*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:Fed's Financial Accounts Report Unexpectedly Reveal Terrible News For Markets

.......... Nonfinancial debt: Household debt grew by 8.3% in the first quarter of 2022 (this and subsequent rates of growth are reported at a seasonally adjusted annual rate), a bit higher than in the previous quarter. Home mortgages increased by 8.6% amid surging home prices, and nonmortgage consumer credit increased by 8.7%, buoyed by rapid growth in credit card borrowing and auto loans.

.....

***** Roberts: The Scissors of Slump

Last week, US Treasury Secretary Janet Yellen told the US Congress that “We now are entering a period of transition from one of historic recovery to one that can be marked by stable and steady growth. Making this shift is a central piece of the President’s plan to get inflation under control without sacrificing the economic gains we’ve made.”

It’s true that the US economy since the depths of the pandemic slump, (which remember in terms of national output, incomes and investment was the worst since the 1930s – even worse that the Great Recession of 2008-9) has made a recovery. But it could hardly be described as ‘historic’. And as for the claim that the US economy, the best performing of the major economies in the last year, is heading towards ‘stable and steady growth’, that is not supported by reality.

Yes, there is ‘full employment’ of sorts ie the official unemployment rate is near ‘historic’ lows, but many of these jobs are part-time, temporary or on contracts. And many pay poorly. The employment participation rate, which measures the number of people working out of those of working age, remains well below pre-pandemic levels, levels which were already in decline.

.... World Bank economists reckon that the combined impact of the pandemic and the war would leave global economic output in the five years from 2020 to 2024 more than 20 percent below the level implied by trend growth between 2010 and 2019.

... The view of the OECD economists is, if anything, even more pessimistic.

..... As I have shown before in previous posts in some detail, that, contrary to claims by mainstream politicians, central bank governors and economists, there is no ‘wage-price’ spiral. Wages are not driving prices up. Indeed, it’s profits that have risen sharply as a share of value since the pandemic. However, rising unit labour costs (as shown above) because of low productivity growth, are beginning to eat into profit margins.

... Falling profits is the formula for an eventual investment and production slump. That’s one blade of the scissors of slump.

The other blade is debt. As I have outlined on many occasions, I reckon this next major slump will be triggered by a corporate debt meltdown.

.... The scissor blades between falling profitability and rising debt costs are closing and will eventually cut investment, jobs, prices and wages.

The post-Covid fiscal deficit reduction continues to take its toll ... Higher prices automatically result in a spike in tax receipts ... Higher prices, now largely from energy prices pushing up costs, reduce the inflation adjusted value of the public debt, which acts like a tax on the economy ... With the rate of CPI increase above the rate of deficit spending, the effect is that of a budget surplus ... Spiking energy prices as Saudis set prices ever higher shift $ from consumers with high propensities to spend to producers with low propensities to spend, and this won’t end until demand collapses:

....... The Great Financial Crisis recession started in December 2007. It wasn’t made official until December 2008, the same month Bernie Madoff’s Ponzi scheme finally came to light.

The interesting thing this time around is everyone — even Cardi B — seems to be predicting a recession right now.

... In my last post, I discussed how the evidence shows that enormous federal deficits resulting from Covid-related "stimulus" spending were monetized, resulting in an unprecedented increase in spendable money (M2) held by the public. In earlier posts I've discussed how the the tremendous uncertainties surrounding the Covid-related economic shutdowns boosted the demand for money, and how this delayed the onset of inflation by about a year. Inflation didn't start rising until a year after M2 started surging and until it became clear that the Covid threat was receding. Five weeks ago I explained how money demand was likely to start falling, and how this could result in a surge of retail demand (and continued high inflation) over the next year or so.

We now know that federal deficits have collapsed (because spending has collapsed and revenues have surged) and M2 growth has also collapsed. In fact, M2 grew at a very slow 1.3% annualized pace in the most recent 3 month period, and in April of this year it actually declined from its March level. This effectively removes a major source of future inflation potential going forward, thus making the Fed's inflation-fighting job a lot easier.

...... Meanwhile, the dollar is strong, inflation expectations are subdued, and excess M2 is declining. All of which reinforces the idea there is light at the end of this inflation tunnel. The situation is far from being out of control.

Nevertheless, we should expect to see uncomfortably high inflation for another year or so. The huge increase in housing prices in recent years will take at least that long to find its way into Owner's Equivalent Rent, an important component of the CPI, and it will take time for excess M2 to unwind. And meanwhile, supply-chains are still in disarray, and geopolitical tensions are working to boost energy and raw materials prices.

...

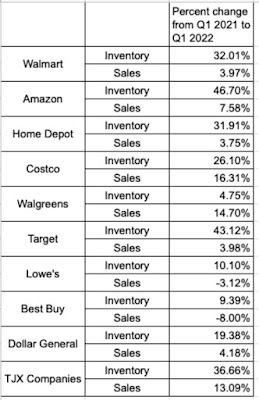

Consumers are tired of buying so much stuff, much to the chagrin of retailers and transporters

... More and more spooky recession signs are cropping up seemingly every day, ranging from cooling housing starts to meek GDP growth, all amid the Fed tightening rates. Record-setting inflation – particularly for gas – is only adding to the premonitions, as Vox’s Emily Stewart wrote Wednesday in a piece aptly titled “The bad vibes economy.” But even as things feel bad, many still cast doubt that we’re headed for a recession this year, pointing out persistently low unemployment and the fact that certain indicators, while not as strong as the beginning of this year, are still unusually healthy.

No one is shocked that what goes up must go down. What’s shocking us all is how quickly the situation changed.

Glum transportation indicators confirm the bad vibes

A downturn, if not a full-on recession, is clear in the transportation world. While the rest of the economy debates whether things are that bad, it’s been clear for months to logistics providers that the situation has worsened — and the velocity of that change is still stunning. ...

...

...... To end, I’d like to emphasize that the vibes are abruptly off and no one really knows what’s happening. My colleagues who went to the Gartner supply chain conference in Florida this week found that executives were confused and not feeling very zesty. Transportation managers canceled orders in early 2020 predicting a recession, then found their hastiness left shelves empty and consumers furious. Now that they’ve built back up, customers aren’t buying anymore and their balance sheets are destroyed.

........ Smith says inventories outside of China are below average, but not as low as in previous years.

The whiplash is baffling.

The overwhelming consensus that inflation is "sticky" and won't easily come down ignores the past 40 years of data, and instead rewinds to 1979. Stranger things, indeed...

First off, I am not making a bet on tomorrow's CPI. I wouldn't write an entire blog post around a single data point. Suffice to say that if the CPI continues to run hot it will only make the Fed policy error that much larger. So, for those in the ultra crowded inflation camp, move along this is not for you. You are part of an overwhelming consensus right now that inflation is intractable. My bet is that the inflation consensus is wrong and the consequences will be cataclysmic.

Unfortunately, we must first re-visit the definitions for inflation and deflation before we can reach a prediction for what comes next. At the individual level, inflation and deflation can feel similar - a lack of spending power. Cost of living higher than wages. A declining standard of living.

It's at the macro level where they are nothing alike. Recall that coming out of the pandemic demand greatly exceeded supply due to the demand stimulus colliding with a supply chain shock. Now, I predict those two factors will reverse. Meaning demand will collapse and supply will overshoot. In everything at the same time. Homes, cars, durable goods, crypto currencies, Tech stocks, and commodities. A glut of EVERYTHING at the same time.

Why will this happen? Because the consumer will collapse. Nothing about this is sustainable. And yet Wall Street is convinced it is. Just this week we see these articles:

CNBC: Bringing Down Inflation Will Take Time

No it won't. It will take sell orders and limit down markets. Not time.

Einhorn: The Fed Can't Bring Down Inflation

Yes they can. They have every time since WWII and they're going to do an even better job this time.

Suze Orman: Inflation Is Here To Stay

You get the point. Inflation is a broad based consensus at a very lethal juncture. ....

.. On a long-term basis, macro deflation is a result of outsourced industries and imported poverty leading to a lack of domestic demand brokered by debt. Debt is deflationary. Now we are seeing the fastest increase in consumer debt in decades.

The net effect of the pandemic was to create a supply/demand imbalance which boosted the prices of everything. But then, policy-makers took away stimulus. So now not only are prices higher, but LIABILITIES are higher as well. Unfortunately, prices can come down but liabilities are contractual. So the middle class is about to get trapped in a deflationary collapse. One in which asset prices collapse and liabilities remain high.

This year will see the largest stimulus removal since the end of WWII, which by the way was a recession.

From almost 20% of GDP last year to less than 5% this year. I can't say when the "official" recession will begin however growth is currently hovering at 0% right now, which means that ex-deficit we are ALREADY in a 5% recession.

.... At the same time as new mortgage applications are going into meltdown, the annualized % price increase just reached an all time record, AND homes under construction just reached an all time record.

Which equates to the mother of all impending housing gluts.

Worse than last time.

.... The physics of collisions... the second one does the harm. When your car hits a telephone pole, no problem. Then, after a slight lag, trouble comes when you hit the inside of your car. Same thing in football: helmet on helmet is all-okay... until your brain hits the inside of your skull.

The same physics govern housing collisions with mortgages. At the new year mortgages were still three-ish. In February, four. At the end of March, five. May, five-and-a-half. Historically, a two-percentage-point rise from cyclical trough has iced housing, the freeze underway a month ago. Now up by three points, and double January.

The pause in housing between the first collision and second is elongated because of human nature. Someone desperate to buy a house is still desperate, and modestly relieved to buy even at a higher price and rate so long as not forced into an unlimited auction. Now it’s time for Wile E. Coyote in his Acme sneakers, running off into thin air and all okay until he looks down.

Looking down... MBS are such a weird market that other markets have not processed what is happening. Stocks are down 2% today, but would be down a hell of a lot more if considering what a full-stop to housing will mean.

Another marker of MBS distress: the 10-year T-note had held 3.00% since April, the important top in 2012 and 2018. Trading 3.05% yesterday, now 3.20% -- retail mortgages jumped triple that amount. The 10s/mortgages spread today is almost 300bps and double the 10s’ yield. Inconceivable.

.... The Fed has had a plan, Powell becoming more concise each day: We will raise the cost of money until inflation comes under control. “It is our job to calibrate demand to supply.” A good, tidy, sorta mathematic way to proceed. But destruction of demand has limits, and this morning we hit one.

... In this circumstance, the Fed’s demand destruction has all the wisdom of Xi’s zero-covid.

... On May 12, USDA released wheat projections for 2022. The estimates suggest 775 million metric tons (MMT) of wheat will be produced globally, which is only down 4 MMT from 2021.

USDA’s numbers show a 50% drop in Ukrainian wheat production, while Russia is on track to produce slightly more than 2021.

Vids:

QOTW:

Mac10: In the perfect world for stocks, the Fed implodes the middle class, inflation comes down, and the Fed rescues markets before they collapse. This is what Wall Street now universally expects from the Fed, because it's been standard policy for the past 40 years. This time, they are flirting with disaster at the zero bound. Anyone who is now betting policy-makers can pull this off, deserves their certain fate...

(not just) for the ESG crowd:

Borio et al, BIS: Finance and climate change risk: managing expectations.

Fundamentally, financial instability arises when the financial and real sectors are out of sync, as exemplified by the financial boom-bust phenomenon. Financial expansions, on the back of aggressive risk-taking, fuel economic activity and overstretch balance sheets. In the process, asset prices and the volume of credit become increasingly disconnected from the capacity of the real economy to generate the corresponding cash flows. Since this disconnect is inherently unsustainable, the process goes into reverse at some point, generally abruptly and violently.

Seen in this light, the risks to financial stability linked to the transition are two-sided. One side is what has attracted attention so far – exposures to overvalued “brown” assets, which should lose their value (become “stranded”) as the transition proceeds. The concern here is that investors either sleepwalk into “brown vortices” or act rashly, generating disorderly “brown runs” (eg Delis et al, 2018). But there is also another side, which has received far less attention and is more similar to the familiar boom-bust pattern. This relates to exposures to either overvalued “green” assets or to assets that purport to be green; a “green bubble”, for short (Carstens, 2021, Aramonte and Zabai, 2021, Cochrane, 2021 and Tett and Mundy, 2022),The first side reflects an underestimation of the scope and speed of the transition; the second an overestimation.

The risk of a green bubble is material.

In recent years, there has been an intense public debate about whether and, if so, to what extent investments in nuclear energy should be part of strategies to mitigate climate change. Here, we address this question from an ethical perspective, evaluating different strategies of energy system development in terms of three ethical criteria, which will differentially appeal to proponents of different normative ethical frameworks. Starting from a standard analysis of climate change as arising from an intergenerational collective action problem, we evaluate whether contributions from nuclear energy will, on expectation, increase the likelihood of successfully phasing out fossil fuels in time to avert dangerous global warming. For many socio-economic and geographic contexts, our review of the energy system modeling literature suggests the answer to this question is “yes.” We conclude that, from the point of view of climate change mitigation, investments in nuclear energy as part of a broader energy portfolio will be ethically required to minimize the risks of decarbonization failure, and thus the tail risks of catastrophic global warming. Finally, using a sensitivity analysis, we consider which other aspects of nuclear energy deployment, apart from climate change, have the potential to overturn the ultimate ethical verdict on investments in nuclear energy. Out of several potential considerations (e.g., nuclear waste, accidents, safety), we suggest that its potential interplay — whether beneficial or adverse — with the proliferation of nuclear weapons is the most plausible candidate.

Other Fare:

Individuals who contract Covid-19 often experience problems with memory, attention, and concentration, even after recovering from the initial illness. In the current manuscript, we argue that these symptoms are likely to manifest as cognitive failures in the workplace.

The Earth moves far under our feet: A new study shows that the inner core oscillates

Pics of the Week:

Pics of the Week:

Contrarian Perspectives

Extra [i.e. Controversial] Fare:

*** denotes well-worth reading in full at source (even if excerpted extensively here)

Regular Fare:

There's an ugly state-federal feedback loop happening.

.............. “Providing $53 billion in corporate welfare to an industry that has outsourced tens of thousands of jobs to low-wage countries and spent hundreds of billions on stock buybacks with no strings attached may make sense to some, but it does not make sense to me,” Sanders said.

As I’ve said before, I think there’s some justification in trying to rebuild a domestic semiconductor manufacturing industry, since having this vital product made mostly in volatile parts of the world is a problem, on both economic and national security grounds. ....

America’s foreign policy goals are often self-serving, while its designs for a rules-based international order primarily reflect the interests of its business and policy elites

What’s good for the US may not be good for the world. The sooner Washington recognises that, the better

In 1924, Lord Gordon Hewart famously declared, “Justice should not only be done, but should manifestly and undoubtedly be seen to be done.” The lord chief justice of England, he believed that even a small allegation of possible bias by a court clerk meant justice was not seen to be done and, thus, was not done.

Lord Hewart’s quote came to mind while watching the opening night of the House’s Jan. 6 select committee public hearings. ...

Climate Fare:

Radagast: The Big Smoke

It sometimes saddens me, to think that our planet is being pushed beyond tipping points where global warming continues until large parts of the world simply become too hot for vertebrates to survive during parts of the year. Consider the old 4 degree chart:

.... We know it’s going to get worse, but I wish to propose to you, that there are some factors that we haven’t sufficiently considered: The collapse of civilization and the rapid melting of the ice sheets. ...

.... There are some scenarios here that could be quite useful. The pink one, with just ice melt in the North Atlantic, would translate into a pretty nice global breathing pause. Similarly, the blue one would translate into a bit of a global breathing pause in the latter half of this century. It’s possible that the ice sheets are what allows Mother Nature to slam the breaks when humans screw things up too badly.

-You need to shut down all the factory farms. It’s the human habit of eating pigs, chickens and cows, being fed soybeans and grains grown where we once had forests, that is mainly causing this global crisis.

-You need to reduce your species fertility rate. There will be 4 billion Africans by 2100, who can think this is a good idea?

-You need to clean the oceans. You can grow seaweed and oysters and mussels, which eat the algae that grow from the soil minerals leaching into the ocean. If you would eat the seaweed, the oysters and the mussels, then this would return balance to the world.

-You need to abandon the airplanes.

-You need to outlaw cryptocurrency mining.

If you do this most emissions would stop, the forests would regrow on the land where once the soybeans grew that are fed to the animals. This is the part I just can’t wrap my head around. You can have most of the stuff that you already have. You can have your Internet, you can have your bicycles, you can have trains, you can have delicious food in various forms. You can have a lot of good stuff.

You can even have all of the good drugs. Cannabis? You can grow it in your garden. Mescaline? All you need is some dry land to grow the San Pedro cactus. Mushrooms? All mushrooms are ecofriendly. We can even have DMT, there’s an invasive plant in Hawaii that has it in its root bark, it can be perfectly sustainable.

You just can’t have everything. No, you can’t have space tourism. No you can’t have two cars. No you can’t have megayachts. No you can’t eat cattle. And no you can’t fly to the other side of the world twice a year. Perhaps if we had used it sparingly we could have had some form of tourism. But humans will just accept no limits. It’s never enough. There is never a moment of gratitude.

And now you see the consequences.

COVID Fare:

I've continued to come across too much excellent COVID-related content (with contrarian evidence-based points-of-view!!) to link to it all

Read everything by eugyppius; el gato malo; Mathew Crawford; Steve Kirsch; Jessica Rose!

Paul Alexander, Berenson, Chudov, Lyons-Weiler, Toby Rogers are also go-to mainstays; a list to which I have added Andreas Oehler, Joey Smalley (aka Metatron) and, Julius Ruechel; Denninger worth staying on top of too for his insights, and especially his colorful language; and Norman Fenton; Marc Girardot; plus Walter Chesnut (on twitter); new additions: Sheldon Yakiwchuk and Aaron Kheriarty; I will of course continue to post links to key Peter McCullough material, and Geert Vanden Bossche, and Robert Malone, and Martin Kulldorff, and Jay Bhattacharya, and Sucharit Bhakdi, and Pierre Kory, and Harvey Risch, and Michael Yeadon, and John Ioannidis, and Paul Marik, and Tess Lawrie, and Zelenko, and Dolores Cahill, and [local prof] Byram Bridle, and Ryan Cole, and…

Read everything by eugyppius; el gato malo; Mathew Crawford; Steve Kirsch; Jessica Rose!

Paul Alexander, Berenson, Chudov, Lyons-Weiler, Toby Rogers are also go-to mainstays; a list to which I have added Andreas Oehler, Joey Smalley (aka Metatron) and, Julius Ruechel; Denninger worth staying on top of too for his insights, and especially his colorful language; and Norman Fenton; Marc Girardot; plus Walter Chesnut (on twitter); new additions: Sheldon Yakiwchuk and Aaron Kheriarty; I will of course continue to post links to key Peter McCullough material, and Geert Vanden Bossche, and Robert Malone, and Martin Kulldorff, and Jay Bhattacharya, and Sucharit Bhakdi, and Pierre Kory, and Harvey Risch, and Michael Yeadon, and John Ioannidis, and Paul Marik, and Tess Lawrie, and Zelenko, and Dolores Cahill, and [local prof] Byram Bridle, and Ryan Cole, and…

but going forward, my linking to material by those mainstays mentioned above will be reduced to key excerpts and/or essential posts

Don't worry too much, OK?

.... I’ll always defer to what the evidence shows. Very bad things can certainly happen in the future, but there is no evidence that bad things are happening right now, or that bad things are impending. All the speculation about killer variants to come is unsupported and really not worth worrying about.

.... Infection and death statistics were always bad and misleading, but they’ve become basically meaningless with Omicron. That’s why it’s important to ignore official Corona numbers, and focus relentlessly on excess mortality and overall rates of respiratory illness instead.

One-third of all excess deaths have been caused by the government's response.

.... COVID-19 deaths caused by the hasty deployment of the mRNA injection purported to reduce transmission, serious illness, and death. There is now substantial evidence that the mRNA injection does none of the three above. I made the point back in February 2021 that, in fact, I suspected that the injection actually increased COVID-19 mortality because it increased COVID-19 incidence, which had a significantly more profound impact than any illusion of protection suggested by the rigged vaccine-efficacy studies.

.............. I suspect that the story told in terms of lost life-years will be even more appalling than this one told in terms of absolute deaths because the ages of people dying directly from the injections is much lower than those dying of COVID-19.

el gato malo: do vaccine rollouts correlate to disabled americans?

... The 7 key studies are:

... It’s somewhat hard for me to avoid the impression that we’re on the trajectory of progressive immune depletion from repeated infections.

i have long been friends with ben. he’s done a lot of great work, runs a fantastic site on US all cause mortality, and has broken open a number of important issues around covid.

this may be another.

and it was not up for an hour before twitter not only marked the tweet as disinformation and locked ben out of his account all for asking a simple question that pretty much leaps out of this data.

the data comes from the FRED tool run by the st louis federal reserve bank. they are a well respected and high quality government run data source.

hard to see the problem with the data.

clearly, their issue is with the conclusion.

and, well, streisand effect and all, well, it caught my attention because naughty kitties love reading banned books.

correlation does not and cannot prove causality, but it can sure give us some strong hints, especially when we already know how off the charts the adverse event rate from these vaccines have been.

and boy is this timing provocative…

A few days ago I posted an article suggesting the mRNA vaccines were causing a spike in disability. Since that time the story has gone viral, I’ve had more time to look at the data, others have as well, and I now feel the case is very strong. Because this message is critically important, I am writing a second follow up article on the topic.

According to Health Canada

........... 48.6% of the Population of Canada has been Boosted, leaving 51.4% Not Boosted. The reason that this is important is because 48.6% of the population is making up a disproportionate rate of 70% of the cases, 69% of the Hospitalizations, and, again…a WHOPPING 82% of the Mortality.

51% of the population that doesn’t have a booster only made up 18% of the deaths…so for those who continue believe that this is Base Rate Fallacy…it actually isn’t…

.......... If you weren’t pissing mad up to this point in the pandemic…ya should be now!

IMO, natural immunity is not breached; the non-neutralizing Abs bind to the virus spike, & enhances infectiousness of virus

- Van Egeren et al.: “Risk of rapid evolutionary escape from biomedical interventions targeting SARS-CoV-2 spike protein”

- Yahi et al.: Infection-enhancing anti-SARS-CoV-2 antibodies recognize both the original Wuhan/D614G strain and Delta variants. A potential risk for mass vaccination?

- An infectivity-enhancing site on the SARS-CoV-2 spike protein targeted by antibodies

- Lectins enhance SARS-CoV-2 infection and influence neutralizing antibodies

- Structural insight into SARS-CoV-2 neutralizing antibodies and modulation of syncytia

- The emergence and ongoing convergent evolution of the SARS-CoV-2 N501Y lineages

- The Omicron variant is highly resistant against antibody-mediated neutralization: Implications for control of the COVID-19 pandemic

COVID vaccine mandates are necessary because the protected need to be protected from the unprotected by forcing the unprotected to use the protection that didn't protect the protected.

But this “protection” only works for a few months... then the vaccines pass zero on the efficacy scale and enter negative efficacy territory. The vaccinated then have an increased risk of infection, compared to the unvaccinated.

Then the only thing that can prevent the vaccinated from being more at risk of COVID infections is getting boosters every few months.

But the boosters can damage your immunity, as noted by Marco Cavaleri, one of the top officials at the European Medicines Agency who, according to Bloomberg,

"warned that frequent Covid-19 booster shots could adversely affect the immune response and may not be feasible. Repeat booster doses every four months could eventually weaken the immune response..."

Scientists are probably working on a solution for the "too many boosters" problem, but have not succeeded yet.

Meanwhile, "trust the science," and "trust the experts." I am sure they will come up with something.

***** Radagast: Progressive immune depletion from repeated infections

Imagine for a moment, that every SARS-COV-2 infection causes some damage to the function of your population of T-cells and it takes six months for your population to fully recover to baseline. This seems to be a fair guess, if hospitalized patients are somewhat representative of all patients. There’s also evidence of some damage after eight months, in people with long covid.

That light blue line suggests that we’re looking at the correct order of magnitude, when I propose it takes six months to recover T-cell immune capacity against SARS-COV-2. This estimate looks rather shocking of course, I may hope that the effect of reinfections on T cell counts is less immense, but I doubt it’s going to be zero.

I can only offer you simplifications for everything, because biology is infinitely complex. The T-cells that die are a non-random subset of your T-cells, other T-cells will fill the gap but their overall diversity will have been reduced and so you may have “holes” in your shield, that certain types of pathogens can make use of, whereas others can’t. This is not necessarily a catastrophe, it happens to everyone as we age, but it’s worth pointing out.

Imagine we come up with a variable that we call “T-cell function” and we’ll say it takes a 6% dip on average whenever you get SARS-COV-2, increasing again by 1% a month until it reaches baseline again after six months. Immunity against SARS-COV-2 is complex, it involves many different factors, but it seems fair to say that T-cells play some role in prohibiting people from getting reinfected, or eliminating an infection so early on during disease that we never notice anything happened and won’t even test positive.

....... If you take all these variables into consideration, it starts to look like it may take just a gentle nudge, to push people from the path towards developing herd immunity against a virus like this, onto the path of continual reinfection. What sort of gentle nudge are we looking for? Well let’s see. Perhaps something like this:

... This was what they saw after two doses of the same vaccine, ie the original protocol. At this point, we’ve injected some people with four doses of the same vaccine. Everything we see suggests those with additional doses get infected at higher rates, once the antibody response induced declines. There could be all sorts of mechanisms involved, like the infection enhancing antibodies or the simple problem that your immune system finds itself attacking all sorts of “decoy” spike proteins stuck on your own cells.

If we imagine for a moment that this is what’s going on, some sort of gradual self-amplifying immune degradation, what could we expect to see? Patterns like this:

..... I think we can agree there hasn’t been a big ADE/OAS bluecheck genocide, in which every Washington Post columnist or Democratic congressman so grateful for receiving their booster becomes equally grateful for every drop of blood they cough up in the ICU.

And yet simultaneously, we can’t pretend that strange things are not happening.

... So let me sketch out the scenario I’m worried about. ...

... If you earn a thousand dollar a month and spend 900, you don’t have to increase your expenses much to get stuck in a feedback loop of entering debt, followed by growing interest expenses to sustain your standard of living. Similarly, we may not need a strong influence, to push a population towards losing immune capacity faster than it is restored through natural compensatory processes. A vaccine that makes the body stuck with an immune response focused at an extinct version of the virus, given to the whole population, could theoretically be enough to tip the balance.

There is hardly anyone who is seriously looking at how mass vaccination influences the evolutionary trajectory of this virus. Geert van den Bossche has put out his predictions, Igor Chudov has pointed out that constant reinfections seem to happen to vaccinated people and El Gato Malo seems pretty worried about the herd-level homogenizing immune fixation, but beyond that, not a whole lot of people seem to be looking at this theoretical problem and what the consequences may prove to be.

There is of course the zero COVID crowd, who seem quite upset by the idea of constant reinfections, but their solution is to persist for longer, in the sort of follies that got us stuck in this situation in the first place: Masks that don’t work, vaccines that actively make it worse, lockdowns that are as damaging as the disease itself, etc.

The problem is, once you’ve made a commitment with your own arm, it becomes hard to reflect critically on these vaccines. If you spend your days terrified of the batsoupflu, the idea that you got fooled into taking a bad vaccine that makes you more vulnerable to this virus is so horrifying that you won’t open your mind to it.

By now we have sufficient evidence that vaccination leads to negative protection against infection from Omicron.

..... I’m sure if you’ve been reading these posts for a while, you’ll notice that it seems like I can’t make my mind up. Either it’s a nothingburger, or we invited a catastrophe onto ourselves. The problem is that the available evidence just doesn’t allow us to draw very strong conclusions. There are too many interacting variables and there is too little historical precedent to look at. This is why you find serious people on all sides of the spectrum, from team nothingburger, to the bluecheck team apocalypse, to the substack team apocalypse BUT ONLY FOR THE VACCINATEDtm.

I honestly just don’t have a clue what the long term trajectory is going to be, the more evidence I run into the more difficult it actually becomes to be convinced by any scenario.

[sidebar:

HA!.. love it, if only b/c that sounds like a very similar story to the different tribes of us trying to figure out inflation: hyperinflation? --- stagflation? --- stag-disinflation? --- recession-disinflation-deflation? ]

... I’ve argued here that we could consider the mass vaccination campaign to be a gentle nudge of the sort that turns a profitable company into a company that finds itself unable to pay off the interests on its debt. But ultimately, to characterize what’s going on as a gentle nudge may flatter the vaccination campaign too much. After all, here’s what we’ve done:.... [long list of 9 long-ish bullet points]

... So there are quite a few pathways towards increased infection susceptibility that are worth looking into. The most popular one is of course the OAS/ADE story, but what we have is concrete evidence that these vaccines have the worst possible effect: They prohibit widely vaccinated populations from developing herd immunity against this virus. ...

People aged under the age of 40 being urged to go and get their hearts checked

May potentially be at risk of having Sudden Adult Death Syndrome (SADS)

SADS is an 'umbrella term to describe unexpected deaths in young people'

Tweets & Quotes of the Week:

Anecdotal Fare:

Back to Non-Pandemic Fare:

CaitOz Fare:

The US Empire Acts Like A Textbook Manipulative Sociopath

Pics of the Week:

Aaron Kheriaty, MD: “New levels of systematic mendacity. Sudden Adult Death Syndrome (SADS) is not a thing. These are cardiac deaths. Stop pretending we don’t know why they are elevated. Just f***ing stop. Enough of this. It’s only a mystery if you are blind.”

Anecdotal Fare:

Was it vaccine related? That's what the math says. Here's my calculation.

Hear from Ernest Ramirez, Dan Hartman, and author Dr. Colleen Huber, NMD.

Back to Non-Pandemic Fare:

GeoPolitical Fare:

Vilches: Pitchforks Soon In Europe?

Dear Europeans, For your own children´s sake — on my knees and with my saddened eyes humbly looking downwards — I beg of you to please stop the current self-destructive nonsense dead in its tracks by immediately demanding from your political class to import the bloody Russian oil normally once again as Europe had been doing for dozens of years. The impact that the ban on Russian oil has upon your daily lives now and for years yonder is such that at the very least a Referendum should have been held. But it was not, and without consultation, the EU leadership acted on their own.

Please be advised that the EU un-elected brass simply does not represent you or your needs. They were all voted amongst themselves into their positions like members of a committee in a private country club. If left unchecked, EU politicians will now continue misrepresenting you and, on your behalf — with your hard-earned assets and livelihoods – will keep on picking a most unnecessary and prolonged armed conflict with Russia, eventually forcing upon you a total war scenario where chances play out all very strongly against you, with Russia probably resulting unscathed.

European leaders crave for their war, so they can´t think of a better way to provoke it than by applying ever larger and ´meaner´ sanctions on Russia as if (a) sanctions were effective and (b) as if Europe could win such war (not).

Accordingly, we now have yet another set of spanking new EU “sanctions” in package No. 6 that will eventually backfire flat on Europe´s face – like all the others — such as banning the insurance and financing of oil tankers that carry Russian oil. ....

... Russia does not need to fire a single shot or land a single missile on European territories to win such a total war. Think tanks in Europe and elsewhere know this but say nothing. It´d be plenty enough for Russia to just shut off your nat-gas supply, period. And not even to the whole of Europe. It could possibly be to only, say, some limited area in Germany. But you need not put up with any of this. Europe should already have learned from history books and its generals not to underestimate or discriminate against Russia. Let alone cheat on it repeatedly as Europe has done since the downfall of the former Soviet Union. Yet again, history will not be kind to anyone directly or indirectly involved, including yourselves.

....... I do not believe for one moment that U.S. intelligence services do not know what is going on in Ukraine and in Kiev. They know that the Ukraine has lost the war and will have to sue for peace as soon as possible. They also have told the White House that this is a case and that the whole idea of setting up the Ukraine to tickle the Russian bear was idiotic from the get go. The question now is who will take the blame for the outcome. Who can the buck be passed to?

“Terror will be not only a means of self-defense, but also a form of agitation, which will affect friend and foe alike, regardless of whether they desire it or not.”– UVO (fascist Ukrainian Military Organization), brochure from 1929.

Part I of a 3 Part Series on Ukrainian Fascism and the U.S.

Part II of a 3 Part series on Fascism and the CIA in Ukraine

The Biden administration clearly overestimated the extent of international outrage at Russia’s invasion of Ukraine.

Eric Zuesse has this analysis: THE AMERICAN EMPIRE IS BEING DEFEATED; ASIA WILL LEAD THE FUTURE.

I agree with the first part, but the second part remains to be seen. Maybe "Asia" is not such an entity. Maybe the future really will be distributed and "multipolar".

Zuesse points out the assassination attempt against Turkey's President Erdogan in 2016, carried out by US-aligned Turkish military officers. Russia saved him at the last minute. The NATO-member veto on new members being approved prevents further NATO expansion while Erdogan lives and cooperates with Russia. It largely incapacitates NATO, since Turkey is in a critical position, controlling black Sea and Mediterranean access, and pipeline transit routes to Europe.

Zuesse does not bring up that Turkey stands to have a much elevated position in a new Eurasian world-economic-order, firstly since it will be able to repudiate it's vast $US denominated debts, but also because Turkey is likely to be less frequently insulted, and given better consideration than the US does. In a new regime, Erdogan clearly sees growth potential for Turkish power and influence.

.... The lack of enforcement of the declining western financial order must become apparent at the same time as an Eastern/multipolar option becomes available. That will make the choice "easy" for many debtor countries, and it will get easier as the number of participants in the alternative system increases.

... The clarity of this path does not determine how quickly it will fall into place, but this summer's dollar shock needs to be managed and people need food. The IMF, World Bank and western finance in general may not see clearly how weak their hand is (hubris). ...

With The Destiny of Civilization: Finance Capitalism, Industrial Capitalism or Socialism, Michael Hudson, one of the world’s leading independent economists, has given us arguably the ultimate handbook on where we’re at, who’s in charge, and whether we can bypass them.

Let’s jump straight into the fray. Hudson begins with an analysis of the “take the money and run” ethos, complete with de-industrialization, as 90 percent of US corporate revenue is “used to share buybacks and dividend payouts to support company stock prices.”

That represents the apex of “Finance Capitalism’s” political strategy: to “capture the public sector and shift monetary and banking power” to Wall Street, the City of London and other western financial centers.

The whole Global South will easily recognize the imperial modus operandi: “The strategy of US military and financial imperialism is to install client oligarchies and dictatorships, and arm-twist allies to join the fight against designated adversaries by subsidizing not only the empire’s costs of war-making (“defense”) but even the imperial nation’s domestic spending programs.” This is the antithesis of the multipolar world advocated by Russia and China.

In short, our current Cold War 2.0 “is basically being waged by US-centered finance capitalism backing rentier oligarchies against nations seeking to build up more widespread self-reliance and domestic prosperity.”

............ Hudson succinctly frames the central issue facing the world today: whether “money and credit, land, natural resources and monopolies will be privatized and concentrated in the hands of a rentier oligarchy or used to promote general prosperity and growth. This is basically a conflict between finance capitalism vs. socialism as economic systems.”

To advance the struggle, Hudson proposes a counter-rentier program which should be the Global South’s ultimate Blueprint for responsible development: public ownership of natural monopolies; key basic infrastructure in public hands; national self-sufficiency – crucially, in money and credit creation; consumer and labor protection; capital controls – to prevent borrowing or denominating debts in foreign currency; taxes on unearned income such as economic rent; progressive taxation; a land tax (“will prevent land’s rising rental value from being pledged to banks for credit to bid up real estate prices”); use of the economic surplus for tangible capital investment; and national self-sufficiency in food.

CaitOz Fare:

The US Empire Acts Like A Textbook Manipulative Sociopath

........... The vast globe-spanning power structure that is loosely centralized around the United States is a powerful military force and a powerful economic force, but its most potent weapon by far is its ability to control the narrative about what’s happening in the world. The use of oligarchic media, Silicon Valley and Hollywood to manipulate public thought and thereby control the way people think, act and vote at mass scale all around the world is unlike anything ever seen in any empire in history.

.... It’s a scary time to be alive. But it’s also fascinating. Unlike anything that has ever happened on this planet before.

Other Quotes of the Week:

Brit mercenary: “Don’t get into a war you don’t really understand”

I look forward to finding out if we escape.

Other Quotes of the Week:

Brit mercenary: “Don’t get into a war you don’t really understand”

Curtis Yarvin: That said: the largest existential risk facing humanity is the present global political order. By far the most effective form of altruism is to replace that regime, replacing an oligarchic political order with a monarchical political order. This is rational and “rationalists” are not. Then again, nor are most people.

Random Stuff:

Random Stuff:

Lemoine: Is LaMDA Sentient? — an Interview

Coyne: Tish Harrison Warren becomes the female Jordan Peterson. And suggest your own “rules for life”!

Well, Anglican priest Tish Harrison Warren isn’t nearly as weird as Peterson, but they’re both religious and they’ve both made lists about how to improve your life and your world. Harrison’s column (click to read) is to fixing the world as a cough drop is to a cough (cough drops don’t work).

I’m starting to realize that Warren is actually not a religion columnist, though she can’t keep Jesus out of her weekly NYT columns, but rather a self-help columnist, commissioned to make people feel better about themselves and the world. She does this like a human Pez dispenser, regularly producing new bromides. There’s nothing wrong with trying to cheer people up, but crikey, can’t she think up something original?

Here’s the lead-in to her column of “solutions for a broken world”, which reminded me of Jordan Peterson’s bestselling “12 Rules for Life” ...

..... Look, this isn’t bad advice, but it’s trite advice, and I, for one, don’t need to pray or observe the Sabbath. What baffles me is why the NYT continues on this hamster wheel of cerebral pabulum.

Long Reads / Big Thoughts

.... now that we’re entering the planetary endgame ....

Democracy is just a kabuki theatre

The notion that We the People are somehow in control just because we go to the polls every few years, or that the political parties we vote for represent us and turn our wishes into action, or that government bureaucracies are tuned in to our needs… If only these things were true.

What we call democracy is really just kabuki theatre: politicians, lobbyists, corporations, think tanks and intellectual pundits thrashing around, jostling each other, triggering social-media storms, running op-eds in the global media outlets.

The sad truth is, none of these so-called political, cultural or intellectual leaders have a clue about how to handle the big stuff, how to fix the climate crisis, or avert the next financial meltdown.

The dawn of the Dark Age

You have to wonder how this current time we’re bumbling through will be remembered. Typically, we slap a label on every era of human history, and usually it’s about a monumental tool we invented or a cultural transformation that fundamentally altered our lives. The Bronze Age. The Renaissance. The Modern Age. The Space Age. The Digital Age.

But now it looks like our era will be known not for a leap forward but a slide back. Future generations will remember us for the damage we did: the carbon we spewed, the plastic we dumped, the forests we clearcut, the species we exterminated. And also for the financial meltdowns we unleashed, the inequality we tolerated, the surveillance we endured, and the epidemic of mood disorders, anxiety attacks and depression we inflicted upon ourselves.

Instead of the Anthropocene, why don’t we call it what it really is: the dawn of a Dark Age, a time when we turned away from nature and each other and ran our planet into the ground.

Rewriting our constitutions

Imagine if we could call it Regenerative Age instead. Imagine if we had courage to even visualise it.

Who owns the water? Should nature have rights? What voice should local communities have over resource extraction? Should future generations have a say?

We need to start re-writing our constitutions with such questions in mind. These documents are the embodiment of our ideals and aspirations, our beliefs and values. ...

Pics of the Week:

No comments:

Post a Comment