Global Debt To Hit All Time High $255 Trillion, 330% Of World GDP.

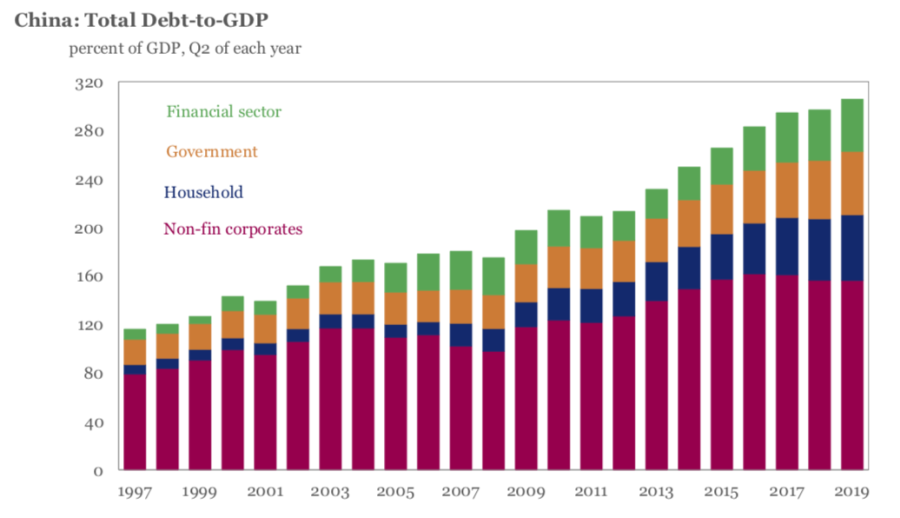

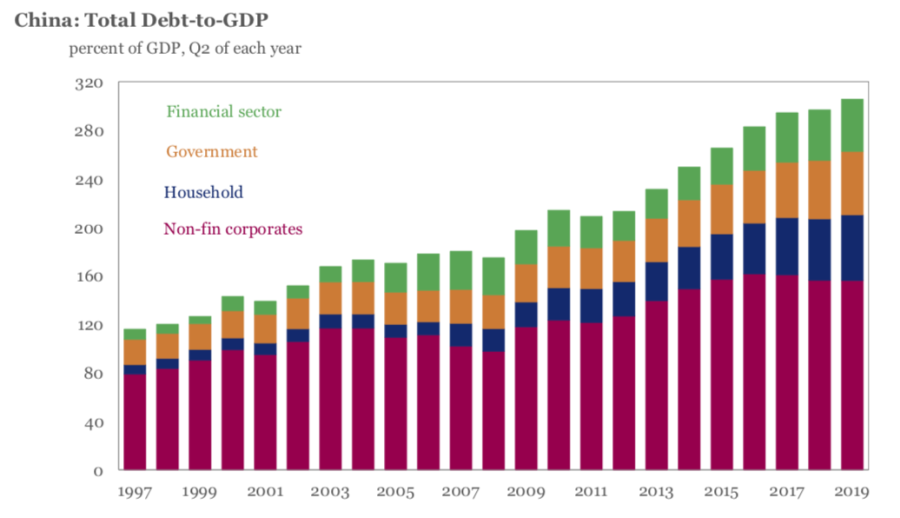

Bank of America's Michael Hartnett on Friday calculated that since the collapse of Lehman, government debt has increased by $30tn, corporates debt by $25tn, household by $9tn, and financial debt by $2tn; And with central banks expected to support government debt, BofA warns that "the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging."

Is There a Threat of a New Global Economic Crisis?

The unprecedented debt load of major economies, like the United States, China and the EU is fraught with a disastrous threat for the entire world. This could lead to a disaster that will by far exceed the Great Depression if deleverage starts, Valdai Club expert Alexander Losev warns. … despite the unprecedented growth of world debt in the past ten years after the 2008 crisis, investment activity in the real economy is declining, growth in the world economy and international trade is slowing and the risk of a global recession is on the rise. The accumulated aggregate debt is becoming a real threat to the stability of the global financial system.

Here's The Simple Reason Why A Global Economic Recovery Is Not Coming.

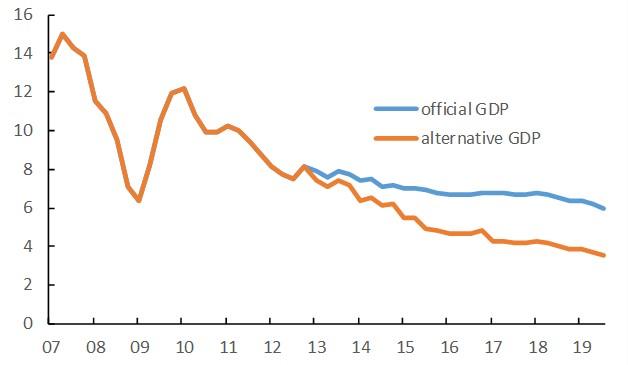

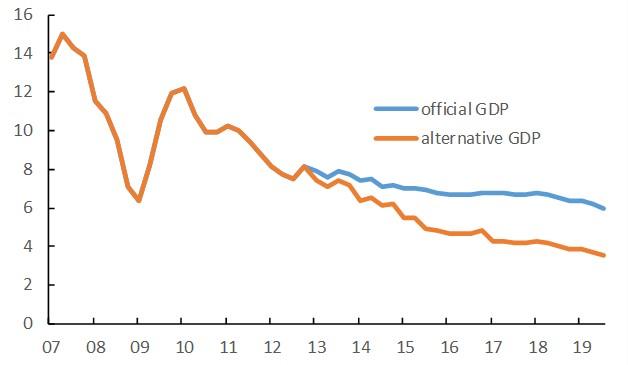

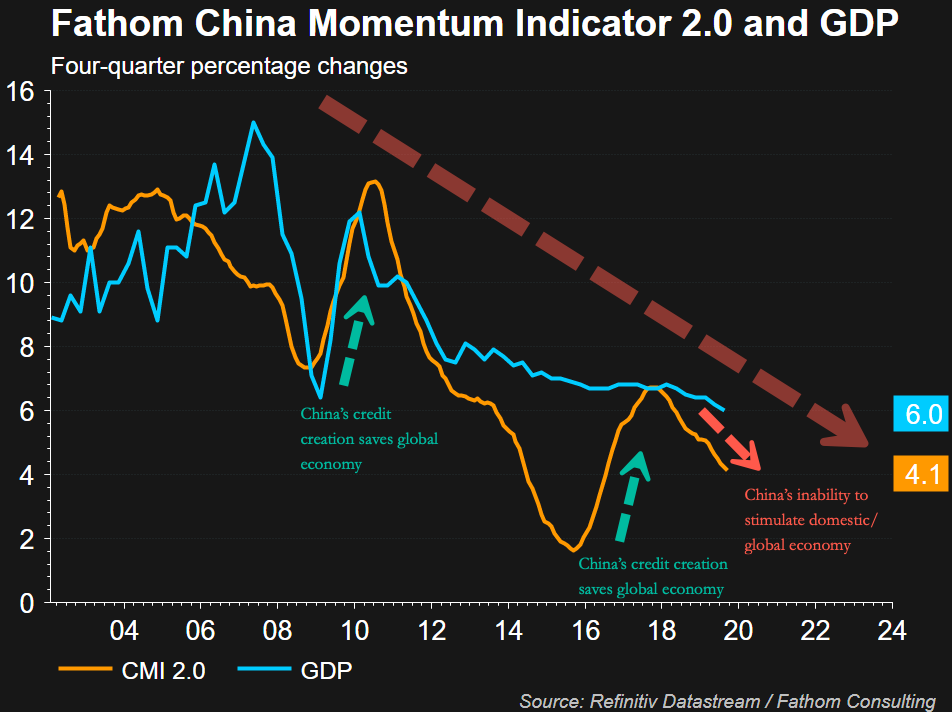

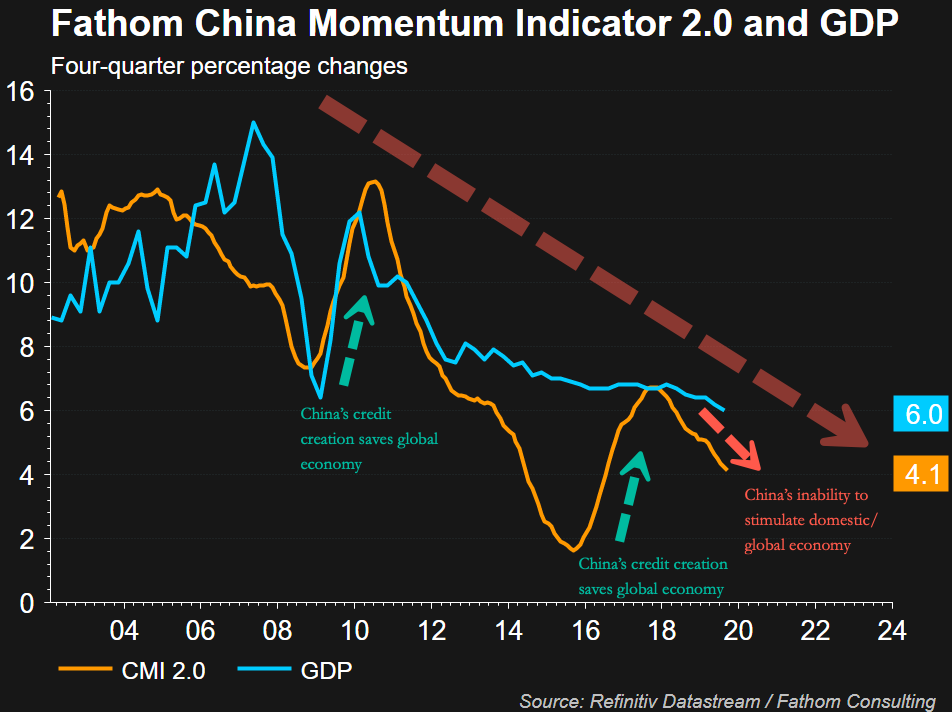

But has the global economy indeed troughed, and is a period of smooth sailing ahead? The answer will depend, as it traditionally has in the past decade, on whether China will stimulate both its own, and the global economy to the point where it successfully triggers a global inflationary shockwave around the globe. Unfortunately, the answer for now appears to be a resounding no, and not just as a result of the latest leading economic indicators out of China which missed across the board, confirming that Beijing is bracing for the first ever sub-6% GDP print. As Saxo Bank's Christopher Dembik writes, there is another reason why China will not open massively the credit tap anytime soon. But before we get into his argument, as a reminder, the latest Chinese credit data was a disaster, with the revised Aggregate Financing data series printing at its lowest level on record as we discussed in "China's Credit Creation Unexpectedly Collapses At The Worst Possible Time."

Why China's Growth Rate Is Much, Much Lower Than You Think.

Seeing as I brought up the topic of the (misleading) savings rate recently:

Why The Measure Of “Savings” Is Entirely Wrong. The reality is the measure of “personal savings,” as calculated by the Bureau of Economic Analysis, is grossly inaccurate. However, to know why such is the case, we need to understand how the savings rate is calculated….

The differential between incomes and the actual “cost of living” is quite substantial. As Researchers at Purdue University found, in the U.S., $132,000 was found to be the optimal income for “feeling” happy for raising a family of four. A Gallup survey found it required $58,000 to support a family of four in the U.S. (Forget about being happy, we are talking about “just getting by.”)

The “gap” between the “standard of living” and real disposable incomes is shown below. Beginning in 1990, incomes alone were no longer able to meet the standard of living so consumers turned to debt to fill the “gap.” However, following the “financial crisis,” even the combined levels of income and debt no longer fill the gap. Currently, there is almost a $2654 annual deficit that cannot be filled.

That gap explains why consumer debt is at historic highs and growing each year. If individuals were saving 8% of their money every year (as per the phony US personal savings rate), debt balances would at least be flat, if not declining, as they are paid off.

Consumers Are Keeping The US Out Of Recession? Don’t Count On It.

Fed's "National Activity Index" Plunges To 2-Year Low.

Bank of America's Michael Hartnett on Friday calculated that since the collapse of Lehman, government debt has increased by $30tn, corporates debt by $25tn, household by $9tn, and financial debt by $2tn; And with central banks expected to support government debt, BofA warns that "the biggest recession risk is disorderly rise in credit spreads & corporate deleveraging."

Is There a Threat of a New Global Economic Crisis?

The unprecedented debt load of major economies, like the United States, China and the EU is fraught with a disastrous threat for the entire world. This could lead to a disaster that will by far exceed the Great Depression if deleverage starts, Valdai Club expert Alexander Losev warns. … despite the unprecedented growth of world debt in the past ten years after the 2008 crisis, investment activity in the real economy is declining, growth in the world economy and international trade is slowing and the risk of a global recession is on the rise. The accumulated aggregate debt is becoming a real threat to the stability of the global financial system.

Here's The Simple Reason Why A Global Economic Recovery Is Not Coming.

But has the global economy indeed troughed, and is a period of smooth sailing ahead? The answer will depend, as it traditionally has in the past decade, on whether China will stimulate both its own, and the global economy to the point where it successfully triggers a global inflationary shockwave around the globe. Unfortunately, the answer for now appears to be a resounding no, and not just as a result of the latest leading economic indicators out of China which missed across the board, confirming that Beijing is bracing for the first ever sub-6% GDP print. As Saxo Bank's Christopher Dembik writes, there is another reason why China will not open massively the credit tap anytime soon. But before we get into his argument, as a reminder, the latest Chinese credit data was a disaster, with the revised Aggregate Financing data series printing at its lowest level on record as we discussed in "China's Credit Creation Unexpectedly Collapses At The Worst Possible Time."

Why China's Growth Rate Is Much, Much Lower Than You Think.

Fathom's China Momentum Indicator Signals More Downside Ahead

Michael Pettis, via Mish: China, like Japan in the 1990s, Will Be Dominated by Huge Zombie Banks.

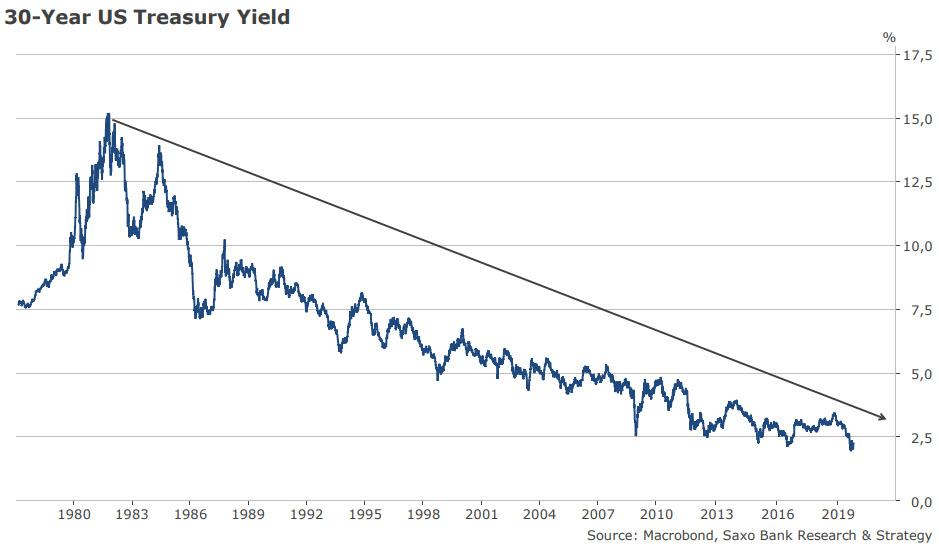

China needs to prepare for zero interest rates.

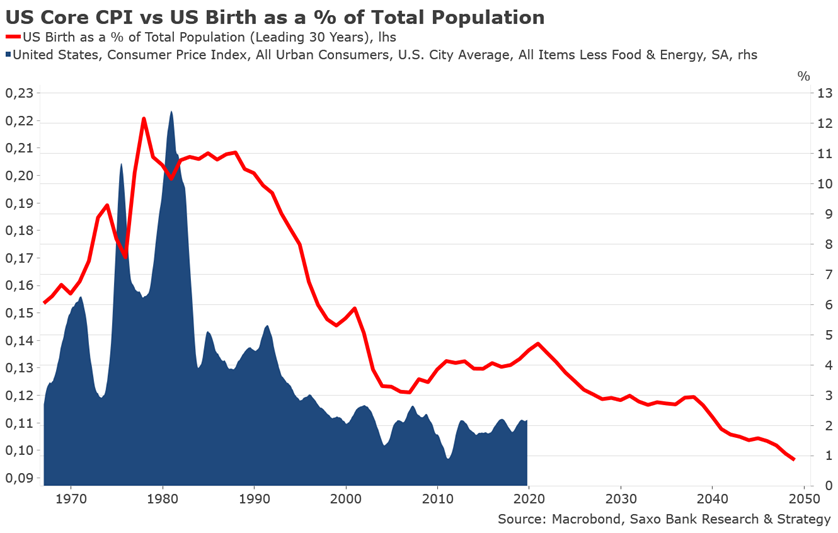

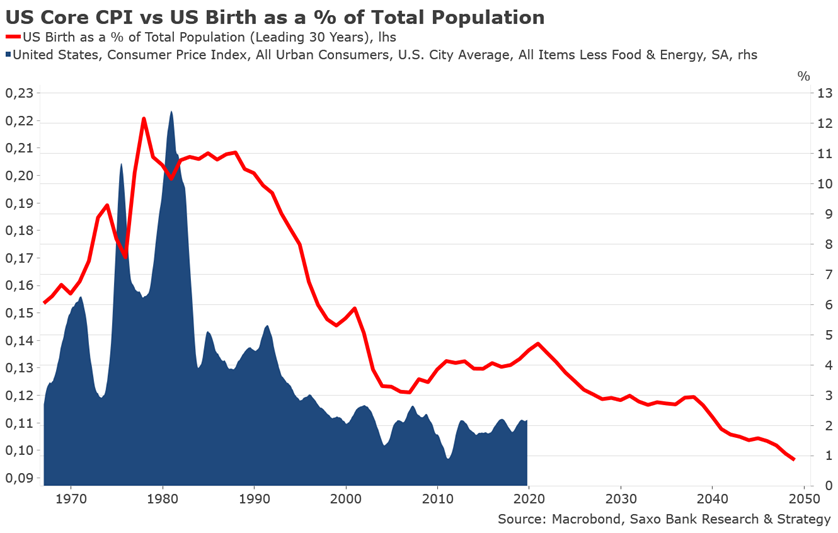

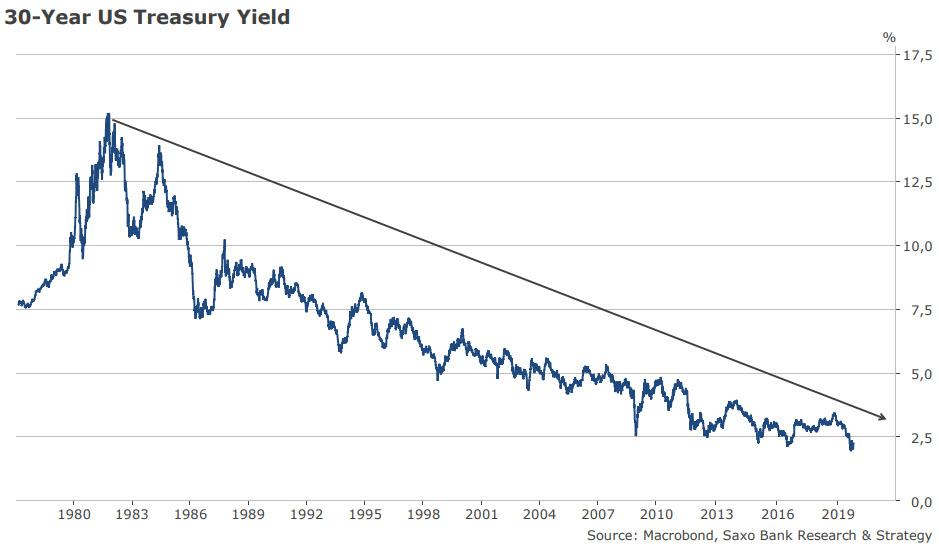

Visualizing The Simple Reason Why America Will Drown In Deflation.

World Trade Barometer Suggests Global Economy Continues To Plunge As Trade War Takes Toll.

Rail Recession: U.S. Carloads Continue Collapse As Manufacturing Slows.

Couple charts from GS from:

Michael Pettis, via Mish: China, like Japan in the 1990s, Will Be Dominated by Huge Zombie Banks.

China needs to prepare for zero interest rates.

Visualizing The Simple Reason Why America Will Drown In Deflation.

World Trade Barometer Suggests Global Economy Continues To Plunge As Trade War Takes Toll.

Rail Recession: U.S. Carloads Continue Collapse As Manufacturing Slows.

Couple charts from GS from:

Here Are Goldman's Top Trades And Themes For 2020.

Wage growth is picking up… from repressed levels back to normal

Wage growth is picking up… from repressed levels back to normal

Seeing as I brought up the topic of the (misleading) savings rate recently:

Why The Measure Of “Savings” Is Entirely Wrong. The reality is the measure of “personal savings,” as calculated by the Bureau of Economic Analysis, is grossly inaccurate. However, to know why such is the case, we need to understand how the savings rate is calculated….

The differential between incomes and the actual “cost of living” is quite substantial. As Researchers at Purdue University found, in the U.S., $132,000 was found to be the optimal income for “feeling” happy for raising a family of four. A Gallup survey found it required $58,000 to support a family of four in the U.S. (Forget about being happy, we are talking about “just getting by.”)

The “gap” between the “standard of living” and real disposable incomes is shown below. Beginning in 1990, incomes alone were no longer able to meet the standard of living so consumers turned to debt to fill the “gap.” However, following the “financial crisis,” even the combined levels of income and debt no longer fill the gap. Currently, there is almost a $2654 annual deficit that cannot be filled.

That gap explains why consumer debt is at historic highs and growing each year. If individuals were saving 8% of their money every year (as per the phony US personal savings rate), debt balances would at least be flat, if not declining, as they are paid off.

Consumers Are Keeping The US Out Of Recession? Don’t Count On It.

Fed's "National Activity Index" Plunges To 2-Year Low.

(Not just) for the ESG crowd:

Brookfield markets new green bond in Canada, sets sights on Brazil and India.

Climate-proofing Canada’s economy.

Lewis Lapham in Lapham’s Quarterly: Paying the Piper.

Steve Keen: ‘4°C of global warming is optimal’ – even Nobel Prize winners are getting things catastrophically wrong.

Climate Change Is Coming for Global Trade. As sea levels rise and storms become fiercer, container shipping could be in for major disruptions

Ford’s Mustang Mach-E is an electric SUV with up to 300 miles of range. (Starting at US$43,895 and coming in late 2020)

Geopolitics

Ian Bremmer: The End of the American International Order: What Comes Next?

Bound to Fail: The Rise and Fall of the Liberal International Order. Journal of International Security.

Other Fare:

Blockbuster WSJ Investigation: How Google Interferes With Its Search Algorithms and Changes Your Results.

Book Review:

David Graeber: Against Economics – reviews Robert Skidelsky’s Money and Government: The Past and Future of Economics.

Quotes of the Week:

Rubino: “Every sector of the U.S. economy is so over indebted I don’t see how we go on much longer. The Fed is desperately trying to prolong this thing. We’re running trillion dollar deficits now, and what that is for is to keep the system from falling apart. We are 11 years into an expansion, a record. This is the longest bull market in history, and this is the longest economic expansion in history… These guys don’t know exactly what’s going to happen in the next recession, but they are afraid that the system is so highly leveraged that even a garden-variety three quarters of a percent of negative growth and a garden variety of 20 % drop in stock prices might be fatal. The system might not be able to handle that because it would cause so much damage and there are so many different places that can blow up that the system would spin out of control. We would get 2008-09 again but on steroids because the numbers are so much bigger this time around. So, they want to avoid that at all costs.”

US AG William Barr: “in waging a scorched earth, no-holds-barred war of ‘Resistance’ against this Administration, it is the Left that is engaged in the systematic shredding of norms and the undermining of the rule of law.”

… much more on Adam Schiff’s and the Democrats’ Orwellian “campaign to blow smoke up America’s ass for three years running” by JHK here, and more on our Pravda-like B.S. media’s inane coverage or our insane world by Johnstone here, in which politicians and the media “use a light sprinkling of fact to weave a narrative that has very little to do with reality”

Photo of the Week:

Hope we don’t have any “Black Swans” coming, because they are fierce-looking!

Totally Unrelated – Catchy Headlines; just checking if you’re reading these:

Pointless work meetings 'really a form of therapy'.

Cops put GPS tracker on man’s car, charge him with theft for removing it.

They Can't Stop Us:' People Are Having Sex With 3D Avatars of Their Exes and Celebrities.

Brookfield markets new green bond in Canada, sets sights on Brazil and India.

Climate-proofing Canada’s economy.

There is no denying that climate change is now a mainstream issue, as evidenced by vigorous debates in the recent federal election. While governments are struggling to come up with public-policy responses, global investors and financial institutions are not standing around. The investment world is already shaping markets in response to the effects of climate change.

Lewis Lapham in Lapham’s Quarterly: Paying the Piper.

The warming of the planet currently spread across seven continents, four oceans, and twenty-four time zones is the product of a fossil-fueled capitalist economy that over the past two hundred years has stuffed the world with riches beyond the wit of man to marvel at or measure. The wealth of nations comes at a steep price—typhoons in the Philippine Sea, Category 5 hurricanes in the Caribbean, massive flooding in Kansas and Uttar Pradesh, forests disappearing in Sumatra and Brazil, unbearable heat in Paris, uncontrollable wildfires in California, unbreathable air in Mexico City and Beijing.

The capitalist dynamic is both cause of our prosperous good fortune and means of our probable destruction, the damage in large part the work of Adam Smith’s invisible hand, guided by the belief that money buys the future. Nature doesn’t take checks. Who then pays the piper—does capitalism survive climate change, or does a changed climate put an end to capitalism? The question informs this issue of Lapham’s Quarterly…

Steve Keen: ‘4°C of global warming is optimal’ – even Nobel Prize winners are getting things catastrophically wrong.

William Nordhaus was awarded the 2018 Nobel Prize in Economics for “integrating climate change into long-run macroeconomic analysis”. This implies that he worked out what global heating means for our economy, given what climate scientists say will happen to our planet. But Nordhaus’s predictions of what global heating will cost the earth are dangerously at odds with the science. In his Nobel Prize lecture, Nordhaus described a 4°C increase in global average temperature as “optimal” — that is, the point at which the costs and benefits of mitigating climate change are balanced. In a subsequent academic paper based on this lecture, he stated that “damages are estimated to be 2 percent of output at a 3°C global warming and 8 percent of output with 6°C warming”. This is a trivial level of damage, equivalent for the 6°C warming case to a fall in the rate of economic growth over the next century of less than 0.1% per year. …. The average global temperature during the last Ice Age was 4°C cooler than today. There’s no way we can accurately predict what GDP would be in such a cool world today, but we know that most of Europe north of Berlin, and of America north of New York, would be under a kilometre of ice. To argue that this would cut GDP by just 3.6% is simply absurd.

Climate Change Is Coming for Global Trade. As sea levels rise and storms become fiercer, container shipping could be in for major disruptions

Ford’s Mustang Mach-E is an electric SUV with up to 300 miles of range. (Starting at US$43,895 and coming in late 2020)

Geopolitics

Ian Bremmer: The End of the American International Order: What Comes Next?

This is the text of a speech delivered by Bremmer on November 18 at the 2019 GZERO Summit in Tokyo.

Bound to Fail: The Rise and Fall of the Liberal International Order. Journal of International Security.

The liberal international order, erected after the Cold War, was crumbling by 2019. It was flawed from the start and thus destined to fail. The spread of liberal democracy around the globe—essential for building that order—faced strong resistance because of nationalism, which emphasizes self-determination. Some targeted states also resisted U.S. efforts to promote liberal democracy for security-related reasons. Additionally, problems arose because a liberal order calls for states to delegate substantial decision-making authority to international institutions and to allow refugees and immigrants to move easily across borders. Modern nation-states privilege sovereignty and national identity, however, which guarantees trouble when institutions become powerful and borders porous. Furthermore, the hyperglobalization that is integral to the liberal order creates economic problems among the lower and middle classes within the liberal democracies, fueling a backlash against that order. Finally, the liberal order accelerated China’s rise, which helped transform the system from unipolar to multipolar. A liberal international order is possible only in unipolarity. The new multipolar world will feature three realist orders: a thin international order that facilitates cooperation, and two bounded orders—one dominated by China, the other by the United States—poised for waging security competition between them.

Other Fare:

Blockbuster WSJ Investigation: How Google Interferes With Its Search Algorithms and Changes Your Results.

Book Review:

David Graeber: Against Economics – reviews Robert Skidelsky’s Money and Government: The Past and Future of Economics.

There is a growing feeling, among those who have the responsibility of managing large economies, that the discipline of economics is no longer fit for purpose. It is beginning to look like a science designed to solve problems that no longer exist. A good example is the obsession with inflation. Economists still teach their students that the primary economic role of government—many would insist, its only really proper economic role—is to guarantee price stability. We must be constantly vigilant over the dangers of inflation. For governments to simply print money is therefore inherently sinful. If, however, inflation is kept at bay through the coordinated action of government and central bankers, the market should find its “natural rate of unemployment,” and investors, taking advantage of clear price signals, should be able to ensure healthy growth. These assumptions came with the monetarism of the 1980s, the idea that government should restrict itself to managing the money supply, and by the 1990s had come to be accepted as such elementary common sense that pretty much all political debate had to set out from a ritual acknowledgment of the perils of government spending. This continues to be the case, despite the fact that, since the 2008 recession, central banks have been printing money frantically in an attempt to create inflation and compel the rich to do something useful with their money, and have been largely unsuccessful in both endeavors.

We now live in a different economic universe than we did before the crash. Falling unemployment no longer drives up wages. Printing money does not cause inflation. Yet the language of public debate, and the wisdom conveyed in economic textbooks, remain almost entirely unchanged.

One expects a certain institutional lag. Mainstream economists nowadays might not be particularly good at predicting financial crashes, facilitating general prosperity, or coming up with models for preventing climate change, but when it comes to establishing themselves in positions of intellectual authority, unaffected by such failings, their success is unparalleled. One would have to look at the history of religions to find anything like it. To this day, economics continues to be taught not as a story of arguments—not, like any other social science, as a welter of often warring theoretical perspectives—but rather as something more like physics, the gradual realization of universal, unimpeachable mathematical truths. “Heterodox” theories of economics do, of course, exist, but their exponents have been almost completely locked out of what are considered “serious” departments, and even outright rebellions by economics students (from the post-autistic economics movement in France to post-crash economics in Britain) have largely failed to force them into the core curriculum.

As a result, heterodox economists continue to be treated as just a step or two away from crackpots, despite the fact that they often have a much better record of predicting real-world economic events. What’s more, the basic psychological assumptions on which mainstream (neoclassical) economics is based—though they have long since been disproved by actual psychologists—have colonized the academy, and have had a profound impact on popular understandings of the world.

Nowhere is this divide between public debate and economic reality more dramatic than in Britain, which is perhaps why it appears to be the first country where something is beginning to crack. It was center-left New Labour that presided over the pre-crash bubble, and voters’ throw-the-bastards-out reaction brought a series of Conservative governments that soon discovered that a rhetoric of austerity—the Churchillian evocation of common sacrifice for the public good—played well with the British public, allowing them to win broad popular acceptance for policies designed to pare down what little remained of the British welfare state and redistribute resources upward, toward the rich. “There is no magic money tree,” as Theresa May put it during the snap election of 2017—virtually the only memorable line from one of the most lackluster campaigns in British history. The phrase has been repeated endlessly in the media, whenever someone asks why the UK is the only country in Western Europe that charges university tuition, or whether it is really necessary to have quite so many people sleeping on the streets.

The truly extraordinary thing about May’s phrase is that it isn’t true. There are plenty of magic money trees in Britain, as there are in any developed economy. They are called “banks.” Since modern money is simply credit, banks can and do create money literally out of nothing, simply by making loans. Almost all of the money circulating in Britain at the moment is bank-created in this way. Not only is the public largely unaware of this, but a recent survey by the British research group Positive Money discovered that an astounding 85 percent of members of Parliament had no idea where money really came from (most appeared to be under the impression that it was produced by the Royal Mint).

Quotes of the Week:

Rubino: “Every sector of the U.S. economy is so over indebted I don’t see how we go on much longer. The Fed is desperately trying to prolong this thing. We’re running trillion dollar deficits now, and what that is for is to keep the system from falling apart. We are 11 years into an expansion, a record. This is the longest bull market in history, and this is the longest economic expansion in history… These guys don’t know exactly what’s going to happen in the next recession, but they are afraid that the system is so highly leveraged that even a garden-variety three quarters of a percent of negative growth and a garden variety of 20 % drop in stock prices might be fatal. The system might not be able to handle that because it would cause so much damage and there are so many different places that can blow up that the system would spin out of control. We would get 2008-09 again but on steroids because the numbers are so much bigger this time around. So, they want to avoid that at all costs.”

US AG William Barr: “in waging a scorched earth, no-holds-barred war of ‘Resistance’ against this Administration, it is the Left that is engaged in the systematic shredding of norms and the undermining of the rule of law.”

… much more on Adam Schiff’s and the Democrats’ Orwellian “campaign to blow smoke up America’s ass for three years running” by JHK here, and more on our Pravda-like B.S. media’s inane coverage or our insane world by Johnstone here, in which politicians and the media “use a light sprinkling of fact to weave a narrative that has very little to do with reality”

Photo of the Week:

Hope we don’t have any “Black Swans” coming, because they are fierce-looking!

Totally Unrelated – Catchy Headlines; just checking if you’re reading these:

Pointless work meetings 'really a form of therapy'.

Cops put GPS tracker on man’s car, charge him with theft for removing it.

They Can't Stop Us:' People Are Having Sex With 3D Avatars of Their Exes and Celebrities.