*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

.... After eight years at the Fed...my conclusion was that there is no well-elaborated and empirically grounded theory that explains contemporary inflation dynamics in a way useful to real-time policymaking ...

Inflation, growth theory is ‘just not true right now,’ he says

Fed should begin cutting rates ahead of reaching 2% target

Ackman and Gross made comments that bond markets were ready to hear, driving 10-year yields back down well under 5%

.................... The Fed knows this, which is why they are trying their hardest to spin the story that their policy operates with a lag and therefore they must pause to “study the effects”. How long you gonna sit and wait, Sir Powell? The real reason they are pausing is because while raising rates would hopefully keep a bear steepener from occurring, the regional US banks will start biting the dust again if the Fed keeps raising rates. Remember, depositors would rather bank with the Fed and earn 5.5% or more than keep their deposits earning much less and risk their bank going bust. The regional banks are fucked — but instead of a jackhammer fucking due to continuous Fed rate hikes, the fucking is slow and rhythmic as the bear steepener thrusts on. Also, let me remind you that the US banking system is sitting on close to $700 billion of unrealised losses on US Treasuries. Those losses will accelerate as long-end bond prices continue tanking.

The Fed and US will step in to save the regional banks en-masse once a few more fail. The authorities demonstrated that earlier this year with Silicon Valley Bank, First Republic and so on. But what the market doesn’t believe yet is that the entire balance sheet of the US banking system is de facto government guaranteed. And should the market, and more specifically the bond market, come to that view, inflation expectations are going to MOON, and long-end bond prices will dump even further. .......

M2 update: continued disinflation

... I'm happy to report that M2 continues to decline, thus ensuring continued disinflation. It's still early to worry about deflation, but it could happen if the Fed waits too long to start cutting interest rates. ......

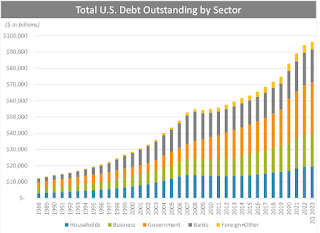

#76: Credit growth has shifted from the private to the public sector, but who will foot the bill?

Aitkens (TD Cowen): Buy Government Bonds

We are increasing our recommended bond weight by 5% drawing down cash. This change leaves us with a recommended asset allocation of 45% equities, 45% bonds and 10% cash. Investors should remain underweight risk assets, both equities and corporate credit, an asset allocation appropriate for the coming economic slowdown. The selloff in government bonds, currently underway, sets the stage for its own reversal by dampening economic growth.

There are three main reasons to emphasize government bonds at this point in the cycle. First, current yields now offer the best value since before the GFC recession. Second, the Fed is engineering an economic slowdown and history shows that weak economic growth typically drives government bond yields lower and therefore prices higher. And third, holding government bonds hedges the risk of a greater than expected economic slowdown. .......

PodCast:

Quotes of the Week:

Mac10: Clearly, bulls and bears are on the exact same page now - stocks have ~5% upside, and -50% downside. Which makes this a tradable opportunity for someone with an IQ of a dead gopher. Or hedge fund managers desperate not to underperform the market into year end. In summary, position accordingly.

...

..

..

...

(not just) for the ESG crowd:

Nearly every day since mid-June 2023 has been warmer than any equivalent day since 1958.

Global Warming in the Pipeline will be published in Oxford Open Climate Change of Oxford University Press next week. The paper describes an alternative perspective on global climate change – alternative to that of the Intergovernmental Panel on Climate Change (IPCC), which provides scientific advice on climate change to the United Nations.

Our paper may be read as being critical of IPCC. But we have no criticism of individual scientists, who include world-leading researchers volunteering their time to produce IPCC reports. Rather we are questioning whether the IPCC procedure and product yield the advice that the public, especially young people, need to understand and protect their home planet. ...

It’s called a pangenome, and it could explain the DNA that makes each of us unique

Researchers found that listening to our preferred music reduces pain intensity and unpleasantness, knowledge which could optimize music-based pain therapies

Geopolitical Fare:

The imperium's late-stage paralysis.

When the Jordanian king, Abdullah II, cancels a planned summit with President Biden, when Abdel Fattah al–Sisi, the Egyptian president, declines to meet the U.S. leader, when Mahmoud Abbas, the head of the Palestinian Authority, will not take Biden’s telephone calls: Given the extraordinary rejections that greeted Joe Biden during his days in West Asia last week, it is time to conclude the renewed violence between Israel and Gaza has cost the Biden regime a lot of friends in a region where Washington’s influence was once without challenge.

Let us dilate the lens. Xi Jinping, the Chinese president, stopped talking to Biden months ago. Vladimir Putin has made it clear severally he sees no point speaking or meeting with Biden because, the Russian president has said on numerous occasions, it is impossible to take Biden at his word. The Biden White House’s grand plan to sponsor the normalization of Israel’s relations with the Saudi kingdom—whose de facto leader, Crown Prince Mohammed bin Salman, is openly contemptuous of President Biden—now appears all but dead.

Joe Biden and his top national security people, notably Secretary of State Antony Blinken and National Security Adviser Jake Sullivan, began making a mess of U.S. foreign policy as soon as Biden assumed office in January 2021. This was first evident in its initial contacts with China, in March of that year, but was obvious in the case of Russia a couple of months later. Now we see the disaster of the Biden regime’s incompetence in matters of state on full display in West Asia. Why? How do we explain the shocking ineptitude of these people as they conduct America’s relations with the rest of the world? These are our questions. .....

Israel and U.S. are Taking a Diplomatic Pounding

News Coverage of Israel and Palestine Makes Me Ashamed to be a Journalist

..... In reality, you don't need to be an expert to understand what’s happening: It's one state colonising another. As Europeans, we should know all about that, shouldn’t we? Of course, the geopolitical context surrounding it can be confusing. But the central issue here is to honour both Israeli and Palestinian victims, while understanding that the initial cause of all this suffering on both sides is the colonisation of Palestine by Israel. And anyone speaking about the conflict without acknowledging this crucial piece of context is telling a very partial version of the story. ......

.... “This information blackout risks providing cover for mass atrocities and contributing to impunity for human rights violations,” Human Rights Watch correctly notes.

And I’m going to go ahead and say that’s probably not just a convenient coincidence for Israel. A genocidal massacre in total darkness works very much to the advantage of those doing the massacring. ........

Vids of the Week:

No comments:

Post a Comment