*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

....... “Our analysis concludes that today’s inflation is largely driven by supply shocks and sectoral demand shifts, not by excess aggregate demand. Monetary policy, then, is too blunt an instrument because it will greatly reduce inflation only at the cost of unnecessarily high unemployment, with severe adverse distributive consequences.”

The Consumer Price Index (CPI) in November was just 0.1% higher than in October on a seasonally-adjusted basis. Since June, the CPI has grown at a yearly rate of just 2.5%.

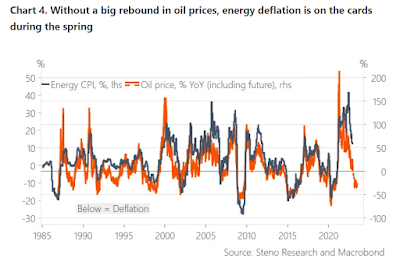

At first glance, this looks like the post-reopening normalization that optimists had been anticipating for the past 18+ months. But while there are some encouraging signs in the details of the data, it would be premature to conclude that America’s inflation troubles are over. The downturn in energy prices will probably end soon unless there is a severe economic contraction, while the latest Producer Price Index (PPI) numbers suggest that the benefit of falling manufactured goods prices may have already peaked. Overall, the price data are still consistent with the claim that underlying inflation is stabilizing around 4-5% a year—which also happens to be what is implied by the wage data. ......

US CPI printed at 7.1% - smack dab at our forecast - but it is not necessarily a signal to buy risk assets. Margins increased when inflation was hot. The opposite will happen now.

It's not just Academy strategist Peter Tchir who bucks the prevailing consensus of at least two more rate hikes in 2023, and expects that today's 50bps rate hike will be last one by the Fed: Bloomberg strategist Simon White is also in this contrarian camp, and here's why - looking at historical data back to 1972, White finds that the last Fed hike takes place, in average terms, about 22 weeks after the peak in CPI. With the peak CPI in this cycle hitting in June, about 22/23 weeks ago, that would put the last Fed hike of the cycle at today’s meeting. After that, the first cut then happens - in median terms - about 16 weeks later, which in the current cycle would put us in early April 2023. In short, today the tightening cycle and, and the easing cycle begins in 4 months. .....

The Real Goal of Fed Policy: Breaking Inflation, the Middle Class or the Bubble Economy?

.......

Breaking the “Fed Put”

In the face of all this economic strife, why is the Fed not reversing its aggressive interest rate hikes, as investors have come to expect? Former British diplomat and EU foreign policy advisor Alastair Crooke suggests that the Fed’s goal is something else:

The Fed … may be attempting to implement a contrarian, controlled demolition of the U.S. bubble-economy through interest rate increases. The rate rises will not slay the inflation “dragon” (they would need to be much higher to do that). The purpose is to break a generalized “dependency habit” on free money.

Danielle DiMartino Booth, former advisor to Dallas Federal Reserve President Richard Fisher, agrees. She stated in an interview with financial journalist and podcaster Julia LaRoche:

Maybe Jay Powell is trying to kill the “Fed put.” Maybe he’s trying to break the back of speculation once and for all, so that it’s the Fed – truly an independent apolitical entity – that is making monetary policy, and not speculators making monetary policy for the Fed.

............

Pushing “Until Something Breaks”

Whether or not popping these raging speculative bubbles is the goal, the Fed’s interest rate hikes are having that effect. ........

BofA Global Research:

10 Key Themes from BofA Macro/Strategy Teams for '23

- Markets turn "risk on" in mid '23: Suggest investors long bonds, particularly 30y UST and steepeners in 1H23 as recession and credit shocks hit risk assets. In 2H23, with inflation, the US$ and Fed hawkishness having peaked, get long stocks, credit, copper, industrials, small caps, EU banks, Asia HY. Nibble at S&P 3600, bite at 3300, gorge at 3000. - Hartnett. Near term market risk as EPS forecasts are slashed (US Strategy estimates $200 for '23), but S&P 500 typically bottoms 6M ahead of recession end, suggesting a rebound starting around mid-year. - Subramanian

- A recession is all but inevitable in the US, Euro Area and UK: Expect a mild US recession in 1H23 with risk that it starts later. Europe likely sees recession this winter with shallow recovery thereafter as real incomes and likely overtightening pressure demand. - Harris/Gapen/Segura-Cayuela/Wood

- Rates stay elevated but expect a decline by YE '23: We expect the yield curve to dis-invert & rates vol to fall. We estimate both 2Y & 10Y US Treasuries to end '23 at 3.25%. Sectors hurt by rising rates in '22 may benefit in '23. - Cabana

- ......

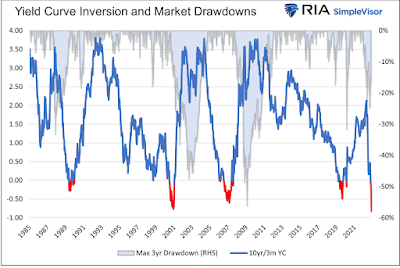

............ Since 1986 every yield curve inversion has been followed by a recession. We only show the last four inversions, but be mindful that each of the previous eight inversions led to a recession. However, and this is a common theme in the following graphs, economic and financial hardship did not occur until after the curve steepened to a positive slope. It has taken anywhere from three to thirteen months and .53% to 2% steepening until a recession began.

The next graph shows stock market drawdowns follow a similar pattern. In all four inversions, the maximum drawdown in the market occurred after the curve started to steepen.

.......

........ California is not the only state that is trying to help its residents. Other states have found different ways to help people cope with the high inflation rates, but in most places, the help ends in December.

..... (3) Stop pretending that there are laws in economics. There are no universal laws in economics. Economies are not like planetary systems or physics labs. The most we can aspire to in real economies is establishing possible tendencies with varying degrees of generalizability.

(4) Stop treating other social sciences as poor relations. Economics has long suffered from hubris. A more broad-minded and multifarious science would enrich today’s altogether too autistic economics.

(5) Stop building models and making forecasts of the future based on totally unreal micro-founded macro models with intertemporally optimizing robot-like representative actors equipped with rational expectations. This is pure nonsense. We have to build our models on assumptions that are not so blatantly in contradiction to reality.

Vid of the Week:

Today's 3.7% unemployment rate is highly deceptive.

It ignores the 100 million US adults who are considered "outside the workforce".

Yes, many of them are retired, stay-at-home parents, students or in the military.

But a large and growing number of them -- millions and millions -- are prime age able-bodied adults "giving up" on paid work.

And sadly, they're not eschewing it for greater fulfillment. The vast majority of them report feeling depressed, demoralized and living sedentary, disengaged lives.

This has reached epidemic proportions, toxic to both the individual and society. Yet we're not having a national dialogue recognizing this.

Today, I sat down with economist Nicholas Eberstadt, who has been researching this "invisible crisis" for years.

Quotes of the Week:

Marks: In my 53 years in the investment world, I've seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today.

Blanchflower: “The one piece of historical data I can hang my hat on is that the Fed has consistently been wrong on its projections.”

Mac: The newly released FOMC outlook for 2023 was super hawkish. Clearly Fed members are getting frustrated at the fact that financial conditions are no longer tightening. The exact same thing happened in the summer, forcing the Fed to pound markets back down. Today is deja vu, but this society has LETHAL amnesia. The Fed doesn't understand that they are using the wrong policy tool to tighten financial conditions. They should be reducing their balance sheet at a much faster pace. So in the meantime they keep raising rates, each time expecting a different result. The Fed has now raised rates as much as they did in 2003-2006, but in a third of the time. The consequences of which have yet to be determined. It's highly likely that this will be the amount of interest rate buffer that the Fed has going into a depression of their own making.

Radford: Let’s not dwell on this too long. It simply isn’t that important in itself. Cryptocurrencies have never been a serious solution to a problem in the real world. They were, and still are, strange outcomes of a paranoia born well back in time, but which burst forth in current from as a consequence of the great financial crisis. They were, in short, a libertarian response to both the emergence of too heavy an emphasis on finance in modern economies and the almost inevitable instability that such an emphasis produced. Notwithstanding the critique of our right wing friends the great crisis in 2008 was a product of over zealous and borderline unethical finical practices being built on a view of the world that was more hubris than analysis.

...

...

(not just) for the ESG crowd:

Sci Fare:

Light carries with it the secrets of reality in ways we cannot completely understand.

No comments:

Post a Comment