Here's What To Expect From Fed Chair Powell Today. zerohedge. Nov. 13, 2019.

Bank Of America: Stocks Are The Most Expensive Since The Jan 2018 Meltup "But There Is No Alternative"

Must Read:

A Striking Collection of Duck-Like Features. …as usual with Hussman, I recommend reading the whole thing; lotsa gems; this is just an appetizer:

Technically Speaking: A Correction Is Coming, Just Don’t Tell The Bulls…Yet.

CLO

Slump Sparks Warning: "There's More Volatility Coming". (see the chart at link of monthly returns of BB CLO bonds… October,

ouch)

The Long Read:

History as a giant data set: how analysing the past could help save the future. The Guardian.

(not just) for the ESG crowd:

Ben Hunt: The Rake

Morgan Stanley: Decarbonization: The Race to Net Zero.

‘Profound shifts’ underway in energy system, says IEA World Energy Outlook. Carbon Brief.

It’s too late for a carbon tax—it’s time for a world war against climate change. Adele Peters, Fast Company. Nov. 4, 2019.

Book review:

Yanis Varoufakis: Good Economics for Hard Times by Abhijit V Banerjee and Esther Duflo review – methodical deconstruction of fake facts

Quote(s) of the Week:

“Tyler Durden”:

Key Takeaways from Powell's Prepared Remarks (via Bloomberg)

- The Fed chairman says the current stance of monetary policy is “likely to remain appropriate” as long as the economy remains on track for moderate growth

- In a dovish note he adds: “Sluggish growth abroad and trade developments have weighed on the economy and pose ongoing risks,” and inflation pressures “remain muted”

- Powell’s outlook remains positive; “My colleagues and I see a sustained expansion of economic activity, a strong labor market, and inflation near our symmetric 2 percent objective as most likely”

Bank Of America: Stocks Are The Most Expensive Since The Jan 2018 Meltup "But There Is No Alternative"

Must Read:

A Striking Collection of Duck-Like Features. …as usual with Hussman, I recommend reading the whole thing; lotsa gems; this is just an appetizer:

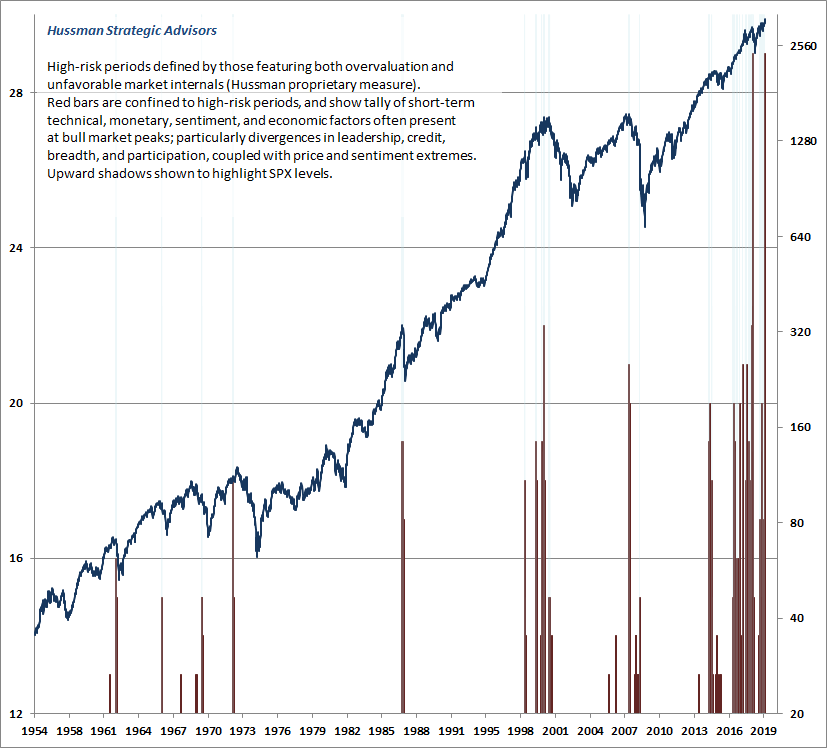

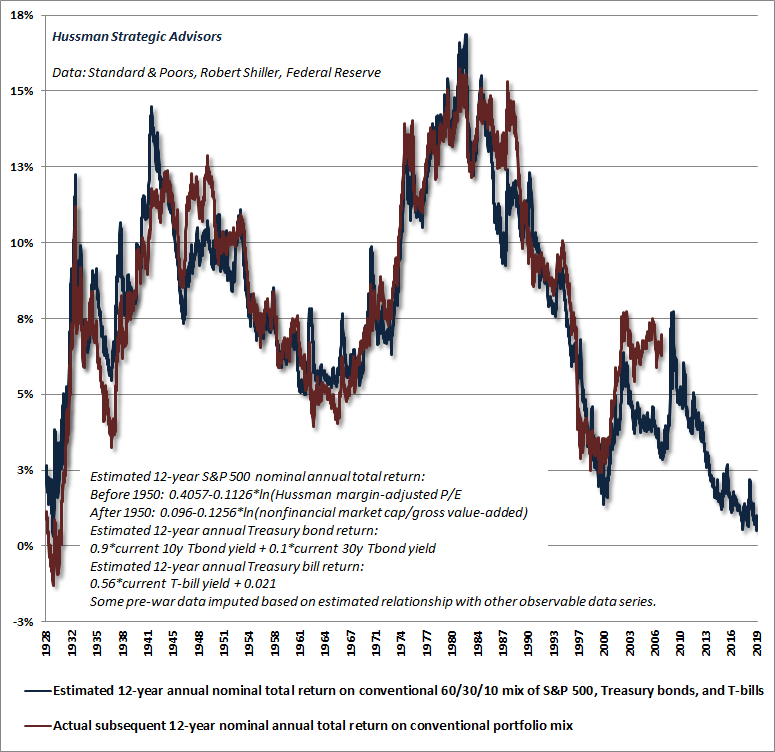

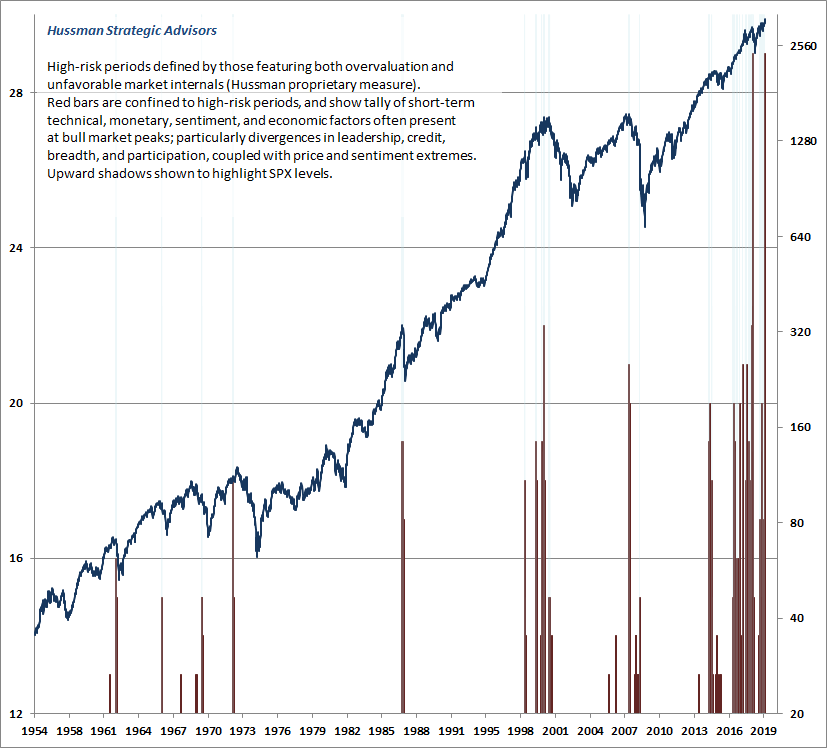

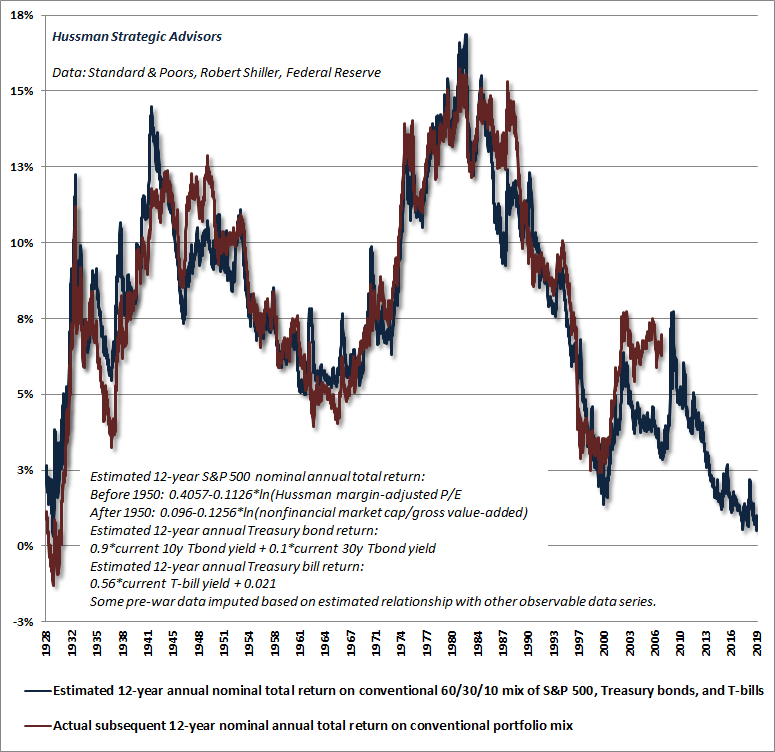

“Are stocks in a bull market? Are stocks in a bear market? The answer isn’t actually observable in real-time. As I’ve noted for decades, bull markets and bear markets exist only in hindsight. When will the bull market end? It might have ended Friday. I kind of think it did. But that question is irrelevant to our investment outlook, because our outlook is a reflection of current, observable evidence. We choose our actions based on the conditions we observe, and the range of outcomes that have historically followed. No future-looking labels are necessary. We also pay special attention to features that tend to emerge – usually as a collection – at the most extreme points of opportunity or risk. The goal isn’t so much to forecast future conditions but instead to identify present ones: to gather observable evidence, to insist on knowing how that evidence has been associated with actual subsequent outcomes, and to align our investment stance with the “distribution” of likely opportunities or risks, understanding that the outcome in this particular instance is unknowable ….

Below is a version of a chart I shared last year. In hindsight, the large collection of duck-like features we observed the week of September 21, 2018 was immediately followed by a -19.8% swoon into year-end. As I observed at the time: “The only time we’ve ever seen a confluence of risk factors anywhere close to those of today was the week of March 24, 2000, which marked the peak of the technology bubble. In my view, this sort of analysis is useful because it doesn’t rely on any single risk factor, and emphasizes that while these risk factors can emerge individually without consequence, a large and critical mass of them probably shouldn’t be dismissed. My impression is that this is as close as one gets to ringing a bell at the top.” We observed an equivalent extreme last week (ended Friday, November 8, 2019). While this is again as close as one gets to a duck, we can’t know until later whether it’s actually a duck. All we can say with confidence is that current, observable market conditions present us with a striking collection of duck-like features.”

Technically Speaking: A Correction Is Coming, Just Don’t Tell The Bulls…Yet.

(MW: Okay, its kinda early to be saying this, but:)

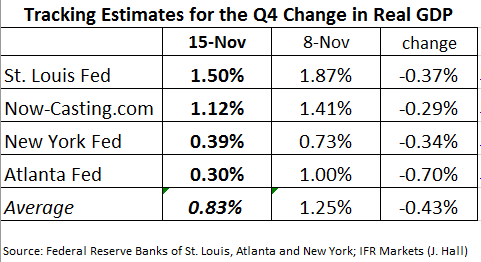

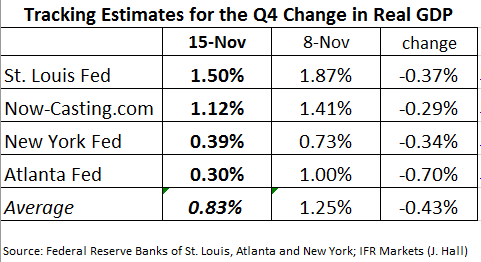

Following a

burst of poor US economic data, including today's disappointing retail sales

and dismal industrial production, the US economic surprise index has slipped

back into the negative after peaking in late September.

Bank

lending, UK, China, India. (charts at the link)

The Long Read:

History as a giant data set: how analysing the past could help save the future. The Guardian.

Calculating the patterns and cycles of the past could lead us to a better understanding of history. Could it also help us prevent a looming crisis?

(not just) for the ESG crowd:

Ben Hunt: The Rake

1) Require by law that the board Chair of publicly traded companies may not also be the CEO. [and if you really want to get serious about this, require that the board Chair be an independent director]

2) Require by law that board directors may only receive cash compensation for their services and are not eligible for any form of stock-based compensation.

3) Require by law that board directors may not exercise any form of previously granted stock-based compensation while they serve on the board.

Do these proposals go far enough? I don’t think so. But they’re a start.

Morgan Stanley: Decarbonization: The Race to Net Zero.

Morgan Stanley produced a Sustainability report in October called Decarbonization: The Race to Net Zero -- it has sections on Renewables; EVs; CCS; Hydrogen; and Biofuels; followed by economics consequences of climate change (low-balled / understated ... if a report doesn't acknowledge the potential economic loss by 2100 is infinite, then it doesn't understand the science ... yes, I'm serious, and so are the scientists -- even if the IPCC, a political body, doesn’t say so); implications for coal/oil/gas (also under-stated, b/c (a) what big US bank is going to piss off its big-time energy clients, and b/c of (b) my last point, i.e. that if we don't keep most of the oil in the soil, we're toast -- if you don't want to believe me, and who does, feel free to check out all the research I've collected on my other blog re: positive feedback effects, tipping points, irreversibilities and abrupt climate change --- particularly re the release of undersea and permafrost methane); green financing; and a just transition(?)

‘Profound shifts’ underway in energy system, says IEA World Energy Outlook. Carbon Brief.

The world’s CO2 emissions are set to continue rising for decades unless there is greater ambition on climate change, despite the “profound shifts” already underway in the global energy system.

It’s too late for a carbon tax—it’s time for a world war against climate change. Adele Peters, Fast Company. Nov. 4, 2019.

“The reality is that we have zero years and we have to change all of our infrastructure.”

Aronoff: We Need a

Green Bailout for the People.

Book review:

Yanis Varoufakis: Good Economics for Hard Times by Abhijit V Banerjee and Esther Duflo review – methodical deconstruction of fake facts

Good Economics for Hard Times is the latest attempt by economists to defend their profession. It is, happily, an excellent antidote to the most dangerous forms of economics bashing: the efforts of opportunistic politicians to weaponise discontent with mainstream politics and to press it into the service of a xenophobic ideology that denies facts and serves the interests of a nativist, global oligarchy.

The book’s authors, MIT economists Abhijit Banerjee and Esther Duflo, write beautifully and are in full command of their subject. They examine the most crucial issues humanity faces (migration, trade wars, the scourge of inequality, climate catastrophe) with a combination of humility over what economics cannot tell us and pride over its contributions to our limited understanding. On every page, they seek to shed much-needed light upon the distortions that bad economics bring to public debates while methodically deconstructing their false assumptions. In their words, the book’s noble, urgent task is “to emphasise that there are no iron laws of economics keeping us from building a more humane world”.

Serendipity would have it that even as Good Economics… was still in the pipeline Banerjee and Duflo, who are also partners in life, were awarded (with Michael Kremer) this year’s Nobel prize in economics. It was an inspired choice. Unlike previous winners, mostly older white males whose grand theories are built upon mathematics of dizzying complexity, they have made a name for themselves by studying the circumstances of the world’s poorest people.

….

in Good Economics…, the plentiful facts do not go far enough in exposing the deeper causes of our current predicament. …. Every book as important as this one must include a theory of change: how shall we use its insights to bring about a more humane world? Banerjee and Duflo’s offering is enlightened selfishness by the rich, and razor-sharp analysis that is disseminated to the public. This is unconvincing, but it could not be otherwise. To provide a persuasive progressive policy agenda at a time when the usual fixes (quantitative easing, taxation) no longer work, the roots of capitalism’s stagnation and flirtation with climate catastrophe must come to the surface. It is a remarkable sign of the times that, as my friend the philosopher Slavoj Žižek once said, even the brightest minds would rather fathom the end of the world than plan for the demise of capitalism. Perhaps the greatest contribution of Good Economics… is precisely this: it demonstrates both the brilliant insights that mainstream economics can make available to us and its limits, which a progressive internationalism has a duty to transcend.

Quote(s) of the Week:

“Tyler Durden”:

"The fact that Dennis Gartman - the most successfully contrarian indicator in the history of capital markets - on Tuesday repeated the now traditional Treasury bear gibberish, that "the case can be made that the three decade long bull run in 30 Year Treasuries has run its course to the end", only gave us certainty that the Treasury selloff is now over."Bill Mitchell:

“One of the stark facts about the academic economics discipline is its insularity and capacity to deliver influential prognoses on issues that affect the well-being of millions with scant regard to the actual consequences of their opinions and with little attention to what other social scientists have to say. The mainstream economists continually get things wrong but take no responsibility for the damage they cause to the well-being of the people”JFK (to James Tobin):

“Is there any economic limit to the deficit? I know of course about the political limits. People say you can’t increase the national debt too fast or too much. We’re always answering that the debt isn’t growing relative to national income. But is there any economic limit to size of the debt in relation to national income? There isn’t is there? Well, what is the limit?” – Tobin said the only limit is really inflation – JFK: “That’s right, isn’t it? The deficit can be any size, the debt can be any size, provided they don’t cause inflation. Everything else is just talk.”

Lars Syll:

Which reminded me of Robert A. Heinlein, in Stranger in a Strange Land.

Photo of the Week:

“A cheetah has given birth to a giant litter of seven adorable cubs… In the wild cheetahs usually give birth to three to five young, and they are vulnerable to predators from birth, so to see seven siblings together is very unusual.”

There are “difficulties encountered by heterodox thinkers. Orthodox thinkers share a dogma, or at least a set of a priori assumptions, and usually a methodology. In essence, this makes orthodox thinking an echo chamber where basic ontology is never questioned. When the heterodox argue, as in the economically heterodox here, the argument eventually descends (or ascends?) into metaphysics; into ontology and epistemology. This is both the benefit and drawback of thinking and arguing from any kind of heterodox position. While we are all drawn here by our rejection of orthodox economics, each of us has a particular perspective. That perspective is drawn from our enculteration and areas of study. That perspective is a kind of filter through which we see and interpret the world. Our only commonality appears to be a rejection of orthodox economics…. After rejecting orthodox economics, which unavoidably involves critiquing and rejecting its patently fallacious ontology, we are faced with the task of constructing a new ontology suitable for modern political economy. It’s not an easy task and there will be many disagreements on perspective. There are two keys in my view. Empiricism is one. “It is a fundamental part of the scientific method that all hypotheses and theories must be tested against observations of the natural world rather than resting solely on a priori reasoning, intuition, or revelation.” ”Lisa Duggan:

“We are in the midst of a major global, political, economic, social and cultural transition—but we don’t know which way we’re headed”

As quoted by Chris Hedges, who also said:

“The corporate coup orchestrated by the ruling oligarchs over the past few decades gave us Donald Trump. If this coup is not reversed, far worse will follow. The oligarchs are the last to understand the consequences of their moral depravity.”

Followed by:

“Oligarchs, freed from outside oversight and regulation, wantonly pillage the political and economic institutions that sustain them. They run up huge government deficits by slashing taxes on the rich. This forces an underfunded government to borrow from the banks, further enriching the oligarchs, and impose punishing austerity programs on the public. They privatize traditional government services, including utilities, intelligence gathering, large parts of the military, the police, the prison system and schools to make billions in profits. They create complex financial mechanisms that ensure usurious interest rates on mortgages, personal and student loans. They legalize accounting fraud and suppress wages to keep the public trapped in a crippling debt peonage. They loot trillions in taxpayer money when their speculative bubbles burst. They are no longer capitalists, if we define capitalists as those who make money from the means of production. They are a criminal class of financial speculators that rewrite the laws to steal from everyone, including their own shareholders. They are parasites that feed off the carcass of industrial capitalism. They produce nothing. They make nothing. They manipulate money. And this gaming of the system and seizure of political power by finance capital is why the wealthiest 1% of America’s families control 40% of the nation’s wealth.”

“Government! Three-fourths parasitic and the rest stupid fumbling.”

Photo of the Week:

“A cheetah has given birth to a giant litter of seven adorable cubs… In the wild cheetahs usually give birth to three to five young, and they are vulnerable to predators from birth, so to see seven siblings together is very unusual.”