*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Treasuries were unchanged overnight. Not ‘unchanged’ insofar as yields held a tight range in otherwise listless trading as investors sought trading direction in an uncertain market; no, unchanged because Tokyo and London were both closed for Good Friday. As we alternate between our BLS and SIFMA voodoo dolls, it also isn’t wasted on us that there is no settlement of trades conducted today until the world is back online next week. This is an ideal backdrop for an outsized response to any detail of this morning’s payrolls release that doesn’t confirm with market expectations. As we’ve observed in the past, the headline jobs number is easy to dismiss as old information in the case of an upside surprise; after all, hiring decisions associated with March’s NFP-survey week were unlikely to be impacted by the regional banking sector turmoil. For evidence of fallout, investors will need the patience required to wait for the bulk of Q2’s data for a better understanding of the ultimate ramifications. On the other hand, a downside disappointment will speak to the prevailing concerns that the labor market was already weakening before the events of mid-March…

… For this week’s focus on the fundamentals, let us not forget the simmering uncertainty in the financial sector. In terms of the relative containment of the turmoil, responses to our second special question ranged from 1 to 5, with a mean and median reply of 3. We’ll characterize this as a cautious optimism that the worst is behind the market in terms of banking sector volatility, with some acknowledgment of the risk that the Fed’s macroprudential tools will not be sufficient to contain a larger crisis. One of the main macro questions at the moment is what the uncertainty is worth in terms of tightening and how that may influence Powell’s decision making. ........

Historically, “illiquidity + leverage + catalyst” has been the recipe for “crisis”. The Fed & Treasury have stabilized regional banks but cannot reach every last levered, illiquid asset. Investors have another opportunity today to take profits in overvalued bonds & stocks.

The three most important recession “tells”

150 years of history show key signals ahead of recessionary bear markets: 1. yield curve steepening (check), 2. tighter credit conditions (check), 3. the Fed forced to cut (not yet).

Last month, we noted credit conditions this tight always meant recession (7 out of 7 times). This is important because, regardless of Fed QE, bond market liquidity, etc., credit to the real economy directly affects business plans, jobs, wages, & consumption. The stock market is ignoring the risk (Exhibit 1).

...

And three signs it’s time to buy

To capture a market low this year, data since 1871 suggests: 1. buy when EPS troughs; 2. buy more as stock indexes rally above the 200-day average; 3. be fully invested once unemployment peaks (Exhibit 19). Don’t get shaken out of inflation hedges.

…3. Raise cash on the first Fed cut

Several Fed cuts to start easing policy have been unabashedly bearish signals (Exhibit 11). Recessionary bear markets typically see 25% more downside after the Fed’s first cut

Conclusion:

If we see the moves noted above (Friday and Employment data are likely to be important here) then it strengthens the view for us that the “Die is cast” both in terms of likely recession and a pivot to easing by the Fed. They will resist this initially and try and pause and hold the line, but I have little confidence that they will not blink. We went, in two weeks, from a fed talking 50 bp’s hike to considering a pause. They know that “it is broken” and they will end up having to ease

The charts above suggest the potential for some very aggressive moves, and we are healthily sceptical that we will go to some of the more “extreme” targets. However, 2 points are worth noting

1. That is what we said in 2006-2007 when similar setups suggested unthinkable moves in yields and the yield curve. The only thing unthinkable in these markets is that anything is unthinkable.

2. While we did not expect the aggressive targets for 2008 (US 10 year yield to 2%) to materialize, we stated that even if we saw moves half that size it clearly suggested that

a. Something was broken

b. The Fed would have to ease

We are once again in that camp

..... For those expecting the long-overdue mea culpa from the BLS on its payrolls fabrication, especially after the dismal JOLTS and claims prints, well they will have to wait some more because today's jobs report was the 11th monthly beat in a row.

......... Perhaps the biggest surprise in today's report, however, was the continued drop in hourly earnings, which in April came in at 4.2% Y/Y, down from 4.6% in February and below the 4.3% expected. On a monthly basis, earnings rose 0.3%, as expected, and up modestly from 0.2% last month. That, however, may be due to another modest drop in the average hours worked, which dipped from 34.5 to 34.4, below the 35.5 expected.

The Fed could be cutting rates sooner than expected given the historically short period between the last rate hike and the first rate cut. “Higher for longer” is a neat phrase, but it rarely plays out like that in practice. Rapid rises in borrowing costs invariably lead to something going wrong, which typically has to be put right by cutting rates. In fact, the median time between the last Fed hike and the first cut is only four months, while the average time is only six weeks.

We start to see the absurdity of the current reliance on monetary policy as a counter-stabilisation tool, when you read the calls from the Bank of England Monetary Policy Committee member talking about the risk of a ‘significant inflation undershoot’. In a detailed analysis of the current situation, the external MPC member noted that inflation was falling faster than expected because the supply constraints were reversing quickly. She also noted that the interest rate hikes had now reached a point where unemployment was certain to rise and lead to, in the face of the supply reversals, to deflation. And that would require faster and larger interest rate cuts. Here is an insider admitting that the Bank of England is more or less gone rogue and out-of-step with reality. Overshoot at the top of the hiking cycle, swinging to a massive undershoot at the bottom. Absurd.

Speech by External Member of the Bank of England MPC

The external member of the MPC and LSE Professor of Economics gave a talk at the Scottish Economic Society conference in Glasgow (April 4, 2023) – Quantitative Easing and Quantitative Tightening – where she commented on current monetary policy settings.

The first part of her speech concentrated on myths surrounding QE.

She correctly refutes the popular claims that QE is about money being “”‘created’ or ‘printed'”, which she considers to be part of the “most pernicious myths about QE”.

QE is “a tool … which … can potentially affect longer-term interest rates”.

That is all it ever was and is.

A lot of the myths about QE come from mainstream monetary economics itself which considers that the central bank controls the money supply by adding or subtracting bank reserves, which then allegedly allow the banks to loan more or less.

So a lot of mainstream economists claimed during the early days of the GFC when a lot of central banks followed the practice of the Bank of Japan and started swapping reserves for bonds (QE) that it would be inflationary because the money supply would expand too quickly.

They also claimed that it would stimulate bank lending and therefore get the world out of the GFC-recession because banks now had more reserves to loan out.

They were wrong on both counts because their theoretical framework is wrong.

Banks do not loan out reserves to retail borrowers.

They create loans out of thin air which create deposits (liquidity).

That process depends on how many credit-worthy borrowers come through the door seeking loans.

And while the mainstream claim that the causality runs from reserves to broad money, the reality is that it works in the opposite direction – the demand for loans creates deposits and liquidity, which then through the payments system (the daily system of reconciliation of all the cross-bank transactions), creates a demand for reserves.

And if there are not enough reserves currently in the banking system, then the central bank provides them to maintain financial stability (so all the ‘cheques clear’).

So, with such a flawed theoretical approach, it was no wonder the mainstream were confused about QE.

The speech by the MPC member clarifies these aspects of QE, yet most academic economists are still teaching the flawed stuff.

She wrote (her speech was published) that:

… for the private-sector as a whole, QE involves swapping one type of liquid asset – reserves – with another – government bonds.

That is why descriptions of QE as ‘money printing’ fall wide of the mark. The net amount of assets and liabilities held by the private sector, and held by the consolidated public sector, remains unchanged.

..........

However, I really want to focus on the latter part of her speech where she talked about interest rate setting.

First, she noted that:

… there is no link between QE and recent inflation outturns.

Why?

Because:

… inflation over the past 18 months was caused by large and unexpected external shocks, primarily the war in Ukraine, and the strong global demand for goods at a time of global supply chain disruption, which could not have been offset by any realistic monetary policy …

I would emphasise that the supply-demand imbalance was largely due to the supply restrictions rather than a massive boost to demand.

She noted that:

… extremely large external shocks, and not domestic demand conditions, have been the overwhelming cause of this period of very high inflation … above-target inflation can be accounted for by the extraordinary increase in global energy prices caused by the war in Ukraine, and by the increase in globally-traded goods prices stemming from the effects and after-effects of the pandemic … much of the rest of the inflation increase stemmed from the indirect effects of these shocks via the supply chain.

So claims that fiscal expansion was the problem are not supported here.

Yes, the income support during the pandemic from fiscal policy helped keep private spending up and created price pressures in goods markets as supply became highly constrained due to Covid.

But that doesn’t constitute classifying the inflation as a traditional ‘demand pull’ (excessive spending) event.

The reason is that the supply side (productive capacity) grows slowly over time and so if nominal demand (spending) becomes too strong relative to the current capacity, then the problem is a demand-side one and policy tightening is required to being the two sides back into balance.

But capacity utilisation of existing productive capacity can adjust quickly.

So, if there is an imbalance between spending and supply but there is also significant idle supply capacity (workers sick, machines, trucks and ships idle) then the solution is not to cut spending significantly, as in the previous scenario, but to wait for the supply-side to resolve and capacity utilisation rates to increase.

That is why I considered this inflationary period to be transitory rather than entrenched and did not support any attempts to significantly attack the demand-side.

............ Which tells you that the interest rate hikes were excessive and that the Bank of England (and all central banks that hiked) have a mistaken assessment of what has been driving the inflationary pressures.

And the actual factors involved are largely not sensitive to interest rate manipulation unless you push them so high that recession is inevitable and deep pain is endured.

Among the central banks, only the Bank of Japan management understood this and have held rates low while providing fiscal support for cost-of-living pressures on low-income families.

The MPC member now believes that “Headline inflation will fall more sharply, as direct impacts and indirect effects via the supply chain reverse.”

And here is where the absurdity of the current stance really becomes evident:

In recent months Bank Rate has increased further into restrictive territory, to 4.25 per cent. As the effects of the large and rapid tightening in policy gradually come through over the course of 2023 and 2024, this is likely to drag demand well below its potential, loosening the labour market and pulling down on inflation. In the absence of further counterbalancing cost-push shocks, I judge inflation is likely to fall well below target.

So, in an environment where the driving factors of the inflation are not related to over-spending and are reversing quickly, the Bank of England has set about compounding the problem by a full scale overkill on the demand-side which will push the economy towards (or into) recession with higher unemployment and income loss, and multiply the inflation decline to the point that Britain will experience deflation.

And, be left with a damaging pool of unemployed and increased poverty.

The same scenario is playing out elsewhere as a result of the ridiculous monetary policy choices being made.

I predicted last year that Japan would come out of the inflationary episode just as fast as the rest of the world after experiencing the same sort of external shocks.

The difference will be that unemployment has remained low and the government has provided fiscal support for low-income families.

All nations could have engaged in that approach and should have.

For those that are too young to remember, the legendary English comedy show Monty Python had a famous sketch about a disgruntled customer of a pet shop, who realised he had been sold a dead Parrot. The shopkeeper steadfastly refused to admit that the Parrot was dead ....

Why has this sketch come to mind for me? Because Gregory Mankiw, the author of one of the world’s most popular economics textbooks, has just shown that this fictional shopkeeper has nothing on Mankiw and his mainstream economics colleagues, when it comes to pretending that something which is dead is actually alive and well.

The Dead Parrot in question is the “Money Multiplier”: the theory that banks create money by lending out reserves. It’s also called “Fractional Reserve Banking”. ..............

.......... “The traditional pedagogy”, as Mankiw puts it, is no more necessary for students of economics to learn than it is necessary for students of astronomy to learn Ptolemy’s Earth-centric view of the cosmos before they can understand the Copernican system. It’s a fallacy, it belongs in the garbage bin of science, and its continued presence in mainstream economics textbooks is a major reason why mainstream economists don’t understand money, or inflation, or the causes of financial crises.

A few months ago I wrote post about using the Coppock Curve as a market timing tool. Well, the Coppock Curve for the S&P 500 Index did, in fact, turn higher in March (even if you need a magnifying glass to see it). Other trend-following measures are positive for the index, too: it remains above its 200-day moving average as does the 50-day moving average. These sort of signals suggest this index is currently in an uptrend. However, it is also true that the Coppock Curve did turn higher prematurely in December of 2001, as well, before the S&P 500 Index fell another 30% or so into the fall of 2002. Like any other indicator, this one is not perfect.

Moreover, the late-2001/early-2002 time frame makes for a very interesting price analog. During the bursting of the Dotcom Bubble, there were many spectacular rallies, very similar the one we have seen in Big Tech stocks to start the year, that gave investors hope the bottom was in and that it was time to get greedy. However, these proved to be false dawns as prices went on to make lower lows. If the collapse of SVB is a harbinger of increasing financial distress among non-profitable start ups over the course of this year, then there is a very good chance these stocks, which were the focus of the mania in 2021, have significantly more downside ahead of them which will have consequences for both the broader economy and risk appetites in general.

Basing an investment strategy on the goldilocks investment markets of the last 35 years gives rise to considerable risk, writes Michael Block, and now might be the time to get out of growth assets.

... As detailed in our Month In Macro note, we believe that the pressures on growth have accumulated and are now likely to cause a downturn in economic activity. This growth dynamic will likely make economic growth the dominant driver of asset returns in 2023 versus inflation, which was the dominant driver of returns in 2022. Within this context, our systematic Prometheus ETF Portfolio has come to prefer falling growth expressions, i.e., long treasury securities and short stocks. This week proved a positive one for such expectations. Bonds were generally positive, and gold well-supported

........... Zooming out, the gap between activity in cyclically sensitive parts of the economy and their employment remains large, and therefore the pressure on employment remains in place

......... Furthermore, we think it is important for the shoe to drop before employment will be corporate profits, and therefore an excessive focus on the lack of significant labor weakness is likely to lead to both misdiagnosis and frustration. Regarding future profitability, we see several significant headwinds in place.

Key themes:

- Key tactical (1-3 month) indicators suggest the short squeeze is done. Add downside hedges, e.g. XLK OTM puts.

- Stick with risk-off asset allocation on a 6-month+ view: UW equities + credit, OW USTs + gold. As the market prices in a recession scare, we would sell bonds and rotate into equities.

- US Recession Signal still active: labor market data is very volatile and cannot be relied upon to call a recession in real-time. We expect coincident data to deteriorate clearly from March onwards.

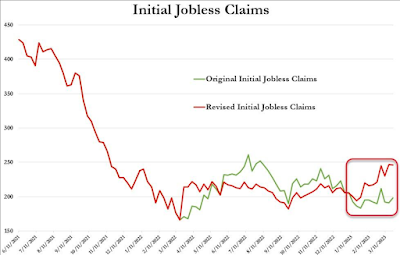

- Debunking key soft-landing narratives: 1) NFPs can be revised more than 10+ times after initial release, 2) Citi’s US economic surprise is likely being driven higher by coincident/lagging data (leading data surprises are negative), 3) S&P services PMI gives a more accurate picture of US private sector services.

- Markets are not pricing in a recession scare. US junk is one of the most complacent asset classes today. Leveraged loans are at the center of a major credit re-pricing.

- Long candidates to hold through the downturn: defensives (tobacco, food, telcos) + capital-scarce beaten-up cyclicals (homebuilders).

- Short candidates: software, healthcare, banks, industrials. All are capital-abundant and have seen significant inflows / earnings complacency.

Factors are the primary market drivers of asset-class returns. In the equity realm, only a limited set of rewarded factors are backed by academic consensus: Value, Size, Momentum, Low Volatility, High Profitability, and Low Investment. These factors compensate investors for the additional risk exposure they create in bad times. Hence, factor strategies are appealing to investors because they provide exposure to rewarded risk factors in addition to market risk and can be a source of superior risk-adjusted performance over the long term compared with cap-weighted benchmarks. ......

The Active Management Delusion: Respect the Wisdom of the Crowd

..... For more than 80 years, the fact that few active managers add value has been validated by numerous research papers ...... Despite a preponderance of evidence, many investors continue to reject the undeniable truth that very few are capable of consistently outperforming an inexpensive index fund. Outside a small and shrinking group of extraordinarily talented investors, active management is a waste of money and time.

A Little Cash Goes a Long Way.

According to the Federal Reserve, households in the United States had an aggregate net worth of $139.9 trillion as of the end of 2022. The large majority - $124.9 trillion - of this “net worth” is comprised of non-cash assets such as stocks, bonds, and real estate, after subtracting household debt, such as mortgages. Cash and bank deposits makes up a relatively small portion.

........ If non-cash assets are valued based on their convertibility to cash, how does $124.9 trillion of non-cash net worth exist if there are only $8.7 trillion1 actual dollars?

The $124.9 trillion of non-cash asset value can never be realized all at once2. Rather, the total value is extrapolated based on the small percentage of assets that are traded for cash across markets every day. These transactions provide a market price that we then apply to the rest of the non-traded assets.

It’s like measuring a football field with a ruler. The ruler can’t reach from end to end, but if you can measure a small unit of the field and can guess how many more units are left in the field, you can estimate the total length. But in the case of financial markets, the football field doesn’t have fixed dimensions. It’s an imagination - one that inherently assumes stable demand for cash vs. non-cash assets.

In the most extreme hypothetical, imagine that U.S. households wanted to trade all their non-cash assets for all the actual dollars in circulation today? The maximum number of dollars that could be exchanged for all non-cash assets held by households at one point in time is $8.7 trillion3. In this mass liquidation event, non-cash asset holders would see a 93% write down in nominal value (from $124.9 trillion of non-cash asset value, exchanged for $8.7 trillion of cash proceeds), even though the utility of those assets has not changed.

Or, what if all commercial bank depositors demanded4 cash back in physical bills all at once? There are $17.3 trillion of commercial bank deposits while banks only hold $3.2 trillion in cash. Without central bank intervention and assuming banks could instantly convert digital reserves to physical currency, all depositors would receive just $0.19 for every $1.00 deposited. The banking system is massively undercollateralized on a cash basis by design.

Neither hypothetical is possible, but both highlight that nominal wealth is an extrapolation, which can change dramatically based on the market actions of a few, and the availability and demand for cash. .......

During its COVID money printing operation, the Fed created $4.7 trillion of new cash. By contrast, household net worth increased by $34 trillion or over 30% - from $110 trillion at the end of 2019 to $144 trillion at the end of 2021. For every dollar the Fed printed, more than seven dollars of household net worth was created5.

The result was a massive increase in nominal net worth during a period in which nominal GDP increased by only 12%. The wealth gains of asset holders far eclipsed the value of any direct stimulus to individuals. On the flip side, household wealth has decreased marginally in 2022, due primarily to the decline in stock values, even as nominal GDP continues climbing at a brisk pace.

However, these calculations of wealth are just the long shadows. It’s better to focus on the puppets. ........

Instead of focusing on the long shadows, some of our best insights come from looking at the puppets. How does cash move, and what does it tell us about the shadows on the wall?

After years of confrontation and souring relations with Spanish energy giant Iberdrola, Mexico’s AMLO government has just agreed to purchase 80% of the company’s Mexican operations.

Bubble Fare:

Markets are priced for 100% bailout. Anything less than that and they will spontaneously explode.

...... Four weeks ago, Powell announced that the Fed was re-accelerating their rate hikes. By the end of that same week, the U.S. had suffered the second (Silicon Valley Bank) and third (Signature Bank) largest bank failures in U.S. history.

Subsequently, the Fed implemented their "BTFP" asset repurchase program whereby banks temporarily trade their unrealized loss encumbered assets in exchange for fresh Fed loans at 4.75%. Unfortunately, the average long bond exchanged in these programs is bearing 1.75% so the BTFP program allows banks to go out of business slowly, instead of instanteaneously if they marked to market.

Meanwhile, Congress held a hearing into the collapse of these banks and thoroughly castigated the FDIC for bailing out wealthy depositors using the "Systemic Risk Exception" (SRE). Which is moronic because the entire catalyst for the bank run was wealthy depositors assuming that they can't rely upon the SRE for future bailout. Congress has now conveniently confirmed that assumption.

Therefore, imagine if you will that next some smaller banks implode and the FDIC decides NOT to implement the SRE and instead allows wealthy depositors to get wiped out. When that happens, we will witness mass bank failure as ~$8 trillion of uninsured deposits flees small banks and heads for money market and t-bill funds.

It's the same set of events that led up to Lehman. There had been multiple failures and multiple bailouts followed by a bailout-weary Fed finally deciding that Lehman was NOT too big to fail. So markets exploded. Because they were priced for 100% bailout.

All of which explains why after four weeks of BFTP, the small banks are at new lows. We are one non-bailout away from wholesale meltdown. So what to do?

Load up on risk.

...... The other development over the past four weeks since Silicon Valley Bank exploded, is that the economy has fallen off a cliff.

Why? Because banks have tightened lending standards due to the new tighter regulatory and funding environment. Which means that the IPO equity market AND the bank lending market are both shutdown at the end of the cycle.

All of which means that the end of cycle stock to bond rotation has now begun. The exact same pundits who didn't predict the bank run, also did not predict the resulting slowdown in the economy. Which is why t-bond shorts are now getting duly monkey hammered.

Recession is a lock for 2023. And now even the majority of pundits who've been saying it wouldn't happen are finally realizing they were wrong. All because they thought that Fed tightening at the fastest rate in 40 years wouldn't lead to a tightening of credit ...

Quotes of the Week:

Citi: So US rates market benchmarks appear to be going into NFP and CPI with a relatively unstable overall positioning set-up. All our medium and long-term momentum studies still guide quite bullishly while shorter-term studies, and the recent price action that reflects it, indicate an increasingly 1-sided, and long, tactical posturing.

@BLS_gov notoriously abysmal at cyclical inflection points. Revisions will sort through the noise being reported but we won’t see that for years plural.

SpecialSitns: Trust me, I wish life was all 🦋 and 🌈, and would love to be 80% long good companies at cheap/reasonable prices. But after the fastest rate hiking cycle in 40 years, stubborn wage inflation, deteriorating US economic fundamentals, slowing global economy, peak margins, banking stress, trillions in commercial real estate floating rate debt (1.4 trillion maturing in next 2 years), Medicaid expiring for 5-15mn, student loan payments restarting, and consumer savings dwindling, an $SPY earnings recession and $JNK default spike is inevitable.. ...

...

Vid Fare:

(not just) for the ESG crowd:

This timely, important book by Jake Bittle argues that mass migration triggered by climate change will fundamentally rock U.S. society.

Tooze: Carbon Note 2: The "Western" energy transitions - narcissism of small differences.

.................. Now there may be quibbles with both the Bloomberg data and the GDP numbers. And the full effects of Europe’s programs and the IRA are yet to make themselves felt. But even the largest estimates of the IRA’s cumulative impact over ten years - $1.2 trillion in public support plus $3 trillion private - on top of what the United States is already spending, will do no more than match China’s current effort, on a much smaller gdp per capita. And, all analysts agree, that if China is to meet its decarbonization objectives - the current trend in its emissions is a matter of some dispute - it spending will have to ramp up considerably.

In short, we are all having a problem of realism. ........ And, on all sides, there is a gulf between rhetoric and the emissions reductions, which as far as climate stabilization is concerned, are the only things that count.

Other Fare:

One look at a particularly green subset of tech stocks and it becomes clear that there is a lot of hype surrounding AI. Yet when we look at how ChatGPT can complement - or even overhaul - financial analysis, we are certain that many Wall Street jobs will soon vanish and be replaced with faceless (and much cheaper) AI algos. ......

8. Wendell Berry, Life Is A Miracle: An essay against modern superstition (2000):

“What I am against—and without a minute’s hesitation or apology—is our slovenly willingness to allow machines and the idea of the machine to prescribe the terms and conditions of the lives of creatures, which we have allowed increasingly for the last two centuries, and are still allowing, at an incalculable cost to other creatures and to ourselves. If we state the problem that way, then we can see that the way to correct our error, and so deliver ourselves from our own destructiveness, is to quit using our technological capability as the reference point and standard of our economic life. We will instead have to measure our economy by the health of the ecosystems and human communities where we do our work.

It is easy for me to imagine that the next great division of the world will be between people who wish to live as creatures and people who wish to live as machines.”

9. AI is apocalyptic in exactly one narrow sense: it is not causing, but rather revealing the end of a world. We get our word apocalypse from a Greek word meaning “to reveal, to disclose, or to uncover.” What I am suggesting is that AI, as it is being developed, deployed, and hyped (and criti-hyped), forces us to reckon with the fact that modernity is expiring, and it is expiring precisely to the degree that it no longer serves the interest of and is at various points, particularly in its techno-economic dimensions, openly hostile to the human person. As a second nature, the culture of technological modernity, while undoubtedly improving the lot of humanity in important ways, has become, in other respects, inhospitable to our species. AI can thus be read as a last ditch effort to shore up the old decrepit structures and to double down on the promise of scale, efficiency, rationality, control, and prediction. It can also be read as an effort to extend the logic of late modernity to a point of absurdity. So where we see a proposed or actual application of AI, we might do well to ask how it relates to the end of the world we have called modern.

Peter Attia explains how we can battle the "Four Horsemen" of modernity conspiring to degrade our ability to live a long life free of chronic conditions and disabilities.

........................... We are far from powerless when it comes to keeping the Four Horsemen from destroying our health. Even if we eventually succumb to one of the Horsemen in the end, we can delay the onset of the attack for decades, buying additional years or decades of healthy lifespan. Everyone already knows that exercise and nutrition are very important, but sleep is also critical. We need to come up with individualized plans in all three areas to optimize for better health and longevity.

Knowing that something is important is very different than figuring out a personal action plan. One easy way to tell whether you’re dealing with a charlatan is when the prescribed action plan is the same for everyone. The truth is that every individual’s health situation is different and the action plan that each person can sustain will vary widely. Peter Attia avoids making one-size-fits-all recommendations. In order to get a personalized plan of action from Attia, you would have to enroll as a patient which is probably a very expensive proposition. The rest of us can benefit from the guidelines provided in the book.

It is very clear that Attia regards exercise to be the cornerstone of good health which he refers to a the most powerful longevity drug. This makes sense because exercise has multiple benefits from both a physical and mental health perspective and the benefits tend to compound over time. Exercise helps us maintain good metabolic function, keeps our cardiovascular system in shape, and can be extremely beneficial for our mental health as well. Personally, I feel physically and mentally healthy only on days when I go running in the morning.

Perhaps even more importantly, strength training helps us to maintain adequate muscle mass and tone later in life.

No comments:

Post a Comment