rather than just forecast yield levels and projected market returns for 2010, I took a quarter-by-quarter view, to reflect my anticipation that:

Q1 would be the quarter of people thinking "onward-and-upward, heading back to normal",

Q2 would be a quarter of people thinking "hmmm, the economy's getting better still, but at a slowing pace", then

in Q3 people woudl be thinking "this isn't what we bargained for! where's my recovery, dude?!", and

Q4 would be the quarter of people throwing in the towel, thinking "crap, here we go again, 2009 recession reprisal; we really are turning Japanese!"

the projected price appreciation (cumulative YTD) across the curve based on my yield forecasts were:

the projected price appreciation (cumulative YTD) across the curve based on my yield forecasts were:

I think I got the general shape of things pretty right, i.e. yields up in H1, yields way down in H2 (so far, anyhow):

I think I got the general shape of things pretty right, i.e. yields up in H1, yields way down in H2 (so far, anyhow): Q1 evolved largely as I thought (orange diamonds vs. blue-squares-line), though I was way off on my projection of 4-year bond yields;

Q1 evolved largely as I thought (orange diamonds vs. blue-squares-line), though I was way off on my projection of 4-year bond yields;

Q2 was the turning point, as I expected, but the transition came sooner and more emphatically than I anticipated; my forecast (green-triangle line) fell roughly half-way in between April's peak yields (circles) and the much lower yields at quarter-end (triangles) --- so I didn't anticipate yields bear-flattening as fast or as much as they did in the first 3 weeks of April, nor did I anticipate them rallying as much as they did in the balance of the quarter (and, surprisingly, while I was not bearish enough on the front part of the curve for early Q2, I was actually TOO bearish on long bonds, as long yields never got as high as I forecast for June 30, and their yields at June 30 were as low as what I pictured for September 30)

so, for Q3, we've got the rally I anticipated, but a lot of the rally I pencilled in for Q3 (orange-ish circle line) actually happened in May/June; and yields have, through mid-August (blue crosses), already fallen lower than I projected for Sept 30

okay, so its good to review one's old forecasts to back-check one's thought process and to re-evaluate one's expectations in light of where one went right and where one went wrong (okay, that's enough 3rd-person talk!)

I still think my thematic labelling of each quarter remains pertinent; no change to my view there --- if anything, I'm now even more resolute in my economic beliefs

how about yields? well, not surprisingly, I'm still a bond bull in the mid-term

BUT, the rally we've had in recent weeks has been ferocious --- and nothing moves in a straight line for long; so we can expect a pull-back at some point here; so, in the short-term, I'd be willing to be only small long, rather than max-long

but a near-term sell-off should NOT ratify the views of the bond bears! though I anticipate that over-bought bonds will take a tumble in the near-future, I can't possibly imagine yields getting anywhere near their Q2 highs; furthermore, though they may sell-off, that will likely be temporary, as yields should set new lows this year relative to the crisis lows of 2009

aside:

by the by, when the U.S. 10-year was at about 3.30%, I made a bet with one of our friendly bond sales coverage-people that the 10-year yield would fall below 3% before it got to 4%; I'm not sure I would have been quite as confident had the yield at the time of the bet beeen 3.50% rather than 3.3%, making for a symmetric situation, but, as it was, I was confident enough in my side of the bet to risk what will turn out to be a $1,000+ dinner (for 9).... though it bugs me that the downside risk for me was totally out of my wallet, but the loser of the bet will likely expense the damn dinner! next time, J.I., cash only!!

anyways, my point of all this is that my convictions are strong, and I've been willing enough to put my money where my mouth is

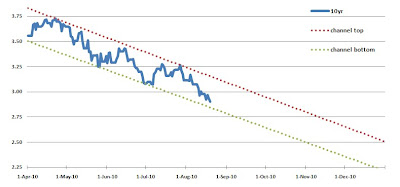

so, what DO I expect? what I expect is that the trends since April will persist, i.e. that we will stay in the trend channel that has developed:

if you push that trend channel even further out, to year end, you get this:

if you push that trend channel even further out, to year end, you get this:

in other words, as opposed to my year-end forecast that I set out last December of 2.5% for 10s, I would not be at all surprised if by year-end they trade below 2.5% to as low as 2.25%

I'm certainly not a slave to this trend channel (I wouldn’t be at all surprised if it breaks out the top-side of that channel, and maybe the channel that has developed so far is too steep, given how fast we’ve come so far, compared to how the channel might evolve going forward; but, then again, it wouldn’t surprise me either if we stay in the channel; and, in any case, I do not buy the case for higher yields in any sustainable way), but it IS reasonably consistent with my prevailing forecast, and is certainly consistent on my views of what's in store for the economy and for the stock market as we get closer to 2011

p.s. I said earlier that I'd be willing to be small long, rather than long long --- but that conflicts with what I've done recently; I tend to invest based on my big picture view, and ignore the potential for taking a different tack for short-term trades, for fear of a short-term trade taking me offside from my big picture orientation and missing the big picture move I'm betting on --- which is a long-winded lead-up to noting that I recently took a position in ZROZ, PIMCO's ETF for 25+ year zero coupons, a position I took on not just for the long D, but also as a currency bet

No comments:

Post a Comment