*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Inflation: should we take away the soup bowl?

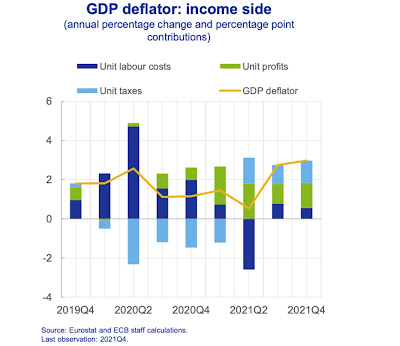

The graph below [above] has been constructed by economists of the European Central Bank. It’s based on national accounts data. It shows that present day inflation is profit driven, not wage driven. Money flows to profits, not wages. What does this mean for monetary, fiscal and income policy, taking some other aspects of inflation into consideration? Quite a lot.

High central bank interest rates have a dual purpose. First, they are intended to show that central banks are serious. Let’s call this Peacock rates: showing your feathers. This should somehow give people the idea that increasing prices is a bad, costly, unnecessary habit which, people being rational, leads people to stop raising prices. Second, they are meant to increase borrowing costs which should lead to lower investments (think: construction) and consumption (less consumer borrowing). Let’s call this: ‘taking away the soup bowl’ rates: demolishing livelihoods. For younger readers: intended pun. In the case of a wage-price spiral this should,after a considerable lag (18-36 months?) mitigate wage increases. But: there is no wage-price spiral. What’s staring us in the face is a profit-price spiral. Because of this profit-price spiral real wages are declining with, depending on the EU country, 5 to 10%. This decrease will already lead to a decline of purchases and a decline of prosperity of, especially, poor households. Considering the composition of present day inflation (high energy and food prices, high input prices for among other sectors construction) this will lead to less demand without any increase of interest rates. Inflation itself is, considering the composition of present day inflation, already . For central banks the silver lining is that profit margins are much more sensitive to changes in demand than wages – which means that business cycle related increases in profit margins will crash (if they haven’t already) and inflation will get lower on its own.

Let me be clear: I do think that present day negative rates are especially fortuitous. They have fueled asset price booms (houses!). Not good. Fiscal instead of monetary policies should have bore more of the business cycle brunt in the EU (which might include lower VAT rates (0%) on labor intensive services etc. etc.) while unemployed should be put to work and unsustainable debts should be written off. But this is not about the level of rates. It’s about the question if they have to be increased to mitigate inflation. The answer to this is clear no. A profit-prices spiral is highly sensitive to changes in demand and demand (consumption, investment, exports) is already coming down.

Company scaling back warehouse footprint amid e-commerce slowdown

It ain't about the money.

......... As the great Northwestern University economist Robert Eisner explained almost a quarter-century ago, Congress could always bestow the same legislative language on Social Security’s trust funds or even dispense with the trust funds altogether. They are, after all, “merely accounting entities.” Instead of fretting over arbitrary numbers on a ledger, Eisner wanted people to understand that “Social Security faces no crisis now or in the future.” It cannot “go bankrupt.” It will be there as long as those who seek to undermine it don’t get their political way.

Ironically, it’s the same point made here by MMT economist Alan Greenspan (wink). Okay, we don’t claim Greenspan as one of our own, but he does get this one right. And, more importantly, he gets it right for the right reasons. It’s as if those are MMT lenses he’s wearing!

Listen to him explain to former Congressman Paul Ryan (R-WI) why his obsession with “system solvency” isn’t the right thing to worry about when you’re thinking about the spending capacity of a government that issues a non-convertible (floating exchange rate) currency....

... It’s a shame more people don’t understand that the entire debate over “solvency” is rooted in a flawed understanding of our monetary system and the mechanics of government finance.

Quotes of the Week:

...

... ...

Bubble Fare:

... Pundits are just starting to realize that recession is inevitable. Most believe that it will happen in 2023. The technical definition of a recession is two quarters of negative growth. This week, final Q1 GDP came in at -1.6% and Q2 real-time GDP crashed down to -2.1%. Which means that technically we've already met the definition of a recession. Theoretically, Q2 could pull out of the nosedive, however Q2 just ended, therefore only backward data revision can save the quarter. In other words, recession will very likely be backdated to the beginning of 2022 and yet most pundits see it happening in early 2023. They are a FULL YEAR off from reality. With forecasting like that, who needs enemies? Somehow, the Fed is even more clueless because they are still holding out hope that recession won't happen at all.

Then there are the pundits who are saying, Ok recession is inevitable but it will be a "soft landing". They never quite explain what that means. The difference between a soft landing and hard landing is whether or not there is deleveraging of households and corporations. Because mass deleveraging implies major job cuts. Most stock forecasters remain sanguine on further market downside, because they assume a "soft landing", despite the fact that the Fed has the least amount of dry interest rate powder in history. This key assumption makes it easy for them to data mine the past 50 years and find the LEAST painful recessions and bear markets for comparison to the current market. Which has become a very common practice lately.

We are to believe that the LARGEST asset bubble in human history will require the LEAST amount of Fed rate buffer and will be a soft landing.

You have to be brain dead to believe that, hence it goes largely unquestioned.

....... Why did so many economists happily ignore the COLLAPSE in consumer confidence that has been taking place throughout 2022? It's because they believe they are far smarter than the average consumer, whereas the opposite is true, they are as dumb as a brick.

... Another lie we've been told is that there are shortages of everything, especially semiconductors.

This week we learned that there is now a massive glut of semiconductors.

No surprise, semiconductors were the WORST performing sector of Q2 since they are at the intersection of Tech AND Cyclicals.

... Commodities of course are a huge part of "inflation". June saw the fastest collapse in copper since 2011, and before that 2008.

... Which gets us to the imploding housing bubble.

... In summary, there are no shortages of ANYTHING. Soon there will be oversupply of EVERYTHING. The shortage lies were told so that companies could jack up prices and create a buying frenzy to pull forward demand.

It worked great. What's coming is an everything deflation, that will be out of central bank control. And it will give lie to all of the sugar coated bullshit that investors have been SOLD in 2022.

... You don't have to be a genius to figure out what's coming, but you do have to be able to fog a mirror. Which appears to be a bridge too far for most people.

“The industry and these companies are shrouded in mystery. In that situation, history tells us that there will be all sorts of risky behavior, fraud, and deceit,” says John Reed Stark, a former chief of the Securities and Exchange Commission’s Office of Internet Enforcement. “It’s not the Wild West. It’s a Walking Dead-like anarchy with no law and order.”

Bitcoin is down 70% from its high and has taken about $900 billion in market capitalization down with it. And that’s just Bitcoin. The other tokens and coins are, for the most part, down even more. The related market for NFTs is also crashing.

Back to Bitcoin – it’s an epic fall for an asset that many believed would offer diversification from the stock market and a hedge against inflation. It has failed to do either, in spectacular fashion. .....

1. Everyone hates rules and regulations until it’s too late. The fantastyland idea of software protocols and algorithms and communities policing themselves flies in the face of 500 years of financial market history. Digital money is still money and people are insane. That doesn’t change, no matter what kind of investment we’re talking about. Financial markets were born in a time where you could not safely drink water so everyone drank alcohol all day long, out of cups made of lead. This is Europe in the 1500’s. We were crazy then and we are crazy now.

(not just) for the ESG crowd:

In emphasizing technological solutions, the elite are sidestepping their own responsibility for the climate crisis.

Other Fare:

Contrarian Perspectives

Extra [i.e. Controversial] Fare:

*** denotes well-worth reading in full at source (even if excerpted extensively here)

Regular Fare:

The ACA Marketplace Is a Scam Covered With the Veneer of “Choice”

Doctorow: McKinsey, consiglieri of the opioid crisis

McKinsey is a global "consulting" giant, with its tendrils in every unsavory industry from private ICE gulags to (mis)managing violent prisons to publicly funded private charter schools. Internally, McKinsey promotes itself as akin to the Jesuits and the Marines (no, really): "analytically rigorous, deeply principled seekers of knowledge and truth."

McKinsey has been embroiled in an endless series of grotesque scandals, caught "advising" companies and governments on projects that produced literal crimes against humanity, at scale. Naturally, the company downplays its role in these scandals, insisting that it was mostly involved in "marketing." ...

Unsustainability Fare:

Limits and Beyond: the message from Dennis Meadows. A review of the 3rd chapter

We have reviewed the first two chapters of the new book Limits and Beyond. The reviews can be found at The Yawning Gap (Chapter 1) and No More Growth (Chapter 2). In this post we take a look at the third chapter, written by Dennis Meadows, a co-author of the original Limits to Growth. Dr. Meadows reports that he has delivered over a thousand speeches to a very wide variety of audiences. In this chapter the author summarizes “19 of the most common questions, comments and objections” that he has received over the years. Some of his insights are as follows: ...

COVID Fare:

SmI've continued to come across too much excellent COVID-related content (with contrarian evidence-based points-of-view!!) to link to it all

Read everything by eugyppius; el gato malo; Mathew Crawford; Steve Kirsch; Jessica Rose!

Paul Alexander, Berenson, Chudov, Lyons-Weiler, Toby Rogers are also go-to mainstays; a list to which I have added Andreas Oehler, Joey Smalley (aka Metatron) and, Julius Ruechel; Denninger worth staying on top of too for his insights, and especially his colorful language; and Norman Fenton; Marc Girardot; plus Walter Chesnut (on twitter); new additions: Sheldon Yakiwchuk and Aaron Kheriarty; I will of course continue to post links to key Peter McCullough material, and Geert Vanden Bossche, and Robert Malone, and Martin Kulldorff, and Jay Bhattacharya, and Sucharit Bhakdi, and Pierre Kory, and Harvey Risch, and Michael Yeadon, and John Ioannidis, and Paul Marik, and Tess Lawrie, and Zelenko, and Dolores Cahill, and [local prof] Byram Bridle, and Ryan Cole, and… but going forward, my linking to material by those mainstays mentioned above will be reduced to key excerpts and/or essential posts

Smalley: 21st Century crimes against humanityAn update from my indomitable friend, Douglas Brodie of Nairn covering the similarities between COVID, climate change and the WEF Great Reset.

This is a follow-up to my previous emails here, here, here and here to inform you of developments, facts and opinions which are not reported by the corrupt, Bill Gates-bribed mainstream media (MSM) on the government’s criminal abuse of the general public.

I hope that the new material in this email will help more people to wake up as to what is going on.

More evidence on the Covid “plandemic” .......

Guetzkow: Springtime for Stillbirths in GermanyWinter for women and babies

I just received FOIA’d data on stillbirths in Germany from my friend and colleague, Prof. Christof Kuhbandner and share them with his permission. The picture they reveal is jaw-dropping. ...

A very unusual pattern this year -- 9 months after young people vaccinated

Budapest is the new Taiwan -- Birth Rate Drop of -22.2%!

..... You can see that the five least vaccinated counties experienced only a 4.66% drop in birth rates between Q1 of 2021 and Q1 of 2022. At the same time, five most vaccinated counties experienced a 15.2% drop in birth rates!

.... It is becoming fairly apparent that the 2022 fertility drops are the true “black swans” of demographics, unprecedented in the breadth of countries involved, very large, extremely statistically significant, and very worrying.

A big question of the day is: is this a temporary situation or will the declines be permanent? If they are permanent, it may lead to depopulation of affected countries!

The answer is UNKNOWN to me and is also unknown to anyone else. Beware of vaccine advocates saying “birth rate declines are a temporary no big deal, the vaccine is working as expected”. Beware of vaccine skeptics jumping the gun and proclaiming that we will for sure be depopulated. We genuinely do NOT know, yet. The time has not passed yet, for us to know.

Dr. David Martin has a deep medical science and investment resume. Dr Martin also runs a company (M·CAM International) that finances cutting edge innovation worldwide. He is also one of the key people seeking justice in lawsuits suing medical companies and the federal government involved in delivering the so-called vaccines for CV19. In simple terms, according to Dr. Martin, the CV19 vaccines are “bioweapons.” Big Pharma and the government knew it and also knew it would cause massive deaths and permanent injuries. Dr. Martin says, “It’s going to get much worse. . . . It is not a Corona virus vaccine. It is a spike protein instruction to make the human body produce a toxin. . . . The fact of the matter is the injections are an act of bioweapons and bioterrorism. They are not a public health measure. The facts are very simple. This was premeditated. . . . This was a campaign of domestic terror to get the public to accept the universal vaccine platform using a known biological weapon. That is their own words and not my interpretation.”

... Dr. Martin thinks the catastrophic effects of the CV19 injections will hit the medical industry soon. Dr. Martin explains, “The dirty secret is . . . there are a lot of pilots having micro vascular and clotting problems, and that keeps them out of the cockpit, which is a good place to not have them if they are going to throw a clot for a stroke or a heart attack. The problem is we are going to see that exact same phenomenon in the healthcare industry and at a much larger scale. So, we now have, along with the actual problem . . . of people getting sick and people dying, we actually have that targeting the healthcare industry writ large. Which means we are going to have nurses and doctors who are going to be among the sick and dead. That also means the sick and the dying are also not going to get care.”

How to turn the ship around.

................. Understandably, blackmailing people to knowingly and repeatedly play a Russian roulette, until the bitter end, naturally evokes a certain measure of bitterness and dejection on the part of the blackmailed. And a panoply of other strong feelings toward the “authorities,” and the “useful idiots” cheering on and clamouring for more repressions. As some comments to my previous post amply demonstrated.

But, strong negative emotions should not be the only, albeit understandable, response. We should be recruiting allies from and building bridges to the silent passive majority, by continuously providing viable alternatives both in truthful medical information as well as in the moral messaging.

Tweets & Quotes of the Week:

Anecdotal Fare:

Stark indications of the global toll, from Portugal and Hungary, Massachusetts, the Bahamas and Jamaica, the UK, Spain and Italy

Back to Non-Pandemic Fare:

GeoPolitical Fare:

agree with Ilargi (hat tip), who wrote: "Not a fan of Jeffrey Sachs, but this may be useful."

The war in Ukraine is the culmination of a 30-year project of the American neoconservative movement. The Biden administration is packed with the same neocons who championed the U.S. wars of choice in Serbia (1999), Afghanistan (2001), Iraq (2003), Syria (2011), Libya (2011), and who did so much to provoke Russia’s invasion of Ukraine. The neocon track record is one of unmitigated disaster, yet Biden has staffed his team with neocons. As a result, Biden is steering Ukraine, the U.S. and the European Union towards yet another geopolitical debacle. If Europe has any insight, it will separate itself from these U.S. foreign policy debacles.

.... The middle class, the main target of the Great Reset enthusiasts, is beginning to feel prices rising more and more, even though they don’t fully agree with the war at the moment, which is impressive if you consider that public opinion is of little concern to the leaders who are driving the economic-military and diplomatic disaster in Europe. The most practical example of this is recent with the Nordics joining NATO without any referendum or popular poll within the countries’ society. And the argument to be used I can already imagine: “But democracy is representative, William! If the people vote for politician x, it’s because they agree with his platform.” Yes. But that is half right. Not entirely.

Democracy, especially representative democracy, has a serious flaw, precisely in terms of representation. Politicians who are not faithfully committed to the objectives of the nation, of the homeland, but, unfortunately, are rather vain, cause a distortion in the etymological sense of the term “representative democracy”, because who would it represent? Not the people!

Turley: Key Witnesses Challenge Bombshell Allegations of Key Witness Before the 1/6 Committee

There is an old expression in the media that some facts are just too good to check. It is a recognition that journalists can sometimes be reluctant to endanger a good story by confirming an essential fact.

Other Quotes of the Week:

Tracey: Natasha Bertrand, one of US media’s most dedicated Russiagate fabulists, was naturally on hand, under the auspices of her current gig at CNN. It’s nothing new for journalists to systematically botch a story in spectacular fashion, and then subsequently be rewarded with a steady succession of lucrative media gigs — that’s basically how the industry works.

...

No comments:

Post a Comment