Global debt surges to record high $188 tn: IMF chief.

Ray Dalio: The World Has Gone Mad, and the System is Broken.

How Much Higher Can Yields Rise Before Stocks Get Slammed? Marko Kolanovic Answers.

"Not QE", Monetization, & "Definitely Asset Inflation"

Who Needs Graham & Dodd When We Have 'Quantitative' & 'Easing'?

The Recession In The Auto Industry Is Tanking The Global Economy.

Ray Dalio: The World Has Gone Mad, and the System is Broken.

I say these things because:

Money is free for those who are creditworthy because the investors who are giving it to them are willing to get back less than they give. More specifically investors lending to those who are creditworthy will accept very low or negative interest rates and won’t require having their principal paid back for the foreseeable future. They are doing this because they have an enormous amount of money to invest that has been, and continues to be, pushed on them by central banks that are buying financial assets in their futile attempts to push economic activity and inflation up. The reason that this money that is being pushed on investors isn’t pushing growth and inflation much higher is that the investors who are getting it want to invest it rather than spend it. This dynamic is creating a “pushing on a string” dynamic that has happened many times before in history (though not in our lifetimes). As a result of this dynamic, the prices of financial assets have gone way up and the future expected returns have gone way down while economic growth and inflation remain sluggish. Those big price rises and the resulting low expected returns are not just true for bonds; they are equally true for equities, private equity, and venture capital, though these assets’ low expected returns are not as apparent as they are for bond investments because these equity-like investments don’t have stated returns the way bonds do. As a result, their expected returns are left to investors’ imaginations. Because investors have so much money to invest and because of past success stories of stocks of revolutionary technology companies doing so well, more companies than at any time since the dot-com bubble don’t have to make profits or even have clear paths to making profits to sell their stock because they can instead sell their dreams to those investors who are flush with money and borrowing power.

How Much Higher Can Yields Rise Before Stocks Get Slammed? Marko Kolanovic Answers.

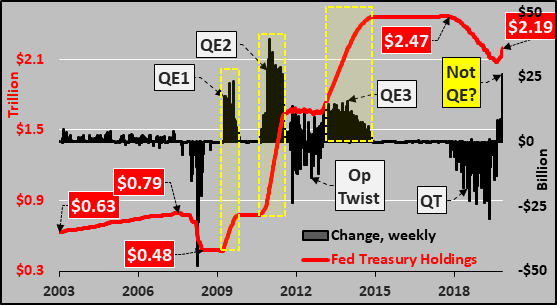

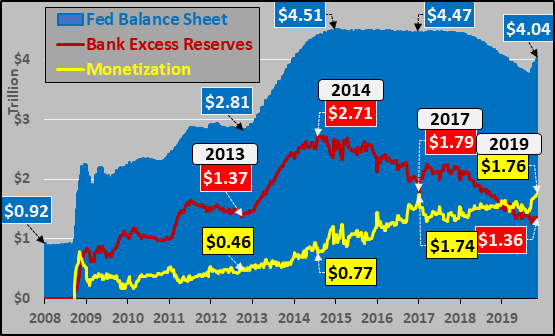

"Not QE", Monetization, & "Definitely Asset Inflation"

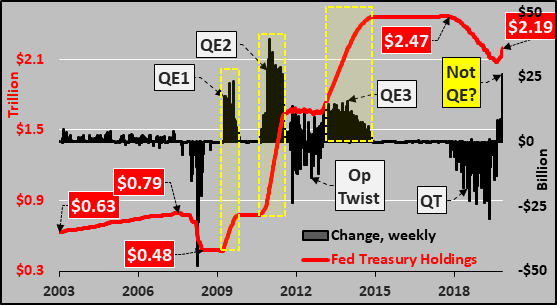

The chart below shows the Federal Reserve holdings of Treasuries, a weekly change (black columns) and total holdings (red line) during QE1, QE2, Operation Twist, QE3, QT, and "Not QE". Got it?!? This current "Not QE" explosion in QE is like some kind of old time vaudeville act (like the old Abbott and Costello bit, "who's on first, what's on second, I don't know's on third"). … As the Fed restarted "not QE" but did not go through the façade of attempting to stock the new money away as "excess reserves", this new money is flowing straight into assets, like monetary heroine.

Who Needs Graham & Dodd When We Have 'Quantitative' & 'Easing'?

The Recession In The Auto Industry Is Tanking The Global Economy.

The global economy continues to grind to a halt and the culprit has never been clearer: the auto industry. For the better part of almost 2 years now, we have been reporting monthly on marked slowdowns in key auto markets like China, North America and Europe. Now, the slowdown in this massive industry is what’s helping spur an overall global economic slowdown, according to FT. The reaches of the auto market go deep, with long supply chains and large consumption of raw materials, textiles, chemicals and electronics. The industry is home to millions of jobs and last year, the sector shrank for the first time since the global financial crisis. The IMF is estimating that this fall in output accounted for more than 25% of the slowdown in the global economy between 2017 and 2018.

Charts from Albert Edwards via Mike Shedlock

“All Big-3 precursors considered, the near-term outlook is weaker than normal but not yet recessionary—the expansion appears to have enough policy support, spending capacity growth and overall momentum to continue through at least the first quarter or two of 2020.Deeper into the year, the outlook could darken as many forecasters predict, especially if corporate earnings continue to slide. But we could just as easily see more of the same—an economy that grinds slowly higher as real incomes grow, asset prices trend upwards and bank balance sheets expand. To gauge which of the scenarios is becoming more likely, I suggest watching the Big-3 and tuning out most everything else.”

“Even though this is a finance and economics blog, I haven’t written about the disruption in the repo markets. That is in part because the upset is not in any way, shape, or form like the 2008 period when banks were unwilling to repo even Treasuries to each other overnight because they were fearful another major dealer (say Morgan Stanley, which was on the verge of going tits up) would go the way of Lehman. I thought posting on it would feed the false narrative (which sadly is still kicking around) that the repo crunch is a sign of systemic stress, which it isn’t. The second reason is that pretty much no one seems to have a clue as to why this is happening including most troublingly, the Fed. Perversely, the fact that the Fed is so clearly behind the curve is almost certain to make whatever the underlying problems are worse. Flatfooted central banks waking up to a problem and randomly hitting switches to try to make it go away is not only not a good look, but it makes the Confidence Fairy have a sad, which makes market upsets worse.We’ll give a high level review of some of the major theories and why they don’t add up (and worse, look like special pleading by banks for regulatory breaks they don’t need) and will turn to an idea from John Dizard of the Financial. Dizard argues that the big banks even with the apparent repo crisis make more money lending to the FX swaps market. This is consistent with big fish like JP Morgan’s Jamie Dimon whining about regulation rather than sounding at all worried.Mind you, we are not saying there are not problems here. What we are questioning is whether they are being characterized properly and whether they could become systemic. If Dizard is right, and Dizard is reviving and amplifying concerns raised by the Bank of International Settlements two years ago, the problem is in FX swaps and forwards, which amount to dollar lending but unlike repos, aren’t booked on balance sheet. That means that this area is a big blind spot for central banks; ….

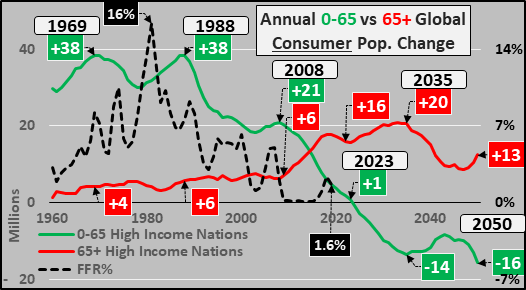

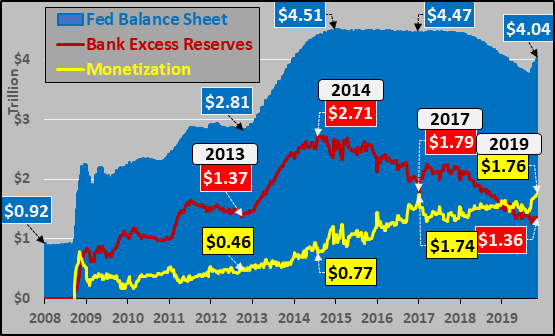

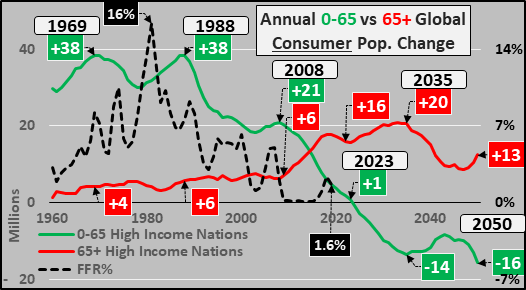

Simply put, in our fractional reserve banking system, the bulk of "money" in the economy is lent into existence by a rising quantity of loans. But the data is clear that those who undertake new loans (create new money) will be in indefinite decline, while roughly equally and oppositely, those that pay down or pay off existing loans (destroy existing money) will take their place. …Thus, there are two options to continue growing debt (aka, "money"). Either encourage the continually fewer working age persons among consumer nations to take out ever more debt (via perversely paying borrowers with NIRP or similar to undertake new loans) and/or central banks conjure it from nowhere. ZIRP, NIRP, QE, LTRO, and acronyms yet to be invented will all have the express purpose to destroy assets (purchasing bonds, stocks, etc. that are never to return to the market) and replace them with newly printed "money" which will chase the remaining assets higher. This monetization is to avoid a free-market from pricing assets based upon a declining quantity of buyers and fast increasing quantity of sellers.

It is the progressive and degenerative fundamental weakness (slowing population growth and outright population declines among consumers) that is the premise for ever greater market interference that drives the observed economic and financial market "strength". Of course, the policy of centrally directing asset appreciation has clear winners (a declining quantity of institutions, asset holders, federal governments) and losers (a fast growing quantity of young, poor, working class, and those with few or no assets).

(read, especially, the “What Does This Mean?” section)

Trending Down. Tim Morgan, Surplus Energy Economics.

Ultimately, the economy isn’t, as the established interpretation would have us believe, a financial system at all. Rather, it’s an energy system, driven by the relationship between (a) the amount of energy to which we have access, and (b) the proportion of that energy, known here as ECoE (the Energy Cost of Energy), that is consumed in the access process.Properly understood, money acts simply as a ‘claim’ on the output of the energy economy, and driving up the aggregate of monetary claims only increases the scope for their elimination in a process of value destruction.…My energy-based economic model, the Surplus Energy Economics Data System (SEEDS), is showing a worsening deterioration, and now points to a huge and widening gap between where the economy really is and the narrative being told about it from the increasingly unreal perspective of conventional measurement.…we should anticipate a major financial shock, far exceeding anything experienced in 2008 (or at any other time), as a direct result of the widening divergence between soaring financial ‘claims’ and the reality of an energy-driven economy tipping into decline.”

(not just) for the ESG crowd :

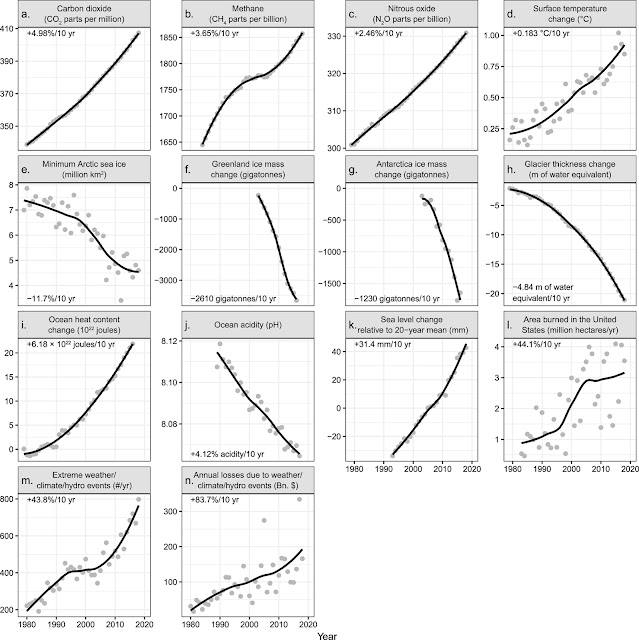

Exactly 40 years ago, scientists from 50 nations met at the First World Climate Conference and agreed that alarming trends for climate change made it urgently necessary to act. Since then, similar alarms have been made through the 1992 Rio Summit, the 1997 Kyoto Protocol, and the 2015 Paris Agreement, as well as scores of other global assemblies and scientists’ explicit warnings of insufficient progress. Yet greenhouse gas emissions are still rapidly rising, with increasingly damaging effects on the Earth's climate. An immense increase of scale in endeavors to conserve our biosphere is needed to avoid untold suffering due to the climate crisis.

In three weeks, the world's leaders will begin to gather in Madrid for the 25th United Nations Climate Change Conference. The intensity of the global climate strikes this year suggests that the proceedings will be scrutinized as never before. But the decisions made, or not made, will also have repercussions for global markets.We’re transitioning towards a lower carbon economy, albeit at a slower pace than needed to stay within a two degrees Celsius climate scenario (2DS).…If governments are serious about halting climate change, some form of stimulus will be needed.…One alternative is to make high-carbon incumbents prohibitively expensive.…Until now, the willingness of governments to take steps to halt climate change has been open to question, given the potential implications for inflation, government debt and employment. But we see several reasons why change may come over the next 12 months. Significantly, awareness and concern about climate change among the general population are growing, driven by more frequent extreme weather, media coverage and actions by protest groups.

(Pictured) Quote of the Week

California Brewery is Printing “Epstein Didn’t Kill Himself” on the Bottom of its Cans.