*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

Nordea: High forever

Signs that ‘term premium’ is driving up Treasury yields stir worry and doubt

Investors and Federal Reserve officials scrambling to make sense of surging U.S. Treasury yields have a new obsession: a number that exists only in theory.

Known as the term premium, the number is typically defined as the component of Treasury yields that reflects everything other than investors’ baseline expectations for short-term interest rates set by the Federal Reserve. That could include anything from an increase in the supply of bonds to harder-to-pin down variables such as uncertainty about the long-term inflation outlook. ....

.... The 10-year yield in September rose above 4% (black line in chart below) for the first time since 2008, based on monthly data, which is used in our modeling. By contrast, the average fair-value estimate was essentially unchanged at 2.83% (red line), slightly higher from the previous month. ...

What’s driving the rise in interest rates? Several explanations are popular, including the rise in the term premium: “he compensation that investors require for bearing the risk that interest rates may change over the life of the bond,” per the New York Fed’s definition.

Some analysts advise that the surge in supply relative to demand for Treasuries is a related factor for the jump in yields (and the commensurate decline in bond prices). The Economist reports: “From January to September alone it raised a whopping $1.7 trillion (7.5% of GDP) from markets, up by almost 80% over the same period in 2022, in part because tax revenues have fallen. At the same time, the Fed has been shrinking its portfolio of long-dated Treasuries.”

Alternative theories range from rising doubts about America’s credit worthiness to fears that inflation will stay higher for longer and so the Federal Reserve will be forced to continue lifting interest rates.

Whatever the explanation, the market is pricing the 10-year yield at what appears to be a lofty and arguably unsustainable level. Skeptics can rightly counter that the inputs to our models may not fully capture current events.

At the same time, the spread chart above suggests that current divergence isn’t unprecedented – far from it. At one point in the early 1980s, the spread briefly topped 3 percentage points — well above the current level.

The spread is now at the 95th percentile, based on history since 1980. That implies that we’re near the peak. The caveat is that events in the months ahead will break precedent and we’re facing a outlier event.

Never say never, but the statistical odds look increasingly favorable for guesstimating that a yield peak is near. In turn, that suggests it’s timely to lift allocations to bonds – especially if current weights are below strategic targets.

At the same time, managing expectations is critical these days. Momentum, after all, dominates modeling recently and that trend could continue for the foreseeable future. The spread rise will end eventually, but the uncertainty of when, and why, remains as thick as ever.

.... Today, there are a plethora of concerning narratives explaining why bond yields are rising. At first glance, they make a lot of sense and should be worrying. However, if you take the time to research them, you will find many recent bond market narratives are insignificant temporary noise. ....

.... The current inflation expectation is 2.21%. If you think expectations will eventually return to average pre-pandemic levels (1.65% – 2017-2019), the fair value ten-year yield falls to 2.09%. With current yields around 4.60%, a turnaround to fair value would generate a 20%+ return on a ten-year note plus nearly 5% a year in coupon payments. ...

China's reserves has shifted its dollar reserves from Treasuries to Agencies, and made increased use of offshore custodians. The available evidence suggests that it still holds about 50 percent of its reserves in dollar bonds.

............. There are, obviously, two sources of data about China’s reserves: China’s own (limited) disclosure, and the U.S. data on foreign holdings of U.S. securities. Both broadly tell the same story – one at odds with most press coverage of the slide in China’s formal reserves. ........

........... Bottom line: the only interesting evolution in China’s reserves in the past six years has been the shift into Agencies. That has resulted in a small reduction in China’s Treasury holdings – but it also shows that it is a mistake to equate a reduction in China’s Treasury holdings with a reduction in the share of China’s reserves held in U.S. bonds or the U.S. dollar.

***** Hoisington Quarterly Review and Outlook, Q3 2023: Impending Recession

The long history of business cycles illustrates that rising inflation precedes recessions.

Inflation accelerations don’t just happen, they are caused. Accordingly, a more complete description of these aggregate fluctuations is that monetary accelerations precede rising inflation, which then requires monetary decelerations that inevitably lead to recessions. Thus, monetary policy actions are pro- rather than counter-cyclical and the financial cycle will continue to lead the GDP and price/labor cycle.

The process of the monetary policy reversal from the 2020-22 inflation is presently at an advanced stage, suggesting a repeat of the standard business cycle process. To be sure, the quick spread of inflation in this cycle was abetted by massive fiscal stimulus via transfer payments along with the central bank’s dramatic balance sheet expansion. These combined monetary and fiscal actions have resulted in negative net national saving, a condition that will impair economic growth well after the Fed reverses the severe monetary restraint currently in place. Indeed, the coming downturn may send net national saving even more deeply negative. .....

...... Inflation and real bank credit, since 1960, have exhibited a virtually unblemished record of lagging the GDP cycle. Yet, over the past four to five quarters they both declined while real GDP was rising. These divergences suggest that the economy is far weaker than real GDP and employment indicate and that the economy is currently far more susceptible to a downturn than is generally recognized. .....

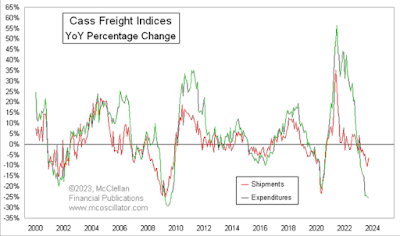

In the past three quarters, real GDI declined at a 0.6% annual rate while real GDP gained at a 2.3% pace, with the average of the two being just 0.8%. However, monetary and fiscal restraint intensified during this span, suggesting that the revisions are more likely to take the results lower rather than higher. In addition, the global economy, has continued to deteriorate. In the twelve months ended July, the volume of world trade declined 3.2%, a growth rate normally associated with recessions. The erosion of this very high multiplier sector indicates that the foreign sector will add to the downward force of the financial cycle. This environment will be favorable for lower Treasury bond yields.

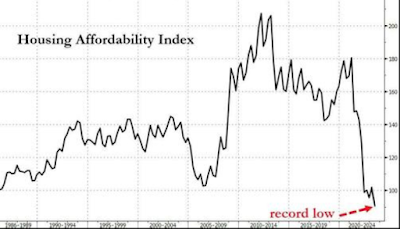

.... To reiterate: with increasing confidence I can say that the entire housing market has finally turned. If mortgage remains remain at their current levels, the likelihood of a recession at some point in the next 12 months has increased substantially.

..... As Edwards explains, the 4.9% upside surprise on real GDP was "only achieved because of the surprisingly sharp 1.4% fall in the GDP deflator – that was then added to weak 3.5% nominal GDP growth."

.... Edwards skepticism is corroborated by the far more accurate, PMI data, which signals "worryingly low employment in the non-manufacturing sector with no lockdowns to blame."

... But if the Chniese data is again much weaker than indicated, what does that mean about Beijing's attempts to kickstart the economy and stimulate it out of its Japanification phase? Well, as Edwards explains, "the Chinese authorities have been in easing mode recently, but the degree of easing can be described as support for the economy rather than stimulus" which is what one would expect from a country that has a record 300%+ debt/GDP

NAHB builder confidence weaker for a 3rd consecutive month as housing data are respecting the lag of higher rates, and moving lower. Gravity (i.e., rate sensitivity) still exists. #Hope #macro pic.twitter.com/l9GLXJwofW

— Kantro (@MichaelKantro) October 17, 2023

(not just) for the ESG crowd:

Hansen et al: El Nino Fizzles. Planet Earth Sizzles. Why? (PDF)

Abstract. September 2023 smashed the prior global temperature record. Hand-wringing about the magnitude of the temperature jump in September is not inappropriate, but it is more important to investigate the role of aerosol climate forcing – which we chose to leave unmeasured – in global climate change. Global temperature during the current El Nino provides a potential indirect assessment of change of the aerosol forcing. Global temperature in the current El Nino, to date, implies a strong acceleration of global warming for which the most likely explanation is a decrease of human-made aerosols as a result of reductions in China and from ship emissions. The current El Nino will probably be weaker than the 1997-98 and 2015-16 El Ninos, making current warming even more significant. The current near-maximum solar irradiance adds a small amount to the major “forcing” mechanisms (GHGs, aerosols, and El Nino), but with no long-term effect. More important, the long dormant Southern Hemisphere polar amplification is probably coming into play.

This report offers a global stocktake of the world’s electricity grids as they stand today, taking a detailed look at grid infrastructure, connection queues, the cost of outages, grid congestion, generation curtailment, and timelines for grid development. We find that there are already signs today that grids are becoming a bottleneck to clean energy transitions and analyse the risks we face if grid development and reform do not advance fast enough.

Cleaner, faster, cheaper — the aviation industry’s plan to decarbonize air travel, explained.

Sci Fare:

U.S. foreign policy has set the country on a course destined to lead to a world of rivalry, strife and conflict into the foreseeable future. Washington has declared “war” on China, on Russia, on whomever partners with them.

That “war” is comprehensive — diplomatic, financial, commercial, technological, cultural, ideological. It implicitly fuses a presumed great power rivalry for dominance with a clash of civilizations: the U.S.-led West against the civilizational states of China, Russia and potentially India.

Direct military action is not explicitly included but armed clashes are not absolutely precluded. They can occur via proxies as in Ukraine. They can be sparked by Washington’s dedication to bolster Taiwan as an independent country.

A series of formal defense reviews confirm statements by the most senior U.S. officials and military commanders that such a conflict is likely within the decade. Plans for warfighting are well advanced. This feckless approach implicitly casts the Chinese foe as a modern-day Imperial Japan despite the catastrophic risks intrinsic to a war between nuclear powers.

The extremity of Washington’s overreaching, militarized strategy intended to solidify and extend its global dominance is evinced by the latest pronouncement of required war-fighting capabilities. ...

Hundreds of US congressional staffers are passing around a letter urging their bosses to call for a ceasefire, there’s a silent mutiny brewing in the State Department over the Biden administration’s Gaza actions, mainstream reporters have been refusing to parrot Israel narratives, and the streets are full of pro-Palestine demonstrators.

This is different. What we are seeing right now is a deviation from the usual script.

Lawrence: Decency Becomes Indecent

At this point, Washington’s defense of Israel becomes as baldly obscene as the apartheid state’s long record of lawless aggression toward the Palestinian population.

Lawrence: Roger Waters and the one-state solution.

Breaking the silence.

It’s not just ‘unlikely’ that a Palestinian rocket hit the Gaza hospital. It’s impossible. The media know this, they just don’t dare say it

......... Hamas, if your history doesn’t extend past last week, threw the first punch last week. Russia, under the same assumption, that history doesn’t matter, threw the first punch last year. But I’m rooting for Russia and rooting for Hamas, even so.

Other Fare:

Upheavals from Spain to the Yangtze

Pics of the Week:

haha:

No comments:

Post a Comment