, he skips over the fact that we are in the midst of a revolution, one run by reactionaries trying to cement the advantaged position of the rich and further immiserate the rest of the population. I warned from the outset that the only way to make sense of the Trump policy blitz was that he and his allies intended to created a Russia-in-the-1990s level crisis so as to facilitate elite asset grabs.

Vid:

Geopolitical Fare:

The post-WW2 ‘international rules-based order’ that supposedly underpins global affairs in the interests of peace, democracy and prosperity has always been largely a charade. But Israel’s continuing Gaza genocide, carried out with seeming impunity and with the complicity and even active participation of the US and its allies, has exposed the charade like never before.

Twenty years ago, at the 2005 World Summit, the United Nations General Assembly endorsed the doctrine of the ‘responsibility to protect’ or ‘R2P’. The key concerns were to prevent genocide, war crimes, ethnic cleansing and crimes against humanity. Whenever populations are at risk of such crimes, the international community is supposed to take collective action ‘in a timely and decisive manner’ to prevent mass atrocities from taking place.

In practice, only some massacres matter, whether threatened or actual: namely, those that can be exploited by Western powers to further their own geostrategic interests (for example, see our media alerts here and here). The Nato-led attack on Libya in 2011 is a textbook example. Western politicians and their cheerleaders across the media ‘spectrum’ declared that the world had to act to prevent a ‘bloodbath’ in Benghazi when Gaddafi’s forces there were allegedly threatening to massacre civilians.

In fact, the public were subjected to a propaganda blitz to promote the Perpetual War that had already wreaked havoc in Iraq, resulting in the deaths of over one million people, the virtual destruction of the Iraqi state and the proliferation of Al-Qaeda and other militia groups.

In 2016, a report from the UK House of Commons Foreign Affairs Committee summarised the destructive consequences of Nato’s 2011 intervention in Libya ...............

Every day the Gaza holocaust continues, the western empire tells the truth about itself.

The US government is telling you the truth about itself.

Israel is telling you the truth about itself.

Their western allies are telling you the truth about themselves.

The western media are telling you the truth about themselves. .....................

As Israeli forces resume and expand their offensive on Gaza, Palestinian lives are once again being systematically destroyed.

With no recourse in US courts or Congress, the Taxpayers Against Genocide movement pivots to UN Human Rights Council.

Bernie Sanders has been repeatedly uttering the phrase “Israel has a right to defend itself” on his “Fighting Oligarchy” tour with Alexandria Ocasio Cortez, which in the year 2025 can only be interpreted as blatant genocide apologia.

Israel does not have “a right to defend itself” against an occupied population in a giant concentration camp. Under international law it has a right to end the occupation, and that’s it. .......................

.................... And it’s just a complete and utter lie. Netanyahu didn’t create Israel’s genocidal tendencies, Israel’s genocidal tendencies created Netanyahu. His entire political career has been made possible by Israel’s collective racism and psychopathy upon which he rode into office.

This is nothing other than the classic Obama-style tactic of using attractive progressivish language to advance the most destructive agendas of the US empire.

In other words, it’s Democrats being Democrats.

.................... The challenge at this point is not so much getting information out about the Gaza holocaust, but getting people to really SEE it. Moving it out of the periphery of their awareness as one more bad thing happening in our world and getting them to viscerally grasp what’s happening.

❖

Same movie, different soundtrack. That’s Gaza under Trump.

The Biden administration backed a genocide while occasionally making noises about humanitarian concerns, and now the Trump administration backs a genocide without making those noises.

All that’s changed is the noise.

I keep seeing headlines about “food insecurity.”

SHUT UP

The word is “starvation”. Starvation. You media weasels.

Now despite what a lot of people think, starvation isn’t fast, and there were some stores, but those stores have run out.

So Israel is deliberately starving something like 1.7 million people, to death.

Meanwhile the only nation in the world trying to stop this is Ansar-Allah (the Houthis). And what is America doing? Sponsoring a ground invasion by the “official government” of Yemen.

The Houthis had no blockade during the ceasefire. When the Israelis announced they would cut off all aid to Gaza, the Houthis said they’d give them two days, then start up the blockade again. Which they did. (Note also that America offered Ansar-Allah an end to all sanctions, recognition and rolling the official government into them if they’d stop the blockade. So the Houthis are doing this at GREAT cost.)

People roll their eyes when Iranians and whatnot call America “the Great Satan” but… seems pretty accurate to me. Helping a genocide, and attacking the only nation in the world trying to stop the genocide. .............

Like people almost everywhere in NATO-EU Europe, Germans are currently being subjected to a relentless barrage of shameless, often astonishingly crude propaganda. That’s because their political elites and mainstream media are desperately trying to prepare them for war against Russia. And this time, not by proxy, that is, by way of a devastated Ukraine and dead Ukrainians, but directly.

............ Their meaning, too, is elementary: In essence, if your image of reality is delusional, you don’t have sound arguments, and your case is absurd, do not despair. Instead, ceaselessly drum in a few very basic and bogus ideas until the audience is dizzy with repetition (the broken-record principle), while also eliciting frequent consent from it (the litany effect). In short: Keep shouting the same nonsense at them and make them bleat back “yes” regularly.

Israel assassinated a photojournalist in Gaza in an airstrike targeting her family’s home on Wednesday, the day after it was announced that a documentary she appears in would premier in Cannes next month.

Her name was Fatima Hassouna. Nine members of her family were also reportedly killed in the bombing. She was going to get married in a few days.

The documentary is titled Put Your Soul on Your Hand and Walk, and it’s about Israel’s crimes in Gaza. ................

As Ryan Grim observed on Twitter:

“For this to have been a deliberate act — which it plainly was — consider what that means. A person within the IDF saw the news that Fatma’s film was accepted into Cannes. He/she/they then proposed assassinating her. Other people reviewed the suggestion and approved it. Then other people carried it out.”

Israel has been murdering a record-shattering number of journalists in Gaza while simultaneously blocking any foreign press from accessing the enclave because Israel views journalists as its enemy. ...........

Israel and its western backers understand that truth and support for Israel are mutually exclusive. Those who support Israel are not interested in the truth, and those who are interested in the truth don’t support Israel. .................

The Trump administration continues to arrest and deport people for criticizing Israel’s genocidal atrocities in Gaza and the US empire’s support for it — and Trump’s supporters continue to applaud these abuses. To call this hypocritical after the way these people spent years rending their garments about the erosion of the First Amendment would be a massive understatement. ..............

The first and foremost reason free speech is important is because it puts a check on the abuses of the powerful. The First Amendment of the US Constitution isn’t there to ensure US citizens get to feel nice feelings, it’s there to restrict the government’s right to obstruct the free flow of information, thereby enabling the citizenry to effectively organize any necessary opposition to the status quo. At least in theory. ..............

Free speech, if sufficiently realized, could solve all our problems. If information was really flowing freely without being constantly manipulated and obstructed by the rich and powerful, our rulers would no longer be able to manufacture consent for our abusive status quo, because everyone would be aware of how bad things are and how much better they could be. .............

The US government isn’t deporting critics of Israel because it wants them to feel bad feelings, it’s deporting them because it doesn’t want Americans to hear legitimate criticisms of US foreign policy. They aren’t merely violating the rights of the speaker by restricting the flow of this information, they’re violating the rights of anyone else who would hear it. They are doing this to help ensure public consent for a genocidal status quo that a populace with an informed mind and an informed conscience would never consent to.

Sci Fare:

Inside a New Mexico lab, researchers estimate there is five bottle caps worth of plastic in human brains. Now they are trying to find out its effects.

Scientists achieved “a milestone” by charting the activity and structure of 200,000 cells in a mouse brain and their 523 million connections.

The human brain is so complex that scientific brains have a hard time making sense of it. A piece of neural tissue the size of a grain of sand might be packed with hundreds of thousands of cells linked together by miles of wiring. In 1979, Francis Crick, the Nobel-prize-winning scientist, concluded that the anatomy and activity in just a cubic millimeter of brain matter would forever exceed our understanding.

“It is no use asking for the impossible,” Dr. Crick wrote.

Forty-six years later, a team of more than 100 scientists has achieved that impossible, by recording the cellular activity and mapping the structure in a cubic millimeter of a mouse’s brain — less than one percent of its full volume. In accomplishing this feat, they amassed 1.6 petabytes of data — the equivalent of 22 years of nonstop high-definition video.

“This is a milestone,” said Davi Bock, a neuroscientist at the University of Vermont who was not involved in the study, which was published Wednesday in the journal Nature. ...........

Rational Fare:

The danger of groupthink, the failure of leadership, and the price we pay for pretending not to know what everyone knows

I've long been suspicious of people who add pronouns to their bios. This suspicion stems from two simple, if unflattering, possibilities. Either they genuinely believe in gender ideology, which does not speak highly of their reasoning powers, or they do not believe in it and are simply pretending, which does not speak highly of their courage.

The recent Supreme Court ruling confirmed what any rational person already knew: sex means sex. The Court ruled that The Equality Act 2010 refers to biological sex, not gender identity. In other words, a man cannot be a woman. It is astounding that we needed the highest court in the land to clarify such a basic biological and linguistic truth.

Can’t we just be nice about it? Can’t we be more inclusive? No. Women cannot be men, and men cannot be women. To function, language must have precision. If a word can mean anything, it means nothing. If both sexes can be 'women', then 'woman' ceases to be a useful or coherent term.

Sex is a biological reality. Gender, on the other hand, is an idea. Transgenderism is an ideology, a belief system that attempts to redefine or transcend biological sex. But we cannot sacrifice linguistic clarity for the sake of ideology. ............

What happened here is not simply a matter of political misjudgement. It is a textbook case of group psychology, with many fearing the social costs of truth more than they fear being wrong.

Perhaps the gender madness even constituted a ‘psychic epidemic’, as Carl Jung described it. In such climates, irrational beliefs, delusions or behaviours spread through a population like a contagion, affecting individuals’ thoughts and actions without their conscious awareness. ..............

Great thinkers from Tacitus to Hannah Arendt have long considered groupthink and how to overcome it. My co-author and I also did our best to address it in Free Your Mind. Because once you understand this the psychological stuff we are made of, you understand it is a perennial problem. We survive one psychic epidemic only to fall straight into the jaws of another. Make no mistake, free thinking, rather than just free speech, remains the key question for anyone who values liberty and truth. ..............

Pics of the Week:

No comments:

Post a Comment