***** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

In late 2022, I often said that while I didn’t think it would be severe I figured we would have a recession in 2023 because we had never seen an energy spike at the same time that the Fed was aggressively tightening and not had a recession. Indeed, it would really be weird if those things could happen and not result in a recession. Then, what causes a recession?!?

And as we all know by now, 2023 was not a recession. So, like any good trader who makes a bad call I want to look and figure out why that happened. Funny thing is…I wasn’t completely wrong on that. ........

..........

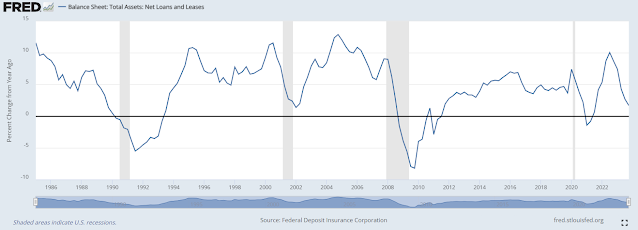

In March 2022, the Fed hiked 25bps. They did 50bps in May, 75bps in June, another 75bps in July, and of course they kept going. Crude crested at $123/bbl in June. So by late summer of 2022, goods production started to see this in declining orders (first chart) and weakening production growth (second chart). My sources in industry started to see a buildup in client inventories, leading to lower orders – the celebrated ‘bullwhip’ effect. By late 2022 and for much of 2023, manufacturing was absolutely in a recession. The Conference Board’s Index of Leading Indicators had gone negative m/m in March 2022 and actually is still negative today.

Normally, that set of events would have produced a recession. But they didn’t. Why? Because the reopening of service industries was gathering steam over 2022. .........

Eventually the two parts of the economy will re-synchronize, but the way the reopening happened is I think why the macro call has been so difficult.

The Committee for Economic Development (CED) of Conference Board recently put out “Explainer: The National Debt” which is pretty much a greatest hits of debt scare mongering. Other than the references to recent events and data, it is timeless: the authors could have put out the same report in any year since the mid-1980s and not much of the contents would have changed. Anyone who thinks that the MMT debate would improve things just needs to read the report to see that progress in conventional economics is largely illusionary.

The shtick of the “explainer” is that “the fiscal crisis is here.” The evidence is everybody’s favourite time series: the debt/GDP ratio ...........

.................. If we accept the MMT premise that the sustainability risk associated with fiscal policy is inflation, then the debt/GDP ratio is an anti-indicator: it falls when inflation rises. ...........

Long-horizon bond yield data from the US Treasury

Bubble Fare:

Measures of investor sentiment are positive, but nothing like past bubbles

Comparison and collation of the various valuation indicators for the stock market

............................... In the “heat of the moment,” fundamentals don’t matter. In a market where momentum drives participants due to the “Fear Of Missing Out (F.O.M.O.),” fundamentals are displaced by emotional biases. Such is the nature of market cycles and one of the primary ingredients necessary to create the proper environment for an eventual reversion.

The tech sector continues to drive returns in US stocks. Multiples are high, but still not quite as high as they reached on the eve of the dot-com bust, while most sectors’ earnings yield is not yet as unattractive as it was versus 10-year yields in early 2000. .........

Maybe we’re not quite there in stocks, but burgeoning FOMO-ness is pushing investors to override their prefrontal cortices and engage in ever more risky behavior. ........

......... Bull markets are treacherous – or at least they should be. If you as investor are blithely long, then you’re missing something. There are several emerging parallels (broad over-valuation, high household allocation, etc) with today’s market and the Dotcom period investors should be aware of. Nonetheless, number may keep going up for now.

Talking about bubbles: There’s a judgment call to be made on individual behavior and group dynamics.

Today’s Points on Bubbles:

- Bears are still being forced to capitulate

- Sentiment isn’t extreme

- There’s plenty of global liquidity to add

- And after the Fed’s pivot, a bubble can keep inflating even without rate cuts

- But don’t forget, valuation suggests any bubble will be followed by quite a reckoning.

Forever Blowing Bubbles

It’s still impossible to have any conversation about markets without being asked whether a bubble is already inflating. So let’s return to the topic, yet again. And to be clear about the terms, we’re not asking whether the market is too cheap, or whether corporate fundamentals will improve to support further gains. We’re simply asking: Will this market keep going up? That requires a judgment on individual behavior and group dynamics. Valuation, for the possible melt-up of the next few months, is beside the point. .............

More or less everyone was surprised by the non-arrival of a recession last year, and they continue to be surprised by US robustness now. That forces the strategists for big sell-side firms, who tend to be influential, either to revise their forecasts for the end of this year upward, or to predict a fall between now and then. For example, the following chart was published by the Goldman Sachs equity strategy team in January. It showed the projected path to the target of 5,100 on the S&P 500 by Dec. 31. As we know, the S&P 500 has already got there. .......

.............. Finally, a necessary word of caution. Valuation is more or less irrelevant when trying to predict the next year, but it’s everything you need to know to predict the next decade. That’s only a slight exaggeration. Subramanian’s note raising her target for 2023 also included this chart looking at price/earnings ratios compared to subsequent 10-year returns. The correlation is above 80%:

Following this to its conclusion, there is powerful reason to believe that the next 10 years won’t be very good. As there’s also pretty good reason, as we’ve seen, to expect share prices to rise healthily for a while longer. The implication is that after this rally, or bubble, reaches a peak, the market is set to go down for a while. The logic that might lead you to jump in to a potentially forming bubble will also require you to keep looking over your shoulder to decide when to sell.

White: Stock Market's Top Will Outlast Your Disbelief

The stock market is entering its topping phase. That’s not necessarily a reason, however, to hit the sell button as market tops typically persist long after fundamentals have ceased to support them, making them fraught with risks. The current market has yet to display the majority features present at previous tops, suggesting it can keep grinding higher — perhaps even culminating in a blow-off in prices — despite growing skepticism in the rally.

Markets exhibit asymmetric behavior at tops and bottoms. The latter are points in time, but tops are a process, often lasting many months. The most recent ones: the pandemic in 2021, the subprime crisis in 2007, the 2000 tech bubble and the savings and loan crisis in 1990 lasted many months – with the exception of the pandemic – and endured mounting disbelief before they finally gave way. ........

Market tops obey a variation of the Anna Karenina principle, in that every one is alike, but they all end in their own way. Each typically displays many of the following features at their climactic point:

- weakening leading economic indicators, with coincident indicators yet to decline

- signs of over-extension in corporate activity

- worsening excess liquidity

- stretched breadth and price technicals

- extreme bullish sentiment, and absence of bears

- nosebleed valuations

Only some of the above are currently present, indicating the market is entering its topping phase, but one that could last several months yet. ........

Quotes of the Week:

"It feels very much like a fomo...yolo...and momo market.

Still like the quote...’long, staying long, but slightly uncomfortable’ as the best way to describe how many investors feel at the moment."

Simon White:Valuation is about as much use as a helicopter ejector seat when it comes to timing, but as overvalued stocks become more widespread it means when the market does start to sell off it is primed to be more pronounced.

...

...

...

...

(not just) for the ESG crowd:

Why the Requirements Are Much Weaker Than Planned and What They Mean for Companies

Biden needs to decide if he likes the climate more than he hates China.

Geopolitical Fare:

Lawrence: “The sickness of silence.”A letter to future historians.

I write this letter so that you, who will look back on our time as professionals trained in the craft of recording history, will see it in the whole for all that it is, nothing missed. We who are alive now do not have the vision I urge you to bring to our present and what will be for you your past.

Ours is a time of catastrophe, of savagery in the name of righteousness, a time of commonly shared depravity, of defeats for the human cause, of civilizational collapse. But this larger import of the events to which I refer—apartheid Israel’s condemnable aggression against the Palestinians of Gaza and the West Bank, the profligate wastage of human lives in America’s proxy war with Russia in Ukraine—is simply too large for most of us to manage. It is as if we sit too close to a movie screen properly to see the picture. You must do better than we in this. You must master the vision that eludes us and write the true, whole picture into history.

Many important events are hidden from us. They are often written out of the record at least in part and sometimes altogether as if they never occurred. In addressing you I mean to do what small thing one can do to make sure the truth of our time is properly recorded. To know that the histories you will write will comprise some or all of what power has sought to obliterate can be a kind of redemption, a source of confidence in humanity’s capacity for goodness.

Justice is not retroactive: The wrongs we witness daily cannot be taken back or reversed, I mean to say, just as a mother and child wantonly murdered with an Israeli sniper’s bullet in Gaza cannot be brought back to life. But we can honor all such victims of injustice if we write their stories truly, as you are in a position to do. Their sufferings and their deaths will not, in this way, be altogether in vain.

It is by way of the historical record, the recording of history, of “what happened,” that the lies proliferating all around us as I write this letter can be exposed and, at least in the way our story is told, transcended. ...........

What is JSOC doing, and where are they doing it?

...............................

.....................

Bottom Line

This suggests, or demands, several questions.

Where else is JSOC operating? Africa and the Middle East can’t be the only places.

Who really are they killing? Just “terrorists,” declared enemies of the U.S.? Or are they sent out by our “partners” to kill our partners’ enemies as well? The ongoing op against Boko Haram seems one example of the latter.

Are they killing foreign politicians? Just curious.

What are they doing domestically? NORTHCOM is responsible for North America, the “homeland.” JSOC isn’t geographically limited. Are people being quietly killed here as well?

In the real world, it’s hard to imagine the dystopia this represents.

Sci Fare:

Other Fare:

Lapham: Power OutageOn the thermodynamics of history.

......... Since Joe Biden prides himself of being an absolute killer of a genocidal wartime president, the least he can do for the folks back home is to get the eugenics craze up and running at full speed. The fact that his Centers for the Prevention of Disease Control just officially made the Covid isolation protocols go away, Biden will make it opaguely plain at this Thursday's State of the Union speech that he aims to transform your health care into a full scale cutthroat competition You see, the problem with the American health care industry is not that it's even called an industry instead of a universal program for the public good. It's not that even insured citizens are going bankrupt at record numbers when they get sick. It's not the unaffordable premiums, co-pays and deductibles..

It's that the government-subsidized insurance behemoths should be fighting more among themselves for every last denial of benefits and every last nickel that they steal from your pockets.

As reported by Politico, Joe Biden will use part of his State of the Union speech this Thursday to announce the creation of a (drum-roll, please) brand new Task Force to study and root out the roots of the corporate greed they apparently have only recently discovered exists in this country.

This task force is the next best thing and the only alternative to single payer, government-run medical insurance. The idea is that once Biden's task force studies the problem, it will then have the chops to gently chide the insurance predators into playing in a new Free Market Olympics for the fostering of capitalistic good will and understanding on the killing fields. ........

No comments:

Post a Comment