Recent index levels therefore provide little guidance regarding future direction: one might as well assume that stocks could tend towards their recent lows as to trend towards their past highs.

What is required, therefore, is a reliable measure of valuation.

Based on a price of 1125 and trailing-year operating earnings of $72.50, the market is trading at a price-to-earnings multiple (P/E Op) of 15.5. This compares favourably to the historical median P/E Op (using operating earnings data available since 1988) of 18.3 (i.e. the market appears to be 15% undervalued relative to this valuation norm since 1988).

Furthermore, based on forward operating earnings estimates of $82.77 for next year and $95.87 for the following year, the forward P/E Op of 13.6 and the 2-year forward P/E Op of 11.7 both suggest that the S&P 500 currently represents good value.

However, based on forward earnings estimates, the S&P seems always to represent good value! (irrespective of its price level). Since the end of 2005, the forward P/E has consistently been around 15 and the 2-year forward P/E around 13. At no time did those "valuation indicators" remotely suggest the possibility of either a price decline of 50%, nor, for that matter, of a rally of 80%.

Despite operating earnings having already risen 43% from their 2009 trough, analysts are projecting earnings growth of 14% in the coming year and 16% in the following year, for a cumulative rise of 32% over the next two years (and a rise of 89% from the trough).

The expectation of earnings of over $95 would eclipse the 2007 high of $91 --- which was established at a time when corporate profits accounted for their highest proportion of GDP since 1949; profit margins were historically very high; the economy, and particularly the financial sector, were excessively leveraged; unemployment was under 5%; retail sales were up over 5% year-over-year and establishing their peak level (5% above the level sales are currently at); when housing starts were double the current level and housing prices had just started to deflate; household net worth was at a record high, etc. All this is simply to suggest that analysts’ expectations are apparently predicated on a return to 2007-type economic “norms”.

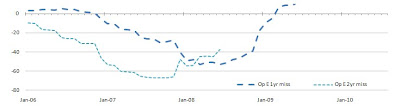

In any case, analysts have established an un-enviably poor track record of projecting earnings. The following chart shows at each month-end over the last five years the level of trailing operating earnings and, at the same point in time, analysts’ estimates on a going-forward basis of forward and following year earnings. While from the above it is clear that analysts have a tendency to simply “scale-up” the existing level of earnings, the following chart more clearly demonstrates how unreliable analyst forecasts have been (even for operating earnings, much less reported earnings). For instance, 3 years ago, in August 2007, analysts projected forward earnings of $96 and following year earnings of $107, but operating earnings as of August 2008 were under $70 and for August 2009 were under $40.

While from the above it is clear that analysts have a tendency to simply “scale-up” the existing level of earnings, the following chart more clearly demonstrates how unreliable analyst forecasts have been (even for operating earnings, much less reported earnings). For instance, 3 years ago, in August 2007, analysts projected forward earnings of $96 and following year earnings of $107, but operating earnings as of August 2008 were under $70 and for August 2009 were under $40. Furthermore, operating earnings have become further and further divorced over time from companies’ total reported earnings. In fact, the ratio of forward operating earnings to revenues is now higher than it has ever been. As John Hussman has said:

Furthermore, operating earnings have become further and further divorced over time from companies’ total reported earnings. In fact, the ratio of forward operating earnings to revenues is now higher than it has ever been. As John Hussman has said:

“Ultimately, the value of any security is the properly discounted stream of cash flows that the security will deliver into the hands of investors over time. It is very convenient for Wall Street to operate on the basis of "operating earnings" - which aren't even defined under Generally Accepted Accounting Principles (GAAP) - because this measure of earnings is detached from any need to properly deal with portions of earnings that are lost to writeoffs, "extraordinary" losses, option grants to insiders, and so forth. Yes, these items appear in net earnings, but to most analysts, it is apparently unimportant if companies repeatedly write off previously reported "earnings" as losses, or quietly divert them to incentive compensation - all of that is water under the bridge even if it occurs quarterly.”

So, though one may feel tempted to use operating earnings and operating earnings estimates as a guide for the sake of determining stock market valuation, one must recognize the flaws with such an approach given both the awful track record of analysts' earnings estimates and the significant and growing deviation between operating earnings and the true level of earnings available to shareholders.

No comments:

Post a Comment