**** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

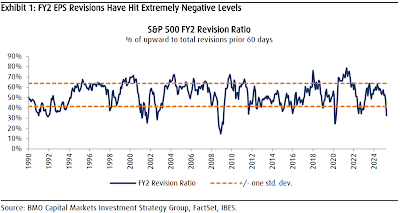

Stock prices are no longer a leading indicator. This post provides empirical evidence behind how the Cyclical Economy leads company earnings which leads stock prices

.................................................... In the last three Business Cycle recessions of 1990, 2001 and 2008, the Cyclical Economy peaked and declined in advance of S&P 500 earnings. In the 2008 example, the lead time was significant.

So it’s not accurate to say stocks lead the economy.

It’s conclusive that several critical sectors of the economy move first, and it’s this stress that causes the decline in earnings, stock prices, and broader economic pressure.

.............. Today, as depicted, the Cyclical Economy has rolled over, lower than January 2023, and pressure is likely to remain as the Leading Economy is still in a downturn. This suggests that cyclical or economically sensitive assets will continue to underperform.

The more blue-chip and defensive investments, like the S&P 500 or the Mag7 heavy Nasdaq, have a window to continue outperforming because Aggregate Economic activity continues to march along.

The weight of the evidence is back in balance as market technicals improve but macro challenges persist

Last week began with breadth thrust and ended with a US debt downgrade. These bookends perfectly encapsulate the current dynamics in the financial markets. The technical backdrop for equities has improved substantially over the past month while macro conditions continue to create a challenging environment. Historically, stocks do very well in the wake of breadth thrusts (more on this in a moment). At the same time, historically do quite poorly when bonds yields are pushing higher (30-year Treasury yields are at a level rarely seen in the past 2 decades). ........

Technicals over narratives in this case

There is one thing that is true in every bond market - the 30-year point on the government yield curve is its own beast driven by buyers that aren’t dictated by price but rather the need to hedge their liabilities.

For Europe, US, UK and Japan, the dominant player is usually pension and insurance funds who are looking to hedge long liabilities. Large moves in 30-year yields relative to the rest of the curve usually indicate a change in behaviour from these players. ............

It is simple. The US cannot close its very large current account deficit unless it closes its fiscal deficit too. But over the last few days we are learning something very important: the US appears unwilling to do that. The emerging reconciliation bill from the US Congress points to ever-wide fiscal deficits above 6%. The US - China trade accord effectively signals a very low pain threshold on taxing (tariffing) the US consumer. In all, even if we account for the (now diminished) revenues from tariffs the US budget deficit will keep growing. The current account deficit will likely keep widening in this scenario too.

The significance of this conclusion cannot be over-estimated. We have been arguing over the last few months that the market is reducing its willingness to fund US twin deficits. This is arguably entirely reasonable given the expressed US desire to reduce them. But actions speak louder than words: the newsflow over the last few days aligns with the opposite outcome. We worry this is brewing a major problem for the dollar and potentially the US bond market too. ............

.............. The market conclusion is clear. For foreigners to continue financing US debt one thing needs to happen: the non-dollar price of US Treasuries needs to decline, either via currency depreciation or a drop in the price of the bonds. The problem for the latter is that it makes US debt dynamics even worse so is not sustainable. We are ultimately left with the only solution to this problem being dollar weakness. That will effectively lead to a capital writedown of foreign holdings of US assets and an improvement in America's net external asset position

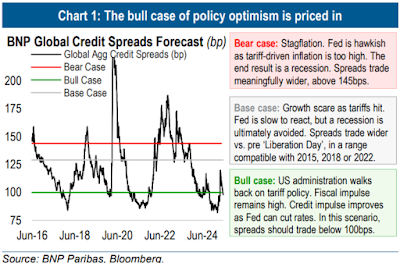

.......... Jamie Dimon, chief executive officer of JPMorgan Chase & Co., and Josh Easterly, co-founder and co-chief investment officer of Sixth Street Partners, are among those warning that the credit market may not be pricing in enough risk. And the lowest rung of junk bonds are flashing warnings that the US economy could soon face slower growth and higher inflation, as well as the possibility of a recession.

Risk premiums on junk bonds rated in the CCC tier have widened 1.56 percentage points this year, and 0.4 percentage point in the latest week. The gap between spreads on CCCs and the next tier above them, Bs, has been widening this year and in the last two weeks, signaling that the weakest bonds are lagging.

The CCC widening and underperformance are red flags, said Connor Fitzgerald, fixed-income portfolio manager at Wellington Management, a firm that oversees more than $1 trillion of assets. ..........

........ Dimon, who was early to spot risks in the mortgage market during the US housing bubble, said on Monday that credit spreads aren’t accounting for the impacts of a potential downturn. He added that the chances of elevated inflation and stagflation are greater than people think and cautioned that America’s asset prices remain high.

Credit is a “bad risk,” Dimon said at JPMorgan’s investor day. “The people who haven’t been through a major downturn are missing the point about what can happen in credit.” ..........

The president’s modus operandi makes long-term planning futile

Everyone’s busy debating whether Donald Trump’s global tariff plan is economic protectionism, geopolitical strategy, electoral propaganda, or the act of a madman who has lost the plot. It seems to me that such excitement is misplaced. Trump’s flip-flopping trade war is in many ways a red herring. What is framed as a bold economic policy that will drive investment in the US and ignite a new economic boom serves to distract us from its real purpose, which belongs to a completely different playbook. As paradoxical as it may sound, the ongoing economic slowdown of the United States is not the painful yet necessary short-term side effect of Trump’s tariffs, but rather its goal. Collateral damage is the intended outcome. In other words, Trump’s aggressive neo-mercantilism works mostly as perception management (whether he means it as such or not). It is much less about reshoring manufacturing than feeding the credit addiction of financial capital. Let’s break this down.

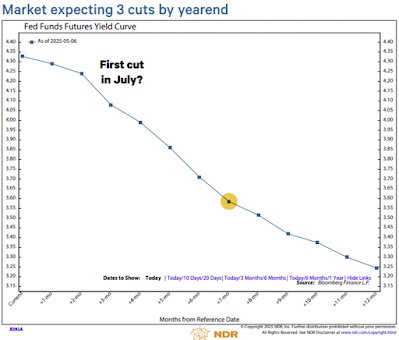

Uncle Sam’s GDP has already shrunk by an annual rate of 0.3% in the first quarter of 2025, after growing by 2.4% in the previous quarter. A sustained, tariff-related economic slump would not only serve to justify an inflation that in fact has never dropped (when measured against wages and savings). More crucially, it would provide the Federal Reserve with the perfect pretext to lower interest rates (the cost of money), which in turn will bring down yields on sovereign debt. The absolute priority for the US Treasury is as urgent as it is banal: to refinance around $9 trillion in maturing debt by the end of 2025. In addition to this historically unprecedented “maturity wall”, the Congressional Budget Office projects a $1.9 trillion federal deficit for fiscal year 2025, bringing the total debt issuance requirement to over $10 trillion. Without the US dollar as global reserve currency, this massive imbalance would have already precipitated a default.

As things stand, what is required is sending the 10-year Treasury yield well below 4%, while also exerting pressure on a 30-year yield that has recently jumped to 5%. In systemic terms, the interest on this mammoth debt must fall whatever it takes, since it defines the entire financial environment and therefore the entire constellation of Western capitalism, and beyond. ....................

If there’s one point that Trump has been coherent about, it is that he wants lower rates. He’s not alone. Especially after Moody’s downgrade of the US credit rating (16 May 2025), most corporate media seem to have joined the “agent of chaos” President in calling for the same policy. So while tariffs may lead to inflation in the short term (which official data can easily misrepresent), sustained economic contraction would force the hand of the Federal Reserve to bring down rates and “stimulate”, which would also put an end to the boring Trump vs Powell pantomime. After all, this has been the playbook of “soap bubble” capitalism over the last few years. .....................

Tariffs: What the hell just happened?

Why you shouldn’t get excited about his “deals”

A potential supply and demand shock means the US economy may be in for years of volatility

It is a mark of how eager investors are to put the idea of a trade war behind them that markets surged last week on the news of a tariff “deal” between the US and China.

Never mind that it was a 90-day pause on higher rates that is likely to bring only temporary relief. Investors bought the story that US President Donald Trump’s market friendly Treasury secretary Scott Bessent was now firmly in the driving seat, China hawk Peter Navarro had been pushed into a broom cupboard somewhere in the back of the White House and we could all go back to pre-“liberation day” bullishness.

I don’t buy it.

I think we are still in for a lot more volatility — not only in the next three months as the new normal of 10 per cent across-the-board US tariffs shakes out (and this is the best-case scenario), but over the next few years, as the long-term structural trends towards a new global economic paradigm continue.

Let’s start with the immediate issues. ............

Charts:

1b:

(not just) for the ESG crowd:

Burning, worsened by global heating, overtook farming and logging as biggest cause of destruction of tropical forests

The US political world can today be divided not only between left and right, but along another axis: Trump maximalists and Trump minimalists. Maximalists are inclined to view Trump as an agent or conduit of a sudden historical rupture, whether the transformation of the party system, the destruction of American democracy or the implosion of the liberal world order. Minimalists see Trump not as a fundamental break but rather as a lurid symbol of longer-running developments, or a symptom of crises that lie elsewhere – a black hole detracting attention from real political problems.

This is not a cleanly partisan or ideological distinction, which is one of the things that makes it interesting. ............

............... First, the tariffs. On ‘Liberation Day,’ Trump appeared to deliver the international economic demolition job that many maximalists feared and some hoped for. Yet at the first sign of bond market jitters, he switched course from global trade realignment to simple trade war on China – and then, a few weeks later, pulled back from that, too. Significant duties on China remain in force, and further tariff shenanigans remain likely, but transformational change appears to be off the table. On Wall Street, what the Financial Times has dubbed ‘the Taco trade’ – based on the theory that Trump Always Chickens Out – has sent markets roaring back to their pre-tariff levels. .................

Trump’s escalation of censorship and retaliation is terrifying. The groundwork for it was prepared years in advance.

Today on TAP: Yet more horrors are hidden in the fine print.

Geopolitical Fare:

Empire’s don’t collapse; they commit inevitable suicide by destroying their primary sources of wealth: respect and industry. The American empire has existed since July 4, 1776 when it was declared as colonial elites revolted against the British in a quest to expand their territory across the mainland of North America. Over the course of two and a half centuries, the empire has become the most dominant force—militarily, economically, and culturally—that the world has ever seen.

After a couple world wars left every other major power weakened, the US inherited a position of supreme power, with no historical parallel to match the overwhelming global influence that the US Government now commanded. Going into WWII, US planners were well aware America was the strongest economic force in the world, as it had been for decades at this point, and that it would be in a position of strength at the wars end which would allow Washington to shape the affairs of international politics—indefinitely if that were possible—and that they would need to create a global order that would ensure the control of a majority of the worlds resources for American corporations, primarily those in the energy sector.

To be sure, these supposed “wise men” at the creation of the “Pax Americana” indeed achieved much success. .......................

While the empire maintains its peripheral status as the world’s leading power, the gap between the US and peer competitors has grown considerably smaller. Much has changed the last decade-plus. The unipolar moment is no more, mostly cordial relations with the Russians in the 1990’s and 2000’s have completely devolved, the Chinese are the leading manufacturer in the world (the US held this title for more than a century until 2010), Beijing and Moscow have formed a defacto coalition with the Iranians and others to fight American hegemony, and the US—after having unmatched power and credibility once again after easily liberating Kuwait from Saddam in 1991—has lost what goodwill it has in the world and is now viewed, largely, as a rogue state that threatens international peace and security.

Of course, all imperial powers behave like rogue states, but the cultural hegemony and prestige of America has had nearly as much to do with its global dominance as military strength or economic might. To instill obedience into an empire, a state needs mystique and the ability to seduce allies and partners to do their bidding. The US doesn’t really have this any longer, as the world has long seen the hypocrisy of American actions. .....................

............................... Washington doesn’t stand a chance economically in the long term. You can see this in the Trump tariffs, launched on not just China but essentially the entire world. Trump’s “liberation day” and trade war is a sign of desperation from an empire that knows it can’t compete economically with its top competitor anymore. Their only avenue is tariffs in an attempt to slow industry and production down in China, as well as in America’s own colonies, while hoping this will somehow strengthen the US economy long term.

Washington is really gambling on damaging the global economy in the hopes of maintaining American primacy. As Yanis Varoufakis explains: “This is what his (Trump) critics do not understand. They mistakenly think that he thinks that his tariffs will reduce America’s trade deficit on their own. He knows they will not. Their utility comes from their capacity to shock foreign central bankers into reducing domestic interest rates. Consequently, the euro, the yen and the renminbi will soften relative to the dollar. This will cancel out the price hikes of goods imported into the US, and leave the prices American consumers pay unaffected. The tariffed countries will be in effect paying for Trump’s tariffs.”

That’s one possible outcome. The American empire is hoping the world falls in line and that the damage done to economies across the world leaves the US in the drivers seat, albeit much weaker both economically and geopolitically. Another far likelier scenario, in my view, is that America simply further isolates itself and slides deeper into economic recession, imperial decline, and drives allies into adversarial hands because they simply cannot trust doing business with such an unstable and untrustworthy regime. America has become the rogue nation of our time in not only reality, which it’s always been, but even to most of the world who essentially fear it. What they’re most likely accomplishing is simply strengthening the bilateral relations between key allies and their top adversary long term. ........................

The inexorable decline of the American Empire has arrived at an Imperial Paradox. It must either fight a war and die, or not fight a war and yet still die.

Here are the options:

China

Neither South Korea nor Japan want anything to do with a war against China, leaving only the Philippines dumb enough to play along. ...................

Iran

In the context of a war against Iran, all the geography is against the US. ...........

Russia

From a geographic and logistical standpoint, the only remotely conceivable war is one in Ukraine against Russia. ..............

So if you're an empire that thinks it needs a war to reaffirm at least its short-term relevance and fading glory ... well, these are your choices.

Sic transit gloria mundi.

The Liberal Intellectual Paradigm is Broken

............. The real action in the US is not happening in seminars at Brookings or in op-eds in the New York Times. It is happening backstage, out of sight; beyond the reach of polite society, and mostly off-script. America is undergoing a transformation more akin to what befell Rome in the age of Augustus.

Which is to say, the main happening is the collapse of a paralytic élite order, and the consequent unfolding of new political projects.

The collapse of global liberalism’s intellectual paradigm -- its delusions together with its associated technocratic structure of governance -- transcends the red/blue schism in the West. The sheer dysfunctionality associated with western culture wars has underlined that the entire approach to economic governance must change.

For thirty years Wall Street sold a fantasy … and that illusion just shattered. The 2025 trade war has exposed the truth: Most major US companies were duct-taped together by fragile supply chains, cheap energy, and foreign labour. And now? It's all breaking.

Frankly put, liberal élites simply have demonstrated that they are not competent or professional in matters of governance. And they do not understand the gravity of the situation they face -- which is that the financial architecture that used to produce easy solutions and effortless prosperity is well-past its ‘sell-by’ date. ........................

The demonstrative support shown once again by Berlin for Israel-while-committing-genocide is a spectacle that remains very revolting and puzzling to many and certainly to everyone who is intellectually and morally sane. Across changes of government, Germany is displaying a callous, brutal, and also perfectly tone-deaf come-what-may loyalty - if that is the word - to the genocidal apartheid state of Israel that practices an ideology and commits crimes all too reminiscent of Nazism. ..........

.................................. It’s been so transparently obvious this entire time that Israel’s entire objective is to remove Palestinians from a Palestinian territory so their land can be used for Israel’s own purposes — but you’d never have known it from looking at the western press.

For the last year and a half the western media have been brazenly lying to the public by framing this as a “war with Hamas” instead of the naked ethnic cleansing operation it clearly is. ............

If the western press had been doing actual journalism, Israel would never have been able to bring Gaza to this point. Because the western press have instead been administering propaganda this entire time, Gaza is now an uninhabitable pile of rubble full of desperate, starving people, allowing Israel and the Trump administration to argue that the humanitarian thing to do is to evacuate them all immediately. ...............

None of this would be possible if the west had an actual free press whose job is to create an informed populace. But we do not have an actual free press whose job is to create an informed populace — we have imperial propaganda services disguised as news. .............

A good start.

So, someone killed two Israeli diplomats in D.C. and everyone is crying crocodile tears and screaming about anti-semitism. (One of them was a Christian fundamentalist, as an aside.)

These two diplomats are agents of a genocidal state. Their job is to keep the weapons and ammunition flowing to Israel so that Israel can kill more Palestinians, wipe out the last remaining hospital, torture Palestinians, rape Palestinians (including, it appears, with dogs), deliberately snipe children in the head, cause a huge famine, and turn every building in Gaza into dust.

And I’ve left a number of sickening crimes out.

So, am I sad they are dead? No. Am I going to pretend I give a shit when someone who supports genocide winds up dead? No. Every single pious well wishing for Biden is the equivalent of wishing Petain, the leader of Vichy France, who helped the Holocaust along, a good life.

All of these people are knowingly involved in genocide. They have had many opportunities to stop supporting mass murder and they have refused every single one of them.

They are all, forgive me for using the word, evil. The bad guys. Torture. Rape. Mass murder. Deliberate killing of children.

It is my dream that every single one of them will eventually hang from the neck for their crimes. No exceptions. And I think it would be wise to add the corporate leadership of companies like Palantir and Microsoft, both of which are helping the genocide along.

This is a moral stance, but it is also a pragmatic stance. People who have gotten away with genocide once are not the sort of people anyone wise wants in their society, or in a position of power anywhere. Once could easily become twice.

You don’t even have to give a damn about Palestinians, you just have to have good judgment and a concern for your own neck and the lives, rectums and limbs of people you care about.

From the neck. Till dead. For everyone who knowing aided or committed genocide.

................................ China is important. Its dedication to peaceful development and diplomacy is laudatory and in stark contrast to the bombastic hectoring and warring of the US-NATO block. China cares for the well-being of all its citizens; it seeks win-win relationships with other countries — not the win-lose entanglements of the capitalist West. ......................

And might never be

The day before yesterday, I posted an analysis of the Istanbul talks and what they meant— with the prediction that Russia could not achieve his goals without regime change in Ukraine.

No one had been really talking about that –”regime change” — certainly not in the West where the absolute worst case scenario is just giving Russia the 4 oblasts that have joined its federation and Crimea, with Kiev maintaining sovereignty as an independent nation state over the rest of of what is now called "Ukraine"-- under the same kind of government that has ruled it since 2014.

No one seems to pay much attention to what Putin says!

Ah, when the devil talks you should not listen!

Putin's goals have always been demilitarization followed by denazification to enable a pluralistic democracy and neutrality, along with tangible and realistic long-term guarantees of Russian security. ...............

Russian forces have been building a security buffer along the country’s border, Vladimir Putin has said

After days of disruption by pro-Palestine activists at its Build developer conference, No Azure for Apartheid said, Microsoft made it impossible to send emails containing "Palestine" or "Gaza."

Sci Fare:

Other Fare:

Aurelien: What We Have.The new is dying, but the old cannot be reborn. What do we do?

............... So the subject for this week is how we might survive personally, and even retain our sanity, when governments and institutions of all kinds seem to be beyond redemption and even beyond repair, and yet paradoxically people are expected to depend on them more and more. So first we need to look at where we are, and I will lay out the argument that the political and social order of the last forty years is crumbling, and so each of us needs to think about how we might react. I will then provide some (very preliminary) thoughts about how we might react.

I and others have written enough about the decline in governments and institutions of all kinds that there’s not a lot worth adding here. But it is interesting, perhaps, to dwell for a moment on what this means for individuals, which is the focus of this essay. Institutions should exist to serve people, after all, even if only indirectly. ....................................................

The worst mistake you can make when reading the news is to assume there’s a good reason why the mass media report on something in the way that they do. That there’s a good reason why Israel-Palestine gets framed as a complex and morally ambiguous issue with no clear path forward, even though it all looks pretty self-evident to you. That there must be a valid and legitimate reason why one story gets more coverage than a seemingly far more important story, like how the release of one Israeli-American hostage is currently getting far more news media coverage than the deliberate starvation of an entire enclave full of civilians.

In reality there is no valid and legitimate reason why such things are covered the way they are. The coverage happens in the way that it happens because it serves the information interests of Israel and the western empire, and for no other reason.

So much western ignorance is facilitated by the manipulative way the imperial media report on what’s going on in the world. .................

............ So one of the most important things you need to do to maintain a truth-based worldview is to take complete control over your own understanding of the importance of the pieces of information which come across your field of vision. You can’t rely on others to tell you how important they are, because all the most amplified and influential voices in our society are working to manipulate your understanding of their importance, and most ordinary people you’ll interact with are being manipulated by those voices to some extent. Public political discourse is overwhelmingly dominated by these distortions. ..............

Economic uncertainty and AI are causing employers to think twice about all but the most sterling candidates

Pics of the Week:

Ziggurat Skyscrapers and Hugh Ferriss’ Retrofuturism