***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Policymakers say inflation and unemployment could increase as Trump’s tariffs heighten uncertainty

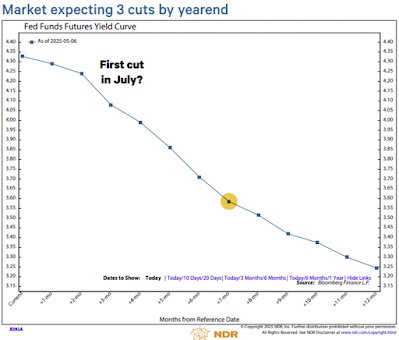

........... Powell also reiterated his recent statements that the central bank was in no “hurry” to change policy as it assesses the effects of tariffs. He said the “right thing to do is await further clarity”. ...........

............ While GDP contracted for the first time in three years in the first quarter, officials put that down to distortions triggered by the tariffs as US businesses look to get ahead of the levies by importing goods.

“It’s a little bit confusing . . . but I think we understand what’s going on and it’s really not going to change things for us,” Powell said.

DB: Tariffs and r* (via the Bond Beat)

Could US tariffs result in higher equilibrium level of interest rates? Yes.

As previously noted, r* isn't equivalent to potential growth. In the US, “other determinants" (i.e., the supply/demand of savings) account for ~80% of the post-GFC decline in r*, compared to only ~20% for potential growth. Tariffs represent a negative supply shock for the US that could lower potential growth (and thus r*). However, fiscal policy among key US trading partners has become notably more accommodative in response to US tariffs. Consequently, the "other determinants" component of r* is likely to increase.

Early evidence suggests that the shift in the global supply/demand of savings is outweighing the decline in potential growth. Bearing in mind the limitations of real-time r* estimates, the estimate derived from the bond/equity correlation continues its upward trend, reaching a post-GFC high following the US tariffs announcement.

The great economist John Maynard Keynes once proposed an international system to eliminate trade surpluses and deficits. Now the ‘Mar-a-Lago Accord’ aims to bring that idea to life.

.............. For years, this document was ignored and overlooked, the radical ideas inside it abandoned. But now, in 2025, some of Keynes’s theories are being combed over once again. And in a turn of events that would doubtless have surprised a determinedly liberal intellectual like Keynes, the man who could help bring them to reality is none other than Donald Trump.

Will Trump Pretend to Fix What He Broke?

There is a long and knotty thread that connects the document written by Keynes in 1941 with today’s discussions about a so-called “Mar-a-Lago Accord”—the much-hyped plan to weaken the U.S. dollar as a way to help reindustrialize America. Where Keynes and Trump converge is over the one big, overarching problem that now plagues the world economy: imbalance.

These imbalances manifest in all kinds of ways. The most visible is the fact that the U.S. imports cheap goods from around the world and pays for them with an unending stream of IOUs, mostly in the form of Treasury bonds. To put it in technical terms, the U.S. has a large current-account deficit ............

.......... But look beneath the surface and those persistent imbalances have left deep scars. In particular, as manufacturing shifted to China, so too did jobs. Old industrial regions—many of them, coincidentally, in swing states in presidential elections—have been hollowed out. That successive presidents have pledged to rebuild American manufacturing is in part a symptom of these imbalances.

The broad contours of this system have been with us for so long they might feel like a natural state of affairs, but there is nothing natural about countries having mammoth surpluses and deficits and—this is the really important bit—having them for so long. Over time, these imbalances really ought to, well, balance. Currencies and wages should adjust, making it more attractive to make stuff in America; China should begin to consume more and import more. ...........

Which brings us to the idea of a Mar-a-Lago Accord, most famously dangled late last year in a paper by Stephen Miran, now chair of Donald Trump’s Council of Economic Advisers. The Trump administration, like many of its predecessors, sees the strong dollar as an obstacle to bringing manufacturing back to the U.S.

Miran argued that new American tariffs would incentivize other countries to sign up for access to a U.S. trade zone. As part of this deal, they would agree to intervene in currency markets to reduce the value of the dollar. They might also swap some of their existing U.S. Treasurys for much longer-dated versions, with the Federal Reserve providing short-term liquidity as needed. Such a dollar-depreciating accord, Miran wrote, would help to create manufacturing jobs in America and reallocate aggregate demand from the rest of the world to the U.S.

Since being appointed, however, Miran seems to have gone cold on the idea, saying recently that the administration isn’t actively considering it. Perhaps that is because Treasury officials have gently pointed out that forcing other nations to accept U.S. bonds that might never be repaid is effectively a default. (After this story was published online, a White House spokesperson told the Journal that “neither Miran nor the administration have ever gone hot on the idea in the first place.”)

Nonetheless, his ideas have captured the attention of many in the international economic community—not so much because they have a chance of success but because they provide some economic scaffolding for Trump’s trade policy. If you believe in the Mar-a-Lago Accord, tariffs suddenly seem to have a deeper purpose: They are there to confront the imbalances in the global economy, something economists have been grappling with since Keynes.

.................. The great irony is that Trump might already have triggered a monumental shift in the international monetary system, not through an accord but essentially by mistake.

Why you shouldn’t get excited about his “deals”

China and others must think afresh as the US steps away from its role as balancer of last resort

............ To understand the problems the world economy faces it helps to start from the topic of “global imbalances”, which was much discussed in the run-up to the global and Eurozone financial crises of 2007-2015. In the years since, these imbalances have grown smaller but the overall picture has not changed. As the IMF’s latest World Economic Outlook notes: China and European creditor nations (notably Germany) have run persistent surpluses, while the US has run offsetting deficits. As a result, the US net international investment position was minus 24 per cent of global output in 2024. ....

So what, a passionate free-marketeer would ask? Indeed, even a not-quite-so-passionate free marketeer might note, with good reason, that the US has been fortunate to live beyond its means for decades. That need not be a problem: nobody, after all, will be able to force the US to pay its liabilities back. It also has ways, both elegant and not so elegant, to default. Inflation, depreciation, financial repression and mass corporate bankruptcies all come to mind. ..............

..................... Trump’s unpredictability and focus for bilateral deals are indeed foolish. But the old US-led economic order is now unsustainable. The US will no longer serve as balancer of last resort. The world — especially China and Europe — has to think afresh.

Tech, trade, finance and military policies are mingling in a manner not seen during the neoliberal era

......... in the 20th century free-market intellectual framework — which is the one in which most western professionals built their careers — it was generally assumed that rational economic self interest ruled the roost, not grubby politics. Politics seemed to be derivative of economics — not the other way around.

No longer. The trade war unleashed by US President Donald Trump has shocked many investors, since it seems so irrational by the standards of neoliberal economics. But “rational” or not, it reflects a shift to a world where economics has taken second place to political games, not just in America, but many other places too. ..................

............... in the meantime, investors and business leaders would do well to note five key points about this geoeconomics debate.

First, this phenomenon is not simply about one man (Trump), but rather marks a much bigger turning point in the intellectual zeitgeist — of a sort we have seen a few times before.

One such shift occurred just over a century ago, when the globalist, Imperialist vision of capitalism that reigned before the first world war was displaced by nationalist, protectionist policies. Another came after the second world war, when Keynesian economics took hold. Then, in the 1980s, free-market neoliberal ideas displaced Keynesianism.

The fact that the intellectual pendulum is now swinging again, towards more nationalist protectionism (with a dose of military Keynesianism), thus fits a historical pattern — although few predicted that the swing would take quite this form. ...............

.......... Third, an (obvious) factor behind this rivalry is that China is now challenging America’s incumbent dominance. This pattern has often been seen before, as Ray Dalio, the hedge fund luminary, notes in a provocative forthcoming book. Investors should also note that Dalio suggests such conflict is rarely resolved quickly or smoothly — least of all when there is a debt cycle involved.

........... But what is evident is that there is rising acceptance in the US that government should shape commerce in the national interest. This will invariably prod regions such as Europe to follow suit.

All of which will horrify many observers, particularly those raised in that neoliberal era. But don’t expect the intellectual pendulum to swing back soon — even if the US cuts a few trade deals, as Dan Ivascyn of Pimco notes, Trump’s love of tariffs runs deep. For better or worse, we all need to learn to navigate geoeconomics. We cannot just wish it away.

Summary: This report explores gold’s reemergence not merely as a store of value, but as a strategic monetary tool for circumventing sanctions, supporting trade diplomacy, and conducting debt management. Drawing upon historical precedent, contemporary developments, and theoretical frameworks such as Stephen Miran’s Mar-a-Lago Accord, this essay proposes that the United States is positioned to reengage in a sovereign-level gold trading for purposes of reducing debt, rewarding trade partners, and restoring the US manufacture-export base. This mechanism, once dominated by bullion banks and now emulated by sanctioned states, enables the monetization of gold without outright liquidation. Gold-forward hedges provide the United States with an opportunity to strategically weaken the dollar as a component of its need to remain competitive in export driven global economies, reduce debt obligations, and support trade-partner allies through targeted currency support. This report argues that gold’s transformation under Basel III, coupled with a shift in U.S. monetary strategy, marks a return to gold’s core geopolitical function.

Examining the CDS entrails

It’s that magical time of the year again, when we once again worry that the broken US political system will result in the unnecessary sovereign default of the world’s premier reserve asset and usher in financial Ragnarok.

The – Japanese asset price bubble – burst in spectacular fashion in late 1991 (early 1992) following five years in which the real estate and share market boomed beyond belief. The boom coincided with a period of over-the-top neoliberal relaxation of banking rules which encouraged wild speculation. The origins of the boom can be traced back to the endaka recession in the mid-1980s, after the signing of the – Plaza Accord – forced the yen to appreciate excessively. This was at the behest of the US, which wanted to reduce its current account deficit through US dollar depreciation. The narratives keep repeating!

Bubble Fare:

The promoters of scam currency spent more money than any other group in 2024. They’re now realizing a massive return on investment in Donald Trump’s White House.

................................ The $FECAL episode was a small but telling sign of how crypto, despite being a relative flop commercially, has infiltrated American politics. Once the memecoin appeared, Casten’s unremarkable comment turned into an opportunity for graft and self-dealing, however ludicrously conceived and executed. Casten recognized as much. If he weren’t a known critic of the crypto lobby, Casten said, the token might have provoked some suspicion—that, say, the congressman was in on the grift. “You should be asking me hard questions about that, right?” he said in an interview. “It’s insane.”

If no part of society is immune from the all-powerful hand of the market, the same might now be said of crypto. Never has so much power, authority, and attention been afforded to such an economically unproductive industry. Never has so much energy and human potential been wasted chasing illusory profits in a business that relies on Ponzi economics. And never have politicians had so many opportunities for clandestine personal enrichment, in a parallel financial system that they’ve largely let run amok. ..................

President Abraham Lincoln is considered to be the moral savior of the United States for ending slavery. To pay for the war, he made enormous changes in the basic relationship between the federal government and money. These changes greatly diminished individual property rights and increased the power of Washington over the private economy.

The paper money created by Abraham Lincoln to finance the Civil War was the first crypto currency. Lincoln relied on the issuance of nonconvertible paper currency to support the military effort, in today’s terms like forcing people to accept buttons or miscellaneous crypto tokens in payment. Lincoln used interest bearing paper “money” or “greenbacks” to finance the Civil War and, more significant, passed laws mandating the acceptance of paper currency as “legal tender” for all debts.

When Treasury Secretary Salmon Chase asked Congress to pass the legislation in order to maintain government bond prices and procure supplies for the army, the law provided that import duties and interest on the public debt would still be paid in gold. Paper money was seen as inferior to gold. In fact, paper was not seen as money at all, but rather as a form of debt.

Though the Founders made provision under the Commerce Clause of the Constitution for trade between the states free of tariff, there was no provision for a common currency or banking system to tie together the nation or even the individual states. State-chartered banks issued various forms of debt to the public in return for some future promise to pay in hard money—that is, gold or silver.

The major difference between the private money of the 1700s and modern crypto tokens is that the former at least promised payment in a tangible asset—gold. The latter explicitly promises nothing save a speculative flutter on price appreciation. When you buy a crypto currency, you buy an option on finding a greater fool, but nothing more, a transaction that would have provoked contempt in Lincoln’s day. ..........................

................. Many Americans remember President Richard Nixon for closing the gold window at the Treasury in 1971, a mostly symbolic act that ended any pretense of a link between the dollar and gold. Yet by ending the use of gold as money in America four decades earlier, FDR ensured the political survival of the Democratic Party, enshrined the paper dollar as de facto money and put America on the road to hyperinflation and excessive debt a century later. The dollar today is simply a crypto currency supported by the legal monopoly of the United States.

Tariff Fare:

Reflections on the unfolding US tariffs gambit

Snapshot: This essay explores the 2025 US tariff imbroglio with the aid of game theoretic concepts. It consolidates reflections and comments that I have made in various posts over the last few weeks. In doing so, it reveals how a series of strategic miscalculations by the Trump Administration, particularly its overestimation of America’s centrality in global trade and the decision to grant a 90-day grace period to all countries except China, backfired. Rather than isolating China or compelling allies into bilateral trade concessions, the US triggered a multipolar coordination game. In such as game, nations are incentivised to delay action, deepen ties with one another, and shift away from reliance on Washington. The result is a consolidation of the evolving contours of global trade toward a post-American order. In this context, strategic patience, coalition building, and distributed power are the principal features. ..........

DB: Trade policy uncertainty: There's too much confusion, I can't get no relief (via The Bond Beat)

In recent work we replicated and extended analysis by Federal Reserve staff which quantified the impact of trade policy uncertainty on the economy (see “Analysis of the paralysis from trade policy uncertainty” and “The short and variable lags of trade policy uncertainty”). At the time we warned that the results were a best-case scenario, as it assumed trade policy uncertainty would quickly revert to historical averages rather than persisting at elevated levels.

We update that analysis using data for trade policy uncertainty through April. Unsurprisingly, the April 2nd Liberation Day announcements which lifted tariffs to the highest level in a century, and subsequent partial reversal of some tariffs but further escalation with China, led to record readings for trade policy uncertainty last month.

Updated results suggest that annualized real GDP could be depressed by as much as 2.5 percentage points in Q3 and Q4 2025. This estimated drag is meaningfully larger than the 1-1.5 percentage points dent estimated using TPU data through February and March. These results are consistent with our forecast of near zero growth in H2 and still elevated recession risks.

The recent shift in trade policy by the new US administration is impacting global trade and creating volatility in financial markets. This column quantifies the economic impact of the 2nd April tariffs on Europe, discusses the financial market response to the announcement, and looks at the role of the exchange rate response for the transmission of the shock. The authors provide different scenarios for the exchange rate going forward. While economic theory would imply an appreciation of the US dollar, its recent weakening must be seen in the broader policy context. Implications are derived for the case that the weakness of the US dollar vis a vis the euro persists.

Natixis: A four-fifths cut in China exports to the US could axe 6.4 million jobs; Nomura: Beijing’s GDP could hit the low single digits if exports are halved

Well, maybe. Who the hell knows what he’ll do. Anyway, tariffs are back to 10% on either side and negotiations will continue.

Note that China got what they wanted, minus 10%—no negotiations until the tariffs are removed.

There will still be a two month trade burp. Ships weren’t leaving China for the US at all, literally zero. Lot of freight companies are about to make a mint, though. So expect some shortages, but nothing worse than Covid, and hopefully lasting less time.

The fundamental problem remains, however, which is that there’s no certainty around any of this, so business people can’t make long term plans, including plans to build or relocate manufacturing. Trump and the US can’t be trusted to stay steady on policy, so avoiding making big plans involving the US makes sense.

The Great Power picture is clearer, however. The US tried to impose its will on China and failed. China wouldn’t negotiate till its pre-conditions were met. The world has two great powers, with the EU bidding to become the third (I think they’ll fail, but that’s what the rearmament is about.)

And, in economic terms, China is by far the pre-eminent great power. It isn’t even close. The era of American hegemony is officially over. The US tried to impose its will on the world and failed.

Tariff Tweets of the Week:

...US policy chaos has already damaged the economy, by undermining confidence and forcing companies to postpone capex and hiring. That was the story of Q1. But the real recession risk comes from lower earnings over the summer, and how the corporate sector responds.. 🧵

— Dario Perkins (@darioperkins) May 9, 2025

There was various media stories about potential tariff cut on Chinese goods after the trade talks.

— Anna Wong (@AnnaEconomist) May 9, 2025

Connecting the various dots—including shipping data— I arrive at a similar conclusion (before I saw those stories).

Specifically, there appears to be a good chance tariffs on…

Charts:

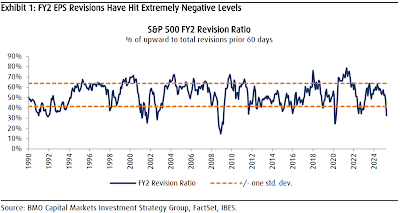

1: "As we approach the end of corporate earnings season, the now backward-looking results from Q1 can be best described as better-than-feared. In aggregate, year-over-year S&P 500 earnings growth is tracking higher than expectations at the start of the earnings season (12% vs. 6%) – and better than the ~9% long-term average growth in EPS. Unfortunately, these results are somewhat meaningless because the world today is much different than pre “Liberation Day.”

(not just) for the ESG crowd:

...........................................................

..................................................

..................................................

The Road to 2050: Scenarios for Humanity

If emissions continue, warming could reach 2.4–2.7°C by 2050, triggering cascading crop failures, mass migration of 216 million, and uninhabitable zones in the Gulf Coast and South Asia. Aggressive renewable transitions might limit warming to 2°C, but legacy damage—acidified oceans, depleted soils—would still cause widespread famine and conflict.

The J.P. Morgan report Heliocentrism: 15th Annual Energy Paper (2025) casts significant doubt on the feasibility of a full global transition to 100% renewable energy by mid-century, citing systemic, economic, and technological barriers. While solar and wind capacity are expanding rapidly, the report emphasizes that the energy transition remains linear, not exponential, and faces critical limitations: .........................

.........................................

....................... In short, the report underscores that the energy transition is a century-scale industrial shift, not a rapid revolution. Without radical policy interventions, global cooperation, and trillions in infrastructure investment, fossil fuels will remain entrenched—even as renewables expand.

A global “Marshall Plan” deploying degrowth economics and regenerative agriculture could stabilize populations. Yet this requires dismantling entrenched power structures—a prospect hindered by nationalism and corporate influence. ......

This is a book review of Ramana’s Nuclear is not the Solution: The Folly of Atomic Power in the Age of Climate Change

U.S. B.S.:

As the Trump administration prepares to increase the enormous U.S. defense budget to over one trillion dollars, it is an appropriate time to describe how the U.S. arms industry participates in a structure of normalized corruption that I call defense racketeering. The Military-Industrial Complex that President Eisenhower warned against in 1961 has grown and evolved in ways that are grossly wasteful, promote armed conflict, and weaken national defense. I will describe this pernicious system of grifting and offer some recommendations for ending it.

A few years ago, I made the diagram shown below depicting the financial circulatory system of the U.S. Military-Industrial Complex (aka, The Blob). Eisenhower originally intended to describe it as the Military-Industrial-Congressional Complex, and this would have been a more accurate term because the defense budget funding committees of the U.S. Congress are the beating heart of the Blob.

Geopolitical Fare:

It can make you feel like you’re going mad. How phony and superficial it all is. How we’re a year and a half into history’s first live-streamed genocide and our whole society is acting like everything’s peachy.

We’re murdering kids. We’re starving them. We’re dropping high tech military explosives on them. Blowing their limbs off. Ripping their guts out. Shooting them in the head. This isn’t just being done by “Israel”. It’s being done by the entire western empire which backs these atrocities. ........

Imagine the reaction if Chinese forces were caught massacring medical workers in ambulances.

Imagine the reaction if Russia bombed an international humanitarian aid convoy in clearly marked vehicles.

It would be all we’d hear about for weeks.

❖

My social media feeds are filling up with footage of skeletal starving children in Gaza. If we had sane and responsible news media in the west, this would be the lead story in every outlet and publication. But we do not have sane and responsible news media. We have propaganda services disguised as news media. ...............

After a year and a half of genocidal atrocities, the editorial boards of numerous British press outlets have suddenly come out hard against Israel’s onslaught in Gaza. ..............

.................... It is odd that it has taken all these people a year and a half to get to this point. I myself have a much lower tolerance for genocide and the mass murder of children. If you’ve been riding the genocide train for nineteen months, it looks a bit weird to suddenly start screaming about how terrible it is and demanding to hit the brakes all of a sudden.

These people have not suddenly evolved a conscience, they’re just smelling what’s in the wind. Once the consensus shifts past a certain point there’s naturally going to be a mad rush to avoid being among the last to stand against it .......

'Let the IDF Mow Them Down!': In Israel, Violence Saturates Everyday Life

Sci Fare:

Book Fare:

Sci Fare:

The thalamus is a gateway, shuttling select information into consciousness.

Other Fare:

ChatGPT has unraveled the entire academic project.

Human sperm count is rapidly declining, and that may lead to a fast demise of the homo sapiens species.

Book Fare:

Ursula Le Guin's "Planet of Exile"

Let me start by saying that there is no novel by Ursula K. Le Guin that is not the best novel by Ursula K. Le Guin. All her novels are her best novels, and all are masterpieces. It is an incredible series of stories, each one different, and each one surprisingly insightful, deep, interesting, and prophetic.

It is true for this fantastic novel: Planet of Exile, written in 1966, her second novel, written at 37. Look, this is such a masterpiece that I don’t know where to start in telling you about it ...............

No comments:

Post a Comment