*** denotes well-worth reading in full at source (even if excerpted extensively here)

Economic and Market Fare:

The signal and the noise

....... conclusion is indeed gloomy. Markets have been fooled by randomness. There may be a lot more tightening in the pipeline than is priced in atm.

The Path to Q1 Deflation

The odds that we get at least one month of negative inflation data in Q1 is increasing. Will deflation become a concern in Q1? That is possible (and maybe even probable) if we continue on the course of action that we are currently taking. I do not believe that we will be worried about inflation in a meaningful way by the end of Q1. In fact, as you can tell from Inflation Risk Factors and 2 + 2 = 5, I think that we have already set ourselves on a course that we will regret.

Today we will outline how and why Q1 deflation is a bigger risk than having high inflation in Q1. I use the term “risk” because the deflation will be linked to a recession that starts sooner and will be worse than consensus (Friday’s data makes me wonder if it hasn’t already started). ....

... The lag effect is real and even with that lag, inflation is behaving better. What happens when more hikes (that have already been announced) kick in? Deflation seems to come to mind, but we have potentially only just begun to go down that path.

.... Part of me would like to type QED now and say that we’ve proved our point and enjoy the rest of the weekend, but there is a lot more to write about to convince you why deflation is the path that we are on. .........

... In any case, I’m not sure we should cheer low oil prices. Maybe what is counteracting all of the potential reasons for oil to be higher is that the economy is slowing much faster than is currently showing up in the official data. ......

The path to deflation is becoming less avoidable and beating inflation (so badly) is not the victory that we should be striving for.

This week’s “risk-off” trading with low yields and lower equities may be a harbinger of things to come based on our apparent policy priorities and data “analysis.”

................... A profits contraction has started as wages, import prices and interest costs are now rising faster than sales revenue. Profit margins (per unit of output) have peaked (at a high level) as unit non-labour costs and wage costs per unit are rising and productivity stagnates. The post-pandemic profits bonanza is over. When we get full data for 2022 corporate profitability, expect it to have fallen again as we enter a new slump in the US in 2023.

In my 53 years in the investment world, I’ve seen a number of economic cycles, pendulum swings, manias and panics, bubbles and crashes, but I remember only two real sea changes. I think we may be in the midst of a third one today. .....

On December 13 Ghana reached staff-level agreement on a $3 bn IMF credit package. In addition it is seeking to negotiate a 30 percent haircut with private creditors on tens of billions in bonds. Already in September Ghana’s 2026 eurobonds plunged to a record low of 59.30 cents on the US dollar. By the end of October yields had surged to 38.6 %, up from less than 11% at the end of 2021. Meanwhile, inflation is headed to 40 percent and the cedi is the worst performing currency not just in Africa but of all currencies in the world.

You could shrug and say that this is Ghana’s second IMF deal in 3 years and its 17th since independence in 1957. Plus ça change. But it is more than a national crisis. It is the latest sign that the entire model of market-based development financing is in crisis.

The fact that borrowers like Ghana find themselves in trouble at this moment is not surprising. The hiking of interest rates occurs in waves and whenever it happens it hits the weakest. We don’t call it a global dollar credit-cycle for nothing. This year, as the Fed has hiked, the average emerging-market dollar yield has doubled to over 9%. Debt issued by stressed frontier market borrowers has seen yields surging to 30 percent or more.

But to treat the news from Ghana as “just another predictable crisis”, is to trivialize and to fail to grasp the significance of the current moment.

Ghana is an important African success story. ....

Africa needs a development leader. Ghana can't afford to play the game of borrow-and-bailout.

...... Obviously Ghana’s development is most important to the ~32 million people who actually live in Ghana. But it’s also important in the broader context of African development, because it’s one of the leading candidates to become the “first mover” in the region. ......

Quotes of the Week:

Field: Financial markets (credit and equity) beginning to price in Fed's commitment to driving US economy into a severe recession. Fed officials wondered why markets hadn't fallen previously. Why? Market participants didn't think Fed stupid enough to trigger unnecessary recession.

...

...

Bubble Fare:

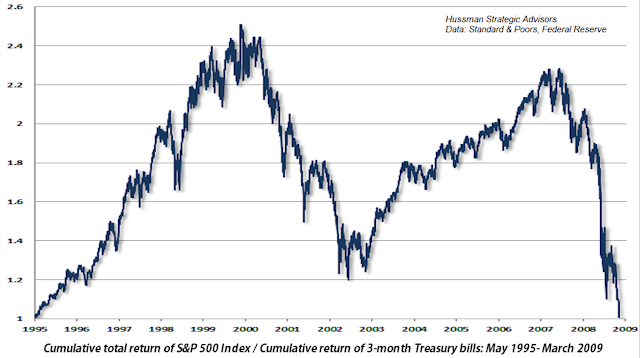

As of Friday, December 16, the S&P 500 Index is down -19.7% from the most speculative level of valuations in U.S. history – exceeding even the 1929 and 2000 extremes, based on the valuation measures we find best-correlated with actual subsequent market returns in cycles across history. The apparent shallowness of this loss isn’t a sign of “resilience.” Despite being nearly a year into what we expect to be a far deeper retreat, the relatively shallow loss isn’t even surprising. The same thing happened in the first year of each of the three deepest post-war stock market collapses: the 2000-2002, 2007-2009, and 1973-74. .........

...... This year, the Nasdaq has fared far worse than the broader market. To date, this is the worst year for the Nasdaq since 2008 and before that 2000. Nevertheless, bulls are doing a great job putting lipstick on this pig.

I would point out to bulls that the Fed was already easing at the end of 2000 AND 2008. And as we see from Y2K, the Nasdaq continued falling for another two years AFTER the Fed started easing in 2000.

Which gets us to the housing market. So far, the bubble has remained mostly intact with some regional deviations. Few if any pundits are sounding the alarm on another full scale 2008 style meltdown. Except for Michael Burry who predicted the last housing meltdown. He has been warning all year. .....

WHATEVER HAPPENED TO RETURNS ON CAPITAL?

FOREWORD

If you own a portfolio of stocks whose value has risen over time, or a property whose market price has increased, you are at liberty to cash in those gains by selling your investment. This, though, does not apply to investors in the aggregate because, by definition, any sizeable selling activity drives prices down, thus reducing, eliminating or reversing prior capital appreciation.

Put another way, the tidal-wave of cheap money poured into the economy over the past fourteen years, whilst it may have enriched some, has created paper, notional or non-realisable gains for the majority of investors, including those ‘ordinary’, non-wealthy people whose savings are managed by institutions, and whose wealth is often based on inflated property values which, in the aggregate, cannot be turned into cash.

The principle is that, unlike incomes from dividends or rents, aggregate gains in asset prices cannot be monetized.

Though critical, this point is entirely missed by any media reporter who writes about the billions (or trillions) ‘gained’ by investors over a given period of time, and by those statisticians who, by multiplying the price of the average home by the number of properties, purport to put an aggregate ‘value’ on a nation’s housing stock. The multiplication of aggregate quantities – such as the numbers of stocks, bonds or properties – by marginal transaction prices creates valuations which are as meaningless as they are often impressive.

This needs to be borne in mind when we look at the gains supposedly made ‘by investors’ since the authorities adopted policies which, by driving down returns on capital, have created enormous increases in the market values of assets.

The subject of ‘investors’ has become almost toxic since the global financial crisis, when the authorities were accused of ‘rescuing Wall Street by plundering Main Street’. Inequalities of incomes and wealth have undoubtedly widened dramatically, and some governments have actually made this worse by ‘helping’ young people to go deeply into debt in order to shore up property prices to the benefit of their elders. There is nothing here that any reasonable person would try to defend.

Analytically, though, something fundamental has happened to returns on capital. Income returns – in the form of bankable cash – have been crushed, and replaced by non-bankable capital gains which, in the aggregate, can’t be monetized.

We know how this has happened, and we can be pretty sure about where it ends, which is in falls of varying (but generally severe) magnitude across the gamut of asset classes.

But why has the financial system behaved in this way? The view set out here is that an economy characterised by cosmetic “growth” has been forced to resort to replacing bankable investment returns with cosmetic, non-monetizable “returns” on capital.

What follows is not, in any sense ‘sympathetic’ to investors, still less a defence of the paper beneficiaries of the divergence between incomes and asset prices. Rather, the aim is to examine the abandonment of market and capitalist principles in the face of unacknowledged economic contraction. ..............

(not just) for the ESG crowd:

SWOT satellite will bounce radar off water bodies to give scientists a new window into climate change and the global water cycle.

Sci Fare:

The brain of an octopus has some similarities to humans, and shows many signs of high intelligence.

Other Fare:

No comments:

Post a Comment