*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Watching the testimony by various officials of the Fed and FDIC this week, it occurred to us that the central bank is replaying several scenarios at once. This may account for the confusion and, at times, contradictions in some of the congressional testimony this week.

First, we are replaying the 1980s, when Fed Chairman Paul Volcker pushed market rates points above bank funding costs, and annihilated a whole class of non-banks known as Savings & Loans. By pushing benchmark interest rates above bank deposit rates, many S&Ls and commercial businesses died.

Second, we are replaying the scenario of the Great Crash of 1929, when the FOMC slammed on the brakes in mid-1928, raising short-term rates from 4% to 6% to stamp out “speculative behavior.” That relatively large increase in interest rates led to the Great Crash of 1929. ......

.................... As Robert Eisenbeis taught readers of The Institutional Risk Analyst years ago, the Federal Reserve System is always a net-expense to the U.S. Treasury. Fact is that the Fed’s purchase of Treasuries bid up bond prices and put downward pressure on interest rates. Now is the time to reverse this trade.

One of the great ironies of economics is that, while the public regards economists as experts on money, the issue of how money is created is still not settled within economics.

In 2014, the Bank of England published a landmark paper explicitly rejecting the textbook model of money creation ........

....... Banks are creatures of accounting: they create not goods and services, but financial assets and liabilities. Double-entry bookkeeping is central to both accounting and the operation of actual banks. Yet one striking feature of mainstream economics is the near complete absence of double-entry bookkeeping in its models of banking and money creation. This leads to mainstream economics being replete with concepts and models that contradict double-entry bookkeeping—and which are therefore false as models of the real-world. ............

........... Consequently, in the model shown in Table 3—and in the real world—credit is a substantial source of both Aggregate Demand and Aggregate Income. This is the logical explanation of the difference in behavior between the “Loanable Funds” model shown in Figure 8 and the BOMD model shown in Figure 9. It is also the explanation for the real-world phenomena of debt-deflationary crises like the Great Recession, the Great Depression, and the Panic of 1837. Neoclassical economics, by ignoring banks, debt and money in its macroeconomic models, is ignoring the main factors that drive economic performance, and also cause economic crises. .....

Far from Credit having “no significant macroeconomic effects”, as Bernanke asserted, in the real-world Credit is overwhelmingly the factor causing economic fluctuations—and especially severe downturns like the Great Recession. This is because it is by far the most volatile component of aggregate demand—which mainstream Neoclassical economists miss because their false Loanable Funds theory tells them not to even look at data like that plotted in Figure 10.

In doing so, they are like the Ptolemaic astronomers that Galileo ridiculed in correspondence with Kelper five centuries ago, for their steadfast refusal to look through Galileo’s telescope. They therefore never saw the moons of Jupiter, whose existence demolished their Earth-centric vision of the Universe

The U.S. labor force participation rate (LFPR) currently stands at 62.5 percent, 0.8 percentage point below its level in February 2020. This “participation gap” translates into 2.1 million workers out of the labor force. In this post, we evaluate three potential drivers of the gap: First, population aging from the baby boomers reaching retirement age puts downward pressure on participation. Second, the share of individuals of retirement age that are actually retired has risen since the onset of the COVID-19 pandemic. Finally, long COVID and disability more generally may induce more people to leave the labor force. We find that nearly all of the participation gap can be explained by population aging, which caused a significant rise in the number of retirements. Higher retirement rates compared to pre-COVID have had only a modest effect, while disability has virtually no effect.

............ The crucial point here is that the “Fed Put”, the supposed guarantee by the Fed and other central banks that they would back the markets has been voided.

......... To be clear, this is not intended as a moral judgement. My point is not that the little bit of sugar (bailouts) is small beer by comparison with the pain inflicted through inflation-interest rates on the poor old banks. I make the comparison in support of the claim that the situation we are in is novel and not the repetition of previous bailouts. The historically noteworthy thing here is the monetary policy shock, which many thought the Fed lacked the nerve to deliver. .....

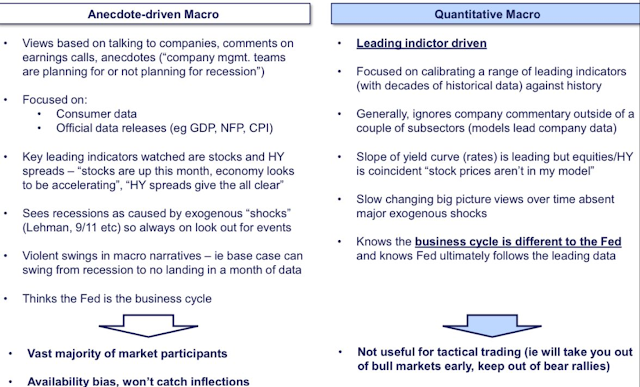

Probabilities based approach

Colonial currencies and the pan-American origins of the dollar system

Quotes of the Week:

MorgStan: Recent increase in Fed balance sheet is not QE, in our view...Many investors believe the Fed's recent intervention to stabilize the banking system is the beginning of the next QE program. However, not all reserves are created equal and it appears to us like the velocity of money this time is more than offsetting the increase in the Fed's balance sheet. As a result, Money Supply (M2) growth is still decelerating and is now the lowest in at least 60 years. If this doesn't reverse, broader growth should soon follow in a way that is not priced into many equities.

DiMartinoBooth: Mass of confusion remains in the wake of the growth in the deflationary parts of Fed liabilities. As with all things in life, time will also heal the confusion. People are too young to recall massive 15% rally in $SPX between March - May 2008.

Malmgren: Loose talk of a coming "credit crunch", making it sound like a brief event. What is coming is a process of credit contaction spreading step by step from one stressed credit sector to another until credit dries up generally and deflationary asset selloff rolls out... everywhere

Charts:

1:

...

...

...

...

...

...

...

(not just) for the ESG crowd:

Yves here. This article is consistent with something we have said for some time: that it will take war-level mobilization to make real headway on reducing greenhouse gas emission. Invoking wartime action is a polite way of saying that the public will have to accept greatly reduced levels of some goods and services, as well as much more top-down direction of the economy. Needless to say, this is diametrically opposed to our current markets uber alles ideology. ...........

AI Fare:

Open Letter Season: Large Language Models And The Perils Of AI

..... Here, therefore, we echo the recommendations of Professor Emily Bender:

“Don’t waste your time on the fantasies of the techbros saying ‘Oh noes, we’re building something TOO powerful.’ Listen instead to those who are studying how corporations (and governments) are using technology (and the narratives of ‘AI’) to concentrate and wield power.”

Science Fare:

No comments:

Post a Comment