*** denotes well-worth reading in full at source (even if excerpted extensively here)

- Is US employment data hot, ‘goldilocks’, or ‘cold’?

- Have you been inundated by calls and messages with the question, “But have you seen the details of the Household Survey?”

- Is the Fed right to keep aggressively hiking?

- BofA’s 2023 Outlook summary is below. I agree with much of their take, which makes me uncomfortable. Though I do disagree with them on recession timing. I think it’s an H2 23’ affair, as the Household savings buffer keeps the economy humming a bit longer than most expect.

- .....

Quotes and Tweets of the Week:

The BIS paper on the ''$80 trillion of hidden US debt'' is making the rounds.

— Alf (@MacroAlf) December 7, 2022

It's really important, and it deserves the attention of every macro investor.

A thread.

1/

1:

...A rot is setting into US job market.

— Danielle DiMartino Booth (@DiMartinoBooth) December 8, 2022

Continuing claims, which include people who have already received unemployment benefits for a week or more, climbed by 62,000 to 1.7 million in the week ended Nov. 26, the highest since February. @USDOL @business pic.twitter.com/dkAIUf26nC

...'Given tighter credit conditions, there is room for equities to underperform bonds.' https://t.co/VFbc6x08PT via @SoberLook pic.twitter.com/YistIqhcHz

— Jesse Felder (@jessefelder) December 7, 2022

...Used car prices are now down over 14% in the past year, the largest YoY decline on record with data going back to 2009. This was a leading indicator of higher inflation rates in 2020 and the recent downturn is likely a leading indicator of lower inflation rates to come. pic.twitter.com/qWH0tyx8eu

— Charlie Bilello (@charliebilello) December 8, 2022

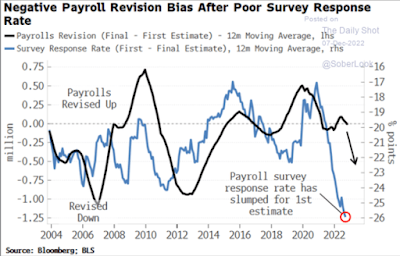

The drop in the response rate for the payrolls survey is bad enough, but can we trust anything in the JOLTS data when the survey response is 30%, half what it was pre-pandemic. #jolts pic.twitter.com/7FWYaEvlLP

— Capital Economics - US (@CapEconUS) December 5, 2022

...

...'After the first rate cut, the S&P 500 fell in all but one of the previous easing cycles. On average, the index dropped 24% before finding a bottom.' https://t.co/7IQtCePhND pic.twitter.com/ai9VvnDNk6

— Jesse Felder (@jessefelder) December 8, 2022

Eurodollar futures is really simple: not quite sure yet *when* Jay Powell gets mugged by reality, but once he does the rate cuts are going to come fast and furious. https://t.co/D1jmffuBjj pic.twitter.com/4o47UnRf6V

— Jeffrey P. Snider (@JeffSnider_AIP) December 8, 2022

...Just heard on CNBC "don't we need to wait for the Fed to pivot for stocks to go higher?"

— Michael A. Gayed, CFA (@leadlagreport) December 5, 2022

HOLY FUCK FOR THE THOUSANDTH TIME FED PIVOTS ARE HISTORICALLY BEARISH. pic.twitter.com/ZSCY5acGTP

Home sales have never dropped so fast and so hard like in this Fed hiking cycle.

— Alf (@MacroAlf) December 5, 2022

The housing market is effectively frozen, and the illiquidity is popping up in real-estate linked products too (e.g. Blackstone BREIT story). pic.twitter.com/LYuHO1KHxz

Vid Fare:

Pics of the Week:

Contrarian Perspectives

Extra [i.e. Controversial] Fare:

*** denotes well-worth reading in full at source (even if excerpted extensively here)

Krishnamurti: “It is no measure of health to be well adjusted to a profoundly sick society.”

Unsustainability / Climate Fare:

... For those who just joined my blog and this is your first article, I have some bad news for you. Please visit these three articles here and here and here for more info. Those articles will help you get up to speed on the situation and this one is the real kicker that will help you see the reality of where all this is headed. ......

Kyle Kimball MEERTALK Summary 🧵 - The assumption that the IPCC gathers the most recent peer-reviewed

— MEER (@MEERsrm) December 5, 2022

science on climate change and reports that are out to the world on an objective basis are, unfortunately, misguided.

Endemic Fare:

Read [almost?] everything by eugyppius; el gato malo; Mathew Crawford; Steve Kirsch; Jessica Rose!

Chudov, Lyons-Weiler, Toby Rogers are also go-to mainstays; a list to which I have added Andreas Oehler, Joey Smalley (aka Metatron) and, Julius Ruechel; Denninger worth staying on top of too for his insights, and especially his colorful language; and Norman Fenton; Marc Girardot; plus Walter Chesnut (on twitter); later additions: Sheldon Yakiwchuk & Charles Rixey & Aaron Kheriarty; and newest additions Meryl Nass and the awesome Radagast; and Spartacus is on substack now!!; I will of course continue to post links to key Peter McCullough material, and Geert Vanden Bossche, and Robert Malone, and Martin Kulldorff, and Jay Bhattacharya, and Sucharit Bhakdi, and Pierre Kory, and Harvey Risch, and Michael Yeadon, and John Ioannidis, and Paul Marik, and Tess Lawrie, and Dolores Cahill, and [local prof] Byram Bridle, and Ryan Cole, and... of course Heather Heying and Charles Eisenstein often bring their insight and wisdom to the topic as well... and if Heying's substack isn't enough, she joins her husband Bret Weinstein at their DarkHorse podcast ....

CO-VIDs of the Week:

'Something Flipped in 2021 by 8 points': Ed Dowd

— New World Odor™ (@hugh_mankind) December 7, 2022

"Excess mortality has shifted so much - it's pretty phenomenal"

Healthy policyholders (exposed to vax mandates) suffered 40% excess mortality in '21, the general population (less exposed) saw a 31.7% excess mortality. pic.twitter.com/QDEI6ww0qv

Anecdotal Fare:

18 y/o Trisha Martin #DiedSuddenly after receiving the Pfizer 💉

— DiedSuddenly (@DiedSuddenly_) December 4, 2022

Her parents didn’t know & had warned of the mRNA dangers- but the media convinced her otherwise.

She said she “felt like she was dying”laid down, & never woke up.

She suffered organ failure and a swollen heart. pic.twitter.com/dwObnQXRdy

COVID Corporatocracy Fare:

Back to Non-Pandemic Fare:

Congratulations to Volodymyr Zelensky for winning TIME's Person of the Year award.

— Danny Haiphong (@SpiritofHo) December 7, 2022

He joins distinguished war criminals such as Adolf Hitler, Winston Churchill, and George W. Bush in sharing the honor. pic.twitter.com/9pAQR2clxw

Scott Ritter 2 min topic:

— hicham (@jackalone12345) November 30, 2022

Every non-ukranian waving the 🇺🇦 flag is not supporting Ukraine but supporting the war pic.twitter.com/qj8O5u8Byb

Rigger-ous Reads (on Culture Wars, Identity Politics, etc.):

🚩 blocked access to safe & effective medicines;

☠️ forced you to take the most toxic shot ever invented;

🤥 while running the largest censorship, propaganda, & surveillance system in history...

🤡 want you to think that “Elon Musk is a threat to democracy!?”

No comments:

Post a Comment