*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

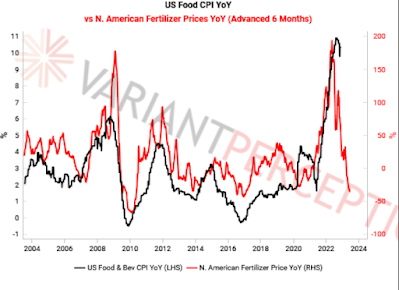

Grannis: The Inflation Tide Continues to Recede

Fed will cause unnecessary harm to the US and world economy this year

ISM Manufacturing Contracts For 2nd Month, Prices Paid & New Orders Plunge

Samsung Profits Plunge 69% As Global Chip Demand In 'Full-Fledged Ice Age'

Flexport CEO Warns Container Shipping In "Great Recession"

Flexport founder and co-CEO Ryan Petersen warned a global shipping downturn is underway. He said the container shipping industry is in "recession" as a glut in capacity plagues major shipping lines. This comes right after Baltic Exchange's dry bulk sea freight index crashed on Tuesday, an ominous sign the global economy could be headed for turmoil. ....

Quotes of the Week:

1:

...Just a quick sidenote.

— Justin Hart (@justin_hart) January 5, 2023

Manufacturing orders are falling at a rate that we haven’t seen since the Great Depression.

That is all. pic.twitter.com/OWV6DhuFPv

...The ISM Prices Paid index called for US CPI at 8% already in summer 2021.

— Alf (@MacroAlf) January 4, 2023

Its rapid decline now points to sub-2% headline inflation at the end of this year already! pic.twitter.com/dH8w5XBtfv

...“The employment data published in the establishment survey is not confirmed by the household survey, which is well known to be more useful/accurate, especially at major turning points in the economy.” https://t.co/icBF1bqUx9 pic.twitter.com/nFOxQKlhkO

— Jesse Felder (@jessefelder) January 6, 2023

FUNDSTRAT sees another monthly #CPI gain of 0.1% for December — which, it says, “would represent a massive decline in the pace of inflation and put the 3M annualized (SAAR) rate at ~2%.” It “would be the ‘floor dropping’ out of [the Fed’s inflation] forecast.”@fundstrat pic.twitter.com/Ep5eJ03Qp3

— Carl Quintanilla (@carlquintanilla) January 6, 2023

Bubble Fare:

In other words, if the Fed woke up to their incipient mistake tomorrow, it would still be too late to bailout markets and the economy.

In summary, the only REAL question is, how much does the Fed have to crush the Nasdaq and the housing market in order to collapse CPI. And then once they find that out the hard way, they can jump in their time machine and go back one rate hike.

That is the bull case in a nutshell.

Before I continue, I want to clearly state that the chance of this fund’s 2023 performance being anywhere near that of 2022’s is roughly equal to the chance of Elon Musk offering me a board seat at Tesla. (For the record, I would not accept such an offer as I don’t want to go to jail!) Okay, now that that’s out of the way…

Tesla’s inevitable meltdown (alright, so I was a mere eight years too early!) was a big contributor to this year’s performance (and we remain short it, as I believe it has another 90% to go), as were our other short positions in the S&P 500 (via SPY) and, early in the year, the garbage-stock ETF ARKK (which I covered way too early, leaving lots of additional profit on the table).

(not just) for the ESG crowd:

Pics of the Week:

No comments:

Post a Comment