**** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Broad strength is consistent with Bull Market Behavior

........... The ACWI is making new highs while nearly 90% of the global markets in the index are above their 50-day averages. The same percentage is above their 200-day average – which is a new cycle high. When broad strength accompanies index-level strength, strength tends to persist.

........ Zooming out, the Bull Market Behavior Checklist is all green as the long-term trend in the Value Geometric Index has turned higher. From a breadth and trend perspective, the equity market is firing on all cylinders. .............

Confirmation is the key

The $SPY ( ▲ 0.5% ) S&P 500 and $QQQ ( ▲ 0.34% ) Nasdaq 100 just pushed to new all-time highs.

Let that sink in.

Through war headlines, rate fears, AI bubbles, and the national debt crisis…

Stocks are trading at the highest prices in history.

This is what markets do. They move forward.

And price action is the clearest truth we have to assess the real story.

Now? We look for confirmation.

............... By my read, there's plenty of confirmation to enjoy this ride. ............................

The six strongest sectors right now account for 73% of the S&P 500’s weight.

That’s not narrow leadership. That’s confirmation. .........

We’re also seeing confirmation beneath the surface.

One of our simplest but most powerful tools is the New Highs minus New Lows line.

We want to see more stocks breaking out than breaking down. Right now?

That’s exactly what’s happening. .....................

So What Do You Do With All This?

You respect it.

Because if you’re waiting for every ratio to scream “buy,” you’re already late.

The conditions we’re seeing now?

They’re how real bull markets behave. Not perfect. Just powerful.

We don’t need everything. We just need enough.

And from where I sit? There’s more than enough confirmation to stay long and strong.

As we cross the midpoint of 2025, the overall resilience that equity markets have displayed in the first two quarters of the year has been nothing short of impressive.

The turbulent backdrop of tariff uncertainties, geopolitical tensions, a U.S. debt downgrade, porous sentiment, and mounting national debt concerns have been a stiff headwind for investors. The incoming economic data has been anything but consistent, if not outright deteriorating.

And yet, the S&P 500 index notched a new all-time high today, just four months after its prior all-time high on February 19 with a roughly 20% drawdown sandwiched between.

It’s easy to understand why investors might feel conflicted today.

Looking forward to the second half of the year, investors have many reasons to be optimistic.

The technical setup remains constructive with many charts showing the potential for breakouts, while sentiment and positioning remain accommodative to a FOMO catch-up trade. Further easing is expected from Fed Chair Jerome Powell. Policy uncertainty is falling which gives CEOs better visibility and confidence on a go-forward basis.

But, over the long run, nothing matters more to stock prices than earnings. ............

Capitalism’s operating system is due for a major upgrade. How that turns out depends on enormously consequential political choices.

The world economy is like a supercomputer that churns through trillions of calculations of prices and quantities, and spits out information on incomes, wealth, profits, and jobs. This is effectively how capitalism works—as a highly efficient information-processing system. To do that job, like any computer, capitalism runs on both hardware and software. The hardware is the markets, institutions, and regulatory regimes that make up the economy. The software is the governing economic ideas of the day—in essence, what society has decided the economy is for.

Most of the time, the computer works quite well. But now and then, it crashes. Usually when that happens, the world economy just needs a software update—new ideas to address new problems. But sometimes it needs a major hardware modification as well. We are in one of those Control-Alt-Delete moments. Against the background of tariff wars, market angst about U.S. debt, tumbling consumer confidence, and a weakening dollar watched over by a heedless administration, globalization’s American-led era of free trade and open societies is coming to a close.

The global economy is getting a hardware refit and trying out a new operating system—in effect, a full reboot, the likes of which we have not seen in nearly a century. To understand why this is happening and what it means, we need to abandon any illusion that the worldwide turn toward right-wing populism and economic nationalism is merely a temporary error, and that everything will eventually snap back to the relatively benign world of the late 1990s and early 2000s. The computer’s architecture is changing, but how this next version of capitalism will work depends a great deal on the software we choose to run on it. The governing ideas about the economy are in flux: We have to decide what the new economic order looks like and whose interests it will serve.

The last such force-quit, hard-restart period was in the 1930s. ............

NewEdge: Mid-Year Outlook: The Summer of Mudd

................ Data is getting muddied by distortions that tariffs have had on household and business buying behavior and sentiment. Policy is muddied by the decisions to “kick the can” on trade deals and tough negotiations around taxes and spending. Growth is muddied as the breakneck pace of 2023 and 2024 growth downshifts to a slower, muddle through type of environment, with limited near-term catalysts for reacceleration and continued signs of “fraying” in the labor market.

This muddiness paints an interesting backdrop for risk assets, which have roared higher since their early April lows, shrugging off headlines and uncertainty to return to prior highs.

We would like to take a moment to focus on one aspect of our outlook, in looking at the puts and takes for equity markets in the second half of 2025. We will do this today by contrasting today’s S&P 500 high with the high reached back in February.

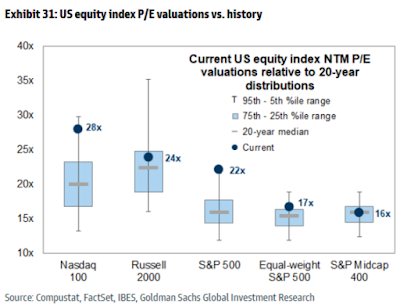

If you recall, our 2025 Outlook was titled Great Expectations because everywhere we looked, that is what we saw. Stretched valuations, stretched positioning, ebullient sentiment, and high hopes for “only just the right stuff” out of DC and policy.

Fast forward to today, two items are relatively similar: stretched valuations and DC optimism. ...............

This set up of positioning and sentiment suggests that the “pain trade”, the direction of travel for stocks that catches the most investors flat footed, is still higher for the U.S. equity market. This does not mean that equities are not subject to bouts of indigestion, volatility, and surprise, which could be amplified by these lofty valuations, but it means that many investors are still in a position where they may have to chase markets higher in order to get fully invested. This creates an environment where dips are bought quickly and “melt ups” may ensue.

Unlike the policy, growth, and data backdrop, “muddy” may not seem to be the exact word to describe this equity market, which seems so resolute in its march to new highs. But we think that the medium-term outlook could be muddied, once light positioning and subdued sentiment are pulled higher and valuations find themselves at even-more-stretched levels. At this point, the earnings backdrop will be the key determinant if new highs can continue to be achieved, or if volatility will come for the “priced for perfection” market. Of course, the muddied data and muddle through growth environment will be an important consideration for earnings. ...............

Bloomberg: This Time Is Different for the US Economy

Downside risks to the labor market are becoming more of a concern for Fed policymakers, with some open to a July interest rate cut.

MS: Watch the Economic Data, Not the US Equity Market | US Rates Strategy (via TheBondBeat)

The stock market at the all-time highs may weigh on the minds of investors who share our view that US rates have much further to fall and the yield curve much further to steepen. History suggests that equity market performance ahead of recessions deceives more than it forewarns. Watch data instead.

Key takeaways

- Ahead of most NBER recessions, the performance of the S&P 500 Index made it entirely unclear that the economy sat on the precipice of recession.

- Additionally, in 4 of the 15 recessions declared by the NBER (27%) back to 1929, the S&P 500 Index peaked in or after the month the recession began.

- Stay long UST duration at the 5y key rate and stay in UST 3s30s and term SOFR 1y1y vs. 5y5y steepeners ahead of potential range breakouts post-month-end.

- Important US labor market data (May JOLTS, June employment) in the coming week carry the potential to bull-steepen the curve in parabolic fashion.

- As we approach July 9, we suggest using any rise in Treasury yields on additional tariff announcements to add to long duration trades and curve steepeners.

NatWest: A giant stirs

Markets continue to assign a high risk premium to the long end of the Treasury curve. This is consistent with expansive fiscal policy, above target inflation, and policy uncertainty.

We think the underperformance of the sector should be understood as an increase in the market’s implicit probability of a “soft” default. In this context, “default” refers to failure to repay the current real value of debt rather than the nominal value.

We expect the Fed to set policy consistent with the inflation mandate. Markets retain the proclivity to expect monetary easing with slowing growth. This behavior reflects a conditioned response to a biased policy reaction function, where the conditioned response was “taught” during the long post-GFC period in which the Fed had the luxury of setting policy for growth and employment due to secular disinflationary pressures. We think the Fed is in the process of “re-training” the market to a more inflation-oriented reaction function. ..........

............ We have argued that this dislocation could persist as long as the level of real yields or the real term premium does not become disruptive, tightening financial conditions. However, we have also illustrated that the level of long real yields is already at levels that have been disruptive historically. To do that, we examined the last 25 years of quarterly SPX price returns, and have illustrated that the condition of long real yields at or above current levels has materially changed the distribution of SPX price returns. The chart below illustrates the unconditional and conditional cumulative distribution function (CDF) constructed from the historical return series.

The way to read the chart is as follows. As illustrated, the cumulative probability of returns less than or equal to zero unconditionally – the historical probability from the whole sample – was 32%. Recall that this was a period in which the SPX rose 400% and as such is a highly biased distribution. However, when 20y real yields were at the current level or higher, the probability of negative returns rose to 56%. What this tells us is that we are already at long real yields that materially alter the return distribution of the SPX. This tells us that real yields are already tightening financial conditions, which on balance makes it less likely that these valuations can co-exist.

If, like the defined benefit pensions sector, you are an essentially infinite horizon investor, this relative valuation offers a generationally attractive opportunity to re-allocate some assets from equity or risk assets more broadly, into fixed income. ............

............ The Supplementary Leverage Ratio was initially implemented as a post-GFC (Global Financial Crisis) safeguard. The idea was simple: limit the amount of leverage banks could take on by tying it to their capital base, regardless of the riskiness of the assets. That meant a Treasury bond and a junk loan were treated equally for leverage purposes. Unsurprisingly, the rule disincentivized the major Wall Street banks from holding low-risk assets like U.S. Treasuries, particularly in periods of balance sheet stress, in exchange for debts with higher yields.

In a welcome reversal, the Fed announced on June 25th that it, the FDIC, and the OCC are easing that constraint by recalibrating the SLR to reflect a more nuanced risk-based approach. Specifically, the new rule adjusts the enhanced SLR (eSLR) add-on to 50% of the Method 1 Global Systemically Important Bank (G-SIB) surcharge, harmonizing it more closely with international standards. This reduces the leverage burden across the largest U.S. banks and opens up substantial balance sheet capacity.

What does this mean in practice? According to Goldman Sachs’ Richard Ramsden, the proposed changes could unlock between $5.5 and $7.2 trillion in bank balance sheet capacity. ............

....................... This doesn’t necessarily guarantee a bond rally, but it significantly tilts the risk-reward back in favor of duration, particularly in high-quality fixed income. For equity markets, lower long-term yields are a mixed bag. Lower yields are historically bullish for growth stocks, UNLESS yields are dropping rapidly due to slowing economic momentum or recession risk.

Portfolio construction should always remain anchored in risk management, and the risk of being short Treasury bonds is clearly on the rise. .........

When the world’s dullest industry gets very exciting

Asset managers have it easy. The parties, the access, the spreadsheets. And the money isn’t bad. However, to keep the show on the road, there is the minor detail of winning and retaining clients. But what if you just bought them?

While this isn’t exactly what private equity firms have done, neither is it completely not what they’ve done. ..............

According to Guy Routh, econometrics is nothing but “mock empiricism, with statistics subjected to econometric torture until they admit to effects of which they are innocent.” Similarly, Mark Blaug in his The Methodology of Economics argued that econometric testing is like “playing tennis with the net down.” ............

A new report from the Bank for International Settlements (BIS) challenged the notion that stablecoins can serve as money in a modern financial system.

According to the BIS Annual Economic Report 2025, stablecoins fail the fundamental tests of “singleness,” “elasticity” and “integrity,” three critical criteria that define effective monetary instruments.

The BIS described stablecoins as “digital bearer instruments” that resemble financial assets more than actual money. “Stablecoins perform poorly when assessed against the three tests for serving as the mainstay of the monetary system,” the report said .................

Charts:

1:

With the Fed on hold and other countries easing, you would think that the dollar would be more bid than it has been. Interest rate differentials, after all, are a tried-and-true driver for currencies.

— Jurrien Timmer (@TimmerFidelity) June 26, 2025

Instead, the USD is teetering near its cycle low. It tells me that the dollar… pic.twitter.com/al4NE2NMMv

(not just) for the ESG crowd:

- Scientists propose a $117 trillion global wind-solar grid, arguing it could provide constant, clean power by connecting regions with surplus renewable energy to those in need.

- Theoretical benefits include energy abundance and reduced infrastructure needs.

- Political and economic hurdles make the idea highly impractical, with massive upfront costs, global coordination challenges, and geopolitical tensions making implementation unlikely.

Phytoplankton, microscopic plant-like organisms crucial for oxygen production and marine ecosystems, are under threat due to rising sea temperatures, ocean acidification, and pollution, warns environmental expert

A decade ago, the world’s countries agreed to a vision of the common good, the Sustainable Development Goals, and a plan to achieve that vision, the Addis Ababa Action Agenda. Ten years later, that effort is failing. Nearly half the world’s population—over 3.7 billion people—live in poverty, while gender injustice, hunger, and other denials of basic human rights are widespread. Since 2015, the richest 1 percent have gained at least $33.9 trillion in wealth in real terms, enough to end annual poverty 22 times over. Billionaires—roughly 3,000 people—have gained $6.5 trillion in real terms, more than the $4 trillion estimated annual cost of achieving the SDGs ................

********** The Crisis Report - 109

Who do you believe?

There are basically five ways to respond to the Climate Crisis that's steadily engulfing our civilization.

- Ignore the crisis and pretend it's not happening. The BAU or FOX News scenario.

- Acknowledge the serious of the Climate Crisis but insist that the situation is still solvable/manageable. Plea with people to “not give up” because renewables are now cheaper than fossil fuels and “net zero” is now inevitable. The MSN, NYT, and WAPO “techo optimist” scenario.

- Come together globally as a species to coordinate resources and responsibilities so that the Climate Crisis is “managed” in an intelligent and humane way. What the UN Secretary General has been pleading for since 2022. The “Best Case” or “Descent Realist” scenario.

- Engage in a global “free for all” struggle at the nation state, regional, and local levels for available resources. Hoarding of vital resources and endemic warfare. Mass starvation episodes as resources are funneled into warfare while social infrastructure collapses. The MAGA “America First” policy as a global scenario or “Worst Case” scenario.

- Argue that “we screwed up” and almost ALL LIFE on planet earth is about to go extinct. In this “extreme doomer” interpretation of events we are basically now in the “End Times”. With human extinction being inevitable and something we are going to live through in the coming years. This is the hardest scenario to characterize because it's difficult to understand how proponents of this viewpoint think people should react to it. Consider this the “If everything is doomed what's the point of anything?” scenario.

By FAR, the Majority of people believe in scenario two.

That's WHY it's the “mainstream” view of the unfolding Climate Crisis. ........................................

U.S. B.S.:

Geopolitical Fare:

We have now entered a new phase of Western-led global savagery — prefigured by the genocide in Gaza — in which all pretences have been dropped and only the logic of raw, unrestrained violence remains

The recent – and certainly not last – massive and unambiguously criminal assaults by the US-Israel complex on Iran has produced much commentary, in good as well as bad faith (that is, propaganda). The latter mainly consists of absurd attempts to pass it off as legal – as shameless NATO Secretary General Mark “Says Daddy” Rutte, for instance, had the gall to claim – or so necessary that legality doesn’t matter – German “think” tank “expert” and decorative TV studio element Christian Mölling, for instance – or somehow both (Western propagandists aren’t good at consistency since it requires logical thinking). These narratives are so obviously motivated and dishonest that they don’t deserve serious attention, only dismay and dismissal. Consider that done.

Regarding analyses, comments, and interpretations that may be correct or misleading but at least merit attention, these have clustered around a few questions, such as: .................

Yet there is one issue that seems to receive insufficient scrutiny, notwithstanding that it is second to none in terms of global significance: How will BRICS be affected by these attacks? In particular, what kind of challenges do they pose for the association and its goals? Finally, how should BRICS respond in the mid-to-long term, and, at least as importantly, what mistakes must BRICS avoid?

The shortest answer to the last question is the best starting-point to answer the others. What BRICS must avoid at all costs because it poses an existential danger to it is what Iran has done for more than two decades: BRICS must not adopt – deliberately or de facto, by negligence – a policy of “strategic patience.” Here is why: .............

..................................... Hence, BRICS must now face an issue that I pointed out long ago: Simply relying on an inexorably unfolding logic of multipolarity to finally demote and cage the West will not work. Because the West will resist this development tooth and nail, ruthlessly and with the added meanness that comes from being cornered by history itself. And next to Russia and China, BRICS and its members will be its single most important target. .......................

......... For the West will not go quietly into what may be a bright day for humanity as a whole but will look like a dark night for its worst and richest exploiters. The West won’t abdicate in a civilized manner, as the Soviets did. The West, in the transition period between its fading dominance and the new multipolar order will be even more dangerous than before, and it will have to be deterred and contained.

Part 2 of 3: Why is Iran so important to U.S. global strategy

China has been kept in a box by Western sea power since the 1840s. The box is still there. The land road is China’s way out.

This is Part 2 of our look at the war to topple Iran. In Part 1 (here) we asked:

Who’s really in charge of all these wars, the U.S. or Israel? Which is the client state and which the master?

So many people have blamed the U.S. for “letting Netanyahu drag America by the nose” (as they would put it) into wars we have no interest in.

I would contend the opposite — that at best, America is partners with Israel, at worst we’re Israel’s master. I go with partners, of the back-scratching kind.

Of course, America and Israel have individual goals.

Israel wants the chaotic destruction of each non-controllable nation in its back yard — which stretches to Pakistan, by the way. Those it lets be are protected by their proved cooperation with Western hegemonic goals, meaning American goals. These nations include the wealthy Gulf kingdoms, home to U.S. bases, and India.

What are America’s goals? The destruction, ultimately, of Russia and China, the only challenges to its absolute superiority, its “full spectrum dominance,” if you will, of all the world. ...........

Why Iran First?

This is not to criticize; just to describe. You can see the sides lining up among folks in the unelected U.S. establishment — those who think the road to Beijing should be marched on at once, versus those who think “Tehran first, then Moscow, then China; weakest to strong.”

It’s clear, isn’t it, that the Iran-first people have won. Why? There are two reasons:

Attacking Iran serves Israel’s needs well, and Israel is critical in keeping its neighbors in line. So call it a gift to a friend.

The Belt and Road Initiative — China’s plan to create land routes that bypass Western sea power, a modern Silk Road for goods and energy — runs right through Iran and the first station opened in May. .....

The Master Plan: Divide and Dominate

The best explanation of the master plan for Asia is laid out in the video below. I’ve included a full transcript — it’s an excellent read. The writer is a well-published scholar who works for the Belt and Road Initiative (BRIX) in Sweden. Take that for what it’s worth.

The meat of his argument is this (emphasis mine): ...................

................................................................... There's a new world economic order emerging out there, [and] because West Asia, Iran, the Gulf countries, Palestine, Syria are so crucial strategically and geographically, this region has become the battleground for the whole situation.

I believe that this is the true reason for the strategies, beyond Netanyahu, beyond Trump and the Zionists — the strategies at the level of people like Tony Blair and the London and Wall Street financial oligarchy, what people call the military-industrial complex. This is what they are thinking about. This is how important it is to defeat Iran.

The plan is to do a regime change in Iran as a key element in coming back to this “pivot of Eurasia,” and also to implement plans like the Bernard Lewis Plan to divide all these countries, but especially Iran, into ethnic entities.

Rarely spoken of is the effects of the Middle Eastern wars on Ukraine. For a long time, Ukraine got everything it wanted, but since Oct 7th, it has been #2, or worse, on America’s priority list. Mossad has a great deal of influence in America, just short of control, almost certainly due to a sickening collection of videos and pictures, and Israel has received the first cut off everything it needed: most especially of interceptor missiles.

Even so, the reason that Israel and the US called for a ceasefire and Iran did not (though it accepted one) is that Israel was less than a week from running out of air defense missiles, and as best I can tell, the US could only have supplied about another 7-10 days worth.

What this means for Ukraine is simple enough, they’re being absolutely hammered by Russian missiles and bombs. They don’t have enough air defense, they don’t have enough missiles for the air defense, and there is no reasonable prospect of re-stocking. The West’s larder is empty.

The tempo of Russia advances continues to increase. It’s still slow, but it’s at least eight times as fast as it was a year ago, and as Ukraine runs out of men, weapons and ammunition (Western shortages go far beyond air defense), plus as morale continues to plummet in Ukrainian armed forces, the prospect of “big arrow” warfare grows closer. ...........

This is a literal epochal period. The “nothing ever happens” fools are missing that this is the end of a literal era: the era of European supremacy (the US is just a European settler state and Britain’s successor.)

The new era will be multipolar only if China wants it to be. They are approaching “America after WWII” levels of industrial and technological power. However, for a time, they will probably allow a multipolar world, as they are smart enough not to want to be a superpower or “world cop.” ....

Aurelien: Digging Deeper.

Because the alternative is worse.

Perhaps the greatest of all traditional political skills is timing. Not just deciding when to launch an initiative or make a speech, but also knowing when an issue is ripe, when to join a bandwagon and most importantly when to get off, because you recognise that something is just too difficult, or even that a cause is now lost and there’s nothing you can do about it. The great British Labour politician Denis Healey famously said “when you’re in a hole, stop digging,” by which he meant that above all you should avoid making an already bad situation worse, and look for a way out, instead

Although today’s western political class has forgotten even the basic skills of everyday politics, you might nonetheless reasonably expect that fear alone would make them think seriously about their Ukraine policy, and how they would survive a defeat politically. After all, the Curse of Zelensky has struck down nearly all of the major western political leaders since 2022: only Mr Macron is grimly serving out the last two years of his term. Traditionally, changes of leader, and especially changes of government, are an opportunity to rethink policies and, in Denis Healey’s words, to get out of the hole your predecessors have left you in. Yet with Ukraine this has not happened, and as western leaders replace others, they take their place one by one in the herd of lemmings headed for the cliff. Only in the United States does a new government appear to offer the possibility of change, although I cannot pretend to know what Mr Trump’s confused thought processes will eventually produce, if anything.

In turn, this unanimity in government is largely a product of the unanimity in the in-grown and incestuous western political class, such that one identikit figure with identikit views is simply replaced by a clone. I’ve written before about the quasi-religious hatred animating much of the European political class, and its obsession with the destruction of Russia as the “anti-Europe,” or at least the anti-Brussels. But even the most fanatical liberal-libertarian, gently simmered for years in the Brussels court-bouillon, should at least be capable of recognising reality. After all, few if any politicians these days are inclined to sacrifice their career for their ideals: it’s almost always the other way round. So why is an entire political class apparently sacrificing its political future in a hopeless cause, and with every appearance of enthusiasm and dedication, at that?

The purpose of this essay is to try to answer that question, at least for European nations, and to do so by looking at the mechanics of how politics typically operates, and how politicians typically think. I’m not going to reveal any grand plans or intricate conspiracies (you can find plenty of those elsewhere) and in the end you may be disappointed by the prosaic, unreflective and self-serving nature of the motives I’ll be discussing: but that’s our contemporary political class for you. And although I have never hidden my views on this class or its behaviour, I’m not here concerned with polemic, or with the rights and wrongs of various interpretations. The Internet is knee-deep in all that, and since the beginning of these essays I have tried to do something different: not to complain that the clock is wrong, if you like, but to remove the clock-face and peer around in the workings. I’m not a great fan of Spinoza (I will finish the Ethics one day), but I’ve always been impressed by his remarks in the Tractatus theologico-politicus that he had attempted “not to laugh at human actions, not to weep at them, nor to hate them, but to understand them.” That’s the spirit of this site (as you will recall from the name) and of this essay as well.

So let’s start. I’ll offer two relatively mundane reasons for the current state of affairs, and a third which is more speculative, but I think well founded. .................

.............................................. Western politics is essentially a gigantic echo-chamber on the subject. Everyone who briefs you, everyone who attends the meetings you attend, everybody who briefs them, everybody you meet at receptions and in the margins of meetings, has basically the same opinions. Your colleagues in other governments, the Opposition spokesman on your subject, the Parliamentary Committee, the Secretary-General of NATO, the journalists who interview you, the EU Commission, think-tanks and influential retired politicians, will all be saying much the same thing. What we have here is quite close to a collective fantasy, a collective hallucination, or a process by which people collectively hypnotise each other. It’s groupthink on an epic scale. Now because this is politics, there will of course be disagreements. Do we send This Weapon or not? Do we provide this training? What do we think of this initiative? How do we respond to Zelensky’s latest diatribe? But everybody you meet will basically have the same broad picture of events. .......................................

“China is the big prize. China will be the final goal of this whole regime change process which started after 9/11.”

— 🅰pocalypsis 🅰pocalypseos 🇷🇺 🇨🇳 🅉 (@apocalypseos) June 23, 2025

With this warning, Hussein Askary (@HusseinAskary) of the Belt & Road Institute in Sweden frames today’s global tensions as part of a long-term Western strategy… pic.twitter.com/CTT6JWE6xr

Oh, Canada:

Sci Fare:

Murphy: Spare Capacity

Lurking in every space weather forecaster’s mind is the hypothetical big one, a solar storm so huge it could bring our networked, planetary civilization to its knees.

Other Fare:

Tech workers at TikTok, Google, and across the industry share stories about how AI is changing, ruining, or replacing their jobs.

J.K. Rowling Destroyed Trans Ideology With One Savage Tweet

....................................... Rowling refuses to apologize, refuses to play by the ever-changing rules of the woke mob, and instead shines a spotlight on the contradictions baked into their rhetoric, like how calling someone a “trans woman” is supposedly empowering until it’s used as a slur. Her wit, clarity, and refusal to back down force her critics to confront the ugliness of their tactics.

Pics of the Week:

Through years of smears, threats, and public pressure campaigns, Rowling has stood firm, using every attack as an opportunity to expose the movement’s double standards and moral incoherence. In an era when most public figures wilt under pressure, she’s become a symbol of courage for women everywhere who are tired of being silenced. She’s not just defending herself; she’s defending reality, and doing it with a fearlessness that leaves her critics sputtering.

Pics of the Week:

neat ambigram:

No comments:

Post a Comment