*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

The balanced portfolio strategy of allocating 60% to equities and 40% to fixed income generated a highly satisfactory 7.9% annualized return over the last 30 years. Despite the excellent returns earned by investors following this strategic model, the past couple of years have seen a parade of articles with headlines such as “Is the 60/40 Portfolio Obsolete?” and “Is the 60/40 Dead?” Given the central importance of this moderate allocation strategy to investment industry practices, we felt a closer look at the 60/40 portfolio was in order.

Valuation Matters

Skepticism and concern over the 60/40 portfolio arose from the valuation extremes reached by each asset class in 2021. Chart 1 plots the yield-to-worst for the Bloomberg U.S. Bond Aggregate Index along with the earnings yield of the S&P 500 Index, our two asset class representatives. Despite excellent backward-looking returns for the 60/40 mix, future returns are driven by current valuations, and those were singularly unattractive in late 2020 and early 2021.

The points in this exhibit represent the joint valuation of stocks and bonds during each quarter since 1976. The four red diamonds found in the lower left portion of Chart 1 signify the last two quarters of 2020 and the first two quarters of 2021, the period when doubts about the 60/40 strategy became increasingly louder. These four quarters represent the worst joint valuations for stocks and bonds in 45 years and starting from valuation extremes in both asset classes, it was hard to see how future 60/40 returns could come anywhere close to the long-term average.

As it turns out, the skeptics were right! The 60/40 strategy had a terrible 2022, and the strategy utterly failed in protecting investors during this severe bear market. Chart 2 depicts annual returns for the 60/40 portfolio, with the red bars measuring the contribution from fixed income, the blue bars measuring equity’s impact, and the black diamonds capturing the combined 60/40 portfolio returns.

The four deadliest words in life are ‘it’s different this time’. Anyone who utters these words usually ends up being carried away, feet first. So, it’s especially worrying that the ‘it’s different this time’ narrative is coming from none other than the world’s most important central bank, the US Federal Reserve.

Through the past 75 years, the US unemployment rate has either not gone up meaningfully, or it has gone up by a lot. The US unemployment rate has never gone up by ‘just’ 1 percent. Yet when asked at last week’s press conference if the cost of killing inflation could be kept to the unemployment rate going up by ‘just’ 1 percent, Jay Powell answered:

“Yeah, absolutely it’s possible… this is not a standard business cycle where you can look at the last ten times there was a global pandemic… it is unique”

The Sequence Of Events Leading To Recession Is Always The Same

It’s not every day that there’s a global pandemic. Then again, it’s not every day that the Bretton Woods monetary system collapses, as happened prior to the 1970s recessions. It’s not every day that the mother of all stock market bubbles bursts, as happened prior to the 2001 recession. And it’s not every day that there’s a nationwide housing bust in the US, as happened prior to the 2008 global financial crisis.

The backdrop to every business cycle is ‘different this time’. But the chain reaction that takes the economy into recession is always the same.

- First, sales decline relative to wages.

- Second, firms’ profits plunge.

- Third, firms lay off workers.

- Fourth, at a tipping-point of a 0.5-0.6 percent rise in the unemployment rate, consumers take fright and increase their precautionary saving, and banks slow their lending.

- Fifth, this further slowdown in spending is the self-reinforcement which causes the unemployment rate to go up by at least 2 percent. Meaning, a recession.

This chain reaction explains why the US unemployment rate is non-linear: it either doesn’t go up meaningfully, or it goes up a lot. ....

..... So far, there is nothing to suggest that it’s different this time. To repeat, the US jobs market remains strong because economy-wide profits have not declined enough to trigger widespread layoffs. We will only discover if it’s different this time after profits plunge, and we won’t have to wait long to find out.

We must watch the data and keep an open mind. But until the data proves that this time is different, it most likely is not. Therefore, the recommendation is to buy the November 2024 Fed funds future (FFX24), or more liquid close equivalent FFZ24.

It also implies staying overweight bonds versus equities on a 6-12 month horizon.

********** Dolan: Why the Inflation of 2021-22 Did Not Spiral Into Stagflation and Implications for Policy Going Forward

The ominous uptick in consumer prices that began in the spring of 2021 triggered alarm bells. By fall, the future looked dark to many observers. A market strategist cited by Reuters warned that the surge in inflation would not be transitory, as the Fed and Biden administration were then promising. “Sticky and sustained” inflation when the country was “past peak growth” would constitute “stagflation," he said, reviving a term coined in the 1960s.

Yet there was no stagflation. The 2021-2022 episode turned out to be very different from the economic turmoil that bedeviled the U.S. economy from the 1960s into the early 1980s. Its brevity was one key difference. A second difference was a far greater volatility of relative prices. A third concerned the role of expectations. As this commentary will explain, these three differences, taken together, carry important lessons for policymakers.

“Transitory” or not, the inflation of 2021-2022 was short-lived

To be sure, not everyone caught stagflation fever. Janet Yellen, the only person to have served as the president's chief economist, Fed chair and Treasury secretary, was one skeptic. “My judgment right now is that the recent inflation that we have seen will be temporary,” she told a congressional committee in May of 2021. By the end of the year, even she had second thoughts. In retrospect, though, her original assessment looks more right than wrong. By the end of 2022, inflation had come down even more quickly than it had risen, and did so while the unemployment rate was, surprisingly, falling.

......... As the chart shows, the wave that peaked early in 1980 was the culmination of three that spanned nearly two decades. Each of the waves made the next one more difficult to handle because of its effects on expectations – a theme to which we return below. The inflation of 2021-22, in contrast, was a single spike that came after a 40-year period of relative price stability that has come to be known as the “Great Moderation.”

............. Episodes of inflation like this that begin with an exogenous change in the price of a single good are known as supply shocks. Supply shocks pose a dilemma for policymakers. When inflation is caused by rising aggregate demand, the Fed’s go-to remedy is to increase interest rates. As the effects spread throughout the economy, they reduce demand for all goods and services, and inflation slows. If rates are raised in a timely fashion and not by too much or too little, the overheated economy will cool off without major disruptions.

Inflation caused by a supply shock is trickier. Since a supply shock begins with an increase in the relative price of one good (oil in our example) and then spreads to other markets where that good is used as an input, there would be no way to prevent an increase in the average price level unless the prices and wages in some other sector fall. But stickiness gets in the way.

Not only are the prices of some goods inherently stickier than others, but many prices are stickier downward than upward. Consider apartment rents, for example. ......

Implications for policy

Earlier sections have described three fundamental differences between the inflation of 2021-2022 and the repeated waves of stagflation that roiled the U.S. economy in the 1960s and 1970s.

- Whether we call it “transitory” or not, the recent inflation has been the shortest of the four episodes examined, with the most rapid rate of acceleration and most rapid rate of disinflation.

- The 2021-2022 inflation, which was, in large part, driven by an unusual combination of supply shocks, had the greatest relative price volatility of any period in the last 60 years.

- The decades of the Great Moderation saw a fundamental regime shift away from adaptive and toward anchored expectations, as shown by a reversal of the Phillips curve pattern and confirmed by conventional survey-based and market-based measures.

Here are some conclusions for policy that I draw from these differences.

Policy in 2021-2022 does not look so bad, after all.

................................................ I’m not quite so pessimistic. In the short run, in the United States, the greater risk is likely to be a plain old recession without the inflation. Christina Romer, head of the Council of Economic Advisers in the Obama administration, explained why in a 2022 keynote address to the American Economic Association. The problem, which she illustrated vividly with a pair of charts, is that any policy moves by the Fed take about two years to affect output and unemployment. That means that sharp increases in interest rates since 2021 are just now becoming visible. Because of the long lags, says Romer, “policymakers are going to need to dial back before the problem is completely solved if they want to get inflation down without causing more pain than necessary.” A “soft landing” without recession is still possible, but the longer the Feds sticks to its strict anti-inflation program, the less likely that becomes.

- The strength of the link between money growth and inflation depends on the inflation regime: it is one-to-one when inflation is high and virtually non-existent when it is low.

- A link can also be seen in the recent possible transition from a low- to a high-inflation regime. An upsurge in money growth preceded the inflation flare-up, and countries with stronger money growth saw markedly higher inflation.

- Looking at money growth would have helped to improve post-pandemic inflation forecasts, suggesting that its information value may have been neglected.

The stock market is betting on a Goldilocks scenario. Jerome Powell doesn’t foresee a recession, instead he forecasts a soft landing. Apollo is bettering the soft landing scenario with an optimistic “no-landing.” Regardless of which description you choose, all three are bets that a recession will not occur.

Assuming the markets, Apollo, and Powell are right, stocks may have already bottomed with a new high not too far away. Accordingly, investors buying into a soft or no landing should ignore numerous recession warnings and load up on stocks.

However, suppose the soft landing crowd is wrong and recession warnings, such as the yield curve and most national and regional manufacturing surveys, prove prescient, as they reliably have. In that case, 2023 may be a rough year for the stockholders.

While a soft landing may be good for stocks, recessions and stock prices are not the best of bedmates. Therefore to better appreciate what a recession is and how we can better track the odds of a recession, we lean on the arbiter of recessions, the National Bureau of Economic Research (NBER).

.... Getting a recession forecast right and early is essential. As shown below, stocks tend to decline three to six months before a recession starts. Being late on a recession call or failing to forecast a recession can prove costly. .......

... Now that we know two crucial recession indicators, we must ask how else we can stay ahead of a recession. The obvious answer is to understand when incomes and employment will decline. .....

Optically flattering economic data, a still-positive real-yield curve and contracting liquidity together show that stocks remain entrenched in a bear market.

“Let no man boast that he has got through the perils of Winter until at least the 7th of May,” said the writer Anthony Trollope. Yet it is only early February and the market is seeing green shoots everywhere.

Last week’s payrolls and services ISM were taken uncritically at face value. But when so many other reliable recession indicators are sounding the alarm, it pays to apply a little more scrutiny. .....

Welcome To The Global Recession, It Began In December Last Year

Consumer spending hit a brick wall in the US, EU, UK and Australia. Guess what that means.

Variant Perception: The Age of Scarcity Part 2: The end of the age of abundance

....... Financial profits vs non-financial profits peaked pre-GFC and are still trending lower. We view financial profit cycles as a proxy for speculative activities reflecting Minsky’s famous hedge vs speculative vs Ponzi financing:

- Hedge: expected income flows sufficient to meet principal and interest payments

- Speculative: near-term expected income flows only sufficient to pay interest

- Ponzi: expected income flows not even sufficient to pay interest, hence, funds would have to be borrowed merely to pay interest.

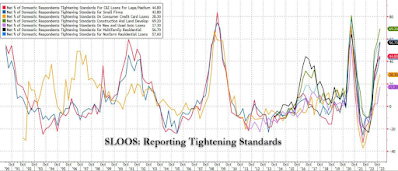

Today, Ponzi and speculative financing are being exposed again as credit availability tightens.

Investors and companies need to adapt to an environment of scarcer credit necessitating a shift back towards “hedge” financing. .....

FRBSF: Financial Market Conditions during Monetary Tightening

Bubble Fare:

...... The money multiplier concept is — as can be seen from the quote above — nothing but one big fallacy. This is not the way credit is created in a monetary economy. It’s nothing but a monetary myth that the monetary base can play such a decisive role in a modern credit-run economy with fiat money.

garbageIn the real world, banks first extend credits and then look for reserves. So the money multiplier basically also gets the causation wrong. At a deep fundamental level, the supply of money is endogenous.

One may rightly wonder why on earth this pet mainstream fairy tale is still in the textbooks and taught to economics undergraduates. Giving the impression that banks exist simply to passively transfer savings into investment, it is such a gross misrepresentation of what goes on in the real world, that there is only one place for it — and that is in the garbage can!

Bubble Fare:

The Technicals Vs The Fundamentals. Which Is Right?

..... Since the beginning of the year, the rise in the market has been purely a function of valuation expansion as both earnings, and earnings estimates, continue to deteriorate. As shown, valuations are rising to 29x, trailing real earnings, which is historically expensive

..... Since the beginning of the year, the rise in the market has been purely a function of valuation expansion as both earnings, and earnings estimates, continue to deteriorate. As shown, valuations are rising to 29x, trailing real earnings, which is historically expensive

.............. Also, on the topic of "fundamentals", this week when asked if she saw a recession on the horizon, Treasury Secretary Janet Yellen replied:

"Recessions don't happen when the unemployment rate is at a 53 year low".

However, it just so happens that TWO recessions took place when unemployment was at a record low. One was exactly 53 years ago in 1970 and the other was three years ago in 2020. In my last post I showed that in an inflationary economy, the jobs market is lagged by so much that it rolls over well AFTER recession has started. .........

....... Of course the problem with saying that stocks will go down a specific 30% based upon historical baselines, is that it's an impossible prediction to make. Until we get down there, we won't DISCOVER how many Bernie Madoffs have been going into business since 2008. So far, we've seen the spontaneous explosion of hedge fund Archegos in 2021 which was over-leveraged to Chinese Tech stocks. In October 2022 FTX Crypto exchange spontaneously exploded due to the Crypto decline. And just recently Indian conglomerate Adani went into full scale meltdown during a global rally. If Ponzi schemes can implode in a massive rally, imagine what is waiting for these markets on the other side of a global crash. People will be shocked at the level of criminality that has accumulated in these central bank Disneyfied markets. ....

Charts:

1: 2: 3: 5: 6: 7: 8: 9:

(not just) for the ESG crowd:

Other Fare:

[Awesome] Pic of the Week:

VISTA gigapixel mosaic of the central parts of the Milky Way

1: 2: 3: 5: 6: 7: 8: 9:

(not just) for the ESG crowd:

Did you know that EVs need up to six times more minerals than conventional cars?

Other Fare:

The ability to defraud and deceive is about to massively escalate. How can we remain anchored to reality?

[Awesome] Pic of the Week:

VISTA gigapixel mosaic of the central parts of the Milky Way

hat tip: nakedcapitalism

No comments:

Post a Comment