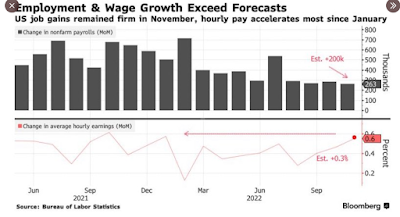

Something Is Rigged: Unexplained, Record 2.7 Million Jobs Gap Emerges In Broken Payrolls Report

............ Alas, there is only so much the Department of Labor can hide under the rug because when looking at the abovementioned gap between the Household and Establishment surveys which we have been pounding the table on since the summer, it just blew out by a whopping 401K as a result of the 263K increase in the number of nonfarm payrolls (tracked by the Household survey) offset by a perplexing plunge in the number of people actually employed which tumbled by 138K (tracked by Household survey) ........

Quotes of the Week:

Carvana’s auto financing volume fell *24%* in Oct and marked the 6th straight month of declines.

Hartnett: “Bears (like us) worry unemployment in 2023 will be as shocking to Main Street consumer sentiment as inflation in 2022...We’re selling risk rallies from here,” with bonds being preferable for the first half of 2023

MacroAlf: Central Banks in 2021: ''We won't raise rates in 2022 or for years to come actually'' 2022: massive rate hikes

Central Banks in 2022: ''We won't cut rates in 2023, higher for longer''

2023: ???

Tweet Thread of the Week:

8:

...

Vid Fare:

Bubble Fare:

Gamblers are assuming the worst is over. Unfortunately, the worst hasn't even started yet......

............

Notably, the Fed never mentioned record corporate profit as a source of inflation. Which I should remind everyone - but mostly the idiots at the Fed - that record corporate profit is AFTER deducting "inflated" employee wages. How could wages be the source of the problem when profits are up 45% in three years?

Here is what BofA has to say about the relationship between jobs, recession, and corporate profits:

"The prospect of negative job growth and a recession probably won’t bode well for the stock market. When the economy contracts, corporate profits usually deteriorate" .........

.... I contend that the Santa rally is ALREADY over. It ended a month too soon this year as evidenced by the biggest two month Dow rally in history. .....

...... Notably, from the inception of Strategic Growth Fund through November 30, 2010 – when the Federal Reserve aggressively expanded its zero-interest rate policies – the hedging approach of Strategic Growth augmented the Fund’s stock selection returns while also reducing portfolio volatility. The Fund remained ahead of the S&P 500 through May 20, 2014. However, as I’ve detailed extensively in other comments, our bearish response to historically-reliable “limits” to speculation became progressively detrimental, as zero-interest rates encouraged persistent yield-seeking speculation among investors well-beyond prior extremes. By the beginning of 2022, our most reliable valuation measures had exceeded the levels observed at both the 1929 and 2000 bubble peaks.

We adapted our discipline in late-2017 by abandoning our bearish response to previously reliable “limits” to speculation, when our measures of market internals suggest speculative behavior among investors. We introduced additional adaptations in 2021 to lean more heavily to a constructive investment outlook – regardless of the level of valuations – when our measures of market internals are uniformly favorable. These adaptations have restored the strategic flexibility that we enjoyed prior to the Federal Reserve’s foray into zero-interest rate policy, with Strategic Growth Fund nicely outperforming a more than 25% gain in the S&P 500 since the February 2000 pre-pandemic high, with substantially lower volatility.

Still, the adaptations to our discipline do not encourage us to adopt a constructive market outlook in overvalued markets with ragged and divergent internals, which is the set of conditions we presently observe, as we did at the 2000, 2007, and 2020 market peaks.

Year-to-date market losses have retraced the frothiest segment of the recent speculative bubble, yet valuations remain at levels that we continue to associate with negative expected S&P 500 nominal total returns over the coming 10-12 year period. As of November 30, 2022, the total return of the S&P 500 is down less than 15% from the most extreme level of stock market valuations in history, based on the measures that we find best-correlated with actual subsequent market returns across a century of market cycles. ........

In our view, steep market losses generally reflect risk-aversion meeting a low risk-premium. As a result, we continue to describe market conditions, particularly in equities, as a “trap door” situation. In Strategic Growth Fund, Strategic Allocation Fund and Strategic International Fund, our equity exposures are fully or nearly-fully hedged (Strategic Allocation Fund always holds at least 5% of assets in unhedged equities). That will change as market conditions change. As always, we believe that the strongest return/risk profile for stocks emerges when a material retreat in valuations is joined by a shift to uniformly favorable market internals. We’ve observed such a shift after every bear market decline since I introduced our key measure of internals in 1998, as well as in a century of historical data.

....... We continue to believe that a value-conscious, risk-managed, full-cycle discipline, focused on the combination of valuations and market internals, will be essential in navigating market volatility in the years ahead. The chart below shows our estimate of 12-year prospective returns for a conventional passive portfolio mix invested 60% in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills. The red line shows actual subsequent 12-year returns for this same portfolio mix. While year-to-date market losses have brought this estimate out of the negative territory that we observed at the recent speculative peak, our estimates are nowhere near levels that we would associate with satisfactory long-term returns.

(not just) for the ESG crowd:

This report reviews evidence that overshooting 1.5°C may push the earth over several tipping points, leading to irreversible and severe changes in the climate system. If triggered, tipping point impacts will rapidly cascade through socio-economic and ecological systems, leading to severe effects on human and natural systems and imposing important challenges for human adaptation. Of particular concern are the likely collapse of the West Antarctic and Greenland ice sheets and the abrupt melting of permafrost grounds in the Arctic, which would result in additional sea-level rise and greenhouse gas releases, leading to more warming. Based on the most recent science and consultations with renowned experts, Climate Tipping Points: Insights for Effective Policy Action argues that it is no longer appropriate to consider the risk of crossing tipping points as low-probability. Overshooting 1.5°C may likely lead to irreversible and severe impacts, which must be avoided, heightening the urgency to drastically reduce emissions within this decade. The report calls for a shift in how tipping points are treated in climate policy today and provides recommendations on how climate risk management strategies can better reflect the risks of tipping points in the areas of mitigation, adaptation and technological innovation.

........... There is evidence that a number of tipping points may already have been crossed or are close to being crossed. For example, it cannot be ruled out that West Antarctic Ice Sheet (WAIS) and the Greenland ice-sheet tipping points have already been crossed, while low-latitude coral reefs and the abrupt permafrost thaw tipping points are likely to be crossed if temperatures increase above 1.5°C (McKay et al., 2022[8]). In addition, the Atlantic Meridional Overturning Circulation (AMOC) has been slowing down in the last two decades (Good et al., 2018[9]) and is at its weakest for over a millennium (Caesar et al., 2021[10]; Boers, 2021[11]). If triggered, these tipping points could potentially lead to cascading global impacts, including triggering further tipping points, with dramatic effects on human and natural systems (Lenton et al., 2019[12]).

At the global scale, such cascading effects, where the crossing of one tipping point leads to the triggering of further tipping elements, could lead to a new ‘hothouse’ global climate .........

The Chinese-chaired “Cop15” global biodiversity conference kicks off in Montreal, Canada this week, and campaigners have called for a deal similar to the historic Paris Agreement secured in 2015 to tackle climate change.

While the collapse of nature may be the less-well known sister problem to the climate crisis, the figures showing what people are doing to the planet are no less stark.

A UN-backed study released ahead of the original 2020 date for the conference – before the pandemic hit – showed up to a million species were at risk of extinction, many within decades.

The scientists warned that the natural world is deteriorating faster than ever as a direct result of human activity, including the clearing of forests and other habitats for crops and livestock, pollution, direct exploitation of wildlife, invasive species and increasingly climate change. ....

In neighboring Indonesia, nickel extraction is causing environmental and social devastation.

The World Meteorological Organization warns that climate-related shortages in water resources could affect two thirds of the world’s population by midcentury and will be felt unevenly

Sci Fare:

World Wildlife Conservation Day falls every December 4th to raise awareness and engage conversations about species that are endangered or under threat of extinction because of poaching, trafficking and other environmental factors. Wildlife conservation is the act of protecting endangered and near-extinct species by preserving their natural habitat.

Other Fare:

Breaking free from the tyranny of fixed ideas

Have you ever been in a team meeting where someone has an idea they’re so wedded to that they can’t entertain other options? Some people in the group might agree, while others might disagree and suggest other solutions. Depending on the group dynamics, each person may become increasingly attached to their own position.

If you’re lucky, however, there’s another person in the group who avoids getting caught up in these strongly held opinions. This person can look at all the different ideas at once, perhaps seeing some that haven’t been suggested, and can move flexibly among them to weigh their pros and cons. They don’t get stuck in one worldview.

In my last essay, I introduced the idea of fixation in the context of behavior. What happens when we become so attached to our own thoughts, opinions, and beliefs that we’re no longer able to put them aside or have any others? How can we get out of this pattern? ......

I’ve written previously that you can only respond to what you notice. One effect of experiencing something as familiar is that it engenders a tunnel vision that closes off other possibilities. While tunnel vision can provide its own sense of comfort, being unable to notice new possibilities can cause you to miss opportunities, or encourage you to walk into dangerous situations while thinking they’re safe. ....

I’ve written previously that you can only respond to what you notice. One effect of experiencing something as familiar is that it engenders a tunnel vision that closes off other possibilities. While tunnel vision can provide its own sense of comfort, being unable to notice new possibilities can cause you to miss opportunities, or encourage you to walk into dangerous situations while thinking they’re safe. ...

For hundreds of years, Christians knew exactly where heaven was: above us and above the stars. Then came the new cosmologists

Vid of the Week:

Contrarian Perspectives

Extra [i.e. Controversial] Fare:

*** denotes well-worth reading in full at source (even if excerpted extensively here)

Krishnamurti: “It is no measure of health to be well adjusted to a profoundly sick society.”

Regular [Everyday Life] Fare:

Perhaps even more stunning than the Biden administration's announcement that it will side with the railroad barons over the workers being denied sick leave is its cavalier assumption that any blowback from congressional Democrats and their constituents will be minimal to non-existent. .....

There is no other word for what the Democratic Party has just done to railworkers than betrayal. I am sorry, dear reader, if you don’t like to hear that.

I don’t think that’s how President Biden sees it. He’s a process guy, he got union leadership and the railroad companies to hash out a deal a couple of months ago, he thinks it’s fine and good. Historic even.

Only the rank and file did not agree. It was unacceptable to the unions representing a majority of railworkers. Biden seems to view this as workers reneging on his deal. That is bullshit. A deal is not a deal until the principal signs on the dotted line, not when some lawyer says it’s the best he could do. Sorry if you think it was your deal, Joe.

The deal was unacceptable not because railworkers are greedy. The “historic” raise in the tentative agreement will barely exceed inflation over the period of the contract. Railworkers are treading water on wages. The unreasonable commie militants seem just fine with that.

The dispute is over how railworkers are treated. Which, in a word, is like shit. ....

........... Recently in Ontario, the government passed a bill which forbade education workers (non-teachers) to strike. It included a $4k fine a day for each striker, and $50k a day for the union. The union struck anyway; other unions stated they would strike as well, and the bill was rescinded.

In the US, general strikes are illegal, made so in the 50s by Taft-Hartley (which also made it so that supervisors can’t join unions — a huge problem).

If a law is unjust, you must break the law. To be successful, you must do it en-masse. I know it won’t happen soon, but US unions need to buckle down and do a wide strike, with the goal of repealing Taft-Hartley and making “back to work” bills illegal. Without that, the right to join unions and their right to call strikes means little.

I do see some hope. I wasn’t sure if Ontario unions would have the guts to do the right thing, but they saw an existential threat, and they acted with solidarity. In the US, the ongoing Amazon and Starbucks unionization efforts are very hopeful because the people doing it are tough — in the face of repeated firings and closures they have simply continued.

People’s backs are to the wall. Since about 1980, the predominant policy in the US has been to immiserate workers, especially wage workers. This was possible because the New Deal and post-war eras had made workers well enough off that they had some surplus which could then be stolen from them.

But now a lot of people are up against the wall. ....

On this day: Dec 04, 1969

Unsustainability / Climate Fare:

The dismal reality is that green energy will save not the complex web of life on Earth but the particular way of life of one domineering species.

CONSERVATION BIOLOGY FINDS itself in a terrifying place today, witness to mass extinction, helpless to stop the march of industrial Homo sapiens, the pillage of habitat, the loss of wildlands, and the impoverishment of ecosystems. Many of its leading figures are in despair. “I’m 40 years into conservation biology and I can tell you we are losing badly, getting our asses kicked,” Dan Ashe, director of the U.S. Fish and Wildlife Service under President Barack Obama, told me recently. “There are almost no reasons to be optimistic.”

This might explain the discipline’s desperate hitching of its wagon to the climate movement. Climate, after all, is the environmental cause du jour, eclipsing all other sustainability concerns, increasingly attractive as a rallying cry for a public that has canonized it as one of the major political, social, and economic issues of our time. Mainstream climate activism of the Bill McKibben variety points toward a grandly hopeful end within the confines of acceptable capitalist discourse: decarbonization of the global economy, with technologies driven by profit-seeking corporations subsidized by governments. Taking up this banner of optimistic can-do-ism, the environmental movement has convinced itself, and sought to convince the public, that with a worldwide build-out of renewable energy systems, humanity will power its dynamic industrial civilization with jobs-producing green machines while also — somehow — rescuing countless species from the brink.

“But this happens to be a lie,” Ashe told me. “The lie is that if we address the climate crisis, we will also solve the biodiversity crisis.” ......

Climate change is “but one symptom of an environmentally dysfunctional system of constant growth of economies and populations,” ecologist William Rees, professor emeritus at the University of British Columbia, told me.

“The meta-problem that we need to keep our eyes on,” Rees said, is ecological overshoot. Modern techno-industrial culture, he writes, “is systematically — even enthusiastically — consuming the biophysical basis of its own existence.” Rees describes this as a malignant process, humanity as cancer.

Rees is hardly alone in his stark assessments of the status quo. In the most recent letter of “world scientists’ warning,” a semiannual notice to the public, 12 experts in life sciences, global system dynamics, and ecology noted that “most planetary boundaries that regulate the state of the Earth are beyond their safe space. Therefore, climate change is not a stand-alone issue. It is part of a larger systemic problem of ecological overshoot.” ........

To me, the central questions that will have to be confronted — not so much by me as by my children and grandchildren — are whether and how they will escape early death and near-term human extinction from now-irrevocable events set in motion by their grandparents and mine.

Richard Heinberg writes:

My generation basically had all the information it needed. We had books like Silent Spring, Limits to Growth, and Small Is Beautiful. We could have tamped down consumption, but instead, we threw the biggest party in all of human history and we’re leaving the next generations to clean up after us.

How that happened is fairly simple to say. We screwed up. Maybe you could say it was through no fault of our own, although that gets harder to utter the longer we ignore what is happening and continue along with extravagant and heedless lifestyles, willfully ignoring the consequences. ......

....... And that’s one of my main targets in the book. Trying to get people aligned with the bitter truth on climate. Because as you know, Manda, my view very strongly is that there are incredible things that are possible for us, which we don’t even understand fully yet. But that some of those things are only going to be accessible if we first get clear on the things which are no longer possible. If we allow some things to move into the rear-view mirror, then other things become possible. This is what Jonathan Lear, for example, famously argued in his amazing book, Radical Hope; that some new hopes only become possible, only become available, only become visible if we give up some things which it just doesn’t make sense to continue to hope for. .....

...

Endemic Fare:

I've

continued to come across too much excellent COVID-related content (with

contrarian evidence-based points-of-view!!) to link to it all

Read [almost?] everything by eugyppius; el gato malo; Mathew Crawford; Steve Kirsch; Jessica Rose!

Chudov, Lyons-Weiler, Toby Rogers are also go-to mainstays; a list to which I have added Andreas Oehler, Joey Smalley (aka Metatron) and, Julius Ruechel; Denninger worth staying on top of too for his insights, and especially his colorful language; and Norman Fenton; Marc Girardot; plus Walter Chesnut (on twitter); later additions: Sheldon Yakiwchuk & Charles Rixey & Aaron Kheriarty; and newest additions Meryl Nass and the awesome Radagast; and Spartacus is on substack now!!; I will of course continue to post links to key Peter McCullough material, and Geert Vanden Bossche, and Robert Malone, and Martin Kulldorff, and Jay Bhattacharya, and Sucharit Bhakdi, and Pierre Kory, and Harvey Risch, and Michael Yeadon, and John Ioannidis, and Paul Marik, and Tess Lawrie, and Dolores Cahill, and [local prof] Byram Bridle, and Ryan Cole, and... of course Heather Heying and Charles Eisenstein often

bring their insight and wisdom to the topic as well... and if Heying's

substack isn't enough, she joins her husband Bret Weinstein at their DarkHorse podcast .... but,

in any case, check out those sources directly as I will my linking to

material by those mainstays mentioned above will be reduced to key

excerpts and/or essential posts

Highlights from recent scientific literature

It is hard to believe, but the CDC is actually recommending that everyone get a booster every two months. Why is that? Because the CDC wants everyone to think that this is how long people are “protected” after injection.

A new study shows that 94% of the US population were estimated to have been infected by SARS-CoV-2 at least once.

Now, as the new variants of Omicron are even less pathogenic than the last, the risk/benefit ratio of a booster every two months is beyond upside down. But let’s look at some of the more recent studies to back up this “claim.” ...

Australia's mortality statistics for 2022 are worse than the ABS is admitting to, so why are they tweaking the data - and where is the investigation?

By now it seems common knowledge that the pandemic year was not 2020 or 2021, but the post-vaccine rollout year of 2022. Nowhere is this more stark than in Australia, one of the few countries that has a relatively comprehensive COVID data set that can be interrogated.

So what happened? Well it seems, according to the Australian Bureau of Statistics latest release that there are a lot of people dying in 2022 that would not normally be dying based on every year previously. They even have pretty graphs to show the carnage….

CDC Policy: avoid autopsies; German Study Explains What They Were Hiding

........ Because most of the Western population now constantly gets SARS-COV-2 as a result of the mass vaccination campaign, the population suffers immune depletion. This is only happening to the highly vaccinated nations. In the unvaccinated nations, cases and deaths from SARS-COV-2 plunged to ~zero after a small Omicron waves .....

................... And hey, I don’t have a Phd, I dropped out of kindergarten so I had to figure things out along the way, but I will say again:

-It was obviously a terrible product when they had to constantly pause the vaccination campaign at the start here in the EU because they couldn’t help but wonder whether all those elderly people dying died from the vaccine itself.

-It was obviously always a terrible risk-benefit trade-off for young non-obese adults like me.

-It was obviously not working once the Scottish hospital beds filled up again in july 2021.

-It was obviously a stupid idea to give a third shot of a vaccine to solve the problem caused by the first two not working.

I will say, if I thought they were going to fuck up as massively as they did I would have started warning about this a lot earlier, but I didn’t anticipate the level of stupidity we witnessed. ....

The Eternal Westoid is the man who thinks there’s always a technological solution just around the corner to every problem he created, provided you can even get him to accept the problem is even real to begin with. You can weaponize the Eternal Westoid’s naive optimism against him, by confronting him with a problem so severe that he will slip into denial about it. I’m not trying to give Xi Jinping or Vladimir Putin any new ideas here, I’m legitimately worried they already figured this out by themselves.

It doesn’t matter which level of the pyramid you look at. Climb to its highest echelons and you’ll find virologists who will insist that surely this strange virus that popped up within a literal stone throw’s distance from a lab where they were funding the development of corona viruses with new furin cleavage sites must have evolved spontaneously somehow without us noticing.

Descend a little further down and you’ll find public health scientists who will insist to us with a straight face that we’re all just going to have to accept that for years to come more people will die than normal. Why? Well people missed medical appointments in 2020 due to the lockdowns so now we’re all just going to have to die, there’s nothing we can do about it. And if you wonder why we had negative excess mortality in summer 2020 then, or heck, in summer 2021 even, you need to SHUT UP and get in line with the new story. ......

... Again, none of this would be very controversial, if we hadn’t faced a cover-up from day one, with all of the world’s most prominent virologists gathering together to protect their (well-funded) hobby of tinkering with viruses to create new abominations. In this sense, the substack stupidity is downstream from the virologist evil.

The Eternal Westoid’s greatest act of naive optimistic stupidity of course was to believe that although all his previous attempts at vaccinating against corona viruses had failed, he somehow had the incredible luck of figuring out how to do it, just in time for a new global corona virus pandemic!

.............. “You want to lock people up in their homes now?” No I’m proposing the radical idea that when you create new viruses and release them into the population all your options suck and there might not be a solution. Yes, this is an innovative new idea, the idea that sometimes you can fuck things up so badly that there’s no way to make things right again. But it’s an idea you’re going to have to learn to live with if you will. ........

I see a lot of reporting on the Chinese government and its zero COVID policy, both from mainstream media and “alternative” media sources. But what I never tend to see, is reporting based on the radical notion that a government ruling over 1.6 billion people, not beholden to corporate interests due to their communist regime, is perhaps not just being retarded.

The takes I tend to see always consist of some variation of “it’s just an excuse to control the population” or “they got stuck on this policy and don’t want to lose face”. What I never see is: “Maybe they know some stuff that we in the West don’t know or simply choose to ignore.” Every take on China and its COVID choices, like their refusal to approve the mRNA vaccines or their refusal to allow the virus to spread, is always based on the simple notion that they must be irrational, pointlessly cruel and prone to stupid errors.

What I never hear, is some acknowledgement that MAYBE we don’t have a monopoly on truth. ....

........ Maybe they’re not being irrational when they refuse to give their population the mRNA vaccines. Maybe they were first just being cautious with novel technologies. And maybe at this point they have no interest in the mRNA vaccines anymore because the data being reported now suggest to them these vaccines merely make the problem worse. ......

And here’s the most radical notion yet that I want you to consider: Maybe Chinese people are smart. Let’s have a look at the PISA school rankings again: ..

Maybe they’re not being irrational when they refuse to give their population the mRNA vaccines. Maybe they were first just being cautious with novel technologies. And maybe at this point they have no interest in the mRNA vaccines anymore because the data being reported now suggest to them these vaccines merely make the problem worse.

Hubris will be our downfall. And the only thing I see when it comes to reporting on Chinese COVID policies, is hubris. .......

The correct explanation is the most straightforward one: They want to eliminate SARS-COV-2, because they’re afraid of SARS-COV-2.

Why would they be so afraid of SARS-COV-2? Well let’s start with something simple. Once you have it, you have it forever. After 359 days, you still find SARS-COV-2 RNA in the lungs of people who are testing negative on PCR tests. Maybe you don’t have it in your lungs anymore, but you still have it in your brain. It never seems to get fully eradicated, your immune system is stuck forever fighting it, hence the immune exhaustion seen in convalescent patients. ........

“But Omicron is a nothingburger!” Here’s the problem with that line of reasoning. After four weeks, 21.5% of BA.5 infected Americans still reported symptoms. And most importantly: BA.5 is the most brain-damaging version we’ve seen so far of this virus. BA.2 was more brain-damaging than the ones before it, BA.5 is now more brain-damaging than BA.2. .....

Imagine the following scenario: Scientists develop a vaccine against a virus, test it and find that it reduces risk of hospitalization from infection by 75%. And yet, despite no change to the virus itself, the vaccine ended up dramatically increasing the number of hospitalizations, even though the 75% protection against hospitalization stood fast as a rock. How could such a thing happen?

Well imagine for a moment that the vaccine increases your risk of infection by 30%, because the sort of immune response it provokes in your body is similar to that in anyone else who receives the vaccine. This is the sort of risk that wouldn’t show up during clinical trials ......

.... And my conviction is that the majority of people reading something like this, even people with Phd’s, will think to themselves: “Well it still works against hospitalization so I’m still better off because I got vaccinated” instead of thinking: “This is how you turn small waves that burn out on their own, into big waves that burn through the whole population.”

Does a 20 or 30% increased risk of infection really matter THAT much? The answer is that yes it does, if you realize the sort of numbers we’re toying with here ......

Professor Emeritus at Kyoto University warns billions of lives could ultimately be in danger due to Covid vaccines.

Natural immunity has been suppressed

MidWestDoc: Critical Thinking in The Age of Censorship Pt. 2

Responding to the Fact-Checkers

...... The bewildering lack of awareness of their own hypocrisy seems to be a feature of COVID obsessed politicians and public health authorities. Another similar, oft-repeated assertion is that the failure of universal masking can be explained by the type of masks being used by the public. Even though the CDC and Dr. Fauci explicitly claimed that wearing anything to cover your face would be effective at preventing transmission, many have now quietly dismissed that messaging. Fauci specifically said that “cloth coverings work,” not just surgical or N95’s. Former Surgeon General Jerome Adams famously suggested that rolling up a t-shirt in front of your face would be effective protection.

Yet public health departments and the media are now highlighting the importance of “high quality,” “well fitted” masks. Their desperation to justify masking has led to remarkably poor studies being released to support their anti-science messaging. There is new research that has been released showing that masks are ineffective, regardless of type. And it’s not just new research, it’s high quality research. The Annals of Internal Medicine just published a randomized controlled trial comparing the ability of medical masks to prevent COVID infection to fit-tested N95’s. .....

Tweets & Quotes of the Week:

Dr. Aseem Malhotra: “Anthony Fauci doesn’t seem to have a basic understanding of evidence based medicine. ‘Trust the Science’ in effect was saying ‘Trust the Psychopath’.”

...

...

...

...

...

...

Anecdotal Fare:

Pushback Fare:

Canadian Prime Minister Justin Trudeau left many of us gobsmacked this week when he denounced China for its crackdown on protesters. .....

COVID Conspiracy Fare:

HE WORKED THERE - calls it the greatest cover-up in history

Back to Non-Pandemic Fare:

War Fare:

Other Geopolitical Fare:

I am proud to announce the release of a 75 page, full color special report titled “Breaking Free of Anti-China Psyops: How the Cold War is Being Revived and What You Can Do About It”. This report features essential research exposing the new false narratives which are working overtime to close your mind off of the reality of the Anglo-Venetian oligarchy at the causal nexus of a global dark age agenda. ....

Orwellian Fare:

Author Douglas Murray and I take on Malcolm Gladwell of the New Yorker, and Michelle Goldberg of the New York Times

The following is a transcript of the Munk Debates in Toronto last Wednesday, November 30th, in which author Douglas Murray and I took on New Yorker contributor Malcolm Gladwell and columnist Michelle Goldberg of the New York Times. As noted, we won with the largest swing in the event’s history, moving from a 48%-52% voter deficit to a 67%-33% win. .........

The FBI as a Democrat Censor

Bills C-11, C-18, C-21, C-26, & C-36 will turn Canada into an authoritarian hellscape

***** CaitOz Fare ***** :

....... When asked to describe this project I often say “I write about the end of illusions,” because from my point of view all of the major problems our species now faces are born of a misperception of what’s really happening. On a collective level human behavior is being driven by propaganda and the systems it manufactures consent for, and on an individual level we’re being driven by the delusion of ego. From my point of view it’s all just illusion, so I frequently swing in and out discussing illusion’s large- and small-scale manifestations without breaking them up too much; that’s why you’ll see commentary on mass media manipulations intermingled with what look like spiritual or philosophical observations, often in the same essay. For me it’s all one issue.

I see illusions as the only obstacle to the creation of a healthy world, which in my view would look like a movement from the competition-based models of capitalism, militarism, imperialism and domination to collaboration-based models where all humans work in cooperation with each other and with our ecosystem toward the common good of all beings. The only things preventing that movement are the large-scale illusions that our rulers have been indoctrinating us with since birth about what’s real and what’s possible, as well as the small-scale illusions of ego and separation which keep us enslaved to fear, greed, and unconscious reactivity.

The prospect of a large-scale awakening of human consciousness and radical transformation of the way humans behave on this planet may sound lofty and impractical, but the way I see it our species has trapped itself in a situation where that will either happen or we’ll go the way of the dinosaur. Every species eventually hits a point where it either adapts to changing situations or goes extinct, and as we accelerate toward nuclear war and the destruction of our biosphere it seems fair to say that that crucial juncture is upon homo sapiens now. ......

.................. “NATO should be renamed ASFP: the Alliance for Self Fulfilling Prophecies,” tweeted commentator Arnaud Bertrand of the alliance’s discussions about Taiwan.

“A defensive alliance doesn’t look to pick fights with a country on a different continent,” tweeted Jacobin’s Branko Marcetic. “This is some classic mission creep from NATO – or, more accurately, Washington.” ......

........ Snider quotes Lyle Goldstein, a visiting professor at Brown University, who says that “In order to maintain its hegemonic position, the US supports Ukraine to wage hybrid warfare against Russia…The purpose is to hit Russia, contain Europe, kidnap ‘allies,’ and threaten China.” .......

.......... Flesh-and-blood armed goons will hesitate to fire upon their countrymen in a domestic uprising. They can be persuaded to side with the people and oust the sitting government. They have beating hearts and aren’t covered in armor. We are still a ways off from AI-guided weaponized robots enforcing the rule of law on our streets, but that does appear to be where we’re headed, and once we’re there it’s entirely possible that the door to revolution will have been bolted shut for good.

If that’s the case, then it’s no exaggeration to say that humanity is in a race between (A) a revolution against the status quo power structures which are oppressing and exploiting us while driving us toward disaster and (B) the ubiquitousness of armed police units. Our rulers keep incrementally pacing us into accepting this in the same way they pace us into accepting internet censorship, whistleblower persecution, and the war on journalism.

So it’s probably important that we do not accept it, and keep shining a bright public spotlight on this freakish trend to keep it from becoming normalized.

Rigger-ous Reads (on Culture Wars, Identity Politics, etc.):

Long Reads / Big Thoughts:

........... As for the crimes against humanity that have unfolded over the Covid era, I want neither to exaggerate nor understate them. Before I list some, I’d like to offer a little historical perspective. You see, I know that some readers will disagree with these points and were probably long ago sick of hearing about them. However, the main theme of this essay series is independent of the crimes of the Covid era, for they stand alongside a litany of atrocities extending back to the dawn of civilization. In their company, the crimes of the Covid era are unexceptional. How do they compare to the Great Leap Forward under Mao, when some 30 million people starved to death under forced collectivization of farmland? Or the Nazi Holocaust, with its millions upon millions of victims? Or the Soviet Gulag? Or the countless genocidal campaigns of the colonial period that exterminated most of the world’s indigenous people? Or the enslavement of Africans over three centuries? How, indeed, do they compare to the prevailing global economic system that has visited poverty and misery upon most of the world throughout the last century? My point here is not to excuse or trivialize the crimes of the Covid era, but rather to paint the problem of evil in broader outline. But my purpose is not to make comparisons; it is to investigate the mechanics of evil. Because, in case you haven’t noticed, the War on Evil hasn’t been going very well.

So here is my partial list:

- The laboratory origin of SARS-CoV2 and the coordinated attempt to hide it.

- The suppression, through fraudulent studies, censorship, and prohibition, of generic and natural treatments for Covid, which could have reduced the death toll by at least 80%.

- Inflation of death statistics to justify extreme public health measures.

- Mass quarantines and lockdowns that plunged hundreds of millions of people into poverty and caused the ranks of the world’s hungry to swell by 150 million, and the severely food-insecure by 207 million. Many of them were children. .....

- Suspension of democratic rights and civil liberties, by which governments established a precedent to seize absolute power by merely declaring a health emergency. What will the next state of emergency be?

- Intimidation, censorship, cancellation, character assassination, and firing of doctors, scientists, and journalists who dared to contradict Covid orthodoxy.

- The hurried development of mRNA vaccines in disregard of plausible mechanisms of harm, and their subsequent mass deployment even though the technology had never before been used on humans.

- A massive propaganda and censorship campaign to promote the vaccines and silence their skeptics.

- The mandating of vaccines even as their harms and limited efficacy became more obvious.

- The willful failure of regulators to ensure good manufacturing practices by the drug companies making the vaccines.

- The ignoring and suppressing of safety signals by the very agencies entrusted to monitor them.

All of this happened with a high degree of coordination among all of society’s leading institutions. The media, the drug companies, the tech companies, regulators, governments, academia, and even financial institutions collaborated to manage the narrative and push authoritarian policies. It looks an awful lot like the whole thing was a monstrous, orchestrated plot ........

There is another explanation. It is not exclusive of the conspiracy explanation, but it is broader, deeper, and more terrifying. It hinges on the very nature of power and the very nature of evil; thus, it offers a unifying principle to tie together the horrors that litter the landscape of history. ...................

Other Quotes of the Week:

Bongino: The media response to the bombshell Twitter revelations was entirely, 100% predictable. Journalism died decades ago, and any sane observer knows it. When you cut through all the bullshit and accept that the media are largely activists, you’ll never be disappointed.

Mckay: The "Putin fell down the stairs and shit himself" fairy tale is another case of projection by the American and British propagandists. There is a president who's constantly falling over and having "bathroom incidents" and he lives at 1600 Pensylvania Avenue not in the Kremlin.

Medhurst: Netherlands beat the U.S. 3-1, knocking them out the FIFA World Cup.

First time I’ve ever seen the US leave an Arab country voluntarily.

Fun Fare Vid of the Week:

Pics:

No comments:

Post a Comment